Xoom Review 2023

Our complete and comprehensive review of Xoom Money Transfers (owned by PayPal) and growing in popularity.

Xoom Money Transfers is designed to send your money where it needs to be, fast. Built for speed, Xoom isn’t the cheapest option and neither does it try to be. What it does offer next to pace is flexibility in payment methods and a long list of supported currencies.

Combined with the security of the PayPal umbrella, Xoom is a leading provider to send money abroad from the US, Canada, Europe and the UK.

In this Xoom review we explain:

Xoom is good for

- Speed: Can send your money within hours

- Range: Send your money to 52 countries from the US

- App: Highly rated app that’s secure and easy to use

Xoom rating: 4.0 / 5.0

Money transfers can be sent from these countries

Xoom has anchored itself in the US, Canada, Europe and the UK and as such, you can only send money from these 4 major currencies:

- US Dollar

- Canadian Dollar

- Euro

- British Pound

Where Xoom really excels is in its range of countries you can send money to and how you want your money to be received. With over 130 locations to send money abroad, this almost unrivalled range is one of the key features that draw customers to Xoom.

Money transfers can be sent to these countries:

We’ve listed all of the countries Xoom can send money to and outlined the delivery method available. In the tables below, you can see all of the other countries you can send money to using both bank transfer and cash pickup, or cash pickup only or bank transfer only.

If you want to send money to the Dominican Republic, Philippines or Vietnam you have the most flexible options. You can send money to a bank, send cash for pick-up and you can also use Xoom's home delivery service.

With Xoom, you can send bank transfers or cash pick-ups to these countries:

Africa

- Benin

- Burkina Faso

- Cameroon

- Democratic Republic of Congo

- Egypt

- Ethiopia

- Gabon

- Ghana

- Guinea-Bissau

- Ivory Coast

- Kenya and M-Pesa

- Mali

Europe

- Austria

- Belgium

- Bulgaria

- Cyprus

- Denmark

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Lithuania

- Luxembourg

Americas

- Argentina

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Ecuador

- El Salvador

- Guatemala

- Guyana

- Haiti

- Honduras

- Jamaica

Middle East

- Israel

Asia

- Bangladesh

- India

- Indonesia

Oceania

- Australia

With Xoom, you can only send cash pick-up to these countries:

Africa

- Burundi

- Comoros

- Djibouti

- Eritrea

- Gambia

- Guinea Bissau

- Liberia

- Madagascar

- Malawi

- Morocco

- Seychelles

- Sierra Leone

- Suriname

- Tanzania

- Tunisia

- Zimbabwe

Europe

- Albania

- Armenia

- Georgia

- Kyrgyzstan

- Macedonia

- Moldova

- Montenegro

- Serbia

- Ukraine

- Uzbekistan

Americas

- Antigua and Barbuda

- Puerto Rico

- Trinidad and Tobago

- US Virgin Islands

Middle East

- Bahrain

- Jordan

- Kuwait

- Oman

- Qatar

- UAE

Asia

- Bhutan

- Cambodia

- Malaysia

- Myanmar

- Mongolia

Oceania

- Samoa

- Tonga

With Xoom, you can only send bank transfers to these countries:

Europe

- Bosnia and Herzegovina

- Croatia

- Czech Republic

- Estonia

- Hungary

- Latvia

- Malta

Africa

- Botswana

- Chad

Asia

- China

- Hong Kong

- Japan

Xoom Sending Limits

When you open a Xoom account you’ll be assigned an account level depending on how you have verified your account. To increase your sending limits with Xoom by moving up to the next account level, you’ll need to provide additional documentation to show your identity and address. If a payment would take you over the Xoom limit for your account level, you’ll be prompted to add more information or verify your account.

In some cases, additional sending limits may be placed by Xoom partners - this will be shown when you model your payments online or in the Xoom app. Here are the limits you need to know about based on your account level.

