Best GBP business account in the US

If you have a business in the US, and have customers, suppliers, contractors or team members in the UK, you may benefit from opening a GBP business account. With a pound sterling business account you can receive GBP payments from customers, pay UK invoices and hold a balance in British pounds.

However, there’s a pretty narrow range of choice for GBP business accounts in the US if you’re planning on sticking with a bank. Specialist non-bank providers like Wise and Airwallex can be good alternatives.

Read on to learn about the best GBP business accounts in the US, the costs involved, and how to open one.

Can a GBP business account be opened in the US?

Yes. You can open a GBP business account in the US with a bank or a non-bank digital provider, like Wise and Airwallex.

Digital providers typically offer multi-currency accounts you can use to hold GBP as well as a broad selection of other currencies – and you can open, verify and manage your account with your phone or laptop.

If you’re a small business owner and you’d prefer to use a US bank to open your GBP business account you’ll find you have a pretty limited selection of options, as many banks reserve foreign currency account options for large corporations which need treasury management services.

This guide will give you some inspiration to start your research, with details of pound sterling account options from non-bank providers and an example account from a US bank to help you compare.

Advantages of a GBP business bank account in the US

- You’ll be able to hold a balance in GBP – so if you receive a payment in pounds you don’t need to convert to USD immediately

- Offer customers the option to pay in GBP instead of dollars – making it easier to market your products in the UK

- Use local GBP account details with PSPs like Stripe or marketplaces like Amazon, to withdraw GBP deposits

- Make convenient payments in British pounds to contractors and suppliers, or to cover overseas tax

- Some accounts offer a debit card you can use to spend and make cash withdrawals in the US and abroad

Best GBP business accounts

There’s no single best GBP business account – which means you’ll need to compare a few to find out which would suit you best. We’ve summarized some key features for several options, with a bit more detail below, to help you start your research.

| Provider | Opening and ongoing fees | Currency conversion and transaction fees | Best features |

|---|---|---|---|

| Wise | 31 USD opening fee No monthly fees | Currency exchange from 0.33% Some no-fee ATM withdrawals monthly before fees | Manage 40+ currencies, with local account details to receive payments Debit and expense cards |

| OFX | No fee to open or operate account | Exchange rate markups will apply when converting currencies No transfer fee | Accounts available in 7 currencies Get currency risk management solutions |

| Revolut | 0 USD – 119 USD/monthly fee | 0.6% fair usage fee on currency exchange exceeding plan limit, 1% out of hours fee 5 USD international transfer fee | Hold and exchange dozens of major foreign currencies Spend globally with a linked Revolut card |

| Airwallex | No account opening or ongoing fees | 0.5% to 1% currency conversion fee, depending on the currencies involved 15 USD – 25 USD SWIFT transfer fee | Multi-currency account features Ways to take customer card payments |

| PNC | Contact PNC directly to discuss options and fees | Transaction fees are likely to apply, which will be disclosed by PNC on application | Interest bearing accounts are offered FDIC insured |

