Wise was launched in 2011 and makes it cheaper, faster and easier to send international transfers, thanks to a radical new payment model.

Today, Wise serves over 16 million personal and business customers with cross-border payments and the Wise multi-currency account. If you receive, send or spend foreign currencies, the Wise account can help, with low, transparent fees and the mid-market exchange rate.

This guide covers all you need to know about the Wise multi-currency account (formerly known as Borderless Account) to help you decide if it’s right for you.

Wise account is good for

- Hold and exchange 40+ currencies

- Local account details for 10 currencies

- No foreign transaction fees

- Mid-market exchange rate

- Low and transparent fees

Learn more

Wise multi-currency account: Key points

Key features:

- Currency coverage: Hold and exchange 40+ currencies, send money to 160+ countries, and spend in 150+ countries

- Low prices: No monthly or annual fee, and low, transparent transaction charges

- Exchange rate: Mid-market exchange rate with no foreign transaction fee

- Fast transfers: 90% of payments arrive within 24 hours and 50% of the total are instant

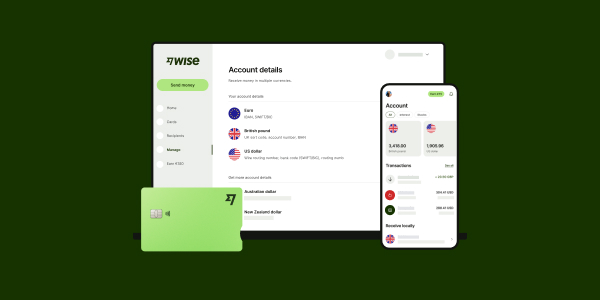

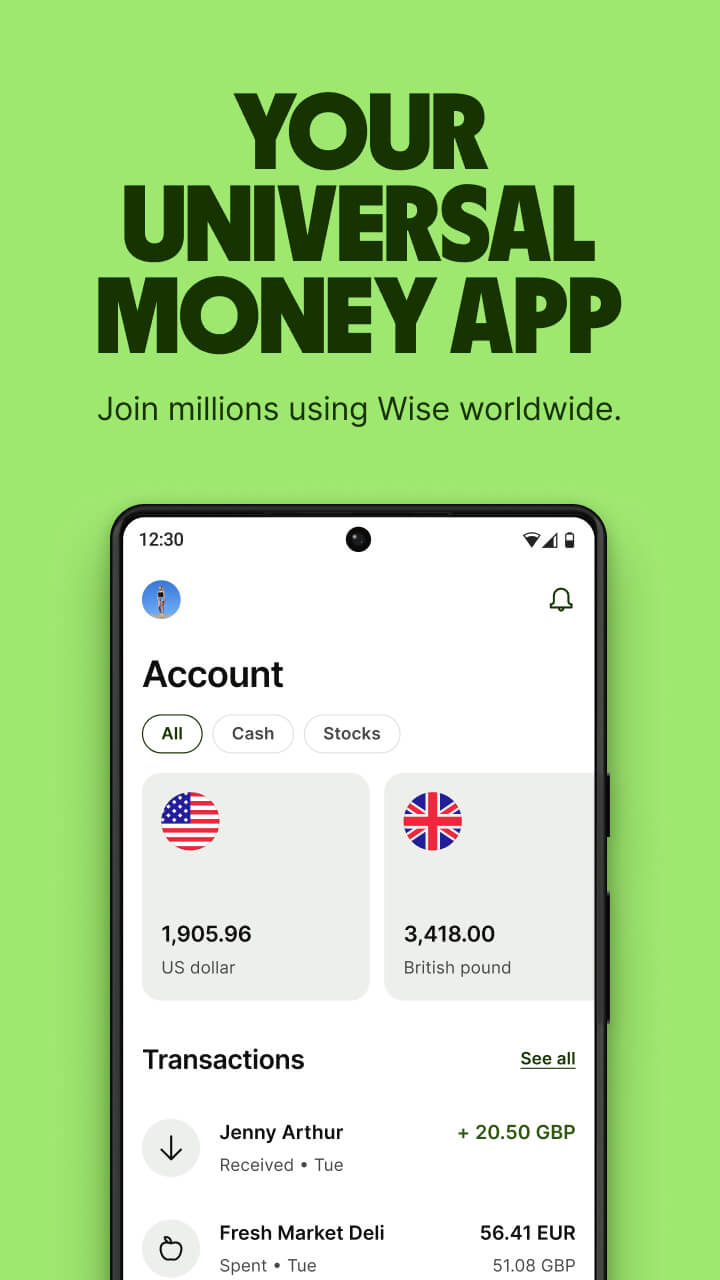

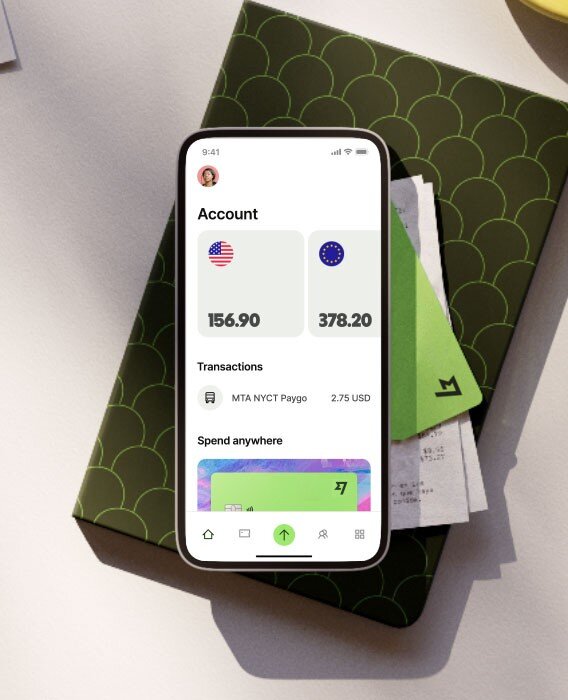

- Convenient to use: Manage your account and card, and make convenient payments, from the Wise app

- Transparent fees: Transparent transaction fees, plus a delivery time estimate when you make a payment

- Safe to use: Regulated by a range of global bodies, with manual and automatic anti-fraud processes

Pros and cons of Wise multi-currency account

- Hold and exchange 40+ currencies and see them all at a glance

- Get local account details in 10 different currencies including USD, EUR, GBP and CAD

- Receive money from 30 countries like a local with your own local bank details

- Spend and withdraw in 150+ countries with your Wise Multi-Currency Card

- See account balances in a glance, and manage your account in the Wise app

- Send money to 160+ countries

