Wise Business Account Review [2025]: Is it a good business account?

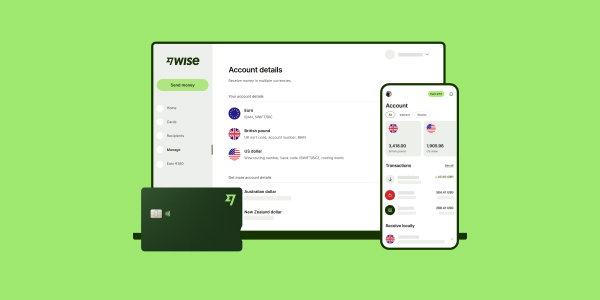

Wise was launched in 2011 with a mission to build a better way to move money around the world, making international payments cheaper, faster and more convenient. Today Wise has over 12 million customers and moves 118+ billion USD annually. As well as low cost international transfers with the real exchange rate, you can also get a Wise account for personal or business use to hold and convert 40+ currencies, and spend with a linked Wise Multi-Currency Card.

With a Wise Business account, you can send payments to 160+ countries, and get paid conveniently from 30+ countries. You’ll also get business friendly features like batch payments, adjustable user-level permissions, automatic reconciliation with cloud based accounting software and a powerful API to automate payments.

In this Wise business account review, we’ll share with you all you need to know about the Wise business account to help you decide if it’s right for your business.

Key points: Wise Business Account

| Key features: |

|---|

|

Advantages and disadvantages of Wise Business Account

| Wise Business account pros | Wise Business account cons |

|---|---|

| ✅ Low start up fee, no monthly cost and no minimum balance ✅ Hold 40+ currencies and pay staff and suppliers in 160+ countries ✅ Local account details to get paid by clients, PSPs and marketplaces in 10 currencies conveniently ✅ International debit and expense cards for spending in 160+ countries ✅ Business friendly features to save admin time and cut costs ✅ Enterprise level services available | ❌ Wise is not a bank and does not offer credit facilities or loans ❌ No or check cash deposits ❌ No in person service – get support online, in-app and by phone only |

Here is a quick overview of FAQs about Wise business:

| Questions | Answers |

|---|---|

| How many currencies does Wise Business support? | Wise Business Account supports 40+ currencies for holding balances and currency exchange. You can also get local account details in 8+ currencies. Wise offers payments to 160+ countries. |

| How much does a Wise Business account cost? | Open a Wise Business account for a one time fee of 31 USD for full account features. There are no monthly or ongoing charges and you only pay a low, transparent fee for the services you need. |

| Is Wise Business safe and legitimate? | Yes, Wise Business is safe and legitimate to use. They use HTTPS encryption and 2FA or two factor authorization to protect your transactions. |

Summary: The Wise business account can be opened for a one time payment of 31 USD, and offers a multi-currency account with linked payment and expense cards, and business friendly features. With no minimum balance and no monthly fee the account suits self-employed, entrepreneurs and business owners who need to receive, hold, send and spend foreign currencies.

Currency exchange always uses the mid-market rate with low, transparent fees for international payments and card spending. Wise is a safe provider, used by 16+ million customers and registered with FinCEN in the US.

What is the Wise Business account?

Wise – formerly known as TransferWise – offers business accounts which come with linked payment and expense cards which can be used to hold, send, spend and receive a selection of foreign currencies conveniently.

You can open a Wise for business account online or via the Wise app. There’s a low, one off charge of 31 USD to register and then you can order debit and expense cards, send one off and batch payments, hold and exchange 40+ currencies, integrate with your accounting software and add team members to your account. Plus you can also get local account details for 10 currencies, to get paid from third party accounts.

How does the Wise Business account work?

Open your Wise Business account online or in the Wise app, and add money in USD or your preferred currency – around 20 currencies are supported for topping up funds, plus you’ll be able to get local account details to get paid by others in 8+ different currencies. You can use your Wise Business account to hold and exchange 40+ currencies and send payments to 160+ countries – great for paying suppliers or taxes overseas, and covering invoices.

