How to Open a UK Bank Account from the USA [2025 Guide]

If you want to open a bank account in the UK from the United States, we’ve got the information you need. Whether you’ve just landed in the UK or you’re planning everything ahead of your arrival, opening a bank account in the UK can be a complex process. Although it can be tough to open an account if you’re not a UK resident or citizen, it’s not impossible.

This article will help you understand how to open an account, the documents you need, and guide you through the available options and compare them to less complicated solutions, such as Wise or Revolut. Online specialists like this can help you open an account in GBP – even as a non-resident – which is often cheaper, more flexible and entirely online. But more on that later, read on.

Quick Summary: UK bank account for non-residents

- US citizens can open a bank account in the UK, but will need to provide some documents like personal identification and, in some cases, proof of UK address or income.

- Specialist digital providers like Wise and Revolut offer online multi-currency accounts for US residents with various features and low international transfer fees.

- Major UK banks like HSBC and Lloyds also cater to US citizens, offering a range of accounts for international clients.

- Various types of bank accounts are available, including current accounts for daily transactions and savings accounts with interest.

Can a US citizen open a bank account in the UK?

Yes, US citizen’s can open either a bank account with a UK bank or an account with a specialist provider. However, non-residents will need to provide identification, such as a passport or drivers’ license alongside other possible requested documents, like proof of address.

Some banks might require you to visit a branch in person to open an account, whereas with specialist providers like Wise and Revolut, you can do it all online.

Whether you’re an international student or another non-resident of the UK, we’ll guide you on how to open an account for all of your UK banking needs.

How to open a bank account in the UK as a non-resident

Opening a UK bank account as a foreigner is possible, but it can be a complicated process and you’ll need to provide proof of identity and a UK residential address. Most banks might also require an in-person visit at one of their branches, making it difficult for those who haven’t yet landed in the UK. You’re more likely to be successful opening an account online with specialists, like Wise or Revolut.

While it is possible for an American to get access to their own UK bank account, it can also be difficult. You have a few different options:

- Several UK banks offer specialist, international accounts. Unfortunately, these accounts often have very high initial deposit requirements, and you will probably need to pay a high monthly fee and pay in a lot of money each month to keep using them.

- Some US banks have “reciprocal relationships” with banks in the UK. This means they can effectively “vouch” for you, which will improve the chances of a UK bank opening your account. Some US banks may even have a UK presence.

- Visiting UK banks on arrival: If you’re planning to be a resident in the UK, you can visit a UK bank when you arrive, and providing you have a valid address document and a valid identity document, you can open an account.

- Multi currency accounts: You can open an online account from specialist providers like Wise and Revolut. We’ll cover more on them later.

Which account is best in the UK for foreigners?

It can be complicated to open a UK account if you’re not located there, but online accounts can offer a convenient work-around. Here is a quick summary of 4 providers we’ll look at in this guide:

| Service | Wise | Revolut | HSBC | Lloyds |

|---|---|---|---|---|

| GBP and USD account options | Yes | Yes | Yes (Global Money Account) | Yes (International Current Account) |

| Open account before you arrive in the UK | Yes | Yes | Yes | Yes |

| Open an account online | Yes | Yes | Yes | Yes |

| Account opening fee | No fee | No fee | No fee | No fee |

| Fall below fee | No fee | No fee | No fee | No fee |

| Maintenance fee | No monthly or annual fees | Standard plan is 0$/month. There are multiple tiers with varying monthly fees. | £0 | £0 |

| International transfers | Yes | Yes | Yes | Yes |

| Close account fee | No fee | No fee | No fee | No fee |

Banks like HSBC or Lloyds: As you can see from the table, all four options allow foreign customers to open an account online before they arrive in the UK. HSBC and Lloyds bank provide online account opening services as long as customers are able to provide the required documents Proof of ID, proof of address, current employment, income or tax details.

Multi currency accounts like Wise or Revolut: While you’ll also need to provide proof of ID with Wise and Revolut, the process is slightly simpler as your employment and income documents won’t be required to open one of their multi currency accounts. GBP multi-currency accounts in the US like Wise and Revolut allow you to hold USD and GBP in one account, offering you fast and convenient money transfers between the UK and the US.

