How to open a business account in Canada from the US [2025 Guide]

If you’ve opened – or are planning on opening a business in Canada, you need a business bank account to keep your personal and company finances separate. This makes it easier to manage your accounts, analyze your profits, and file your taxes.

The right business account for you depends on your situation – including whether you’re in Canada already or not, the type of business you run, and how you intend to grow your company in future. This guide covers 4 of the best business account options available like Wise and Revolut, how to open a business account in Canada as well as how to do it without going there.

Key points: Canadian business account

- Some Canadian banks can offer business accounts to people intending to move to Canada to manage a Candian registered business

- Alternative options include low cost multi-currency accounts from non-bank providers like Wise and Revolut

- Fees, features and account options do vary widely, so shopping around is essential

- You’ll usually need to visit a Canadian bank branch in person with your paperwork to get a bank account

- Digital services can be more flexible, with online onboarding and the option to use a US proof of address if you’re not a Canadian resident yet

Can I open a business account in Canada as a non-resident?

There’s no legal barrier to opening a business account in Canada as a non-resident. However, banks set their own eligibility requirements, which in practice means your options might be limited if you aren’t a resident, and don’t intend to become one any time soon.

If you’re non-resident at the moment, but are moving to Canada in future, it’s good to know that some banks have a newcomers to Canada service, which is designed to help immigrants – including incoming entrepreneurs – get their finances in order. This may be an option if you’re looking for a bank account you can open – or start to open – prior to your move. RBC is a good place to start if this is your preference, as they’ve got newcomer business banking options – although you’ll need to call the bank or visit a branch to understand which account services are available and suited to your specific needs.

You can also opt for an online multi currency account for your business, which you could open more or less wherever you’re based, and operate across US and Canadian dollars, as well as a range of other currencies, to help your business have global reach. Digital non-bank options you can open from the US for your business include Wise and Revolut. We’ll walk through a bit more about the pros and cons of picking a fintech business account solution over a bank in a little while.

One last option if you’re a non-resident but already have a business in the US – check whether your current bank operates in Canada, or has partner banks in Canada. Many global banking brands operate across the border – if you already bank with one of them, this may make it easier to transfer your account when you’re ready.

Can I open a business account online in Canada?

Yes, it is possible to open a business banking account online. Some banks allow you to open a business account online in Canada – however, you may be restricted in which accounts you can select, and the services you can access may be limited. Some banks will require you to open a personal account with them prior to applying for a business account online.

If opening an account online is your priority, you may be better off choosing a fintech alternative from a provider like Wise or Revolut, instead of a bank account. We’ll cover some options in a moment. As these business accounts are operated entirely online, you can get your account opened digitally, and manage your money via a website or app.

What is the best bank for a business account in Canada?

The best business bank or fintech account for you will depend on your individual business needs. Before you decide it pays to shop around and review a selection of business accounts from banks and non-bank alternative providers, to see which suits you best. To get you started we’ve profiled some popular options below:

| Service/Provider | Wise business | Revolut business | OFX business | RBC business |

|---|---|---|---|---|

| Open account online | Yes – fully online opening and onboarding | Yes – fully online opening and onboarding | Yes – fully online opening and onboarding | No – visit or call a branch to get advice on your options |

| Foreign currencies | Supports 40+ currencies | Supports 25+ currencies | Supports 7 currencies | Intended for CAD use only |

| Account fees | 31 USD account opening fee Make some no-fee ATM withdrawals monthly, with low fees after that | Varied fees, from 0 USD – 119 USD/month 2% ATM withdrawal fee | No ongoing fees | 6 CAD/month fee ATM withdrawals 1.5 CAD in Canada, 3 CAD to 5 USD elsewhere |

| International transfer fees | Send overseas transfers from 0.43% Receive payments in several major currencies for free USD wires cost 4.14 USD to receive 10 CAD fee to receive CAD by SWIFT | 5 USD outgoing transfer fee once any no fee allowance is exhausted Incoming transfers may have a fee depending on currency, account and limits | Outgoing transfers have no fee but may include a foreign exchange markup Incoming transfers are free to receive | Outgoing wire from 15 CAD when sent online Incoming wire over 50 CAD/USD in value, 17 USD fee |

| Business debit cards | Available for account holder and team members | Available for account holder and team members | Not available | Available for account holder |