Xoom bank deposit limits:

| Account level | 24 hour limit | 30 day limit | 180 day limit |

| 1 | 2,999 USD | 6,000 USD | 9,999 USD |

| 2 | 10,000 USD | 20,000 USD | 30,000 USD |

| 3 | 50,000 USD | 60,000 USD | 100,000 USD |

Xoom Cash pickup limits:

| Level | 24 hour limit | 30 day limit | 180 day limit |

| 1 | 2,999 USD | 6,000 USD | 9,999 USD |

| 2 | 10,000 USD | 20,000 USD | 30,000 USD |

| 3 | 10,000 USD | 20,000 USD | 50,000 USD |

What is Xoom?

Xoom is a digital money transfer service that was founded in 2001 and acquired by PayPal in 2005. Since then, it’s gathered momentum and increased in popularity with customers worldwide looking for a fast and secure way to complete their international money transfer.

Crowning flexibility and speed as its key attributes, Xoom allows customers to send money to over 130 countries around the world within minutes to a few days.

Xoom also offers a wide range of payment and delivery options. It allows you to send money from your PayPal account, bank account, debit card or credit card.

The recipient can also collect the funds via bank transfer or, for some countries, a cash pickup or home delivery. On top of this, Xoom gives you an option to top up mobile phones and pay bills directly.

All of this has made them into an incredibly popular way for people globally to transfer money to family and friends. While they are cheaper than using your local bank, Xoom can be a more expensive option than other online money transfer services.

Is Xoom safe?

Xoom is very safe and secure. As a PayPal Inc service, it is regulated by both state and federal US government agencies. It partners with other banks and retailers to deliver flexible payment methods across the world, such as Bank of America, Citibank and HSBC.

For more information click here.

Pros and cons of using Xoom

- Long list of supported currencies.

- Flexibility in how you want to send and receive money.

- Fast transfers, often same day.

- Tracking available on transfers.

- High mark-up on exchange rates.

- Required government-issued ID to send and receive money.

- A lot of bad reviews.

- Poor customer service.

How does Xoom compare?

For cash pickups, Xoom has taken on companies such as Western Union who also offer this service. Western Union is hugely popular because of how established it is and their huge global network.

Xoom offers the same flexibility and speed for a money transfer. The only real difference is the price. When comparing sending money to India from the US, Xoom actually comes out on top as the cheaper option.

For digital transfers, we can compare Xoom to the likes of Wise (formerly known as TransferWise). Although Xoom says it can transfer money faster (often same day), Wise offers a better rate and can transfer your money between 1-2 days.