- Wise business payments: Send money to bank accounts in 160+ countries with low fees from 0.33%

- Batch payments for business: Transfer to up to 1,000 people at a time, in a range of currencies, by uploading a single spreadsheet

- Wise API: Automate workflow, track exchange rates, generate payments and more

- Wise multi currency account: Hold and exchange 40+ currencies, and manage your account from a smart device or laptop

- Debit cards: Order debit and expense cards for yourself and your team, and manage spending limits and permissions

- Business account users and permissions: Multi-user access to allow team members to access the account functions they need to do their jobs

- Reconciliation: Reconcile your Wise business account with cloud based accounting software automatically

Now, let’s look at each feature in detail:

Wise business payments

Customers can send payments through Wise domestically in the US, or to 160+ countries around the world. Your recipient won’t need their own Wise account as the money will simply be deposited into their normal bank account directly.

Wise was set up to facilitate low cost international payments – so all international transfers use the mid-market exchange rate and a low transparent fee. To allow this to happen, Wise built its own payment network to move money without incurring high – and unnecessary – international transfer fees. That means your payment will often be cheaper and faster than using a bank or alternative provider.

To make your payment online or in the Wise app just enter the amount you want to send in dollars, or the sum you want the recipient to get in their home currency. You’ll see immediately what your recipient will get in the end, making it easy to pay overseas suppliers, and staff accurately.

Batch payments for business

Cut admin time when you pay suppliers or invoices by using Wise multi-currency batch payments. Upload a single file detailing the payments to be made to make up to 1,000 payments at a time, in as many currencies as you need.

Batch payment services are available off the shelf, ready to go in minutes, and free to all Wise for business account holders.

Wise API

Wise offers customers a powerful API to automate workflows and cut admin time further. Use this to collect recipient details, make payouts, track transactions and reconcile your accounts. All with no setup or integration fee.

Wise multi currency account

Open a Wise business account for a one time fee of 31 USD to access the full account features with no minimum balance or ongoing charges.

You can use the Wise multi-currency account to add, hold, convert and send payments in 40+ currencies. You’ll always get the mid-market exchange rate and a low, transparent fee whenever you convert currencies or send an overseas payment.

If you need to get paid in foreign currencies you can, with your own local account details for 8+ currencies to receive third party payments from 30+ countries. Give your details to clients to get paid directly, or withdraw to your Wise business account from platforms like Shopify, Stripe and Amazon. Cut your international costs and connect with more customers all over the world.

Plus, there are ways to save time as well as money. Add team members, integrate with your cloud-based accounting tools, make batch payments and manage your money on the go from the Wise app.

Receive payments into

With a Wise Business account you can use local account details to receive international payments like a local in 8+ currencies including USD, GBP, EUR, AUD and NZD, making it easy to get paid by customers and clients in 30+ countries.

Wise Multi-Currency Card

Once you have your Wise Business account you can order linked Wise Multi-Currency Cards and expense cards. Have a card for yourself, and order extras for team members to make it easier to manage international business spending and expenses. You can set and adjust card spending limits and track transactions centrally. You’ll also get the mid-market exchange rate when converting from one currency to another, with low fees from 0.33%.

Business account users and permissions

Multi-user access (MUA) allows you to add users to a Wise business account, with the permissions they need to access the features required to do their jobs properly. The Wise business account lets customers select a range of user profiles across the following categories:

- Viewer – can see transactions and download statements

- Employee– can view their own activity and spend with their own business card up to pre-set limits

- Preparer – can set up single and batch payments for approval and download statements

- Payer – can make and manage payments, convert currencies and download statements

- Admin – has overview of all activity, and can add and remove team members

Reconciliation

Cut down on admin time and make it easier to keep track of income and outgoings by integrating your Wise account with Xero and QuickBooks for easy reconciliation across multiple currencies.

Is Wise safe for businesses?

Wise is a safe and trusted provider, fully registered and authorized in the US and also covered by other regulatory authorities around the world in the countries it offers services.

How is Wise regulated in the US?

Wise US Inc. is registered with the Financial Crimes Enforcement Network (FinCEN). It’s licensed as a money transmitter in some US states while in other states it offers services through its partner financial institution the Community Federal Savings Bank.

Wise is also safe to hold money with, following strict safeguarding processes to hold customer funds separate from its own operating capital.

Wise was built with security in mind, and is at the cutting edge of online and mobile account safety. That means your account security is also protected by dedicated anti fraud teams and technology, instant transaction alerts and 2 factor authentication.