- Instant transaction notifications for security

- Safe and regulated provider in the US and overseas

- Wise is not a bank - not all features you’d expect from a bank account are available

- No cash deposits - You can’t pay in cash to your account

- No credit or overdrafts available

- No branch network - service available online, in-app and by phone only

- Transaction fees may apply

Overall: Wise multi-currency account (formerly Borderless Account) has a broad range of features, with no ongoing charges or minimum balance, plus international payments and currency conversion with low, transparent fees and the mid-market exchange rate. Hold and exchange 40+ currencies, send payments to 160+ countries, and spend in 150+ countries with the mid-market exchange rate using your linked Wise Multi-Currency Card. Exiap readers can also get an exclusive, fee-free Wise promo code to bring down the costs even further.

Learn more

What is the Wise multi currency account?

Wise account - which used to be called the 'Wise Borderless account' - is an easy, low-cost foreign currency account which you can use to receive, exchange and send foreign currency payments.

You can get local account details in 10 currencies, to receive payments easily to your Wise account from 30+ countries, plus you can use your account to hold, exchange and spend a total of 40+ currencies. Whenever you switch from one currency to another you’ll get the mid-market exchange rate, with low, transparent charges, and without foreign transaction fees.

You can also spend and make cash withdrawals with your Wise Multi-Currency Card, which is Google Pay and Apple Pay compatible for mobile payments around the world.

How does the Wise multi currency account work?

You can open a Wise multi-currency account online or in the Wise app, and order your linked Wise Multi-Currency Card for a one time fee. Use your account to receive payments from others in a selection of major global currencies, send international money transfers to 160+ countries, and spend and withdraw at home and abroad with the Wise Multi-Currency Card.