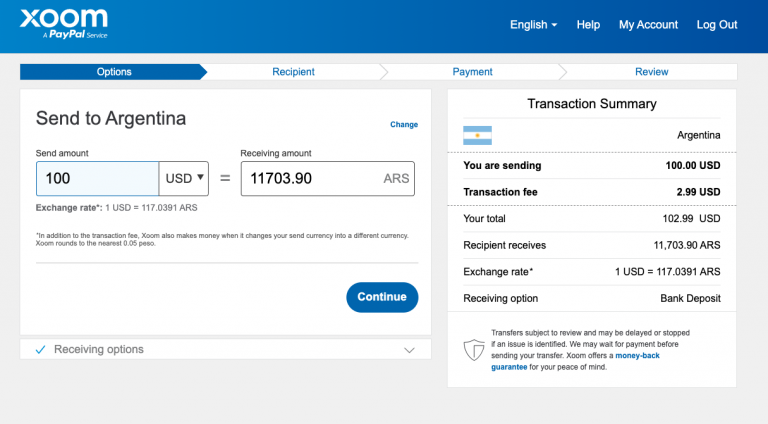

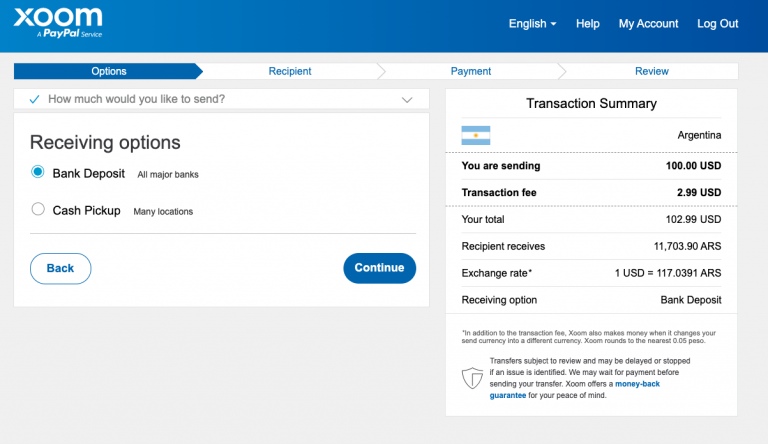

Xoom money transfer fees

When you model your Xoom international transfer online or in the Xoom app, you’ll see the different options and fees that will apply to your payment. Don’t forget there will also be a charge rolled into the exchange rate used - more on that in a moment.

To find the Xoom fees that apply to your payment:

- Log into Xoom and enter the destination country and amount you want to send

- You’ll be shown how much your recipient will get in the local currency

- Click the option Show Xoom fees for this transaction to see the amount you’ll pay based on different methods of funding the transfer

- Check the fees and exchange rate available, and follow the onscreen prompts to continue if you’re happy

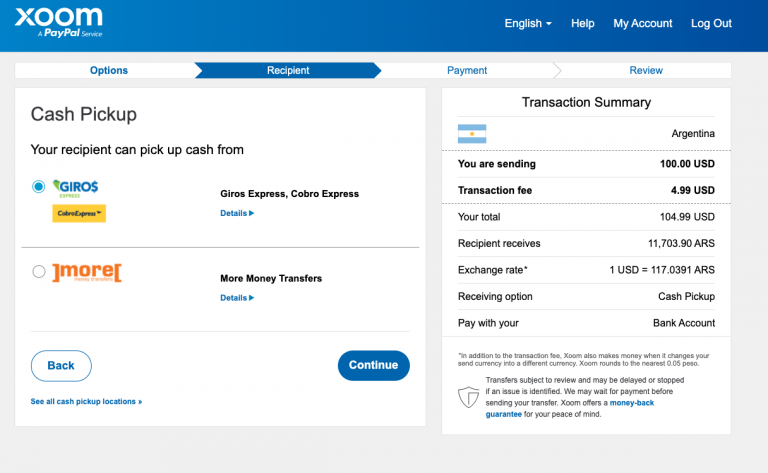

The exact costs involved in sending a payment with Xoom will depend on how you fund the transfer and how you want it to be collected or received by your recipient.

You may find that having your transfer collected in cash is more expensive compared to sending the money right to a bank account. There’s simply more labor required when you use a Xoom agent. It’s also important to note that funding your transfer with a credit card will usually mean you pay your own card’s cash advance fee, with interest applied immediately and without a grace period - that can work out to be a significant expense on top of the Xoom transfer fees.

Xoom has two types of fees attached when transferring money:

- Upfront transfer fee: usually $4.99 or less and applied only to certain currencies

- Hidden exchange rate mark-up: between 1-3%

Xoom money transfer exchange rate

When you make a Xoom international payment, you’ll have a couple of different charges to pay. One is the transfer fee which you can find when you model the payment - the other is the fee which is added into the Xoom exchange rate.

Xoom is very upfront about the fact it also makes money from currency conversion. You’ll see this message on the Xoom homepage before you even model your transfer:

“In addition to the transaction fee, Xoom also makes money when it changes your send currency into a different currency.”

As a large organization, Xoom will purchase most currencies at or near the mid-market exchange rate - the one you’ll find on Google when you look for your currency pairing.

Xoom then adds a markup to the mid-market exchange rate to create the rate that’s passed on to customers. This is an extra fee which means it’s harder to work out the full cost of your transaction, and can mean your recipient gets less than you’d expect based on the mid-market exchange rate.

How fast is Xoom?

Xoom prides itself on two things: its speedy delivery of funds and its easy way to do it

Since the speed of the transfer depends on Xoom’s partnerships with retailers and banks, Xoom says it can transfer anywhere between a matter of minutes and up to 2 days although typically, it sends money within the same day.

