Best Online Business Accounts [2025]

If you’re starting a business you need a business account to help you hold your company funds separately to your personal spending account. Online accounts can be a choice for a startup, SME or sole proprietorship. You’ll be able to open and manage your account with just your phone or laptop, no matter where you are, and you can pick from a selection of providers which all have their own unique features.

In this guide, we’ll look at 5 of the best online business banking accounts in the US, including some which have no ongoing fees like Wise, no minimum deposits and ways to manage your business balance flexibly, on the go, and often across currencies. Let’s dive in.

Quick summary: Online business checking account

Wise business account: Great for holding 40+ currencies with mid-market exchange rates

Revolut business account: Great for different plans to suit your business needs

Payoneer business account: Great for getting paid by customers and marketplaces

Bank of America Business Advantage Fundamentals account: Great for accessing in branch services

Chase Business Complete Checking account: Great for free cash deposits in a US bank branch

What is the best online business account?

A range of online business account providers have emerged over the past few years, offering lots of different account plans. Some are specialists in specific services like multi-currency payments, some integrate with a broad range of ecommerce platforms for easier transactions, some have niche markets like tech startups or freelancers. The good news is that with this broad spectrum of providers and accounts, the right one is out there for you somewhere – this guide walks through pros, cons, features and fees for 5 great picks.

Do some research and compare providers to find the best fit. Here are a few things to consider:

- Ongoing account fees – especially important if you’re not sure how often you’ll use your account. Try an account with no ongoing fees like Wise Business if you’re just testing the water

- International features and costs – for getting paid by overseas customers and paying international suppliers or invoices. Multi-currency functions from providers like Wise or Revolut can cover all your bases here

- Debit and expense card availability – for easy spending and withdrawals

- US branch network – especially important if you transact in person and deposit cash or checks. US bank digital accounts, such as those from BoA and Chase may suit you in this case

Best online business accounts in the US

The truth is that there is no single best online business account – it depends on how you’ll use your account day to day, what services you value, and what type of business you run. Here we’ve profiled popular non-bank services from Wise, Revolut and Payoneer, plus a couple of US banks, Chase and Bank of America, so you can compare their features and fees. Here’s an overview:

| Services/Provider | Wise Business account | Revolut business account | Payoneer business account | BofA Business Advantage Fundamentals | Chase Business Complete Checking |

|---|---|---|---|---|---|

| Account opening fees | 31 USD | No account opening fee | No account opening fee | No account opening fee | No account opening fee |

| Monthly fees | No monthly fee | From 0 – 119 USD | 29.95 USD annual card fee | 16 USD monthly fee | 15 USD monthly fee |

| Minimum balance | No minimum balance | No minimum balance | No minimum balance Transaction fees may vary depending on usage Annual account fees may apply depending on usage | No minimum balance Monthly fee may be waived if you maintain a balance of 5,000 USD or more | No minimum balance Monthly fee may be waived if you maintain a balance of 2,000 USD or more |

| Transaction fees | Currency conversion from 0.43% Some ATM withdrawals monthly with no Wise fees, low fees after that | Currency exchange 0.6% once no fee allowance is exhausted 1% out of hours conversion fee, 2% ATM fee | 0.5% currency conversion fee Variable fees apply to get paid and withdraw to other accounts 3.15 USD ATM withdrawal fee | 3% foreign transaction fee Up to 5 USD ATM fee Incoming wires 15 USD | 3% foreign transaction fee Up to 5 USD ATM fee Incoming wires 15 USD |

| Business debit cards | Available | Available | Available | Available | Available |

| Best features | Hold and exchange 40+ currencies Mid-market exchange rates | Hold and exchange 25+ currencies Different account tiers for varied business needs | No ongoing costs Ways to pay and get paid in foreign currencies | Branch service available Digital first account with some free transactions included in account fee | Some free cash deposit services Branch service available |

