Citibank Foreign Currency Account & Alternatives [2025]

Citibank in the US does not offer multi-currency or foreign currency accounts to personal customers. There is the option to use the Citi World Wallet to get foreign currency in cash for travel purposes, but if you want to hold, send, receive and exchange funds in a multi-currency account you may need a different provider such as Wise or Revolut.

This guide walks through some Citibank multi-currency account alternatives like Wise and HSBC, as well as exploring the services available through Citi World Wallet.

Key points: Citibank foreign currency account

- Citibank does not have foreign currency accounts, but does offer travel money services for some eligible USD account holders

- Wise and Revolut are good alternatives if you want a multi-currency account where you can manage your money online

- HSBC in the US also has its Global Money account which is app-based and allows existing customers to hold and exchange some foreign currencies

- There are foreign and multi-currency account options available in the US, but some research is essential to find the right one for you

Does Citibank have a multi-currency account?

Citibank does not have a multi-currency account on offer for customers in the US.

As an alternative you may want to look at specialist services like Wise and Revolut for flexible and low cost cross currency transfers and transactions. This guide covers the information you might need.

Alternatives to Citibank foreign currency account in the US

Citibank can’t help if you want a foreign currency account – but there are non-bank specialist alternatives like Wise or Revolut which can help. You may also want to look at multi-currency options from global banks like HSBC. Here’s an overview of the Citibank foreign currency account alternatives we’ve picked out to showcase – there’s more detail coming up right after.

| Wise | Revolut | HSBC | |

|---|---|---|---|

| Supported currencies | 40+ | 25+ | 6 |

| Maintenance fees | None | 0 USD – 16.99 USD/month | None |

| Minimum balance | None | None | None |

| International transfer fees | From 0.33% | Variable fees, up to 5% of transfer amount | Variable fees, no cost for some transfers |

| Receive payments | With local account details in select currencies | With SWIFT details in select currencies | From your HSBC account only |

| Debit card | Available | Available | Not available |

As you can see, the options available from different providers are quite varied. Wise and Revolut are not banks but offer the largest currency selection and both have debit cards, making them a solid choice for day to day spending. HSBC customers might choose the Global Money account, which lets you hold a balance in foreign currencies, but you’ll need an existing HSBC USD account to benefit.

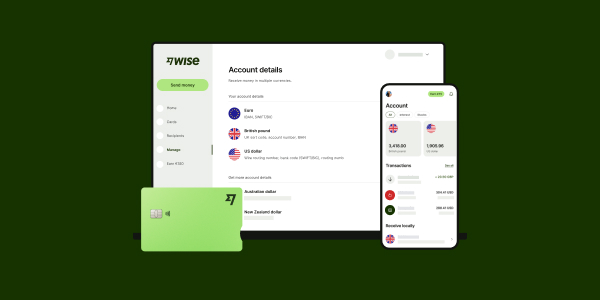

Wise multi currency account

You can open the Wise account as a personal or business customer in the US, to hold and exchange 40+ currencies, and receive payments in select currencies with local account details. You’ll also be able to get a linked debit card for spending and cash withdrawals, making this a good choice for travelers and anyone looking to send and receive payments in foreign currencies. Currency exchange uses the mid-market rate and low fees from 0.33%.

Best features:

