How to receive an international wire transfer with Bank of America [2025]

If you’re a Bank of America customer and need to receive money from someone overseas, you’ll have to take a few steps to make sure your payment can be safely and efficiently delivered to your bank account.

This guide covers how to receive an international transfer with Bank of America, and also touches on a couple of alternatives – Wise, Revolut and OFX, which may suit you for business or personal usage.

Read our full guide to receiving incoming international wire transfers with Bank of America, to learn all there is to know.

Key points: Bank of America receive international wire transfer

- You can receive payments to your Bank of America account in the currency of the account only – if you’re sent a foreign currency it’ll be converted to USD for deposit

- Fees may vary, but as an example, with the Bank of America Advantage accounts there’s a 15 USD fee for incoming international wire payments

- Intermediaries known as correspondent banks may deduct fees while your payment is being processed

- International payments arranged by banks can take a couple of working days to arrive, or longer in some cases

- Alternative providers like Wise or OFX offer local account details in foreign currencies which let you receive payments with being forced to convert back to USD every time

| FAQs | Answers |

|---|---|

| Does Bank of America charge a fee to receive an international wire transfer? | Bank of America may charge a variable incoming wire fee. As an example, with the Bank of America Advantage accounts there’s a 15 USD fee for incoming international wire payments |

| How long does it take to receive an international wire to Bank of America? | International wire delivery times vary a lot, from 2 business days, to about 5 business days depending on the specific payment. |

| Are there better alternatives to Bank of America for receiving international wire transfers? | With alternative providers like Wise or OFX you can get local account details to receive foreign currencies without needing to convert back to USD. More on that later. |

How to receive an international wire transfer to Bank of America: Step-by-step instructions

Receiving a payment from overseas with Bank of America is pretty straightforward. The person sending the payment will need your personal and account information to give to their own bank.

The sender’s bank can then arrange the transfer which will be converted to USD – either by the sender’s bank or by Bank of America – and deposited to your Bank of America account. Here’s an overview:

Step 1: Give the sender your Bank of America account information

The basic information needed by the person sending you a payment includes your name and address, your account and routing number, and the Bank of America SWIFT/BIC code.

You can find your account and routing number easily by logging into the Bank of America online banking or mobile app. Bear in mind that some of the information needed may vary depending on whether the sender will have the payment converted to USD by their own bank, or will send in foreign currency for Bank of America to convert before depositing.

Step 2: Agree who will pay the transfer costs

If you’re expecting to receive a fixed amount in the payment, you may want to ask the sender to cover the transfer costs including intermediary fees and the Bank of America fees for receiving your payment. Otherwise, fees could be deducted as the transfer is processed, which may mean you get less than you expected in the end.

Step 3: Wait for the money to be deposited into your Bank of America account

The sender can then arrange the payment, and once it has been processed it will be deposited into your Bank of America account. The transfer time can vary a lot depending on the originating bank and country. Some payments can settle within a business day or two, others may take up to 5 business days to arrive.

Bank of America fees to receive international wire transfer

There’s a charge to receive your Bank of America payment in some cases. Here’s an overview

| Bank of America incoming international wire transfer fee | |

|---|---|

| Incoming international wire fee | 15 USD* |

| Currency exchange fee | A fee – known as a markup – may be included in the exchange rate used to convert your payment to USD for deposit |

*Fee information is for Bank of America Advantage account products – other accounts may have their own fees**Information correct at the time of writing on 17th October, 2024.

Alternatives to Bank of America to receive international wire transfer

If someone is sending you money, you don’t necessarily need to receive it to your Bank of America account. Using a multi-currency account to receive payments in foreign currencies can be flexible and cheap, and allow you to hold or exchange the payment as you wish. Alternative providers like Wise, Revolut and OFX support multiple currencies and can be selected for business or personal use, depending on the provider you decide to go with.

