How to Open a Foreign Currency Account in the US [2025]

If you travel a lot, have bills to pay overseas, or want to start saving and investing in a foreign currency to diversify your assets, a foreign currency account may be a good idea.

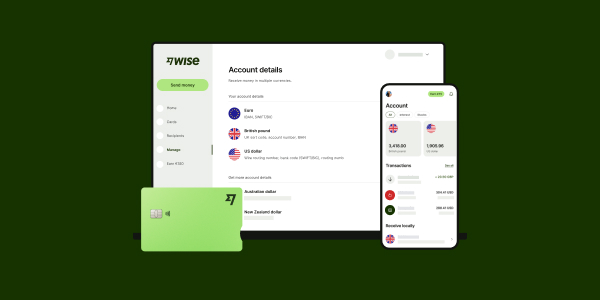

US customers can choose foreign currency accounts from some banks – but these may be aimed towards investors and business customers more so than individuals looking for a day to day travel account. As an alternative, non-bank specialist providers like Wise and Revolut offer multi-currency accounts which come with linked debit cards for easy ways to pay, get paid, send and spend foreign currencies – usually with just your phone.

This guide walks through the basics of how to open a foreign currency or multi-currency account in the US, and highlights a few options to consider, to get your research started.

Key points: Opening a multi currency account online in the US

- You can open a foreign currency account with some banks in the US – but many banks focus on business customers for foreign currency products

- You can open a multi-currency account for day to day use from non-bank specialist services like Wise and Revolut, and some global banking brands

- Having a foreign currency or multi-currency account can help if you travel and spend in foreign currencies, or use foreign currencies to save or invest

- When you choose a foreign currency account consider the range of supported currencies, ongoing and transaction fees, costs of making a transfer and debit card availability

Can I open a foreign currency account in the US?

Yes. You can open a foreign currency account or a multi-currency account in the US for yourself as an individual, or for your business. Some US banks offer personal foreign currency banking services, while others focus their efforts on corporate customers. Non-bank specialists like Wise and Revolut can be a good alternative if you want a foreign currency account for day to day use.

Which providers can I open a multi currency account with in the US?

We’ll look at a few options from banks and non-bank alternatives in more detail later – first a quick overview of some options for foreign currency accounts in the US.

| Multi currency accounts in the US | 💡 Great for: |

|---|---|

| Wise Account | Individuals and businesses looking to hold and exchange 40+ currencies, receive payments with local details, spend with a linked card, and get the mid-market rate |

| Revolut Account | Individuals and businesses who want to choose from different account plans to meet their unique transacting needs – all accounts support 25+ currencies, with some no fee conversion monthly |

| HSBC Global Money Account | Existing HSBC customers needing to manage, hold and exchange 6 currencies through the HSBC app, with preferential rates – intended primarily for transfers in and out of HSBC accounts |

| Everbank Foreign Currency Account | Personal customers who need access savings accounts and CDs in 20 currencies, with either a one off or recurring deposit program |

| Wells Fargo Global Treasury Management | Large businesses and corporations which need foreign currency treasury management services |

What is a multi currency account?

A multi-currency account can hold and exchange several currencies all in the same place – some can hold over 40 currencies. With a multi-currency account you will be able to

- hold foreign currency balances,

- exchange currencies,

- send payments international and domestically,

- in some cases, receive payments,

- spend with a debit card.

As well as US dollars, many multi-currency accounts can often hold currencies that are widely used in international trade and finance, and therefore significant in the global economy and for travelers alike. These can include the euro, the Japanese yen, the British pound, the Swiss franc, the Canadian dollar, and the Australian dollar.

Different accounts have their own features and fees, which we will explore in this guide. First a few pros and cons:

| Multi currency bank account pros | Multi currency bank account cons |

|---|---|

| ✅ Hold and exchange dozens of currencies ✅ Pay overseas bills ✅ Receive money from others in foreign currencies ✅ Save or invest in foreign currencies, for a diversified portfolio | ❌ Some accounts have ongoing fees ❌ Exchange rates may include markups or fees |

What do I need a multi currency account for?

A multi-currency account can be handy for anyone who needs to deal with multiple currencies regularly. Here are some scenarios where having a multi-currency account can be useful:

- If you travel often, a multi-currency account allows you to hold, receive, and spend money in multiple currencies, avoiding excessive currency exchange fees

- If you frequently shop online from international retailers, a multi-currency account allows you to pay in the retailer’s local currency

- If you invest in international stocks, bonds, or other assets, a multi-currency account can make it easier to access overseas markets

- If you have a business you can use a multi-currency account to receive payments in various currencies directly

How to open a multi currency bank account in the US

You can open a multi-currency or foreign currency account with either a bank or a non-bank alternative. If you choose to open an account with a bank you might find you also need a USD account with the same bank before you’re eligible to apply for a foreign currency product.