*Information correct at time of writing – 14th March 2024

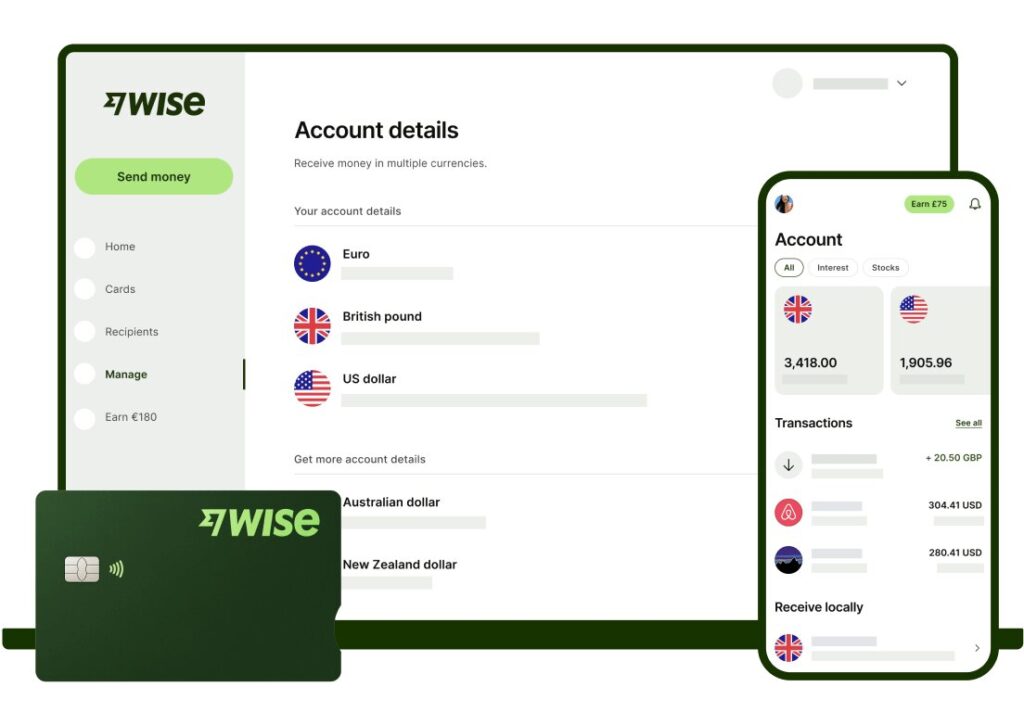

Wise business account

💡 Great for: businesses looking to grow internationally, which need to hold, exchange, spend, send and receive foreign currencies with low costs

Wise for business is a multi-currency online account which lets you hold dozens of currencies, and pay invoices around the world. You’ll also get account details like an IBAN, account number and routing number for receiving USD and foreign currency payments, and can withdraw payments from platforms like Stripe into your account for ease.

Currency conversion with Wise uses the mid-market exchange rate with no markups. There’s just a small per transaction fee which is easy to spot, and can keep costs low overall. You’ll also find there is no monthly fee or minimum balance to worry about, making this a flexible low cost option when you’re starting to grow your business across borders.

Eligibility: US registered business owners and self-employed – Wise is a global business, so if your business is registered elsewhere you may also be able to open an account in other countries

Best features: Wise business account

- Hold and manage 40+ currencies, send payments to 160+ countries

- Business debit and expense cards to spend and withdraw in 150+ countries

- Receiving account details to get paid by others in a selection of major currencies

- No monthly fee or minimum balance to worry about

- Bank level security and encryption to keep your money safe

Wise business account fees

- Account opening fee of 31 USD if you open as a US resident

- Send cross border payments from 0.43%

- 4.14 USD fee to receive a USD wire (ACH transfers are free to receive)

- Make some no-fee ATM withdrawals monthly, with low fees after that

| Wise business pros | Wise business cons |

|---|---|

| ✅ Hold and exchange 40+ currencies ✅ Debit and expense cards available ✅ Mid-market exchange rates ✅ Send and receive low cost transfers ✅ No ongoing fees or minimum balance | ❌ 31 USD account opening fee ❌ Currency conversion costs from 0.43% ❌ No branch network |

Revolut business account

💡 Great for: 25+ supported currencies plus accounts to suit your specific business needs, with 4 different plans available for customers in the US

Revolut customers can open a Basic account which comes with no ongoing fees but limited features, or upgrade to Grow, Scale or Enterprise plans. Different account tiers have their own fees and features – Scale plans cost 119 USD a month, while Enterprise accounts are tailored to business needs.