Wise Business account pricing

To access the full Wise business account features you’ll pay a 31 USD one off charge. After that the account has no ongoing monthly or annual fees, you simply pay for the services you use. Here’s a quick overview of the key Wise Business account pricing you should know about:

| Service | Wise Business fee |

|---|---|

| Open a Wise Business account | 31 USD |

| Order a Wise Multi-Currency Card | First card on the account is free – 5 USD per card for additional cards |

| Hold money | No fee |

| Send overseas payments | From 0.33% |

| Spend in a currency you hold in your account | No fee |

*Correct at time of writing, 15th August 2024

Wise Business transfer fees

Wise splits out the costs of international business money transfers and shows them clearly and in advance, so you can compare them to other providers.

Currency conversion uses the mid-market exchange rate, so you can also be confident that there are no extra fees hidden there.

Here are the Wise transfer fees you’ll pay:

- Fixed fee: This covers the fixed costs associated with the transaction and can be around 6.11 USD for a wire transfer on popular payment routes from the US

- Variable fee: This covers the cost of the currency exchange and can be from 0.33%, with fees of around 0.5% common on many popular routes from the US

When you set up your Wise money transfer online or in the Wise app you’ll be able to instantly see what you’re paying – and what the recipient can expect to get in their account in the end.

Here’s an overview of the Wise transfer fees for a 1,000 USD payment on a few popular payment routes, to give you an idea of the fees you may pay with Wise:

| Sending | Maximum payment |

|---|---|

| EUR | 1.2 million EUR |

| USD | 1.6 million USD |

| AUD | 1.8 million AUD |

| CAD | No limit |

| SGD | 2 million SGD |

*Fees correct at time of writing, 15th August 2024

The fees you pay with Wise can vary based on the currency you’re sending, how you pay, and the total value of the transfer. However, Wise will always split out the fees so you can easily see what your transfer costs, and what the recipient will get deposited to their account in the end.

Is the Wise Business account free?

It’s not free to open a Wise Business account. You’ll pay a one time fee of 31 USD when you register – but it’s then free to hold balances in 40+ currencies, and to spend in any currency you hold using your Wise Multi-Currency Card. There are low conversion fees if the balance you hold in the currency you’re spending is not enough to cover the transaction.

There are no ongoing charges for a Wise account, and many features you can access are free to use. Here’s an overview of some of the Wise Business account features you can get for free – this isn’t a comprehensive list, and as Wise is working to bring down the costs of services and add in extra features all the time, you may find other Wise features are also free to access now or in the future.

| Wise Business account service | Fee |

|---|---|

| Hold a currency balance in any of 40+ supported currencies | No fee |

| Spend a currency you hold in your account with the Wise Multi-Currency Card | No fee |

| Send a same currency payment to another Wise account | No fee |

| ATM withdrawals to monthly account limit | No fee** |

| Receive payments to Wise in 8+ foreign currencies with local account details | No fee |

| Receive payments to Wise in USD via ACH | No fee |

| Make batch payments | No fee |

| Access the Wise API | No fee |

*Correct at time of writing, 15th August 2024

**ATM operators might charge their own fees.

Wise Multi-Currency Card fees

| Wise Multi-Currency Card service or feature | Fee |

|---|---|

| Order the first Wise Multi-Currency Card for your Wise Business account | No fee |

| Order additional Wise Multi-Currency Cards for team members | 5 USD |

| Card delivery | No fee |

| Spend a currency you hold in your account with the Wise Multi-Currency Card | No fee |

| Convert currencies for card spending | From 0.33% |

| Foreign transaction fee | No fee |

| First 2 ATM withdrawals, up to the combined value of 100 USD, every month | No fee |

| ATM withdrawals once monthly no-fee allowance is exhausted | 1.5 USD + 2% |

| Replace a lost card | 5 USD |

Wise exchange rate

The Wise exchange rate for international transfers and currency exchange is the same as the mid-market exchange rate – the one you’ll find on Google or using a currency converter tool. That applies whether you’re sending a transfer, converting between currencies within your account or spending in a foreign currency using your Wise Multi-Currency Card.

This is a different approach to most banks and many other currency exchange services. It’s common for providers to add a markup – an extra fee – to the mid-market exchange rate to calculate the rate they pass on to customers. That’s not transparent and it can push up the costs overall.

How does Wise (TransferWise) international transfer work?