Here’s an overview of these providers based on some key features. There’s more coming up about each in just a moment.

| Wise | Revolut | OFX | |

|---|---|---|---|

| Eligibility | Personal and business customers | Personal and business customers | Business customers |

| Supported currencies for holding | 40+ including GBP, EUR and USD | 25+ including GBP, EUR and USD | 7 including GBP, EUR and USD |

| Local and SWIFT account details | Local account details in 8+ currencies, and SWIFT details available in 20+ currencies | USD and GBP local account details provided SWIFT account details available in select currencies | Local account details for 7 currencies |

| Fee to receive money | Free with most local account details 6.11 USD for USD wires 10 CAD for CAD SWIFT payments | No fee | No fee |

| Exchange rate | Mid-market rate | Revolut rate with no additional fee, to plan limit – fair usage and out of hours fees may apply | Exchange rates include a markup |

*Information correct at the time of writing on 17th October, 2024.

Wise

The Wise Account is available for personal or business customers, and can be used to receive, hold, send, spend and exchange a broad selection of currencies.

Your account offers ways to get paid in select currencies with local and SWIFT account details, often with no incoming payment fee.

You can then use your linked debit card to spend online and in person, with currency exchange which uses the mid-market exchange rate with low conversion fees from 0.33%.

You can also send payments to others from your Wise balance, or withdraw your money back to your USD bank account if you want to.

Business customers get similar perks to personal customers, plus some extras like batch payment solutions and cloud accounting integrations.

Learn more from this guide: How to receive money internationally with Wise

| Related: Wise Account Review |

Revolut

Revolut offers digital accounts which support 25+ currencies, and which come with USD and GBP account details to receive payments from abroad via local transfer.

You can also get SWIFT details to be paid to your account in a broader selection of currencies, although Revolut does warn that with these details some intermediary fees (which are not paid to Revolut, but correspondent banks involved in processing the payment) may apply.

Revolut personal customers in the US can choose from 3 different account tiers depending on needs, all of which come with a linked debit card and some no fee currency conversion every month.

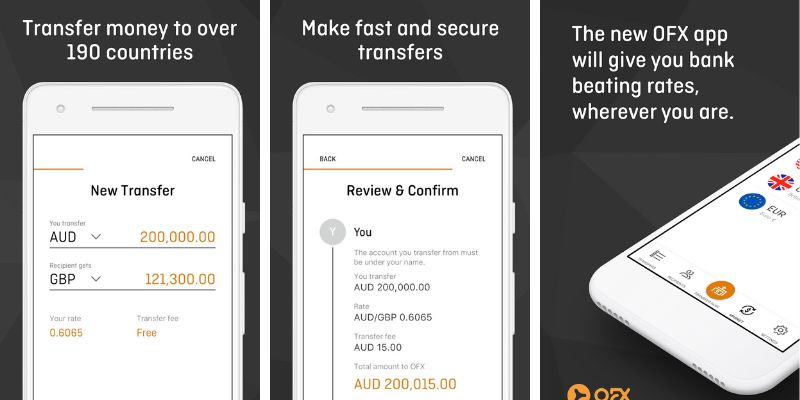

OFX

If you need an account for your business, the OFX Global Currency Account is a popular option, with 7 currencies supported for receiving, holding and exchange.

Your account comes with local account details to receive payments from customers or to get paid through PSPs and marketplace sites in major foreign currencies. This makes it a good choice for online sellers working with international customers.

There’s no linked debit card with this account, but you can send or withdraw your funds whenever you want to – with no fee for outgoing transfers when you send money from your account.

Exchange rates might include a small markup.

What information is needed to receive a wire transfer Bank of America

To receive an international wire transfer to your Bank of America account you must give the sender some important information.

Having incorrect or incomplete information may mean the payment is delayed, rejected or deposited into the wrong account.