Additionally, while all options offer standard current accounts with no opening or monthly maintenance fees, Revolut does have paid tier plans which provide more features than their free Standard plan.

Let’s take a detailed look in each provider.

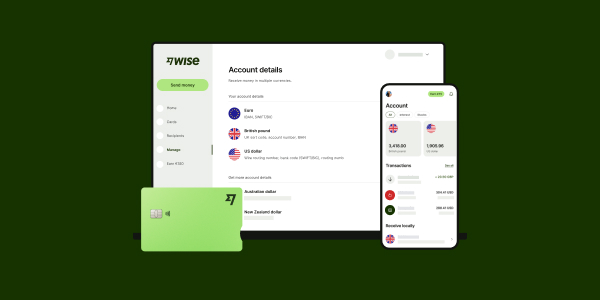

Wise GBP account – no monthly fees, GBP account details

Wise is a popular currency exchange and international money transfer service, providing mid-market exchange rates and low fees for sending money around the world. Their multi-currency account is a flexible and convenient solution for opening a bank account in the UK from the US.

Here is how Wise account works:

- The Wise account is a multi currency account that lets you hold money in more than 40 currencies, including USD and GBP.

- You can get local account details in 8+ currencies, including GBP and USD, which effectively means you have a UK bank account with its own sort code and account number.

- Receiving GBP payments is free. There’s a 4.14 USD fixed fee to receive USD wire transfers, but receiving ACH payments are free.

- You also get a linked Wise Multi-Currency Card, so you can spend money from the account internationally in 150+ countries including the UK and the US.

- There’s a Wise app that tells you how much is in your account at all times, and you can set-up transfers easily.

- You can also use your Wise to send money to over 160 countries or in 50+ currencies.

Fees for the Wise account

There are no minimum account amounts, no monthly fees and no maintenance fees on the multi-currency account. The Wise fees you’ll pay are:

- Low fees when converting between currencies, starting from 0.43%

- There are no Wise fees for first 2 ATM withdrawals, up to the total value of $100 every month – you’ll pay 2% + 1.50 USD per withdrawal for ATM withdrawals beyond that

The amount charged for converting between USD and GBP is as follows:

- USD to GBP: A fixed fee of 4.18 USD if you’re converting $1,000

- GBP to USD: A fixed fee of 0.26 GBP if you’re converting £1,000

How to open a GBP account with Wise

Open a Wise account in GBP easily and quickly by following these steps:

- Register online: Register with Wise, either online or via the Wise app to open your account. Just click the Register button and enter your email address or sign up using your Google, Facebook or Apple account.

- Verify your identity: Verify your identity by uploading a picture of your ID alongside a selfie. Wise will provide on-screen prompts to guide you through each step and the process can be completed online or using your phone.

- Open your currency balance: Once your account has been verified, you can set up your GBP currency balance. To do this, log into your account, click ‘Open a balance,’ and select GBP.

- Your account will opened and be ready to use instantly.

Revolut Account – free tier option, some no-fee ATM withdrawals

Revolut accounts have been available to personal customers in the UK since 2015.

5 different personal Revolut account plans are available:

- The Standard plan doesn’t have a monthly fee.

- Plus for GBP 3.99/month

- Premium for GBP 7.99/month

- Metal for GBP 14.99/month

- Ultra for GBP 45/month

Paid plans allow you to access additional features and benefits including no-fee ATM withdrawals, preferential customer service, premium physical cards and disposable virtual cards. Revolut business accounts, and junior accounts for children are also available.

With Revolut, you can hold over 25 currencies in the same account and manage your money using an app. Revolut users can send money internationally with no fees, except on weekends, and sending between Revolut accounts is instant. There are also handy budgeting features to help you save, a reward and cashback program and options to buy, sell and trade crypto currencies and commodities.

Fees for Revolut account

Here are some of the fees you’ll come across when you have a Revolut account.

- A monthly 2.99 GBP for the Plus plan, 6.99 GBP for the Premium plan and 12.99 GBP for the metal plan.