Wise is not a bank. While banks tend to send cross-border transfers using the SWIFT network, Wise built its own payment network to be faster, cheaper and more efficient.

Firstly let’s take a look at the SWIFT system favored by traditional banks. SWIFT is established and reliable but can also be slow and expensive. This is largely because there can be several banks – known as correspondent banks – involved in a single payment. Each bank involved in the payment can deduct their own fee as they process the transfer. Because you won’t always know in advance which correspondent banks will be used, you may not know the final cost you’ll pay until after the transfer completes. That can leave the recipient with less than you expect.

Wise works differently. Wise international payments use a network of local accounts instead of relying on SWIFT. When you send a Wise business payment you fund it using a local payment to a USD account. Wise then pays out the equivalent amount in the currency you need from their local account in the destination country. That means you’ll know in advance exactly what you need to pay, and exactly what the recipient will get in the end.

Because no money actually crosses borders there are no intermediary costs. Wise passes on the savings to the customer so you get a cheaper payment which can also arrive faster than with a bank.

How long does a Wise payment take?

Because Wise uses its own payment network, transfers are typically fast. In fact at present 50% of Wise’s international transfers are instant (delivered in less than 20 seconds), while 90% are delivered within 24 hours. Wise is working towards increasing the number of instant payments for customers until all transfers can arrive in minutes.

When you send an international payment the delivery time will vary based on a few things including how you pay, the currency and country you’re sending to and the value of the transfer. However, you’ll always be shown an estimated delivery time before you confirm your transfer and you can easily track your payment once it’s on the move.

How to use Wise for business

Using Wise for business is straightforward. Here’s how to make a Wise business transfer:

- Choose where you’re sending from – your linked payment method or Wise balance

- Enter the payment value or how much you want the recipient to get

- Add the recipient’s details and check everything over

- Choose your payment method and confirm the transfer

- Your money is on the move

Wise payment methods

You’ll see the available funding methods when you set up your transfer. Usually these include:

- Bank debit (ACH)

- Wire transfer

- Debit or credit card

- SWIFT

The cheapest – and often most popular – way to pay is using a bank transfer from your linked business bank account.

Learn more about Wise payment methods here.

Payout methods

Most Wise business transfers are sent directly to the recipient’s bank account for convenience. However Wise does support other payout methods depending on the destination country.

Track expenses

With a Wise Business account you can order Wise debit and expense cards for team members so they don’t need to use their own money for business spending. This can save time as the expense process is streamlined – and you’ll be able to view, set and manage spending permissions centrally, too.

- Issue team members with Wise debit and expense cards for business spending

- Set card spending limits and review transactions easily

- Filter spending by team member for easy tracking

- Give account permissions and access to key team members so they can help you manage your company’s money

How to pay an invoice with Wise (formerly TransferWise)

You can use your Wise account to pay invoices for suppliers and staff in 160+ countries. The recipient doesn’t need their own Wise account, as you can have the funds deposited into their preferred bank account for convenience.

Here’s how to pay an invoice with Wise:

- Log into your Wise Business account and select Send

- Enter the amount and currency of the invoice you need to pay

- Choose the way you’d like to pay

- You’ll be shown the exchange rate and fees that apply for your transfer

- Follow the prompts to enter the recipient’s bank account details

- Confirm, and fund your payment from your Wise account or with your preferred payment method

How to create a Wise Business account (formerly TransferWise)

Opening a Wise business account is easy and can be done entirely online.

- Open the Wise homepage or app

- Click Register and confirm you want to open a business account

- Follow the prompts to enter information about your business, including your business registration and industry

- Enter details of names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business

- Complete your own personal details and SSN – if you’re not a director of the business you may need to upload proof you’re acting on behalf of the business

- Upload images of the documents requested to get verified

The exact documents you need to verify your Wise Business account can vary depending on the type of business you have and the transactions you want to make. However, you’ll be guided through the process by online prompts, and you can also save and close the registration and return to it later if you don’t have everything you need. We’ll look at the documents usually needed for verification next.

Documents you need for Wise Business account

As with banks and other providers, you’ll need to get verified before you can use your Wise for business account. This is to keep your money safe and comply with laws in the US and globally.

Exactly what information and documents you need will depend on your business entity type and structure.

The documents and information needed to open a Wise Business account will usually include:

- Business location, industry, social media and web presence

- Business registration document or details

- Documents showing who owns or controls the company

- The names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business.