Depending on your account plan you’ll get no-fee services up to predetermined limits, with low fixed fees after you exceed these. That means you can choose to move to a higher tier of account when your business starts growing, right up to tailored enterprise level products.

Eligibility: US registered business owners and freelancers – Revolut is available in many other countries, so if your business is registered elsewhere you may also be able to open an account in that location

Best features: Revolut business account

- Hold and transact in 25 currencies and get physical and virtual ATM cards

- Local account details for USD, SWIFT details for other currencies

- Different account plans for different business size and need

- Currency conversion uses the mid-market exchange rate on weekdays, up to your account limit

Revolut business account fees

- Monthly fee from 0 – 119 USD depending on account selected

- Currency exchange 0.6% once no fee allowance is exhausted

- 1% out of hours conversion fee

- 2% ATM fee

| Revolut business pros | Revolut business cons |

|---|---|

| ✅Pick from different account tiers depending on your needs ✅ Accounts with no ongoing fees available ✅ Hold and exchange 25 currencies ✅ Receive payments in USD and other currencies ✅ Some no fee transactions to plan limits | ❌ Top tier accounts have ongoing fees to pay ❌ 1% out of hours fee for currency conversion ❌ ATM fees apply to all withdrawals |

Payoneer business account

💡 Great for: Businesses looking to combine income from several platforms into one account, and then manage their money directly from Payoneer rather than making withdrawals

Payoneer has solutions for freelancers, ecommerce sellers, small businesses and enterprise customers. As a specialist in business transactions, Payoneer is integrated with a range of freelance and marketplace platforms, so you can get paid through several routes, all into the same account. You’ll also be able to charge clients in multiple currencies and then either manage your money in Payoneer or withdraw to a regular account.

Check out the fees before you sign up – there are markups on currency conversion and fees for some payments and withdrawals.

Eligibility: US based freelancers and registered business owners

Best features: Payoneer business account

- Sell and do business globally and bill in your client’s local currency with receiving accounts in several foreign currencies

- Integrate with platforms like Shopify, Fiverr and AirBnB to get paid easily

- Make payments to contractors, employees and suppliers, or pay your VAT direct from your account

- Fees apply to receive payments – there are also costs wrapped into exchange rates used for currency conversion

Payoneer business account fees

- 29.95 USD annual card fee

- Annual account fees may apply depending on usage

- 0.5% currency conversion fee

- Variable fees apply to get paid and withdraw to other accounts

- 3.15 USD ATM withdrawal fee

| Payoneer business pros | Payoneer business cons |

|---|---|

| ✅ Industry specific services and products available ✅ Get paid to local receiving accounts in currencies like USD and GBP for free ✅ Capital advance services available ✅ Invoicing options – fees may apply ✅ Easy to use, including debit cards for eligible applicants | ❌ Variable and fairly complex fees ❌ 0.5% currency conversion fee ❌ Annual fees apply |

Bank of America Business Advantage Fundamentals account

💡 Great for: Customers looking for a business account from a US bank which supports in branch transactions and cash deposits

The Bank of America business account products include several different options including the Business Fundamentals account which is a good place to start for newer businesses looking to manage their money in USD, with cash deposit and in branch services. Accounts have a monthly fee but you can have this waived by meeting one or more of several different eligibility criteria. Accounts have some free transactions included in the monthly costs, but some transaction fees apply depending on the services you need.

Eligibility: US based registered business owners

Best features: Bank of America business account

- Account from a major US bank

- Get in branch help and deposit cash or checks if you need to

- Ways to have monthly fees waived

- Accounts come with debit cards for ease of spending and withdrawals

- Full suite of financial services available from the same bank if you need them

Bank of America business account fees

- 16 USD monthly fee

- 3% foreign transaction fee

- Up to 5 USD ATM fee

- Incoming wires 15 USD

| Bank of America business pros | Bank of America business cons |

|---|---|

| ✅ Branch services when you need them ✅ You could qualify for fee waivers depending on how you use your account ✅ Upgrade to a different tier account with the same bank as your business grows ✅ Lots of other financial services offered, including credit cards and loans ✅ Secure and reliable | ❌ 16 USD monthly fee ❌ 3% foreign transaction fee for overseas card use ❌ Fairly high incoming local and overseas wire fees |

