Bank of America Currency Exchange Guide: Fees, Rates & How to Order

If you’re a Bank of America customer with an eligible checking or savings account you can order travel money online or on the Bank of America app, to be delivered to your home or a Bank of America financial center. Funds can be shipped pretty quickly, but fees, including delivery and conversion fees apply.

Read on for all you need to know about how Bank of America currency exchange works, how to get your travel money, and what you’ll pay. Plus, as a bonus we’ll take a look at a couple of alternatives – Wise if you’d prefer to manage your travel spending using a card and digital account, and CXI if you want to be able to pick up your cash instantly in a branch.

Key points: Bank of America currency exchange

- Bank of America customers with an eligible checking or savings account can order online and in app to have travel money delivered to their home or a Bank of America location

- Bank of America fees include conversion costs and a shipping fee, which varies depending on how quickly you want to get your money

- Alternatives like the Wise travel money card and multi-currency account can be easy to use, cheap, and secure as you won’t need to carry as much foreign cash

- If you want travel cash faster, you might prefer an alternative like CXI which offers walk in services in 35 branches across the US, with 80+ currencies covered

- This guide will help you understand the currency exchange options at Bank of America, and also compare a few alternatives

Does Bank of America do currency exchange?

Yes. Bank of America does currency exchange, but you will need to have an eligible Bank of America credit card, checking or savings account to use the service. Eligible customers with checking or savings accounts can order foreign currency online or in mobile banking, while customers with credit cards only currency at a financial center.

| Quick summary: | Answers |

|---|---|

| Currencies supported | You can order dozens of currencies including the Canadian dollar (CAD), euro (EUR), and Great Britain pound (GBP), for home or branch delivery, at Bank of America. Alternatives like CXI support 80 currencies, while the Wise Multi-Currency Card and account supports 40+ currencies and can be used for spending and withdrawals in 150+ countries. |

| Bank of America exchange rates | Bank of America uses an all-in exchange rate which can include profit, fees, costs, charges or other markups. Wise uses the mid-market rate with fees from 0.33% which are split out clearly. CXI uses a competitive exchange rate which can include a markup. |

| Does Bank of America charge a fee? | Bank of America includes fees in the exchange rate used to convert your currency. In addition there’s a 7.5 USD fee for standard delivery of orders under 1,000 USD in value – and a 20 USD fee if you want expedited delivery |

What currencies does Bank of America support for currency exchange?

You can see the full range of currencies available from Bank of America on their online or mobile banking app. Simply enter the country you’ll travel to, to see the currency you need there, and the availability.

Popular currencies which are supported by Bank of America include: the Australian dollar (AUD), Canadian dollar (CAD), euro (EUR), Great Britain pound (GBP), Hong Kong dollar (HKD), Mexican peso (MXN), New Zealand dollar (NZD), and the Swiss franc (CHF).

Alternatives like Wise and CXI also offer a wide range of foreign currencies.

We’ll cover more details on them, later on in this guide.

Can I buy foreign currency from Bank of America?

Yes. If you are a Bank of America customer with a checking or savings account you can order foreign currency to be delivered to your home or collected at a Bank of America financial center. You must have a Bank of America account which can be used to pay for your order. If you are a Bank of America customer with a credit card only, you can order and collect foreign currencies at a Bank of America financial center.

Bank of America does not offer multi-currency account services to individuals. However, corporate and large business customers can access solutions to send and receive payments in foreign currencies.

Bank of America currency exchange rate

Bank of America exchange rates are decided using factors including market conditions, the exchange rates available at other banks, risk, required profit, and other market, economic and business factors.

Bank of America uses all-in pricing. That means that the rate you’re quoted may include profit, fees, costs, charges or other markups. Bank of America rates can vary, which means that different rates might be offered for similar transactions, to different customers.

Here’s a quick look at the exchange rates offered by a couple of alternatives to Bank of America – we’ll look at these in more detail later:

- CXI: Competitive rates which may include a small markup

- Wise: Mid-market rate with no markup

- OFX: Competitive rates which may include a small markup

How to check Bank of America exchange rate?

You can check the Bank of America exchange rate for your preferred currency online or in the Bank of America app. Online there are lists of rates, and also a handy calculator tool which shows you how much your dollars would be worth in another currency.

Does Bank of America charge a fee to exchange currency?

Bank of America exchange rates can include a fee – as we explored above. However, on top of that, there may be an additional delivery fee to pay when you get your money dropped off at your home address or at a financial center.