- Up to 5 no-fee ATM withdrawals or £200 per rolling month and then a 2% fee applies.

- No currency conversion fees

- Exchange limits: Standard Plan – A limit of 1,000 GBP per month and then a 1% fair usage fee.

- Plus Plan – A limit of 3,000 GBP per month and then a 0.5% fair usage fee.

- Premium, Metal and Ultra Plans – No exchange limit or fair usage fee.

How to open an account with Revolut

You can open a Revolut account online in minutes. Simply:

- Download the app and enter your phone number where you will create a 4 digit passcode

- Enter a six digit code you receive via text message.

- Enter your personal information

- Verify your identity

You’re then top up your account, and start using it. To open a currency account in addition to your GBP account just go to the home screen and click on the arrow next to your current balance. You can then select ‘+ New’ where you’ll be able to choose your currency.

HSBC account – international bank account options for expats

HSBC offers accessible UK accounts for US citizens relocating to the UK, with no monthly fees on their standard HSBC Bank Account. Here are some key features and fees:

- ATM withdrawal limit: 300 GBP per day

- Foreign card usage fee: 2.75% plus a 2% fee for cash withdrawals outside the UK (minimum 1.75 GBP and maximum 5 GBP).

- Those with an HSBC debit card will receive exclusive access to Home&Away offers from various retailers.

How to open a UK bank account with HSBC

Setting up an account with HSBC is straightforward and can be done from most locations abroad, provided that you have the required documents. You can either apply online or visit an HSBC branch in person. Here’s how to get started:

- Apply online or visit a branch: Apply online if you need to have a UK account up and running before you arrive in the UK or visit a branch for in-person assistance.

- Provide the required documents: You’ll need to provide proof of ID (passport or driving license), proof of address (utility or phone bill) and details of your current employment, income and tax.

- Account activation: Once your application has been processed and approved, you can start managing your finances through HSBC’s mobile app or online banking platform.

HSBC also offers a digital Global Money Account that allows you to hold money in different currencies, including US dollars, with no HSBC fees.

Lloyds account – for foreigners who want to live & work in the UK

Lloyds Bank offers a range of current accounts with varying features which are also accessible to foreigners who want to live and work in the UK. Some features include:

- International payments: Send money internationally in over 30 currencies and make payments in Euros for free. For other currencies there’s a fee of 9.50 GBP.

- Classic Account: This account offers free everyday banking with no monthly maintenance fees and comes with a contactless debit card and overdraft facility.

- ATM limits (Classic account): ATM withdrawal limits amount to 800 GBP per day with the classic account

- Payment limits (Classic account): Maximum daily limit of 5,000 GBP per day.

How to open an account with Lloyds

As a US citizen, you can also apply for an account online or by visiting their nearest local branch; however, you’ll need to make an appointment first. To open an account with Lloyds, you need to be 18 or over and a UK resident and can still apply even if you aren’t currently employed or have an income.

When you make your application, you’ll also need to provide personal details such as

- Date of birth

- Nationality

- Marital status

- Address history

- Contact information

- Income details

- Employment status

- Outgoings (bills, rent, mortgages, etc.)

To open a Lloyds account online, you’ll need one of the following:

- A Biometric Residence Permit

- A current UK photo driving license

- A UK passport

If these aren’t available, you’ll need to bring two documents to the branch as proof of identity and address.

What do I need to know before opening a bank account in the UK?

Opening a bank account in the UK requires a few key documents:

- First, you’ll need to make sure that you have valid identification, like a passport, driver’s license, or national ID card to prove who you are. You’ll also need proof of a UK address, which can be a recent utility bill or bank statement. It’s important to note that these requirements are the same whether you choose to open your account online or visit a bank branch.

- If you’re under 18, you may face some restrictions as most UK banks require customers to be at least 18 years old. For non-UK citizens and residents, such as international students or workers, there are specific accounts available, but these vary between banks.

- While some banks may allow you to apply online, most banks will require you to come to a branch in person. When doing so, it’s advisable to schedule an appointment and bring along the necessary documents. Be aware that some banks may have requirements like maintaining a minimum balance or making regular deposits.