You’ll be guided through the verification process when you register your account and don’t need to enter all of your verification information at once. Just save and exit the process and pick it up again later if you need to.

Wise Business account requirements

You can usually open a Wise Business account in the US if you or your registered business meet the following Wise business account requirements:

- You’re a sole trader or freelancer; or you own a limited company or partnership; or you run a charity or trust

- Your work is not based on providing cryptocurrency services, adult content, tobacco or other prohibited activities

- Your business does not have bearer shares

- Your business does not offer services or goods relating to Cuba

- You’re not based in Nevada, or one of the following US territories – Virgin Islands, Guam, Mariana Islands

Wise Business account verification

The Wise business verification process is part of the way Wise keeps customers and their accounts safe. It’s also a legal requirement.

As part of the Wise Business account opening process you’ll be asked to upload images of some paperwork as part of the verification process. The exact documents needed vary based on the business entity type you have, and you’ll be guided throughout the process by on screen prompts. All you’ll need to do is to take clear images of the documents needed and then upload them to your account using your phone or laptop.

How long does Wise Business account verification take?

The Wise service team aims to have all accounts verified within 2 days – and often accounts are verified within just one working day. If any more information or documentation is needed after you apply for your Wise business account, a member of the Wise team will be in touch to talk you through the details.

Wise Business supported currencies

With your Wise account you’ll get local account details to get paid from 8+ currencies conveniently. Here’s what you’ll receive:

| Currency | Wise local account details |

|---|---|

| Wise USD Account | Routing number Account number |

| Wise Euro Account | SWIFT/BIC code IBAN |

| Wise GBP Account | UK sort code Account number IBAN |

| Wise AUD Account | BSB code Account number |

| Wise NZD Account | Account number |

| Wise SGD Account | Bank code Bank name Account number |

| Wise RON Account | Bank code (SWIFT/BIC) Account number |

| Wise CAD Account | Institution number Transit number Account number |

| Wise HUF Account | Account number |

| Wise TRY Account | IBAN |

As well as using your local bank account details to get paid in these popular currencies, you can also hold an account balance in a broad selection of other currencies.

In total over 40 currencies are supported, including INR, CNY, JPY, MXN, and CHF, to make it easier to spend and make payments on behalf of your business in 160+ countries.

Wise Business account supported countries

You can open a Wise Business account from a broad selection of countries and regions, including the US, the EEA, the UK, Canada, Australia, Singapore and New Zealand. Features and fees may vary based on your location, so if you’re not in the US you’ll need to double check the Wise pricing page for the country you’re in.

US businesses can open a Wise business account. but unfortunately Wise Multi-Currency Cards are currently unavailable for businesses registered in the US. You can learn more about this here, and you can join the waitlist to be notified when the cards are available.

Wise Business account limits

Most Wise business accounts have no upper account holding limit. Some Wise US customers, who have account details with a routing number starting 026 do have some limits on the amount of money you can receive in USD – but limits are set high, at around 50 million USD per year for Wise Business account holders.

Wise also allows customers to make high value payments. Here are the Wise transfer limits for a few major currencies as an example:

| Sending | Maximum payment |

|---|---|

| EUR | 1.2 million EUR |

| USD | 1.6 million USD |

| AUD | 1.8 million AUD |

| CAD | No limit |

| SGD | 2 million SGD |

*Correct at time of writing, 15th August 2024

Large business payments with Wise

Wise supports high value business payments. For most areas of the US you’ll be able to send up to 1 million USD per transfer.

Depending on the type of payment you’re making, Wise may need to ask for more documents to complete verification checks when you send high value payments. These may be required by US law, or by legislation in the country you’re sending to.

You may be asked – for example – to show the source of the funds you’re sending. This can be done simply by uploading an image of a bank statement showing your business received the money you want to transfer, or written proof of where the funds came from. If you’re asked to provide additional paperwork to facilitate your payment, a member of the Wise team will guide you through the process.

If you’re sending high value transfers it’s also good to know that there are automatic discounts on Wise fees, based on the transfer volume. There’s no need to enter a code or voucher, these discounts are simply automatically applied when you reach the transaction value amounts.