Here’s what you need:

| Information needed to receive an international wire transfer to your Bank of America account |

|---|

|

Bank of America SWIFT code for international transfers

The Bank of America SWIFT code is needed to make sure your money is deposited into the right account. It’s a unique identifier which guides the payment from the sender’s bank overseas to your Bank of America account in the US.

| Bank of America SWIFT code |

|---|

| Wires sent in US dollars or unknown currency: Bank of America SWIFT code: BOFAUS3N Wires sent in foreign currency: Bank of America SWIFT code: BOFAUS6S |

How to find Bank of America SWIFT code

Find the Bank of America SWIFT code on the Bank of America website, by calling the bank, or by visiting a local branch.

Bear in mind there are different codes for USD and foreign currency payments.

Bank of America routing number to receive international wire

Get your routing number by logging into your online or mobile banking system. In the mobile banking app:

- Log in to Bank of America’s app

- Navigate to Accounts and select the account you wish to receive the funds into

- Select Account & Routing # to display account details

Or in online Banking:

- Log in and navigate to the Accounts page

- Select the account you wish to receive the funds into

- Navigate to the Information & Services tab

- Click Show full account number in the Account Information section

Bank of America address for incoming international wires

The person sending you money is likely to ask for the full Bank of America address to securely process your payment. This may vary depending on the currency you’re receiving:

| Bank of America address |

|---|

| Wires sent in US dollars or unknown currency: Bank of America address: Bank of America, N.A. 222 Broadway, New York, NY 10038 Wires sent in foreign currency: Bank of America address: Bank of America, N.A. 555 California St. San Francisco, CA 94104 |

Bank of America receive limits for incoming international wires

There’s not usually a limit on the amount of money you can receive as an incoming payment to Bank of America. However, the exact limits can vary depending on the specific account you have, so if you have a large payment on the way it may be worth checking with the bank directly to ensure there are no issues with receiving your money.

How long does it take for Bank of America to receive an international wire transfer?

The length of time it takes to receive a payment to Bank of America will depend a lot on the bank which is sending the payment in the first place.

Generally banks use the SWIFT network to process international payments, which can take up to 5 days to process a transfer.

SWIFT payments usually go through one or more intermediary banks before they arrive in the destination account – this can take some time, and may also mean that additional fees are deducted from the transfer as it passes through the system.

If you’re looking for a quicker transfer you might want to ask the sender to use a specialist service like Wise.

Transfers sent with Wise often arrive instantly, and 90% are in the recipient’s account in 24 hours. This is because Wise uses its own payment network to process payments without SWIFT, cutting out cost and making the process more streamlined.

How to track an incoming international wire transfer with Bank of America

If you want to check on the progress of the money that’s winging its way to you, you’ll need to ask the sender to log into their bank account and track the payment on your behalf.

What can you do if your transfer is not delivered yet

In the first instance it is worth asking the sender to have their bank track the payment to see what has happened to it.

You can also ask Bank of America if they have any information on the transfer.

Ultimately, the sender’s bank can put a trace on the wire transfer if it has been misdirected, but there is likely to be a fee to pay for this service.

Talk to your local Bank of America branch for advice if you’re not sure what to do about a missing payment.

If you’re a BofA customer, our other guides might be helpful:

- Bank of America international transaction fees

- How to open a Bank of America account as a non resident

- How to wire money internationally with Bank of America

- Bank of America currency exchange

- Bank of America business accounts

Conclusion: Bank of America incoming international wire transfer

You can receive incoming international transfers to Bank of America, but you might find there’s a fee of 15 USD to pay. Plus, because the payment is converted back to USD before being deposited there may also be charges added into the exchange rate used for conversion.

As an alternative, you might want to look at accounts which offer local account details, such as the Wise account or the OFX Global Currency Account. These options let you pass the sender local account details in their home currency, so they can send a local payment which is received to your account in the foreign currency.

So – your friend in the UK can send you a payment in GBP easily, and using a local transfer method, which is usually free or cheap for them, too. You can then hold your balance in the foreign currency, convert and withdraw the money, send it to others, or spend it. This gives flexibility and often means lower costs in the end.