- Receive money with Wise: Get local account details for 10 currencies to receive payments to your Wise account

- Hold money with Wise: Hold 40+ currencies in your Wise account, and review your balances instantly in the Wise app

- Supported currencies: Hold and exchange 40+ currencies, receive money to Wise in 10 currencies,

- Spend with a Wise Multi-Currency Card: Spend and withdraw with your Wise Multi-Currency Card in 150+ countries

- Transfer from your account: Send payments with Wise to 160+ countries, with the mid-market exchange rate and low fees

- Convert money on Wise: Switch between currencies to send or spend, with the mid-market exchange rate and low, transparent fees

Receive money with Wise

When you open your Wise account you’ll be able to quickly and easily open a currency balance in any of 10 major currencies including USD, GBP, EUR, AUD and NZD, and get local account details to get paid in these currencies directly to Wise. Give your account details to people who want to send you money from overseas, to receive payments into your Wise account conveniently from 30 different countries.

Wise account currencies:

| Currency | Wise local account details |

|---|---|

| 🇺🇸 Wise USD Account |

|

| 🇪🇺 Wise Euro Account |

|

| 🇬🇧 Wise GBP Account |

|

| 🇦🇺 Wise AUD Account |

|

| 🇳🇿 Wise NZD Account |

|

| 🇸🇬 Wise SGD Account |

|

| 🇷🇴 Wise RON Account |

|

| 🇨🇦 Wise CAD Account |

|

| 🇭🇺 Wise HUF Account |

|

Learn more: How to receive money internationally with Wise

Hold money with Wise

You can use your Wise Borderless Account to hold 40+ different currencies, and you’ll see all your balances in a glance on the Wise app or by logging into your account online. It’s free to spend in any currency balance you hold with your Wise Multi-Currency Card, and you can also exchange between currencies with the mid-market rate and low, transparent fees as and when you need to, in just a few clicks.

Wise is an authorized and regulated provider, which means your funds are safeguarded for security - no matter what currency you’re holding.

What currencies does Wise account support?

You can hold money in any of the following currencies in your Wise Account (formerly known as Wise Borderless Account):

Europe

- British Pound

- Bulgarian Lev

- Croatian Kuna

- Czech Koruna

- Danish Krone

- Euro

- Georgian Lari

- Hungarian Forint

- Norwegian Krone

- Polish Zloty

- Romanian Leu

- Swedish Krona

- Swiss Franc

- Turkish Lira

- Ukrainian Hryvnia

Americas

- Canadian Dollar

- Chilean Peso

- Costa Rican Colón

- Mexican Peso

- Uruguayan Peso

Oceania

- Australian dollar

- New Zealand dollar

East Asia

- Bangladeshi Taka

- Chinese Yuan

- Indian Rupee

- Japanese Yen

- Nepalese Rupee

- Pakistani Rupee

- South Korean Won

- Sri Lankan Rupee

Southeast Asia

- Hong Kong Dollar

- Indonesian Rupiah

- Malaysian Ringgit

- Philippine Peso

- Singapore Dollar

- Thai Baht

- Vietnamese Dong

Middle East

- Israeli Shekel

- UAE Dirham

Africa

- Botswana Pula

- Egyptian Pound

- Ghanaian Cedi

- Kenyan Shilling

- Moroccan Dirham

- South African Rand

- Tanzanian Shilling

- Ugandan Shilling

Spend with a Wise Multi-Currency Card

Spend and withdraw in 150+ countries with no foreign transaction fees, with a Wise Multi-Currency Card. You can order your Wise Multi-Currency Card online for a one time fee of 9 USD, and add it to Google Pay or Apple Pay for easy mobile payments.

Smart auto-convert technology means that you’ll always pay in the local currency wherever you are. If you don’t hold the right balance your card can convert it for you in the cheapest possible way - plus you’ll also get instant transaction notifications when you spend and you can freeze and unfreeze your card in the Wise mobile app for security.

Keep an eye on your money using Wise Spending Insights which lets you track monthly spending and categorize payments for easy budget management, right from the Wise app.

Read more in our full Wise Multi-Currency Card review. Also, you can check out our guide on How to use Wise Multi-Currency Card overseas to learn more about using your Wise Multi-Currency Card for international travel.

Transfer money easily from your account

If you hold a Wise balance you can withdraw your money from Wise to a local bank account or make international payments to 160+ countries.