Here’s how Wise high value payment discounts work:

| Volume of payments in a calendar month | Discount (%) |

|---|---|

| 0–20k GBP (around 26k USD) | 0 |

| 20k–300k GBP (around 26k USD – 394k USD) | 0.1 |

| 300k–500k GBP (around 385k USD – 640k USD) | 0.15 |

| 500k–1m GBP (around 640k USD – 1.3m USD) | 0.16 |

| 1m+ GBP (around 1.3m USD+) | 0.17 |

*Correct at time of writing, 2nd of September 2024. Learn more about limits and high value transfer discounts here.

Can I use a Wise personal account for business?

If you have a registered business, having a designated business account may be mandatory, depending on the type of business entity you run. Even if it’s not a legal requirement, having a specific business account can make it much easier to manage your company finances separately from your personal finances.

Wise personal vs business

Not sure if a Wise personal account or Wise Business account is best for you? Here are some key differences you’ll want to know about.

| Wise personal account | Wise Business account |

|---|---|

|

|

Wise Business Account reviews

When it comes to the Wise Business account, you shouldn’t just rely on our review. Doing your research is essential when it comes to opening a business account, and that includes exploring what other customers have had to say. Take a look at some of these customer reviews on Trustpilot.

Positive reviews focused on fast transfers and low fees:

“Wise has been a critical partner on receiving payments from my clients. You are truly a cash flow bestfriend! I don’t even remember already how long I’ve been using Wise. It’s been many years now. I believe I was one of your first users too! Keep being amazing! Your super-fast fund transfer from my Wise account to my local bank accounts is unparalleled!”

“Awesome service. I’ve been using wise regularly for several years now. The fees are low and the exchange rate is always at the current market value. No hidden fees, no exorbitant exchange rate fees. ACH bank transfer is the best way to go. Transfers less than 850 dollars takes a few minutes. Transfers over 850 dollars may take up to 3 business days. You can use debit or credit card but fees are a little high.”

On the other hand, negative reviews mentioned customer service issues and complications with account verification:

“When they started this was a great service. However in the last year the product has downgraded. My account which I’ve used via wise.com for at least 8 years they say cannot connect. With repeated efforts to fix it on my end, wise support continually has no idea what’s wrong or what’s going on, and it seems they have bots reviewing the information we provided at their request. As a small business owner I rely on transfers to vendors in a timely manner. This latest development with wise.com has cost me a lot of time and effort and still their issues are unresolved. I will have have to look for an alternate transfer service based on this.”

“Terrible company for business transfers. Constantly we have to verify our account for small transfers we make monthly to an employee. This is not simply 2FA, they need your ID and all these annoying things that businesses simply don’t have time for. It’s overbearing.”

Overall, Wise scores high and has been rated as “Excellent” with a TrustScore of 4.3 stars out of 5 from a total of 229,844 customers.

Conclusion: Is Wise a good business account?

Wise business customers can send and receive payments, and handle multiple currencies all in the same account. You can manage your money online or on your mobile device for convenience, and get linked Wise business debit and expense cards for easy payments and withdrawals.

To get full account features you’ll pay a one off 31 USD fee, but there are then no ongoing charges or minimum balance requirements. That makes the Wise account equally suited to freelancers and entrepreneurs, as well as business owners and enterprise level organizations.

If you need to pay or get paid from abroad, the Wise account might suit you. Get paid conveniently from 30 countries, and manage international payments and invoices with batch payments in just a few clicks. All currency exchange uses the mid-market exchange rate and low transparent fees, and there’s no foreign transaction fee to worry about when you spend with your Wise Multi-Currency Card.

Wise for Business review FAQs

What are the advantages of a Wise Business account?

Wise Business account offers money transfers to more than 160 countries, and local account details in 10 currencies including USD, GBP, CAD and EUR. Wise also offers many business-friendly features such as batch payments, connections to Xero and Quickbooks as well as API integration. Wise uses mid-market exchange rate for cross currency transactions, and has a transparent fee structure.

How long does Wise take to transfer funds?

The majority of Wise international transfers arrive instantly or within 24 hours.

How does Wise apply exchange rates?

Wise uses the mid-market exchange rate with no markup, no margin and no hidden fees.

Does Wise have a mobile app?

Get the Wise mobile app on both Apple and Android phones.

How does Wise work?

Open a Wise business account online or in the Wise app, to send and receive payments, and hold and exchange 40+ currencies.