Different banks have their own set of rules and services, so it’s wise to do some research or contact the bank directly to understand exactly what you’ll need. This is especially beneficial if you’re new to the UK or if you’re looking for more flexible banking options, as some banks cater specifically to these needs.

Benefits of opening a bank account in the UK

Opening a UK bank account provides various benefits, especially for those living, working or studying in the country. A UK bank account will significantly simplify all of your financial transactions, providing you with a safe place to manage your money. Key benefits include:

- Access to financial services: Having a UK bank account gives you access to a range of services like overdrafts, loans, credit facilities and more. This might be crucial when managing unexpected expenses or when making bigger purchases like buying a home.

- Ease of transactions: Without a UK bank account, handling daily financial activities like shopping, paying a bill or receiving a salary are much more difficult.

- Building your credit history: Using a UK bank account responsibly will help you to build up a credit history in the country, which is important if you want to apply for future lines of credit.

- Security: UK banks are regulated and deposits are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, offering a high level of security for your funds and peace of mind that your money is safe.

Can I open a bank account in the UK before arrival?

It’s tricky to open a bank account in the UK prior to arriving in the country. That’s because most banks need you to be able to show a UK issued proof of address.

If you want to get ahead of the game and get your GBP bank account set up before you arrive, you’ll probably be better off with a specialist service like Wise or Revolut.

Can I open a UK bank account online?

Yes, you can open a bank account online in the UK, even before you arrive. However, it could be difficult as not all banks offer this for foreigners who are not yet living in the UK and banks typically require proof of address as well as other documents and sometimes even in-person verification.

Online specialist providers like Wise and Revolut make a great, flexible alternative, making it significantly easier for non-residents to set up a GBP bank account remotely from the US. These online platforms have been specially designed to cater to the needs of international customers, offering a quick and simple application process that can be completed anywhere from abroad.

How to open a bank account in the UK from US online

Opening a bank account in the UK from the US online is a relatively simple and straightforward process, allowing you to set up an account remotely without the need to visit a physical branch.

- Choose your provider: Select a UK bank that offers online account opening for foreign residents like HSBC or Lloyds, or digital providers like Revolut and Wise.

- Fill out an application form or register online: Depending on your chosen bank or provider, you’ll need to complete an online application form with your personal details.

- Verify your identity: You’ll need to verify your identity by providing your passport or driver’s license. It’s important to note that some banks may also require additional documents, like proof of address. Depending on your bank, you might also need to complete some additional verification steps.

- Wait for approval: Once you’ve submitted your application and have verified your identity, your provider will review it. The process can take a few days to a week, or within 24 hours for most online specialists, and you’ll be notified once your account is approved.

- Set up online banking: Once your account is open you can now set up online banking to manage your account and finances.

How long does it take to open a bank account in UK

Exact timelines for opening a bank in the UK will depend on your specific bank or specialist provider. While the process can take a few days and even sometimes up to a few weeks, the majority of standard bank accounts can be opened within 1-2 days.

How much does it cost to open a bank account in the UK?

Opening a UK bank account with both banks and online specialist providers, is generally free of charge, especially when it comes to basic current accounts.Wise and Revolut, for example, offer the convenience of opening an account at no initial cost and with no monthly maintenance fees, making them a good choice for those who need flexibility alongside international services.

However, it’s important to mention that bank accounts may have maintenance fees, which will vary depending on the type of account and services required. While opening a current account is generally free, premium accounts that come with added benefits like credit card options or higher interest rates, usually come with monthly or annual fees.

In addition, certain services within your chosen account may incur extra costs, such as sending money abroad, making transactions in foreign currencies, withdrawing money from ATMs or using an overdraft facility which usually involve interest charges.

Is it possible to open a fee-free account in the UK?

Most major UK banks provide basic current accounts with no ongoing services fees. They are designed to provide essential banking services without a monthly fee, although some transactional fees may still apply for specific services like international transactions or overdrafts.

Digital providers like Wise or Revolut also offer fee-free account options with a wide range of features, often at lower costs, minimizing fees typically associated with banks.

What are the additional costs?