Making a Wise transfer is easy and can be done with nothing more than your smartphone or laptop. If the person you’re sending money to has a Wise account of their own, you can make a Wise to Wise payment in the same currency for free - and if the recipient doesn’t have a Wise account yet, you can simply arrange for the transfer to be deposited into their regular bank account for convenience.

If you don’t have the currency you need for your transfer, you’ll get the mid-market exchange rate when you send your payment, with low, transparent transfer fees. Just log into your account and tap Send money to get started.

More information: Wise money transfer review

Convert your money in Wise

Within your Wise account you can conveniently convert between 40+ currencies using the mid-market exchange rate with no markup. You’ll just pay a small currency conversion fee which can be as low as 0.42% of the value of the transaction for major currencies. Currency conversion is instant, so you can get started spending right away.

Wise exchange rate

Wise uses the mid-market exchange rate for currency conversion. That applies whenever you switch from one currency to another to make a money transfer, when you convert a balance you hold in your account, or when you spend in a currency you don’t hold using your Wise Multi-Currency Card.

Learn more

Wise Borderless account and debit card fees

Here are the key Wise account fees you’ll want to know about when you open a Wise multi-currency account (Wise Borderless Account):

| Service | Wise account fees |

|---|---|

| Open a Wise account | Free |

| Hold 40+ currencies | Free |

| Get local bank details for 10 currencies | Free |

| Order a Wise Multi-Currency Card | 9 USD (one time order fee) |

| Spend currencies you hold using your card | Free when you have enough balance for your purchase |

| Spending in currencies you don't hold | Currency conversion fees from 0.42% |

| ATM withdrawals up to 100 USD/month | First 2 ATM withdrawals up to the total value of 100 USD/month for no Wise fees. 1.5 USD fee per withdrawal after that. |

| Withdrawals over 100 USD | 2% of the amount |

| Convert a currency using your card | Low fee from 0.42% |

| Receive money in AUD, EUR, GBP, HUF, NZD, RON, and SGD | Free |

| Receive USD | Receiving by ACH or bank debit is free. Receiving by wire has a fixed fee of 4.14 USD. |

| Receiving CAD | Receiving by SWIFT has a fixed fee of 10 CAD. Other methods are free. |

| Send international payments | Low currency conversion fee from 0.42% + fixed fee which varies by currency |

Get a full rundown of the Wise fees here.

Is the Wise account free?

It’s free to open a personal Wise account, and there are no ongoing monthly or annual fees to pay. Once you have a Wise account it’s free to create a new currency balance in any of the supported currencies, and free to spend a currency you hold using your Wise Multi-Currency Card.

Some transactions and services have fees, which are shown transparently in the Wise app or on the Wise desktop site. However, here’s a quick overview of some of the key features you’ll get for free with the Wise account.

| Wise account service | Fee |

|---|---|

| Open a Wise personal account | No fee |

| Hold a currency balance in any of 40+ supported currencies | No fee |

| Spend a currency you hold in your account with the Wise Multi-Currency Card | No fee |

| Send a same currency payment to another Wise account | No fee |

| ATM withdrawals to monthly account limit | No fee |

| Receive payments to Wise in 8 foreign currencies | No fee |

| Receive payments to Wise in USD via ACH | No fee |

Wise account fees for holding money

It’s free to keep money in a Wise account, in any of the 40+ supported currencies. You’ll be able to review your account balances in the Wise app easily so you’re always on top of your finances.

Wise account conversion fees

When you convert between currencies within your Wise account, or to spend with your Wise Multi-Currency Card, there’s a small, transparent fee to pay. There’s no fee to spend a currency you already hold in your Wise account with your Wise Multi-Currency Card - and if you don’t have enough of the required currency to cover the transaction, the card can auto convert your funds from the currency you hold which attracts the lowest possible charge.

Wise conversion fees start from 0.42% and vary by currency. Here’s a look at the conversion fees from USD to some other major currencies.

| Wise fee | Amount in converted currency | |

|---|---|---|

| Convert 1,000 USD to CAD | 5.25 USD (0.53%) | 1,343.60 CAD |

| Convert 1,000 USD to GBP | 4.95 USD (0.5%) | 787.19 GBP |

| Convert 1,000 USD to EUR | 4.86 USD (0.49%) | 924.62 EUR |

| Convert 1,000 USD to JPY | 5.44 USD (0.55%) | 148,912 JPY |

| Convert 1,000 USD to INR | 6.05 USD (0.61%) | 82,225.66 INR |

*Fees correct at time of writing: 13th February 2024

Wise international transaction fees

There’s no Wise foreign transaction fee when you spend with your Wise Multi-Currency Card overseas. It’s free to spend from any currency balance you hold with your card when you have enough balance for your purchase. If you don't have balance in that currency, Wise'll use smart auto-conversion technology to convert from the most advantageous currency possible. If you need to convert from one currency to another for spending, there’s a low conversion fee from 0.42%.