As an outline, let’s walk through how to open a multi-currency bank account in the US.

1. Choose the right account and provider

Weigh up a few options before you pick, including a thorough review of features, fees and eligibility requirements.

2. Prepare your supporting documentation

We’ll look at the documents you might need in more detail in a moment, but it’s important to understand that you must complete a verification step to open any bank or non-bank alternative financial account. This requires some information and important documents like a photo ID.

3. Apply online, or in a branch person

Complete the application form with your personal and contact details. You may benefit from online account opening services from your bank or you might need to choose a digital first provider like Wise and Revolut to enable you to get started remotely.

4. Submit your documents online or in a branch

Either take photos of your required documents and upload them, or if you’re in a branch pass your paperwork to a member of staff for review and checking.

5. Once your account is verified you’ll be able to start transacting

Account verification can take a day or two, but once this process is complete you’re good to start to transact.

How to open a multi currency account online in the US

If opening an account online or in an app is important to you, choosing a fully digital provider is a good idea. Options like Wise and Revolut have been built for an intuitive onboarding experience you can manage with just your phone or laptop.

Here’s how to open a multi-currency account with Wise, as an example;

- Download the Wise app, or open the Wise desktop site

- Register with your email address, or an Apple, Google or FaceBook account

- Follow the prompts to enter your personal details

- Upload your ID documents for verification – you’ll also be prompted to enter your SSN

- Once your account is verified, you can start to transact.

If you’ve opened and verified a Wise account you can activate different currencies simply by tapping Open in the app homepage and selecting the currency balance or balances you need. Top up your balance, complete any required security step, and start transacting.

What do you need to open a foreign currency account?

In all cases you’ll need a few documents to open your account – usually including:

- A photo ID document like a passport or a driving license

- Proof of your address such as a utility bill in your name

- Your SSN

Business customers will also need to provide details of their company and some ID for all beneficial owners. In some cases you might also have to pay a minimum opening account deposit at the point of setting up your multi-currency account.

Best foreign currency accounts in the US

There’s no single best foreign currency account in the US – but it’s worth doing some research because different accounts have their own features, benefits and fees. As different banks and providers target their own customer niches, the options are pretty varied. Here’s an overview of the accounts we’ve picked out as an example – there’s more detail coming up right after.

| Wise | Revolut | HSBC | Everbank | Wells Fargo | |

|---|---|---|---|---|---|

| Supported currencies | 40+ currencies | 25 currencies | 6 currencies | 20 currencies | Not specified |

| Maintenance fees | None | 0 USD – 16.99 USD/month | None | Monthly fee applies to easy access products | Not specified |

| Minimum balance | None | None | None | 2,500 USD or 100 USD/month | Not specified |

| International transfer fees | From 0.33% | Variable fees, up to 5% of transfer amount | Variable fees, no cost for some transfers | Not specified | Not specified |

| Receive payments | With local account details in select currencies | With SWIFT details in select currencies | From your HSBC account only | Not specified | Not specified |

| Debit card | Available | Available | Not available | Not available | Not available |

As you can see, the options available from different providers are quite varied. Wise and Revolut are not banks but offer the largest currency selection and both have debit cards, making them a solid choice for day to day spending. HSBC customers might choose the Global Money account, which lets you hold a balance in foreign currencies, but you’ll need an existing HSBC USD account to benefit. Everbank has savings and CD products in foreign currencies, while Wells Fargo turns its attention more to corporate customers. We’ll dig into each a little more now.

Wise multi currency account

You can open the Wise account as a personal or business customer in the US, to hold and exchange 40+ currencies, and receive payments in select currencies with local account details. You’ll also be able to get a linked debit card for spending and cash withdrawals, making this a good choice for travelers and anyone looking to send and receive payments in foreign currencies. Currency exchange uses the mid-market rate and low fees from 0.33%.

Best features:

- Mid-market exchange rates

- Great selection of supported currencies

- Ways to receive, send and spend currencies conveniently

Supported currencies: 40+

Local account details: Available in select currencies

Exchange rates: Mid-market exchange rate

Account fees: No fee to open or maintain, currency exchange from 0.33%

Learn more: Wise Account Review

Revolut multi currency account

Revolut serves US business and personal customers, with a selection of accounts which can include some with no ongoing fees. All accounts offer some no fee weekday currency exchange which uses the Revolut exchange rate, before fair usage fees apply. Different account tiers have their own features – accounts with monthly charges may get discounts on services like international transfers, and also perks like lounge access and travel extras.