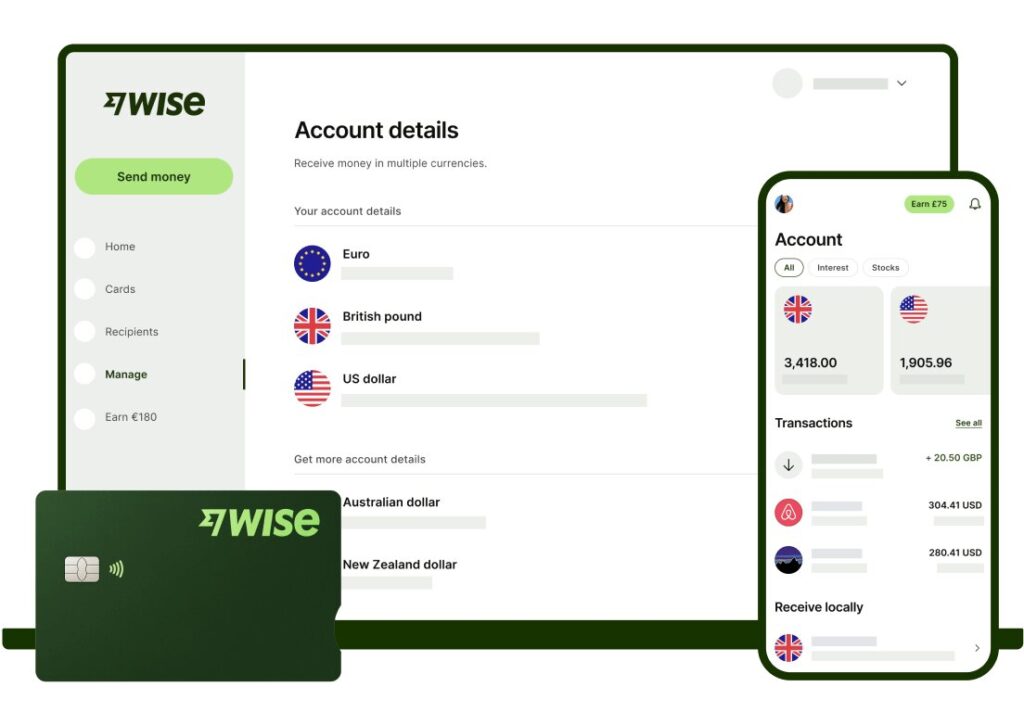

Wise Business account

Wise Business accounts support pounds as well as 40+ additional currencies. With your digital Wise account you can get local account details for various foreign currencies including British pounds, so you can receive payments conveniently from customers, PSPs and marketplace sites.

Currency conversion uses the mid-market exchange rate with low, transparent fees. Accounts also offer debit and expense cards for you and your team, perks like batch payments and cloud accounting integrations, and access to a powerful API to streamline workflow.

There’s a one time account opening fee, no monthly charges and low, transparent transaction fees to pay. There’s no fee to receive payments in GBP using local account details.

Key Features:

- Local account details for select foreign currencies

- Debit and expense cards

- Batch payments, cloud accounting integration and API access

Currency coverage: Multi-currency account to manage 40+ currencies including EUR, USD, GBP, AUD, CAD and more

Receiving payments: Receive payments with local account details in 10 currencies, with further options to receive SWIFT transfers

Account fees: One time 31 USD business account opening fee, currency conversion from 0.33%, 6.11 USD incoming USD wire fee, 10 CAD incoming CAD SWIFT fee

Debit card: Available to account owner and eligible team members

| Wise Business pros | Wise Business cons |

|---|---|

| ✅ 40+ supported currencies for holding and exchange ✅ Receive GBP through local transfers ✅ Get a debit card for spending and withdrawals ✅ No monthly fee | ❌ One time account opening fee of 31 USD ❌ Some transaction fees apply |

Eligibility: Available for business owners in the US and many other countries globally, with valid ID and proof of address. Apply online or in-app for a fully digital onboarding

OFX Global Currency Account

OFX is a currency specialist which offers multi-currency accounts aimed at online sellers. Account holders don’t get debit cards, but can get paid in pounds, send transfers and withdraw their money. This means you can use your OFX account to receive payments from marketplace platforms, PSPs and from your own website if you’re an online seller. OFX also offers broader currency services, including currency risk management products like forward exchange contracts, used to cut down the risk involved with fluctuations in the forex markets.

OFX accounts have no opening fee and no monthly fee, but currency exchange includes a markup.

Key Features:

- 7 supported currencies, with no ongoing or account management fee

- Great reputation for customer service

- Access currency risk management solutions and payments

Currency coverage: Multi-currency account to manage 7 currencies including GBP, USD, EUR, AUD, and CAD

Receiving payments: Receive payments with local account details in 7 currencies

Account fees: No opening fee and no monthly fee, but currency exchange includes a markup

Debit card: Not available

| OFX pros | OFX cons |

|---|---|

| ✅ No account opening or monthly fee ✅ Get paid online through PSPs and marketplaces ✅ Manage your account in the OFX app for ease ✅ No international transfer fee | ❌ Exchange rates include a markup ❌ No debit card option |

Eligibility: Available for business owners in the US and many other countries globally, with valid ID and proof of address. Start your application online or in the OFX app and wait for a call back from the OFX team to discuss your requirements

Revolut Business Account

Revolut business accounts can hold and exchange British pounds alongside many different currencies, with several different account tiers available depending on your business requirements. You can get paid with local USD account details, or receive other currencies like British pounds with SWIFT details. Some accounts offer no fee international transfers – a 5 USD fee applies if you exceed your plan’s no fee limit.