Is it safe to keep money in Wise?

Wise is FinCEN registered and licensed to operate in most US states. In other US locations, Wise offers services through a partnership with Community Federal Savings Bank. Wise is also covered by regulatory authorities in the other countries and regions it operates in, such as the FCA in the UK.

There are many different manual and automatic processes in place to keep customers and their money safe, including:

- Customer funds are safeguarded and kept separately from Wise’s own funds

- Wise holds a fixed level of capital on hand at all times

- Regular stress testing exercises to check plans and processes are robust

- 24 hour support with dedicated anti fraud teams and technology

- Account verification processes and 2 factor authentication

- Instant transaction alerts, with the option to freeze your card in the Wise app

Read more about Wise safety here.

Is Wise (formerly TransferWise) a bank?

Wise is not a bank, but for the services they offer, they’re just as safe as a bank. Read our full Wise review to learn more.

Wise is authorised to operate in the US independently, or through a partner, just like your normal bank will be. That means it’s subject to the same regulations as other financial service providers, both in the US and in all the other countries it operates in. And as a financial technology company, Wise has built its services and platforms with security in mind, to keep customers safe while offering an intuitive way of managing your money.

Learn more

Who is the Wise multi currency account for?

The Wise Multi-Currency Account (formerly Borderless account) can be opened by both personal and business customers, and suits a broad range of people.

Wise personal multi-currency accounts may suit customers who:

- Travel often, and need to pay for goods and services in foreign currencies

- Shop online with international retailers

- Get paid from overseas

- Pay regular bills internationally, like an overseas mortgage on a vacation home

- Manage their money online and on the move

The Wise Business account may suit customers who:

- Pay suppliers and invoices from abroad

- Manage payments internationally through one off or batch payments

- Receive money from customers and clients based overseas

- Withdraw in foreign currencies from PSPs like Stripe or marketplaces like Amazon

- Want to reconcile their international account with cloud-based accounting software

Check our Wise personal vs Wise Business account comparison to learn more.

Learn more

How to open a Wise account

Here’s how to open a Wise account step by step:

- Open the Wise desktop site or app and click on Create account

- Register with your email address, Google, Facebook or Apple ID

- Tap the type of account you want to open – personal or business

- Confirm your country of residence from the dropdown list

- Add your phone number, and verify it using the code you’re sent

- Get verified by uploading your SSN and/or images of your ID and proof of address

You’ll be guided through the process to open a Wise account online or on the app, by on screen prompts - and if you don’t have everything you need to hand you can simply save your progress and return to it later.

Documents you'll need to open Wise account (Borderless account)

As part of the process to open your Wise account you’ll need to upload some documents for verification. This is required by law, and is one of the ways Wise keeps customers and their accounts safe.

To open a personal Wise multi-currency account you’ll usually need to provide your SSN or ITIN if you’re a US resident. If you don’t have an SSN you may also choose to upload an image of your personal ID document, such as a non-US issued passport, National ID card or driving license.

You may be asked to take a selfie with your documents to show your identity matches your paperwork.

Customers looking to open a Wise business multi-currency account will need to provide business documentation which can vary based on entity type, as well as the names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business.

The exact documents you need to open your Wise account may vary a little depending on your personal circumstances and the type of transaction you’re making. We’ve set out the commonly needed documents for proof of ID and address below - and you can always reach out to the Wise team if you need more information about how best to get verified in your particular circumstance.

| Examples of accepted documents for: ID verification | Examples of accepted documents for: Proof of address |

|---|---|

|

|

How long does verification take

Account verification can happen on the same day or even instantly for many customers. The Wise service team aims to have all accounts verified within 2-3 working days and will be in touch if any more information or documentation is needed to get your account up and running.