Learn more: Bank of America Business Account

Chase Business Complete Checking account

💡 Great for: US business owners who need to deposit cash or checks, and take card payments in person

The Chase Business Complete Checking account is a good starting account for US business owners, particularly if cash or check deposits are a feature that’s required. Chase offers some free cash deposits monthly for eligible customers, as well as lots of other extras like ways to accept card payments in person. Accounts hold USD only, but as Chase is a major bank you’ll also be able to get lots of other financial services including loans and credit if you need to.

Eligibility: US based registered business owners

Best features: Chase business account

- Ways to have monthly fees waived

- Cash deposit options including some free transactions

- Full suite of banking products available

- Ways to get paid by card using a Chase payment terminal

- Safe and reliable option from a major US bank

Chase business account fees

- 15 USD monthly fee

- 3% foreign transaction fee

- Up to 5 USD ATM fee

- Incoming wires 15 USD

| Chase business pros | Chase business cons |

|---|---|

| ✅ Large bank with good branch network ✅ Ways to have monthly fee waived are offered ✅ Some free cash deposit services available ✅ Accept card payments with a Chase card terminal ✅ Secure and reliable | ❌ 15 USD monthly fee ❌ No multi-currency holding options ❌ 3% foreign transaction fee |

Best online international business accounts

Businesses working internationally might need cost saving features like multi-currency account functions, local account details in foreign currencies, or cheaper ways to send and receive international payments.

From the 5 providers we’ve looked at earlier, 3 can be especially good for international businesses, here is a summary of their features:

- Wise business account: Feature packed multi-currency accounts, offering multi-currency receiving account options, low cost international payments to 160+ countries, mid-market exchange rates and debit or expense cards for global spending

- Revolut business account: Hold and exchange 25 currencies, get local USD details and SWIFT account details for incoming foreign transfers, linked debit cards and lots more

- Payoneer business account: Receive payments in a selection of currencies, including from marketplace sites and PSPs, exchange currencies with relatively low fees and send money around the world

The 2 bank business accounts we touched on – from BoA and Chase – only allow you to hold USD, and aren’t really optimized for international use. Exchange rates are likely to include a markup, and incoming wire fees are fairly high.

Online business account fees

While some business accounts are free to open there may be other factors to consider like minimum deposit requirements or monthly fees. Even with online accounts, there are likely to be transaction fees in some situations – making it crucial to weigh up different options based on account fees before picking the best online business account for your needs. Here’s an overview of the key charges for the accounts we looked at earlier.

| Service fees/Business account | Wise business account | Revolut business account | Payoneer business account | Bank of America Business Advantage Fundamentals account | Chase Business Complete Checking account |

|---|---|---|---|---|---|

| Account opening fee | 31 USD | No account opening fee | No account opening fee | No account opening fee | No account opening fee |

| Monthly or annual fees | No monthly fee | From 0 – 119 USD | 29.95 USD annual card fee | 16 USD monthly fee | 15 USD monthly fee |

| Transfer fees | Mid market exchange rate Currency conversion from 0.43% | Mid market exchange rate to plan limit; then 0.6% fee 1% out of hours conversion fee 5 USD transfer fee once plan allowance is exhausted | Variable fees 0.5% currency conversion fee | No fee for transfers sent in foreign currency – exchange rate markup applies | No fee for transfers sent in foreign currency – exchange rate markup applies |

| International transaction fees | No foreign transaction fee | No foreign transaction fee | Up to 3.5% foreign transaction fee | 3% foreign transaction fee | 3% foreign transaction fee |

| Receiving USD payments | 4.14 USD fee for USD wire (ACH is free) | May vary based on account tier | Transaction fees may vary depending on usage | Incoming wires 15 USD | Incoming wires 15 USD |

| Receiving international payments | 10 CAD fee for CAD SWIFT payment Other incoming payments free | May vary based on account tier | Transaction fees may vary depending on usage | Incoming wires 15 USD | Incoming wires 15 USD |

| Other fees to consider | Some free ATM withdrawals monthly, low fees after that | 2% ATM fee | 3.15 USD ATM withdrawal fee | Up to 5 USD ATM fee | Up to 5 USD ATM fee |

As you can see, each account has its own fees which are worth considering as you pick the account that will work best for you. Here is a quick summary, before we go into more detail on each provider:

- The Wise account has no ongoing costs and offers a very flexible multi-currency service with mid-market rates, making it a good pick for businesses which need to pay and get paid in foreign currencies regularly.