While opening a bank account in the UK might be free, there are various additional fees and charges that you’ll most likely come across. These will vary depending on the bank and the type of account that you have, but these are some of the most common:

- Maintenance fees: Some banks will charge a monthly or annual fee to maintain your account. These can range anywhere from 5 to 10 GBP but it can be higher for more premium and specialist accounts.

- Withdrawal fees: Charges may apply for withdrawing money abroad or ATMs that aren’t in your chosen bank’s network.

- Interest charges: Using lines of credits like loans or overdraft facilities will usually come with interest charges, especially if you exceed your agreed-upon overdraft limit.

- Transaction costs: You could be charged for making various transactions like making bank transfers or international payments.

- Cash and cheque fees: Some banks charge a fee for depositing cash or cheques into your account.

- International transfers: Sending or receiving money internationally will usually involve additional fees, which will vary between providers.

- Transaction limits: Some banks will have a limit on the number of transactions you can make within a month, charging a fee if this is exceeded.

Requirements for US citizens to open a bank account in the UK

Typically, most UK banks require someone to be a resident in the United Kingdom when they set up their account. Alternatively, major UK banks will point you to their international and offshore banking options. These account types are usually available for foreigners and non-residents, but they come with restrictive conditions, and, often, high fees.

What documents do you need to open a bank account in the UK?

To open a bank account with a UK bank, you’ll need to provide proof of identity and proof of address. This usually means you’ll need the following:

- Proof of identity – a valid passport, national identity card or driver’s license for example

- Proof of UK residential address – a bank or credit card statement, utility bill or tax return in your name

Choosing these documents is often the easiest way for the bank to comply with UK legislation designed to stop fraud, money laundering and illegal account use. It helps keep accounts and customers safe – but it’s not always easy to provide this paperwork as a non-resident or a new arrival in the UK.

Luckily, some specialist providers and expat services are more flexible in checking customer identity, making it far easier for non-residents to get a UK account legally.

Can I open a bank account in the UK only with my passport?

To open a bank account in the UK, you’ll generally need to provide proof of address alongside proof of identity, such as a passport or national ID card.

What are the types of bank accounts in the UK

In the UK, bank accounts can be placed into two categories – for residents and non-residents.

For those who don’t live in the UK but need to carry out financial activities within the country, accounts like HSBC’s Expat Account will make managing your finances while in the UK simpler, while offering safe and convenient services.

The most common accounts on offer are:

- Current account: A current account is the most common type of bank account, used for day-to-day financial transactions like shopping, setting up direct debits to pay bills, etc. They usually come with a debit card and have an overdraft facility subject to approval.

- Savings account: Designed for saving money over a period of time, a savings account will usually offer interest on your balance.

- Student account: Tailored for those in higher education, a student account typically comes with special offers or benefits like interest-free overdrafts.

- Business account: Designed for business owners, business accounts are specifically designed for business transactions, helping entrepreneurs to manage their finances and run their businesses.

International and Offshore banking accounts

One expensive way that you can open up an account from the US is to create an international account with a major UK bank. Unfortunately, this will be out of reach for most US citizens for several reasons:

- You’ll typically need to make a large initial deposit

- You’ll need to deposit a sizeable amount of money into the account each month

- You’ll need to earn a significant salary

- You’ll need to pay a monthly maintenance fee to keep the account open

What is a bank account in the UK needed for?

When living in the UK, having a bank account is essential for daily financial activities, such as:

- Receiving your salary: Those employed in the UK typically have their salaries paid directly into a bank account.

- Paying rent and bills: A UK bank account lets you set up direct debits to pay your monthly mortgage or rent as well as all of your other regular payments like utilities and council tax.

- Shopping: A UK bank account usually comes with a debit card, meaning you can make secure and convenient everyday transactions like shopping in stores and online.

Reciprocal relationships between the US and the UK banks

It’s possible that the bank you hold an account with in the US has a relationship with a bank in the UK, which may allow you to open an account there. We recommend contacting your bank in the US directly and enquiring with them about opening a UK account. They may be able to recommend a correspondent bank, or they may even have a branch in the UK where you can access your US account or set up a new bank account.