- Standard delivery: 7.50 USD fee, waived for orders of over 1,000 USD

- Overnight delivery: 20 USD fee

Because Bank of America financial centers don’t stock foreign currency, you have to pay this fee, even if you’re collecting your money at a physical location.

Let’s look at the fee structures for the alternatives to Bank of America we’ll investigate later:

- CXI: Variable fees which can include a delivery charge and a small markup on the exchange rate

- Wise: Currency exchange costs from 0.33% – fees are shown as a separate line item, rather than being included into the exchange rate

- OFX: No fee for currency conversion, but the rate used will include a small markup

How to buy foreign currency from Bank of America

If you have a Bank of America checking or savings account you can choose to order travel money online, in app or by visiting a Bank of America financial center. If you have a Bank of America credit card, you can only order by visiting a Bank of America financial center. You’ll need to pay with your Bank of America credit card or bank account.

Here are your options if you want to buy foreign currency from Bank of America:

Order travel money in a Bank of America financial center: Call into your local branch and place your order with a team member – pay with your Bank of America credit card, checking or savings account

Order travel money online: Log into Bank of America Online, and place your order following the prompts. You can only pay with your Bank of America checking or savings account

Order travel money in the mobile app: Log into the Bank of America Mobile app, and place your order following the prompts. You can only pay with your Bank of America checking or savings account

How to order foreign currency online with Bank of America

If you have a checking or savings account with Bank of America you can order online for home delivery, or for delivery to a financial center for collection. If you’re ordering more than 1,000 USD you must collect it – home delivery is not offered in this case.

Here’s how to order foreign currency online with Bank of America:

- Go to the Bank of America website and navigate to the travel money page

- Pick the currency you want to see a quote and fee information

- You’ll be prompted to log into the Bank of America online banking service

- Confirm if you want delivery or collection, and review the fees

- Your transaction will be completed once you’ve checked and confirmed everything

Buy foreign currency from Bank of America mobile app

If you’d prefer you can also buy your travel money in the Bank of America app:

- Log into the Bank of America mobile app

- Select the account you’ll use to pay

- Tap Mobile orders, then Foreign Currency

- Confirm if you want delivery or collection, and review the fees

- Your transaction will be completed once you’ve checked and confirmed everything

How long does it take to get foreign currency from Bank of America?

The length of time you have to wait to get your foreign currency from Bank of America will depend on the service you select and the time you place your order. Here’s a roundup:

- If you order before 2pm on a working day, Bank of America will ship your travel money the same business day; otherwise will ship the next business day

- If you have selected standard delivery you’ll get your money within 1-3 business days

- If you have selected next business day delivery your money will arrive in 1 business day if your order is placed before 2 pm local time

- Bank of America does not ship orders on weekends or holidays

💡 If you choose an alternative for cash collection or delivery, such as CXI you may get your money quicker. CXI has many currencies in stock, and can dispatch common currencies for next day delivery after order.

💡 If you choose a Wise Multi-Currency Card you can convert currencies instantly in the app – just add some money in USD and tap to change to the currency you need right away.

Alternatives to Bank of America foreign currency exchange

Bank of America may not be the right option for you – so let’s look at some alternatives that offer a wide range of currencies, low fees and good exchange rates. We’ve picked out different options depending on why and how you need currency exchange.

| Bank of America | CXI | Wise | OFX | |

|---|---|---|---|---|

| Currency exchange services | Order travel cash online, in app and in financial centers for delivery or collection | Order travel cash online for delivery or collection | Exchange currencies within your digital account or when you pay with your Wise Multi-Currency Card | Exchange currencies within your digital account |

| Fees | Fees included in exchange rates + delivery fees based on service selected | Variable fees based on currency and delivery option | From 0.33% | Fees included in exchange rates |

| Exchange rates | Exchange rates include a markup to cover costs and Bank of America’s revenue | Exchange rates include a markup | Mid-market rates | Exchange rates include a markup |

| How long does it take? | Standard delivery takes 1 – 3 business days | Next day delivery available on many currencies | Instant conversion in your digital account | Instant conversion in your digital account |

| Supported currencies | Most major currencies including EUR, CAD, GBP, AUD | 80+ including EUR, CAD, GBP, AUD | 40+ including EUR, CAD, GBP, AUD | 7 including EUR, CAD, GBP, AUD |

The right currency exchange option for you will depend a lot on your specific situation.

- If you need cash for a vacation – particularly if you’re in a hurry – CXI may help, with fast exchange in many currencies.