Best features:

- Choose from several different account types

- All accounts have some no fee features and services

- 25+ currencies supported for holding and exchange

Supported currencies: 25+

Local account details: Not specified – you can get SWIFT details for select currencies

Exchange rates: Revolut rate on weekday conversion to plan limit, 0.5% fair usage fees, 1% out of hours fees

Account fees: 0 USD to 16.99 USD monthly fees, other transaction fees apply including international payments fees of up to 5%

Learn more: Revolut review

HSBC Global Money account

If you already have a USD account with HSBC you can also add in the app-based Global Money account. This account is primarily meant for people who want to transfer in and out from HSBC accounts, and can support 6 currencies. You can add money from a linked HSBC account to convert with the HSBC exchange rate – which can be handy for making overseas payments to other HSBC accounts, or if you know you’ll need foreign currency in future for an upcoming bill for example.

Best features:

- Service from a global bank with a full suite of other international products

- Accounts support 6 currencies

- Fully in app management tools

Supported currencies: 6

Local account details: Not specified – transfer in from your linked HSBC account

Exchange rates: HSBC rates which may include a markup

Account fees: No additional maintenance fees for this account, but you may pay monthly fees on your HSBC USD account – transfer charges might apply

Learn more: HSBC Global Money Account Review

Everbank multi currency account

Everbank supports 20 currencies for access savings accounts and CDs. At the point of writing the only currency which earns interest with the access account options is USD, but this can change depending on the rates available around the world. Monthly fees might apply on the easy access account products, these are variable depending on currencies.

Best features:

- 20 supported currencies

- Easy access savings and CD products available

- Some accounts earn interest

Supported currencies: 20+

Local account details: Not specified

Exchange rates: Everbank rates which may include a markup of up to 1%

Account fees: Monthly fees may apply on easy access products

Wells Fargo foreign treasury management

Wells Fargo corporate customers can access products and services including electronic payables and receivables, disbursement, fraud protection, merchant services and more. However, as services are aimed at corporate customers, details are not publicly shared, and can be disclosed to applicants on application.

Which US banks offer foreign currency accounts?

Some US banks have foreign currency accounts, but you’ll often find that the options are aimed more at corporate and business customers than individuals. Options can include those listed above as well as:

East West Bank – for savings products and customers looking to invest in foreign currencies

Citibank – products available through the international and expat services division, aimed at high wealth individuals

Chase – services are mainly intended for business and corporate customers

Learn more: Best foreign currency bank accounts in the US

What is the eligibility for a multi currency bank account?

Different banks and non-bank providers have their own eligibility requirements. You’ll pretty much always find you must be:

- 18 years old or over

- Able to provide proof of ID and address in the US

In some cases you will also need a minimum deposit or proof of earnings, while business customers may face their own requirements including being able to provide a full suite of business information and paperwork.

What is the minimum amount to open a foreign currency account?

You may find that the account you pick has a minimum deposit or balance requirement, or a fall below fee. Fall below fees activate if you don’t meet the account’s minimum balance rules.

Of the accounts we’ve picked out in this guide, only the Everbank products have minimum balances. In this case you need 2,500 USD or 100 USD a month on an ongoing basis, to get an account. Some other accounts which are aimed at high wealth individuals might have higher minimum balance requirements.

Fees to open an maintain a foreign currency account

There may be no fee to open your foreign currency account, but that does not mean it will be free to operate. Some accounts have ongoing charges, and transaction fees are also common, based on the way you use your account. Foreign currency account fees can be extremely varied, but we’ve pulled out a few important costs to look at for some of the providers we’ve highlighted above as an example:

| Wise | Revolut | HSBC | |

|---|---|---|---|

| Maintenance fees | None | 0 USD – 16.99 USD/month | None – you must also have another HSBC USD account which might have fees |

| Order a debit card | 9 USD | No fee | Not applicable |

| Incoming international transfer fees | Free to receive in select currencies 6.11 USD fee for incoming USD wires 10 CAD for incoming CAD SWIFT payments | No fee to receive in select currencies via SWIFT 10 USD incoming USD wire fee | No fee to receive payment from your own HSBC account |

| Outgoing international transfer fees | From 0.33% | Variable fees, up to 5% of transfer amount | Variable fees, no cost for some transfers |

| Currency conversion | From 0.33% | No fee to plan limit, 0.5% fair usage fees after that 1% out of hours fee | HSBC rates apply which are likely to include a markup |

Conclusion: Opening a foreign currency bank account in the US

US customers can open foreign currency accounts from banks and non-bank alternatives. Banks in the US may restrict their foreign currency services to business and corporate customers, or focus their efforts on products which are aimed at people looking to invest and save in foreign currencies. As an alternative you might prefer a non-bank provider like Wise or Revolut.

Wise lets you hold and exchange 40+ currencies with the mid-market rate and low fees from 0.33%. You can get a linked debit card, and spend globally, with easy ways to pay and get paid with low or no fees.

Revolut has different accounts depending on how you like to transact – but all accounts offer a card and some no fee currency conversion during the week, to your plan limit. You can take an account with no monthly fee, or upgrade to one with maintenance charges to unlock more features and get higher non fee transaction limits.

Use this guide to decide which account may fit your needs – and to get started with opening your multi-currency bank or non-bank alternative account.