Monthly fees range from 0 USD to 119 USD. All account types have some weekday currency exchange which uses the Revolut exchange rate with no additional fee. Once you hit your account limit for currency exchange, fair usage fees may apply.

Key Features:

- Different accounts to suit differing business needs

- All account tiers have some weekday no fee currency conversion with the Revolut rate

- Higher tier accounts get extras like expense approval tools

Currency coverage: Multi-currency account to manage 25+ currencies including GBP, USD, EUR, AUD, CAD and more

Receiving payments: Receive payments with SWIFT transfers in select currencies

Account fees: 0 USD – 119 USD /month ongoing fees, 5 USD international transfer fee, fair usage and out of hours fees may apply on currency conversion

Debit card: Available to account owner and eligible team members

| Revolut Business pros | Revolut Business cons |

|---|---|

| ✅Hold and exchange 25+ currencies ✅ Choose from varied account plans to suit different business needs ✅ Add and manage user permissions ✅ Some accounts get extras like expense and payment approval tools | ❌ Out of hours and fair usage fees may apply on currency conversion ❌ Ongoing fees for the highest tier accounts |

Eligibility: Available for business owners in the US and many other countries globally, with valid ID and proof of address. Apply online or in-app for a fully digital onboarding

Airwallex Account

Airwallex GBP accounts are a good option particularly if you need to take customer card payments and want to receive money in British pounds to hold or exchange back to dollars later. Accounts come with linked debit cards for easy spending, which can be issued to the account owner or to team members. Virtual and physical cards are available, but it’s useful to know that you can’t make ATM withdrawals.

There are no ongoing account costs but a few fees may apply, including currency conversion costs of 0.5% – 1% and some SWIFT transfer fees.

Key Features:

- 23 currencies supported to receive, hold and exchange

- No opening or ongoing fees

- Take customer card payments if you’re an online seller

Currency coverage: Multi-currency account which supports receiving in 23 currencies including USD, GBP, EUR and more

Receiving payments: Receive payments with local details in select currencies, as well as options to take SWIFT payments

Account fees: No ongoing fees, 0.5% to 1% currency conversion fee, depending on the currencies involved, 15 USD – 25 USD SWIFT transfer fee

Debit card: Available

| Airwallex Business pros | Airwallex Business cons |

|---|---|

| ✅ No monthly fees ✅ 23 supported currencies for holding and exchange ✅ Take customer card payments conveniently ✅ Get payment links and plugins | ❌ Exchange rate fees of up to 1% apply ❌ ATM withdrawals are not offered |

Eligibility: Available to US business owners, and also in a broad selection of other countries and regions. Apply online or in app, with digital verification offered

PNC Foreign Currency Account

PNC offers foreign currency demand deposit accounts (DDAs) in 30 currencies including British pounds. These accounts let you make and receive payments, manage your money digitally, and can also help to reduce FX risks. However, few details are available publicly as PNC requires potential customers to call or email to learn about the options available based on their specific business situation.

Key Features:

- Broad range of currencies covered

- Major bank which offers a full suite of services

- Account details disclosed by PNC on demand only

Currency coverage: 30 currencies including GBP

Receiving payments: Receive payments in 30 currencies

Account fees: Transaction fees are likely to apply, which will be disclosed by PNC on application

Debit card: Not specified

| PNC pros | PNC cons |

|---|---|

| ✅ 30 supported currencies ✅ Receive and send payments in select currencies ✅ Manage your money with online banking ✅ Reduce FX risks | ❌ Few details available without calling PNC to ask for personal advice

|

Eligibility: Call PNC to ask for information about eligibility and discuss your options.