How to use the Wise account

So - once you have your Wise account set up, what can you do with it? We’ll dive into some more details about the ways you can use your Wise in just a moment - here’s a quick overview of how to use your Wise account, to get us started.

- Top up your Wise account in USD or any of the other currencies supported for loading a balance

- Convert funds within your account, to one of the 40+ supported currencies for holding and exchange

- Get paid in 10 currencies like a local using your Wise local account details

- Order a Wise Multi-Currency Card for spending and withdrawals in 150+ countries

- Send payments to 160+ countries, quickly or even instantly

How to open a currency balance in Wise

You can open a currency balance in a supported currency, and instantly get local account details to receive payments to Wise in 10 major currencies including USD, EUR and GBP.

Here’s how to open a currency balance:

- Log into your Wise account online or in the Wise app

- Tap Open or the + sign, you'll see a list of currencies

- Select the currency you want to open a balance in

- And done! Your currency balance is open, and you can start using it

You’ll be prompted to add funds to your account if it’s the first currency balance you’ve opened. You can choose the most convenient payment method for various payment options. If you already have a balance in another currency, you can also choose the convert from there.

Need a different currency? Just tap the currency you’re looking for, from the supported currencies listed in the Wise app, your balance will be opened quickly.

Once your balance is opened, you can get your local account details instantly, and can use the ‘copy account details’ function to give them to anyone who needs to send you payment in that currency.

How to add money to Wise account

You can add money to your Wise account, or if you already hold a balance in one currency and need another, you can convert to the currency you need, within your Wise account in just a few taps.

Here’s how to add money to a Wise account:

- Open the Wise app or log into the Wise desktop site

- Tap the currency balance you’d like to add money to

- Click Add and enter the amount and currency to add

- Select how you’d like to pay, and click Continue to payment

- Depending on how you’d like to pay, you’ll be guided through the payment steps within the Wise app

You can pay to top up Wise in USD using your debit card, credit card, wire transfer or ACH. Different payment methods have varying fees, so you’ll be able to pick the one that suits your needs from the options available.

How to receive payments into Wise account

You can receive a payment to Wise in any of 10 currencies, using local account details.

Here’s how to receive a payment to your Wise account:

- Log into your Wise account online or in the Wise app

- Tap Open, and select the currency balance you need to receive a payment to

- Follow the prompts to confirm if you’re receiving a local or international payment

- You’ll see your local account details, and can use the ‘copy account details’ function to give them to the sender

You can also request a payment from someone using a payment link. Simply tap the currency balance you want to receive a payment to, and then select More, followed by Request a payment. You’ll generate a payment link you can pass to the sender to make it easier for them to send you money.

How to convert currency in Wise app

You can convert currencies within your Wise account online and in the Wise app. You may want to convert a balance you hold to a different currency, for example if you’re heading off on a trip and want to set your travel money budget in advance. You can also convert currencies at the point of sending a payment, or automatically when spending with your Wise Multi-Currency Card if you don’t already have a balance in the currency you need.

Here’s how to convert currency in the Wise app:

- Tap the currency balance you want to convert from

- Select Convert and enter the amount to exchange, and the currency you want to convert to

- You’ll be shown the exchange rate and fee, as well as how much you’ll get in the converted currency

- Tap continue and follow the prompts to exchange

If you’re spending or making a withdrawal with your Wise Multi-Currency Card and you don’t hold a balance - or enough of a balance - to cover the transaction in the required currency, the Wise Multi-Currency Card’s auto convert function will switch to the currency you need from the balance you hold which attracts the lowest possible fee. This means you’ll always pay in the local currency wherever you are, which avoids possible extra charges involved with dynamic currency conversion.

- How does Wise know which currency to use?

When you spend with a Wise Multi-Currency Card the money will be automatically deducted from the balance you hold in the currency you need. If you don’t have a balance in the currency you’re spending, the Wise Multi-Currency Card will convert your money from the balance you hold that attracts the lowest available fee, using the mid-market exchange rate.

Wise smart auto conversion

Within your Wise account you can set up automatic conversions based on your preferred exchange rate. Simply choose the currency and amount you want to convert from and to, and enter the exchange rate you’re looking for. Wise will track the exchange rate, and automatically convert the amount you’ve selected, when your desired rate - or an even better rate - is achieved.