How does Xoom work?

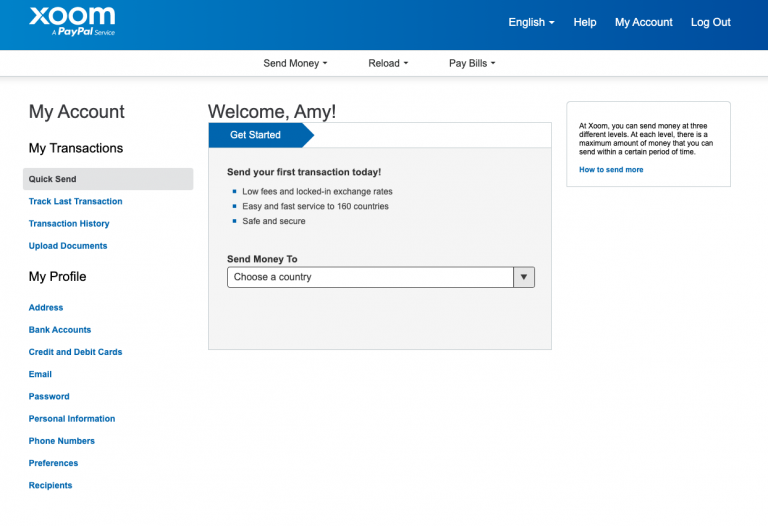

With Xoom you’ll be able to create an account online to send money around the world. You can start an account with just your personal details, or choose to upgrade to a higher account level by adding your SSN or passport information, or proof of identity and address documents. The amount of money you can send will be based on the account level you hold.

Sending money with Xoom is pretty easy once you have an account up and running. Just log into your account online or in the Xoom app, model your payment by entering your destination country and the amount you want to send, and get an instant quote. Check the fee and exchange rate information - more on how to do that in a minute - and follow the online prompts to enter all the details required based on your payment type.

In most cases you can pay for your Xoom transfer using a credit or debit card, or a bank transfer. Because Xoom is part of the PayPal family, you’ll also be able to link your Xoom and PayPal accounts so you can fund your international transfers from your PayPal account if you want to. That means you can pay with PayPal balances, and that any card or bank account you already use with PayPal will be available for you to use with Xoom, too.

It’s worth noting though that Xoom is intended for personal payments only. If you have a PayPal business account you might find your transfers can not be funded via this method if they appear to be related to your company.

How to transfer money with Xoom

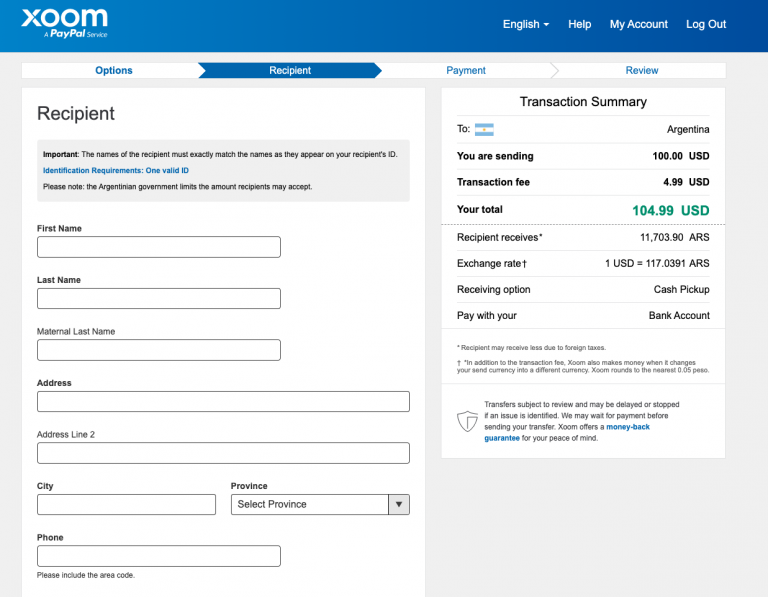

Xoom is designed to be easy and quick for its customers. Once you’ve set up your account with Xoom, it’s pretty easy to navigate your way around. We show you step-by-step how to send money below:

Step 1 - Use you Xoom log in to sign into your Xoom account

Step 2 - You will come to the home screen where you can choose the country you wish to send money to.