GBP business account fees

Choosing a GBP business account with low fees is essential to keep down your overall operating costs. This table summarizes some key costs for the providers we’ve mentioned above. We’ve not included PNC as fee information is not disclosed until you discuss your business account needs with the bank’s service team.

| Provider | Account opening fees | Monthly fees | Transfer fees | Currency conversion fees |

|---|---|---|---|---|

| Wise | 31 USD opening fee | No monthly fees | Outgoing transfers from 0.33% No fee to receive GBP with local account details Incoming USD wires: 6.11 USD Incoming CAD SWIFT payments: 10 CAD | From 0.33% |

| OFX | No fee | No monthly fees

| No incoming or outgoing transfer fee | Exchange rate markups will apply |

| Revolut | No fee | 0 USD – 119 USD/monthly fee | 5 USD international transfer fee once account plan limit exceeded | 0.6% fair usage fee on currency exchange exceeding plan limit 1% out of hours fee |

| Airwallex | No fee | No fee | No incoming payment fee for loca transfers 15 USD – 25 USD SWIFT transfer fee | 0.5% to 1% currency conversion fee, depending on the currencies involved |

As you can see, the fee structures can change a lot depending on the bank or non bank alternative provider you decide to open an account with. Here’s a quick summary of the options outlined above:

Wise: One time account opening fee, then low transfer and conversion costs from 0.33% – some incoming payments have fees, but many are free

OFX: No account opening or monthly fees, no transfer fees – but there are exchange rate markups, which are a fee added to the conversion rate applied

Revolut: Choose accounts with or without monthly fees and get some no fee transactions before paying fair usage and other fees

Airwallex: No account opening or maintenance fees, but charges apply including conversion fees of up to 1% and some transfer fees

How to open a GBP business account in the US

As we’ve seen, opening a GBP account in the US may be a more straightforward process if you use a non-bank digital provider which can help you set up your account remotely. Banks – like PNC – ask potential customers to call to discuss their requirements, and may need a branch visit to set up an account.

That said, the steps you’ll usually need to take to open a GBP business account in the US are broadly similar, whichever service you decide on. They can include:

- Choose the best provider for your needs

- Check you meet any eligibility criteria

- Register for your account in a branch, online, or through the provider app

- Give your personal, business and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

It’s worth knowing that whether you pick an account with a bank or a non-bank alternative provider, you’ll need to complete a verification step to use your account. This is required by law and intended to stop financial crimes. Verification requires you to show some documents to the bank or provider you pick, so they can check you are who you say you are. Exact requirements vary based on business entity type – but you’ll pretty much always be asked for:

- Government issued photo ID to prove your identity

- Photo ID for any other ‘beneficial owner’ – anyone who directly or indirectly controls 25% of more of your business

- Your SSN

- Proof of address – a utility bill or bank statement in your name for example

- Business registration documents which can vary based on your entity type

How to open a GBP business account online

Choosing digital onboarding means you can open your GBP account without needing to leave home. The process and documents needed are pretty much the same as they would be if you were using a bank, but you can do everything with just your phone or laptop:

- Download your preferred provider’s app or visit their desktop site

- Select the Open account option

- Give your personal, business and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

To complete the verification step you’ll upload clear images of your personal ID, address proof, and business documents, to the provider’s app or website. Original documents aren’t usually needed, although you may need to take a selfie or provide a video to show you are the same person featured in the submitted ID document.

Conclusion

Use your GBP business account to receive payments in pounds from customers, PSPs and marketplaces – and to pay suppliers or contractors in the UK. Because you can hold a balance in GBP you won’t need to convert funds back to USD every time, which can help cut out unnecessary currency exchange fees.

Use this guide to consider your options – from a non-bank provider like Wise or Airwallex, a currency specialist like OFX, or a bank like PNC.

GBP business bank account FAQs

Can an American open a GBP business account?

Yes. If you have a registered business, you should be able to open a GBP business account as a non-resident and US citizen. Different providers have their own eligibility rules – but many global services like Wise, Revolut and Airwallex are available to people living in many countries and regions. Apply using your US ID documents and proof of address, and open a British pounds balance for international use.

Related: How to open a UK business account from US

Can I open a GBP business account in the US?

Yes. Open a GBP business account from a bank, or a specialist non-bank online service. Different providers offer accounts with different features and fees, and eligibility requirements may apply. Generally, non-bank providers offer more flexible accounts and a digital onboarding which can be handy for business owners.

How much does it cost to open a GBP business account?

Some GBP business accounts can be opened for free, with no monthly charges or minimum balance requirements. Others have monthly fees or a one off fee for opening, followed by transaction charges. Compare a few to find the right one for you.