How does Wise know which currency to use?

When you spend with a Wise Multi-Currency Card the money will be automatically deducted from the balance you hold in the currency you need. If you don’t have a balance in the currency you’re spending, the Wise Multi-Currency Card will convert your money from the balance you hold that attracts the lowest available fee, using the mid-market exchange rate.

How to change default currency on Wise?

There’s no need to set or manage a default currency on Wise.

If you have a balance in the currency you need for spending or making a payment the funds are deducted automatically from that balance. For example, if you have a Euro balance in your Wise account, and you're spending with your Wise Multi-Currency Card in Germany, then your Wise Multi-Currency Card simply will use your Euro balance for your purchases.

Whenever you spend in a currency you don’t hold in your account, Wise can automatically convert from the currency you hold which attracts the lowest possible fees. Therefore, you can't choose a default currency to be used, or change the currency to be spent from. However, you'd like to prevent a certain currency balance to be spent from, you can simply your your money into a jar and your Wise Multi-Currency Card will use another currency instead.

What is a Wise account jar?

Jars are a Wise feature that helps you save and stash away money for the future, a holiday, big purchase or storing money you want to spend in another currency. Your money is kept separate from your balances, meaning you can’t spend it with your debit card, send it or use it to pay for any direct debits.

Wise jars vs balances

The main difference between a jar and balance is a jar is where you can set aside money that you want to use later. Once your money is in a jar, you won’t be able to use it. That means you can’t spend it with your Wise Multi-Currency Card or use it to pay for direct debits. Once you’re ready to spend it, you simply move it back into your balance, which is the money that is currently available for you to spend.

How to use Wise Jars

Within your Wise account you can create one or more Jars, which are balances held separately to your main spending balance. This can be handy if you’re saving for a specific purchase or for a vacation for example.

Once you’ve opened your Wise Jar you won’t be able to accidentally spend the money using your Wise Multi-Currency Card, making budgeting easier. Then when you’re ready to access your Jar, just move the money back to your main Wise balance for use.

Can I use TransferWise as a bank account?

Wise is not a bank, but a Wise account offers many similar features to a bank account such as local account details to receive payments, debit cards to spend, and options to hold a balance in USD or a selection of other currencies. That means that a Wise account can be handy for day to day spending at home and abroad, but it’s good to know you won’t necessarily be able to access all the same services you can through a bank, such as check and cash deposits or loans.

Is Wise considered a foreign bank account?

The Wise account is a foreign currency account, which can be used to hold balances in 40+ currencies, and to receive payments in 10 currencies with local account details.

How to transfer money between Wise accounts

If you need to send a payment to someone else with a Wise account you can do that easily within the Wise app. You’ll be able to send a payment in USD or any of the 40+ supported Wise currencies, and it’s free to send a same currency transfer to another Wise account holder. If you need to convert currencies there’s a low fee to pay, and you can even send money using just the recipient’s email or phone number if you’d prefer.

Here’s how to transfer money between Wise accounts:

- Log into your Wise account online or in the Wise app

- Select Send Money

- Enter the amount you want to send, or the amount and currency you want your recipient to get

- Pick Wise Balance as the payment method

- Check everything over, enter the recipient’s information, and confirm your payment

Wise account limits

Some limits may apply to Wise accounts when you send, receive and spend money. Limits vary by currency and transaction type, as well as where in the world you live, but they’re usually set pretty high to allow customers to send and receive large value payments easily.

Most Wise US customers have no limit to the amount of money they can hold and exchange in their Wise accounts. Some Wise US customers, who have account details with a routing number starting 026 do have some limits on the amount of money you can receive in USD - but limits are set high, at around 35 million USD per year for personal customers, and even higher for Wise Business account holders.

How much money can I keep in my Wise account?

For most Wise customers, there are no limits to the amount you can receive, add, convert, or hold in your Wise USD account. In some cases, upper limits apply to the value of USD payments you can receive, but these maximum limits are set high, at around 35 million USD per year.

Other Wise limits may apply, depending on the currencies involved, but you’ll be able to see any relevant details for your account in the Wise app.

Wise account minimum balance

There is no minimum balance requirement for the Wise account. And because the Wise account doesn’t have monthly or annual maintenance fees you can simply add money when you want to transact without needing to worry about paying ongoing charges.