In many cases, though, opening a bank account through a reciprocal bank is likely to be difficult and complex.

US banks with UK branches

With the number of people traveling and moving abroad on the up, there’s also been an increase in the number of American banks establishing a significant presence in the UK, offering financial services that US citizens can find at home. While the following isn’t a complete list, notable US banks that can be find in the United Kingdom include:

- Citibank: Part of the large Citibank Group, the UK branch focuses on wealth management solutions and offers products like the Citigold International Citi Debit Card, catering to customers who need to maintain funds in US dollars while living and working in the UK.

- Morgan Stanley Bank International: While Morgan Stanely doesn’t offer banking services in the UK, it does have a presence, providing other products like investment strategy and financial advisory services.

- Chase: Chase, a major US financial institution, is also in the UK banking market offering current and savings accounts.

- Northern Trust – Northern Trust has had a presence in the UK since 1969, with the London office being their regional headquarters for Europe. The finance specialist mainly provides asset and wealth management services to corporations and high-networth individuals.

The UK banks in the USA

British banks also have a presence in the US, providing various financial services that cater towards British and global customers, from personal banking to business banking solutions and wealth management. Here are just some of the major British international banks you can expect to find in the US:

HSBC – One of the world’s largest banks, HSBC has been operating in the US since 1865, allowing US customers to take advantage of its international footprint. From savings to checking accounts, commercial and global banking and more, HSBC has 22 branches and offices around the country.

Barclays – Barclays is another major British bank with a notable presence in the US. While they don’t have any physical branches, they collaborate with 25 companies to provide a range of consumer and small business credit card programs as well as digital personal finance services.

Lloyds – Lloyds bank mainly operates through its commercial business banking sector in the US, focusing on business and corporate banking services.

Visit a UK bank with the right documentation to open an account

While you can’t do this when you’re in the US, we want to make you aware of all your options. If you’re going to be resident in the UK, you can open a bank account shortly after arriving there. Most of the big banks in the UK have accounts for new arrivals, and you’ll have plenty of choice.

- Barclays provides a wide range of current (checking) accounts with good offers for students.

- Lloyds has a large banking network and a “Classic” current account suitable for basic banking needs.

- HSBC provides basic, student, and premier bank accounts.

- Both RBS and Natwest provide accounts for most needs.

How much does it cost to open a non-resident bank account in the UK?

We’ve covered how major UK banks are likely to send non-resident customers in the direction of offshore banking services – and how expensive that can be. For many international and offshore bank accounts, you’ll find yourself with high minimum deposit rates and higher-than-expected fees – although you could also benefit from perks like wealth management advice and personalized services. These products do have a market – but it’s mainly among high-wealth individuals who want the extra services – and the status – that an offshore account can provide.

If you’re looking for a non-resident bank account option that doesn’t come with hefty fees and can offer greater flexibility around currencies, online specialist services may suit you better. We’ve got a couple of top picks coming right up.

The best bank for US citizens wanting to open an account in the UK

As a US citizen, the best UK bank will all depend on your specific personal needs and requirements. For some, major high street banks such as HSBC and Lloyds will cover all of their personal banking needs, while digital providers like Wise and Revolut may be best for those with multi-currency needs or who need to open an account quickly before their arrival in the UK.

For more information about linked GBP debit cards, you can check out our guide: Best GBP cards.

How to open a business bank account in the UK

Most UK banks will offer business accounts to entrepreneurs and business owners with UK-registered businesses. To open a business account in the UK, you’ll need to provide business registration information and a suite of paperwork about the owners and anyone holding a significant share.

Different banks have different processes for arranging business bank accounts, so you’ll want to compare a few and check out the options before you get started. Alternatively, look at flexible digital alternatives like Wise and Revolut, which offer business services with low costs and multi-currency functionalities.

Learn more: Wise business account & Revolut business account

You can also check out our guide on Best Online Business Accounts

UK bank accounts for expats

While there aren’t many, the UK does offer bank accounts specifically for expats, such as HSBC’s non-resident account, designed for people who either haven’t yet moved to the UK or who want to maintain financial links in the country.