- Revolut also has good multi-currency features and lets you pick the account tier that suits your transaction needs – some fees apply to all accounts, such as a 1% out of hours conversion fee and a 2% ATM fee, so whether or not this suits you depends on your specific requirements.

- Our last non-bank provider, Payoneer, is best for businesses getting paid in foreign currencies by other Payoneer users, and then using funds to transfer out to Payoneer accounts or to pay suppliers without requiring currency conversion – fees are pretty complex so worth looking at carefully.

- If you’d prefer a bank business account, either Bank of America or Chase may suit. Both have ways to waive ongoing fees, and both allow cash deposits which can be handy. Chase has some free cash deposits and ways to get paid using a card terminal, which can also be useful features for some US business owners.

Best free online business checking accounts

No business banking service is really free – usually you’ll run into various charges whether it’s account opening, maintenance or transaction fees, depending on how you use your account. Compare different providers’ fee structures, to see which has the best balance of features and fees for you – here’s a quick overview of the free features of the accounts we looked at earlier.

Wise business account: No ongoing account fees, free to receive payments in many currencies, free to spend currencies in your account with your card

Revolut business account: Some accounts with no ongoing fees, no fee to spend currencies in your account with your card

Payoneer business account: Variable fees based on account use, usually free to receive payments using local details

Bank of America Business Advantage Fundamentals account: Have monthly fee waived with minimum balance, some free transactions available monthly

Chase Business Complete Checking account: Have monthly fee waived with minimum balance, some free cash deposits monthly

Best online business bank accounts with no deposit

Some online business bank accounts don’t have minimum deposit requirements for account opening – plus you’ll usually find no minimum balance requirements. However, holding a minimum deposit may mean lower fees in some cases.

Here’s a quick overview of the free features of the accounts we looked at earlier.

Wise business account: No minimum balance

Revolut business account: No minimum balance

Payoneer business account: No minimum balance

Bank of America Business Advantage Fundamentals account: No minimum balance. Have monthly fee waived with minimum balance of 5,000 USD

Chase Business Complete Checking account: No minimum balance. Have monthly fee waived with minimum balance of 2,000 USD

How to open a business account online

Different providers and banks have their own processes for account opening, but generally it’s pretty easy to do.

To give an example, let’s look at how to open a business account online with Wise:

- Download the Wise app or open the desktop site and tap Sign up

- Register by entering your personal details and confirming you need a business account

- Follow the prompts to enter your business information and upload the required documents

- Once your account is verified you can order a card, and start to transact

Usually you need some key information and documents to open a business account, which can include:

- Your name, nationality, birth date and address

- Your ID and proof of address

- Details of the business including trading name, and registered name where applicable

- Your business documentation, based on entity type – business licenses, registration numbers, partnership agreements or articles of incorporation for example

If you are interested in money transfer apps for international payments, this guide might help: Best international money transfer services for business

Conclusion: Business checking account online

Online business accounts can be a great option both for new businesses, freelancers and more established companies looking to manage their finances conveniently and with low costs.

Banks in the US do often offer digital business accounts, but you may find you can get more features, including multi-currency functions and linked payment cards, from a non-bank alternative like Wise, Revolut or Payoneer. Use this guide to compare your options and get started.

Business banking online FAQs

How long does it take to open a business account online?

Opening a business account online can be done in a few minutes in most cases, by entering your personal and business information and uploading a few documents. Once your account has been checked and verified you’ll be able to start to transact.

What is the easiest business bank account to open online?

There’s no single easiest business bank account, non-bank options can be a good choice as they’re optimized for digital onboarding and verification. Check out options like Wise and Revolut to see which works best for you.

If your business is a sole proprietorship, this guide can help you find the right account for yourself: Best business bank accounts for sole proprietorship