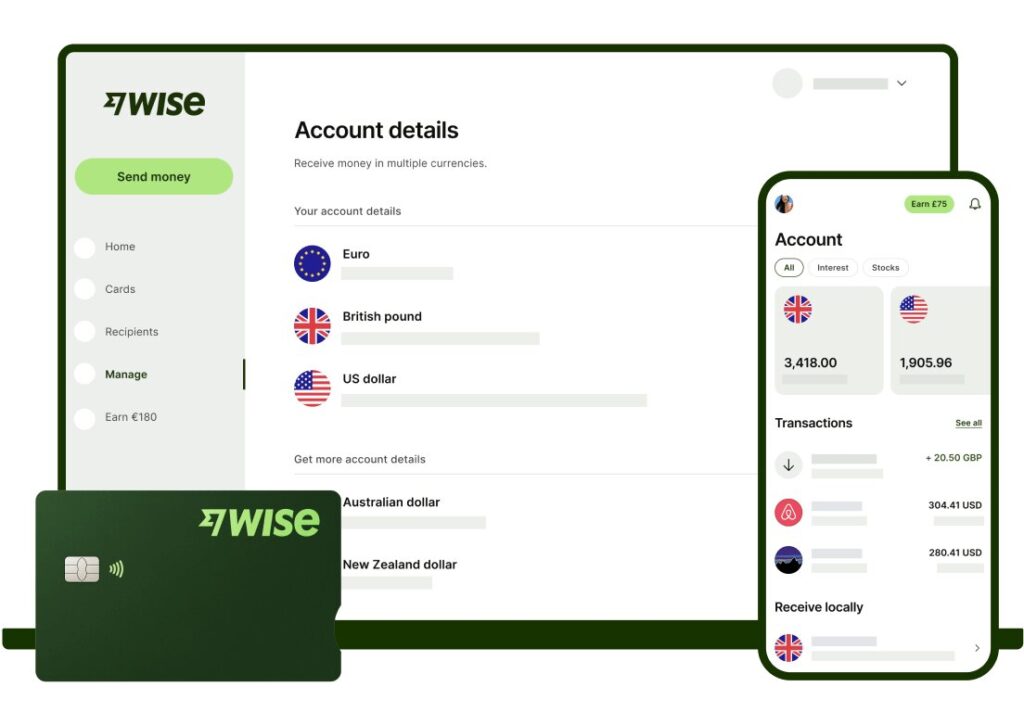

Wise business account

Great for: Low cost currency conversion which uses the mid-market rate, debit and expense cards, and easy ways to pay and get paid in foreign currencies

Wise multi-currency business accounts are a smart option if you want to open your account before you go to Canada, and continue to send, receive and manage multiple currencies. Accounts have no minimum balance requirement and no monthly service charge. Hold 40+ currencies and switch between them using the mid-market exchange rate and just a low, transparent fee. You’ll also get business friendly perks like batch payment solutions and Xero integration.

Best features:

- Hold and exchange 40+ currencies

- Spend in 150+ countries with the Wise business debit or expense card

- Receive major currencies including USD and CAD with local account details

Learn more: How to open a Wise Business account

Revolut business account

Great for: Choosing an account to suit your specific business needs, with 4 different plans available for customers in the US

Revolut offers a Basic business account which has no ongoing fee, as well as other account tiers with ongoing costs up to 119 USD/month, which come with extra features. You can’t open a Revolut business account if you’ve already moved to Canada, but if you intend to run your business in Canada as a US resident it’s a good, flexible option to consider.

Best features:

- Get local details to receive USD and SWIFT details to receive other currencies to your account

- Hold and exchange 25 currencies with some no fee weekday exchange

- All accounts come with linked cards for spending and withdrawals

Learn more: Revolut Business review

OFX business account

Great for: Holding and receiving select global currencies, and accessing extras like currency risk management tools and 24/7 phone support

With OFX you can open a global currency account which is set up for small businesses, medium business or online sellers. Send money to contractors, suppliers and staff in many countries around the world, online. To get started, complete the application online and wait for a call back from the OFX service team.

Best features:

- Receive payments in 7 major currencies including CAD and USD

- 24/7 phone support as well as online and in app services

- Send payments globally with ease and low costs

RBC business account

Great for: Business account from a Canadian bank which you may be able to start opening prior to moving to Canada

As a Major Canadian bank, RBC has lots of different account options for business customers, but the one that’s recommended for newcomers is a digital account to make it easy to access self serve account features. You have to call or visit the bank to set up an account, but this may be possible before moving to Canada if you’ve already incorporated your business there.

Best features:

- Large Canadian bank with extensive branch and ATM network

- Ways to deposit cash and checks

- You’ll need to call the bank to make sure, but you might be able to open this business account from the US if you plan to move to Canada later

WorldRemit – for international business payments

Great for: Cross border business payments you can arrange online or in-app

You may have heard of WorldRemit for personal payments and transfers, but did you know you can also use this service for business payments. If you don’t require a full business account right now, but do need to send money internationally, WorldRemit could be worth looking at. Send a payment more or less anywhere in the world, aside from a few restricted countries, direct to a bank account, or in some cases for cash collection.

Best features:

- Good coverage – send to most countries

- Variable fees and exchange rates which can compare favorably with banks

- Easy to use service for payments

What’s the process of opening a business bank account in Canada?

The exact process you need to follow depends on your chosen bank and the exact account you want – as well as whether you’re intending to move to Canada or not.

There are several different models for opening bank accounts – some accounts can be opened entirely online, by submitting your paperwork digitally. Typically, this option is available if you pick a non-bank fintech provider like Wise or Revolut, which you can open before you leave the US.

Some Canadian banks – like the Royal Bank of Canada – may allow you to get started opening a personal account online before you get to the country, but you’ll need to call or visit a branch to open a business account in Canada. Check out the options available to you based on your personal situation and the provider you’ve chosen.