Online specialist providers like Wise and Revolut also offer multi-currency accounts, which are particularly beneficial for expats dealing with different currencies.

Wise: Wise lets you open an account online from abroad, letting you hold and manage money in over 40 currencies with low and transparent fees – perfect for US expats needing to manage their finances in the UK and across different countries.

Revolut: Revolut also provides a multi-currency account that supports over 25 currencies and can be opened online with multiple tiered monthly plans with various features for international money transfers at favorable rates.

Monzo: Monzo is a regulated mobile-only UK bank account with no monthly fees or fees for card use in the UK and abroad. However, you’ll need to already be living in the UK and be able to provide a UK address to qualify for an account.

Monese: Monese also offers a borderless foreign currency account in GBP, EUR or RON, allowing you to transfer money around to various locations world-wide. It also requires less documents to get set up in comparison to other providers as it doesn’t request proof of address, making it more accessible for foreign nationals needing a bank account in the UK.

Tips for sending money between the US and the UK

Sending money between the US and the UK doesn’t have to be complicated or expensive if you simply follow a few practical tips.

Compare exchange rates offered by various providers to ensure that you’re getting the best deal for your money and consider using financial platforms like Wise or Revolut, which often offer better rates and lower fees than banks.

Checking transaction times is also important, especially if you need to send your money across fast. Most standard bank services take around 3-5 business days, while some other providers, such as online specialists, offer instant or next day delivery services.

Conclusion: Which account is best for non-residents?

There’s no legal barrier to non-residents and new arrivals in the UK opening a bank account. However, non-resident accounts with high street banks tend to be tricky to open, expensive and inflexible.

For many customers, choosing a specialist online service like Wise or Revolut will offer a better overall deal, including a more straightforward verification process, lower fees, and better exchange rates.

How to open a UK bank account as a foreigner FAQs

Can a foreigner open an account in the UK?

Yes. You can open a UK account as a foreigner or non-resident. However, non-UK residents will find it harder to open an account with a high street bank, and may find it easier to get set up with a specialist online provider like Wise or Revolut.

How much do I need to open a bank account in the UK?

You can often open a bank account for free in the UK, although some banks do ask for a minimum deposit amount to start with. Compare a few providers to get the best deal for your needs.

Can I open a UK bank account online?

Yes. You can open a UK bank account online if you have proof of a UK address. If you don’t have this, you may be better off with a specialist online provider, like Wise or Revolut, which allows you to open your account on your laptop or mobile device, with a more flexible verification process.

What is the best UK bank account for non-residents?

Many major UK banks offer international and offshore banking services which are aimed at high wealth individuals. If that’s not what you’re looking for, your best bet might be to open a UK bank account for non-residents online with a specialist provider like Wise or Revolut.

Why can’t I open a bank account in the UK?

There’s no legal reason why you can’t open a bank account in the UK as a non-resident or foreigner. However, because of financial laws aimed to stop fraud, it can be tricky to get an account if you don’t have proof of UK residence yet. In this case, check out online specialist multi-currency account providers which typically have a more flexible approach to account opening processes.

Can I open a bank account in the UK without a job?

Yes. You can open a bank account in the UK without needing to prove you have a job. However, some specialist accounts may require you to deposit regularly, through a salary, benefits, pension or other income. Check the account terms and conditions to help you find the right one for you.

Can I have a UK bank account without a UK address?

You are unlikely to be able to get a regular bank account in the UK without showing a UK proof of residential address, like a utility bill in your name. However, online specialist multi-currency accounts, like Wise and Revolut, are available which accept proof of address from your home country – meaning you can apply online before you move to the UK, and use your US proof of address to get your account up and running.

Can I set up a UK bank account from abroad?

Most UK banks will need to see a proof of UK residence to allow you to open an account – so while online opening is an option, it may not be possible if you’re not already a UK resident. Look at specialist services like Wise and Revolut instead.

How to apply for a bank account online in the UK?

Apply for a bank account in the UK by choosing a bank, or specialist online provider like Wise, that meets all your required needs. Visit the bank’s website and fill out the application form with your requested details, or visit a physical branch in person, and verify your identity by providing the required documents, like a passport or driver’s license.