- Mid-market exchange rates

- Great selection of supported currencies

- Ways to receive, send and spend currencies conveniently

Supported currencies: 40+

Local account details: Available in select currencies

Exchange rates: Mid-market exchange rate

Account fees: No fee to open or maintain, currency exchange from 0.33%

Learn more: Wise multi currency account review

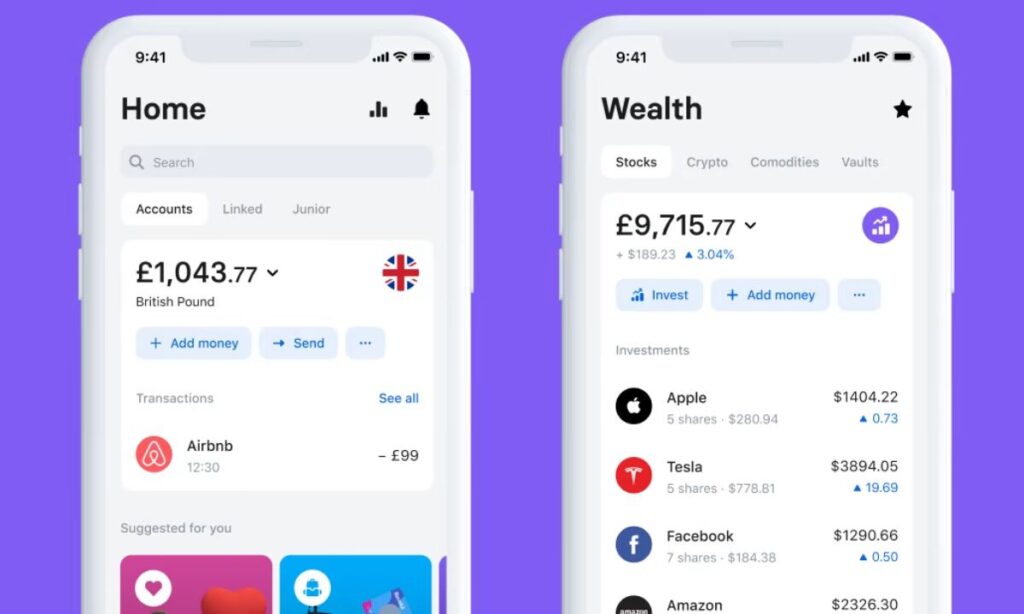

Revolut multi currency account

Revolut serves US business and personal customers, with a selection of accounts which can include some with no ongoing fees. All accounts offer some no fee weekday currency exchange which uses the Revolut exchange rate, before fair usage fees apply. Different account tiers have their own features – accounts with monthly charges may get discounts on services like international transfers, and also perks like lounge access and travel extras.

Best features:

- Choose from several different account types

- All accounts have some no fee features and services

- 25+ currencies supported for holding and exchange

Supported currencies: 25+

Local account details: Not specified – you can get SWIFT details for select currencies

Exchange rates: Revolut rate on weekday conversion to plan limit, 0.5% fair usage fees, 1% out of hours fees

Account fees: 0 USD to 16.99 USD monthly fees, other transaction fees apply including international payments fees of up to 5%

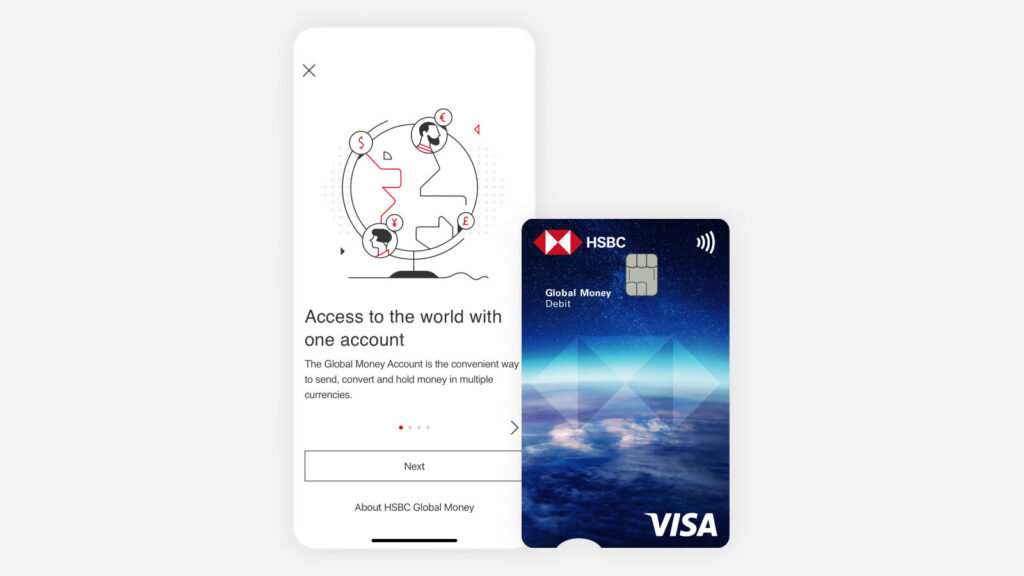

HSBC Global Money account

If you already have a USD account with HSBC you can also add in the app-based Global Money account. This account is primarily meant for people who want to transfer in and out from HSBC accounts, and can support 6 currencies. You can add money from a linked HSBC account to convert with the HSBC exchange rate – which can be handy for making overseas payments to other HSBC accounts, or if you know you’ll need foreign currency in future for an upcoming bill for example.