How to open a business account in Canada online?

If you want to open a business account online conveniently you’ll probably need to pick a digital provider, particularly if you’re not a resident of Canada. Digital accounts from providers like Wise, Revolut and OFX can be opened, verified and managed online – and come with multi-currency functions too.

To give an example, let’s look at how the process works with Wise – a non-bank provider you can use as a non-resident of Canada:

- Download the Wise app or open the desktop site and tap Sign up

- Register by entering your personal details and confirming you need a business account

- Follow the prompts to enter your business information and upload the required documents

- Once your account is verified you can open a currency account in CAD by tapping on the + symbol in the Wise app

- You’ll be able to access local account details for CAD which you can use to get paid by others, or you can top up your account in USD, CAD or select other currencies yourself

Requirements to open a business bank account in Canada

Generally to open a business bank account in Canada you’ll have to be 18 years old or older, with a fully registered business which meets a bank’s acceptable use policy. Some banks may only offer business banking services to people resident in Canada – in which case you’ll also need to be able to prove your legal residency and address.

What documents do you need to open a Canadian business bank account?

In most cases, whether you’re applying in person or online, you’ll need to provide a similar set of details and paperwork. However, exactly what’s required can vary quite a lot depending on the type of business entity you have, the bank you pick and the specific account you’re looking at.

Here is a list of documents and information commonly needed to open a Canadian business account:

- Details of the owner, applicant and/or signatories to the account, including name, nationality, birth date and address

- Personal identification and proof of address for the business owner – directors and major shareholders may also need to provide this, based on the entity type

- Details of the business including trading name, address, type, profit figures or forecasts

- Your business documentation, based on entity type – business licenses, registration numbers, partnership agreements or articles of incorporation for example

If you’re a sole proprietor, you might need a little less in terms of paperwork – commonly these documents and information:

- Your name, nationality, birth date and address

- Your ID and proof of address

- Details of the business including trading name, and registered name where applicable

Most banks have a checklist online showing the documents required by entity type, which makes it much easier to see what’s expected of you. As well as the paperwork, you may also need to hand over a minimum opening deposit amount to get your account up and running. Check the details for your account before you get started.

Fees to open a business bank account in Canada

Before you choose a bank account you’ll need to check out all the fees and charges you’ll need to pay – read the small print carefully and don’t expect charges to be the same as those you’re used to.

You can usually find an account which doesn’t charge you an opening fee. In fact, some banks will even offer perks to new account holders, to entice you their way. That doesn’t mean there are no fees to worry about though. Read the full terms and conditions and look out for minimum opening balance requirements, service or fall below fees, transaction costs and early closure penalties in particular.

Here are the important fees to look out for, for a couple of the options we highlighted earlier. This isn’t a comprehensive list of fees – so do check out the terms carefully, but this should give you a flavor:

Wise Business: Account opening fee of 31 USD if you open as a US resident; send cross border payments from 0.43%; 4.14 USD fee to receive a USD wire (ACH transfers are free to receive); 10 CAD fee to receive a CAD payment by SWIFT (free options also available); make some no-fee ATM withdrawals monthly, with low fees after that

RBC Digital Choice Business Account: 6 CAD/month ongoing fee; incoming wire over 50 CAD/USD in value, 17 USD fee; outgoing wire from 15 CAD when sent online; ATM withdrawals 1.5 CAD in Canada, 3 CAD to 5 USD elsewhere

Fintech providers to open business accounts in Canada

Banks aren’t your only business account option in Canada. You can also choose a fintech company or online bank which offers business accounts for online and mobile use. These accounts are usually as secure as a bank account would be, but can have lower fees and more flexibility in terms of how you manage your account.

We’ve looked at a few options for fintech business accounts already – including Wise, Revolut and OFX – which all have their own features and fees and can present flexible, low cost options for managing your business finances.

| Fintech business accounts – Pros | Fintech business accounts – Cons |

|---|---|

| ✅ Accounts on the market include some with no monthly charge – or others with various plan options to suit your needs ✅ No need to wait in line in a bank branch to transact – do it from your phone ✅ Online business accounts are designed with modern businesses in mind, with features like accounting integration and smart ways to analyze your finances | ❌ The choice of account options isn’t as wide as with traditional banks ❌ You won’t get face to face customer service or support ❌ Typically these are newer providers which are less well known than the big high street banks |

Conclusion: Opening a Canadian business account

Canada is a great place to expand or launch your business, with a relatively similar market, shared language and ease of access. As soon as you’re trading you need a business account – getting this sorted early just means one less thing on your long to do list!

You may be able to open a non-resident business bank account in Canada – but eligibility rules do apply here, so you’ll need to shop around. Alternatively, you could choose a non-bank alternative provider like Wise or Revolut, which offer ways to pay and get paid in CAD and USD, even as a non-resident business owner.

Use this guide to get your research started, and make sure you check out a good selection of both bank and non-bank business accounts to pick the one that suits your company best.