Step 3 - Enter the amount you wish to send. Look at the fees closely on the side of the screen. You will see a transaction fee plus the exchange rate which includes an applied mark-up by Xoom.

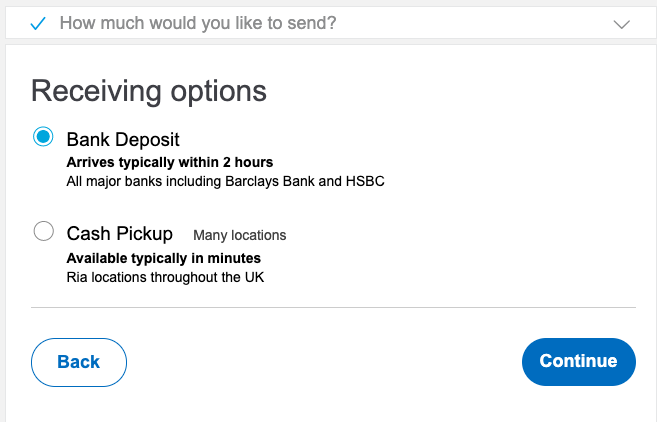

Step 4 - Click Continue and, if available, choose your preferred method for your recipient to receive your money. Most countries offer both a bank transfer or cash pickup service, but depending on where you want to send money to, you simply choose which option suits best.

Note: If you choose cash-pickup, you will need to know the exact location as Xoom will need to know where to send your money provided one of their partners operates within the area. Xoom has a large number of pick-up locations (960 in Argentina alone), so it’s important you choose the correct place.

Step 5 - Enter your recipient’s details and provide an ID for them to be verified. This is usually a form of ID specific to the country e.g. DNI for Argentina or you can supply a passport.

Step 6 - Choose your payment method and review the details.

Step 7 - Confirm and send.

How to receive money with Xoom

If you are on the receiving end of a Xoom transfer, then it should be pretty simple. First, be aware that Xoom will require you to upload a form of ID for you to access your funds, even if the transfer has already been made.

Xoom may also require further documentation if it is requested by the country’s regulations. For example in Jamaica, you will be required to drop off a completed deposit authorization form along with your recipient’s form of ID.

Once the recipient’s ID is verified, funds should appear shortly after or available for you to pickup.

If you are in need of a cash pickup, then your sender will need to choose the specific location and you simply pick it up from there. The funds are usually available within minutes.

For more information on transfer locations, click here.

What information you need to send money with Xoom

With millions of customers globally, all PayPal customers can use the Xoom service easily and quickly through their PayPal account. There is no need to sign up, you simply log in with your PayPal account username and password.

For those who don't have a PayPal account, you can choose to sign up for Xoom separately using the Sign Up option.

However, regardless of if you are a new or existing PayPal, you will be required to upload documents to verify your identity and your recipient’s when you use Xoom. These can be requested for a variety of reasons, such as:

- If you’re using Xoom for the first time

- If you’ve increased your spending limit (you want to send larger transactions)

- If you’ve requested any changes to your account

- If Xoom suspect identity fraud

When ID verification is requested of you, you will need to upload at least 3 of the below documents:

Examples of accepted identification

Passport with photo

Driver's License with photo

State ID

Immigration ID or Residence Permit

U.S. Military ID

Examples of address documents

Driver's License

State ID

Bank or credit card statements

Gas or electricity bills

US government documents

Helpful hints

Make sure your id is valid, recent and not expired

Make sure it shows your full name, your current address and date of birth

Provide clear, bright images for all documentation uploaded to Xoom

ID verification if you're receiving money with Xoom

When ID verification is requested for your recipient, your recipient will need to supply one of the following:

- Government issued ID

- Passport

See more about what documents Xoom needs from you here.