Best features:

- Service from a global bank with a full suite of other international products

- Accounts support 6 currencies

- Fully in app management tools

Supported currencies: 6

Local account details: Not specified – transfer in from your linked HSBC account

Exchange rates: HSBC rates which may include a markup

Account fees: No additional maintenance fees for this account, but you may pay monthly fees on your HSBC USD account – transfer charges might apply

What is Citibank World Wallet account?

Citibank doesn’t have a multi-currency account but you can use your checking or saving account to get foreign currency in cash if you’re planning a trip overseas by using the Citibank World Wallet service.

This option is for existing Citibank customers who can call a toll free number to order foreign currency in cash for home or office delivery or collection in a Citibank branch.

50+ currencies are available, and the USD value of the funds are deducted from your eligible Citibank account in order to pay for your travel money. Standard account holders will pay a fee for conversion, waived for higher value transactions – while Citigold or Citi Priority Account holders have fees waived. Delivery incurs an additional charge.

What is the eligibility for a Citibank World Wallet account?

To use the Citibank World Wallet service you must be an existing Citibank customer with an eligible checking or saving account. Citigold or Citi Priority Account holders may be able to access services for free.

| Opening a foreign currency account in the USA |

|---|

| If you’re interested in opening a foreign currency account in the US, these guides might help: |

Citibank World Wallet account fees

Fees for this service depend on the exact transaction you need, and your Citi account type.

| Citibank World Wallet fee | |

|---|---|

| Service fee | 5 USD for transactions under 1,000 USD Waived for higher value transactions Waived for Citigold or Citi Priority Account holders |

| Delivery fee | No fee for delivery to a branch For home delivery: Standard overnight – 10 USD Priority overnight – 15 USD Saturday overnight – 20 USD Waived for Citigold or Citi Priority Account holders |

| Currency conversion | Currency conversion may include a markup – a fee |

Citibank exchange rate

Citibank currency conversions are done at competitive currency exchange rates, but these rates may still include a markup. This is a fee added to the rate which can be tricky to spot.

Compare the Citi rate against the mid-market exchange rate you can get from Google to see the fees that have been added.

How to use Citibank World Wallet

The Citibank World Wallet lets you get foreign currency in cash conveniently.

You can call 1-800-756-7050 for service – book your travel money by 3 p.m. CST and you’ll get next business day delivery to your home, office or preferred branch location.

How to use Citibank World Wallet account abroad

You’ll need to get your travel money before you leave home, as delivery is only to your registered home or office address, or to a Citibank branch in the US. Once you have your cash you can spend it freely in your destination.

Can I access my Citibank account overseas?

You can’t use the Citibank World Wallet overseas, but you will still be able to access your normal Citi checking or saving account including making ATM withdrawals and card payments. Your online and mobile banking should work as normal – but it is worth letting Citi know you plan to travel so that your card services are not interrupted.

Conclusion: Citibank multi currency account in the US

Citibank does not have a multi-currency account in the US, but it does offer customers with checking or savings accounts easy ways to get foreign currency in cash. This can be handy when you travel, although service and delivery fees may apply.

If you’d rather have a digital account you can use to hold and exchange foreign currencies, to send and receive payments and pay with your global debit card, check out non-bank alternatives like Wise and Revolut. Wise supports 40+ currencies with no ongoing fees and low cost currency conversion with the mid-market rate. Revolut has different account plans, which all offer some no fee transactions monthly, and come with linked payment and ATM cards.

FAQs

Does Citibank offer foreign currency accounts?

Citibank does not have a multi-currency account on offer for customers in the US. Instead you may want to look at non-bank alternatives like Wise and Revolut for flexible and low cost cross currency transfers and transactions.

If you’re interested in a foreign currency account for a specific currency, these guides might help:

- Best Euro accounts

- Best Canadian dollar accounts

- Best Australian Dollar accounts

- Best British pounds accounts

Can I deposit foreign currency into my Citibank account?

No. You can not deposit foreign currency into a USD Citibank account. If you use the Citibank World Wallet service to get foreign currency for your travels, and come home with left over foreign cash, you may be able to sell it back to the bank and receive USD in return.

Does Citibank have foreign transaction fees?

Citibank may have foreign transaction fees – this will depend on your account and card type. There are some credit cards which have no foreign transaction fees, but this isn’t always the case. Check your card’s terms and conditions to see if there’s a fee for spending in foreign currencies.