Wise transfer limits

Both individuals and businesses around the world trust Wise with high value international payments. As such, the Wise transfer limits are set fairly high, at the equivalent of about 1 million GBP per transaction for most currencies. If you need to send more you can always contact the customer service team for guidance.

Here are the Wise transfer limits for a few major currencies as an example:

| Sending | Maximum payment |

|---|---|

| EUR | 6 million EUR* |

| USD | 1.6 million USD |

| AUD | 1.8 million AUD |

| CAD | No limit |

| SGD | 2 million SGD |

* If you want to send more than 1.2 million EUR, you’ll need to transfer it from your Wise account balance

Conclusion: Is Wise a good foreign currency account?

Wise multi-currency account offers flexible and low cost ways to hold, send, spend and receive foreign currencies. Because Wise uses the mid-market exchange rate with low and transparent fees, the overall costs are typically pretty low, and you’ll be able to manage your account and card conveniently with nothing more than your phone.

Open a Wise account in just a few taps, add money and get your Wise Multi-Currency Card for easy spending and withdrawals in 150+ countries, with fast - and even instant - ways to send money to 160+ counties, too.

Wise account is available to individuals, business owners and self-employed who need to pay and get paid internationally, and can make it cheaper and easier to manage money across borders. That can make it a good fit for travelers, expats, digital nomads, people shopping online with overseas retailers, or anyone else who has an international lifestyle.

Create Wise Account

TransferWise Borderless account FAQsHow much does Wise account cost?

There’s no cost to open a Wise personal account, and no monthly fees to pay. Some transaction charges do apply, which are low and transparent.

How long does Wise take to transfer funds?

Many Wise transfers are instant or arrive within 24 hours. You’ll see a delivery estimate when you arrange your payment.

Is Wise account safe?

Wise is a safe and fully regulated provider, registered with FinCEN and covered by a range of regulatory bodies overseas for enhanced consumer protection.

How does Wise apply exchange rates?

All currency exchange with Wise uses the mid-market exchange rate with a low conversion fee. This can be as low as 0.42% for major currencies.

Does Wise have a mobile app?

Yes. Get the Wise app on both Apple and Android phones. It's free to download.

How does Wise work?

Open a Wise account online or in the mobile app to hold, send and receive foreign currencies. You can also get a linked Wise Multi-Currency Card to spend and make withdrawals around the world.

How many currencies can I hold in Wise?

You can hold 40+ currencies in a Wise account, including major global currencies like USD, GBP, EUR, CAD and more. You can also send payments to 160+ countries, and get bank details to get paid like a local in 9 currencies to your Wise multi-currency account.

How much money can I keep in my Wise account?

A limit may apply to the amount of money you can receive into and hold in your Wise account. However, even where a limit applies, it is set fairly high to allow customers to transact as much as they like.

Is Wise an international account?

Yes. Wise offers a multi-currency account which allows customers to hold, exchange, send and spend in a broad range of currencies.

Is Wise a foreign currency account?

With the Wise multi-currency account you can get local bank details for 9 countries including the US, the UK, Australia and Eurozone to receive payments easily from 30+ countries.

What is the Borderless Account by Wise?

Borderless Account by Wise is the same as Wise Multi-Currency Account, the name has been changed from Borderless Account to Wise Multi-currency Account.

Does Wise charge for holding money?

Wise does not charge for holding money in any of the 40+ supported currencies.

How long does it take to open a Wise account?

You can open a Wise account quickly online or in the Wise app, by entering your personal details and uploading some documents for verification. Verification can be instant, but may take up to 2 days depending on the circumstances

Can I have two Wise accounts in different countries?

You can only hold one Wise personal account. It’s not possible to open additional Wise personal accounts in other countries. If you’re moving overseas you’ll be able to update your Wise details to reflect your new address, and you may be required to provide verification of the change.

More information about Wise account

Can you use a Wise Account as a bank account? Click to learn how a Wise Account works, and how it’s different to an account you may get from a bank or credit union in the US.

- Read more ⟶

- 3 min read

Can't decide between a Wise Account and a Wise Business account? Read our comprehensive guide to learn more.

- Read more ⟶

- 4 min read

In this guide, we covered everything you need to know about opening a Wise account in the US.

- Read more ⟶

- 5 min read