How you can pay for your transfer

Xoom offers several payment methods that let you fund your overseas transfer:

- Bank transfer to a Xoom account

- A debit card linked to your bank account

- A credit card

You can pay by most types of debit or credit card, including Mastercard and Visa.

If you make a card payment via credit card, your provider may charge your card as a “cash advance.” This can mean higher interest rates, and could also result in you starting to pay interest on the amount immediately. Check with your card provider to see if that’s likely to happen to you.

Xoom transfer limits

Xoom transfer limits are based on:

- Where you live

- Your delivery method (how the funds are received)

- Partner limits (Xoom’s partnerships with retailers and banks will determine where and how fast your money can go)

Xoom has also categorised its money transfer services into 3 separate levels, each with its own transfer limits that apply to each country.

For digital transfers from the US:

| 24-hour limit | 30-day limit | 180-day limit | |

| Level 1 | $2,999 | $6,000 | $9,999 |

| Level 2 | $10,000 | $20,000 | $30,000 |

| Level 3 | $50,000 | $60,000 | $100,000 |

For cash pickups from the US:

| 24-hour limit | 30-day limit | 180-day limit | |

| Level 1 | $2,999 | $6,000 | $9,999 |

| Level 2 | $10,000 | $20,000 | $30,000 |

| Level 3 | $10,000 | $20,000 | $50,000 |

For more information, click here.

Xoom Mobile Phone App Review

Xoom has a high average rating for its app across both iOS (4.7 out of 5 stars) and Google Play (4 out of 5 stars).

That being said, the reviews don’t all reflect the app and it’s ease of use, but instead of Xoom as a whole. As a result, there are mixed reviews left that range from 1 to 5 stars.

Some key positives:

- The speed of transferring (this is also a key complaint for some people, too)

- Works well for people who live in countries unsupported by a lot of other transfer services

Some key complaints:

- Customer service. The majority of complaints say there is no easy way to contact them and those that are struggling wait a long time for an answer or receive insufficient help.

- Identity verification documents and the process attached. Be aware that a lot of people complain about completing their transaction and the money being ‘held’ with Xoom until further ID is verified. Be sure this is all complete and approved before you transfer your money.

Customer reviews and support

TrustPilot customer reviews for Xoom

Xoom gets a 4.7 out of 5 star review on TrustPilot, with over 20,000 reviews.

Although the majority of people contributing to this average score haven’t left a written review, it’s worth noting that those left on TrustPilot all reflect significantly bad experiences.

These complaints range from poor customer service to unclear messaging about what Xoom needs from its customers. It also repeats a few reviews about deducting the money from people’s bank accounts and holding the money when the transaction can’t be processed.

Of course, these reviews don’t reflect Xoom as a whole and their 4.7/5 star rating is very high and should be considered when choosing if Xoom is right for you.

If you want to have a further look, click here.

Xoom customer care support

8am-5pm all timezones (open times vary for Spanish and French speaking support)

8am-5pm all timezones (open times vary for Spanish and French speaking support) Toll free: (877) 815-1531 / +1 (415) 395-4225

Toll free: (877) 815-1531 / +1 (415) 395-4225 No live chat support available

No live chat support available Email/Contact form: https://help.xoom.com/s/contactsupport

Email/Contact form: https://help.xoom.com/s/contactsupport Available in: English, Spanish, French, German, Italian, Arabic, Vietnamese & Chinese

Available in: English, Spanish, French, German, Italian, Arabic, Vietnamese & Chinese

Ready to go?

Your currency knowledge centre

How to Easily Receive Money from Overseas

There are 3 main ways most people receive money from overseas. Find out the most common fees, exchange rates and money traps to avoid.

- Read more ⟶

- 5 min read

The Absolute Best 6 Money Transfer Services

Finding the best money transfer services in the US can be challenging. We reviewed over 30 banks and online money transfer companies to give your our list of the best service to send money overseas.

- Read more ⟶

- 5 min read

International Bank Wires: Your Best Options in 2019 Compared

Wire transfers let you send thousands of dollars, to almost any other bank account in the world. There’s just one catch. Transfers through your bank are expensive—really expensive.

- Read more ⟶

- 5 min read