- If you would rather manage your money digitally and pay with a card when you’re away – with the option of using an ATM when you need cash – Wise may suit, with low costs and mid-market exchange rates.

- OFX is a good solution if you need a business account and access to specialist currency services such as risk management.

CXI (order online for collection or delivery)

CXI has 35 branches throughout the US, including in city center locations and airports. You can buy 80+ currencies, many of which are held in stock so you can walk into a branch and get sorted right away. Or if it’s easier you can order online and either have the money delivered to your home, or head out to collect in the branch when you’re ready.

| CXI pros | CXI cons |

|---|---|

| ✅ Huge range of currencies ✅ Many major currencies held in stock ✅ Next day deliveries available ✅ Buy coins as well as notes for major currencies | ❌ Fees including delivery fees may apply ❌ Exchange rates include a markup |

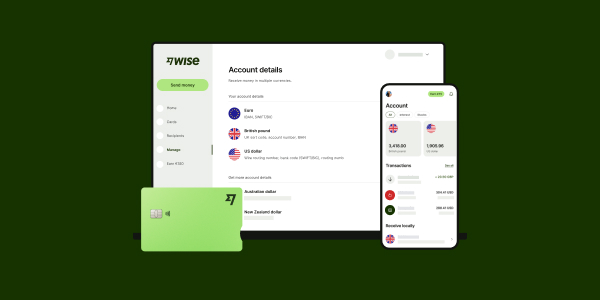

Wise (multi-currency card for spending and withdrawals)

Open a Wise account online or in app, add USD from your bank or card, and convert instantly in your account. You can then tap and pay with a Wise Multi-Currency Card, or make cash withdrawals in foreign currencies when you’re away. Currency conversion uses the mid-market rate with low fees from 0.33% – and accounts can hold 40+ currencies. Spend and withdraw with your card in 150+ countries.

Learn more: Wise Multi-Currency Card review

| Wise pros | Wise cons |

|---|---|

| ✅ Hold and exchange 40+ currencies ✅ Mid-market exchange rates ✅ Some no-fee ATM withdrawals every month* ✅ Manage all your money with just your phone | ❌ No cash home delivery or collection ❌ Some transaction and withdrawal fees apply |

*ATM operators may charge their own fees.

OFX (digital currency exchange for businesses and online sellers)

If you’re interested in currency exchange for your business or as an online seller, the OFX Global Currency Account may be a good bet. Accounts support 7 major currencies and you can switch between them in the app or online. OFX also offers more complex currency risk management products which can be especially helpful for businesses trading internationally.

| OFX pros | OFX cons |

|---|---|

| ✅ Business and online sellers can open accounts instantly ✅ No ongoing account fees ✅ Receive,exchange and send foreign currency payments ✅ Instant currency conversion in your account | ❌ Exchange rates include a markup ❌ No debit card or cash options |

If you’re looking to exchange foreign currency at a local bank, this guide might help: Best banks for exchanging foreign currencies

Conclusion: Buy foreign currency at Bank of America

Bank of America extends foreign currency conversion services to personal customers with a checking or savings account, with select services also offered to credit card holders. You can order dozens of currencies online, in app or at a financial center, for collection or delivery. If you’re using your credit card – or if your order is over 1,000 USD – you must choose collection. Delivery fees apply both for home delivery and if you choose to collect from a Bank of America location.

- Bank of America customers with a checking or savings account can order in person, online and in app to have travel money delivered to their home or a Bank of America location

- Bank of America customers with a credit card must order and collect at a Bank of America financial center

- If you want travel money in cash, compare the rates and fees from alternatives like CXI which may get your money to you quicker

- Customers who prefer to use a card to spend and withdraw when away from home may like Wise – which offers multi-currency accounts which use the mid-market exchange rate

- OFX is a good choice for business customers looking for currency services include exchange and more complex requirements such as forward exchange contracts

- Bank of America fees include conversion costs and a shipping fee, which varies depending on whether you select standard or expedited delivery

FAQs Bank of America currency exchange

Can I deposit foreign currency at Bank of America?

You can not deposit foreign currency at Bank of America, but the bank may buy back some unused travel money from you if you come home with extra. Fees, which may be included in the exchange rate, will apply.

Can I buy foreign currency from the Bank of America mobile app?

Bank of America customers with a checking or savings account can order travel money in the Bank of America app. If you have a credit card you must visit a financial center to place your order.

Can I walk into Bank of America and get foreign currency?

No. You must order online, in app or in person and then have your money dispatched, either to your home or to a financial center for collection.

Related article: Does Bank of America charge foreign transaction fees?