International Business Money Transfers Guide: Fees, How-to & Limits [2025]

If you need to pay suppliers, contractors or staff overseas, you will want to find the best available international business money transfer for your specific needs. You’ll be able to pick between making overseas business payments with your bank, or with a specialist provider like Wise, Revolut or OFX. Specialist services have often optimized the international business payment process, to keep costs low and achieve super fast delivery times. Let’s explore.

Key points: Business to business international money transfer

| International business money transfers | |

|---|---|

| Fees | Fees can include a transfer fee paid to the provider, third party fees paid to intermediaries, and fees levied by the recipient’s own bank |

| Exchange rates | It’s common to find an exchange rate markup is added to the mid-market rate when calculating the costs of your payment – look for a provider like Wise which uses the mid-market rate. |

| Transfer limits | Business transfers usually have high limits, or may have no upper limit at all, to allow you to transact freely – documents may be required to support very high value transfers |

| Safety | Pick a licensed and regulated bank or provider – all of the services we review on Exiap are safe to use |

| Speed | SWIFT transfers can take 3 – 5 days to arrive in some cases, providers like Wise and OFX may offer faster delivery times using their own payment networks |

Best ways to send money internationally for business

If you need to send a money transfer for business you’ll want to shop around, looking at different services to get the best balance of costs and convenience based on the destination country and value of transfer.

While you can make an international business payment with your bank, you may also want to consider using a specialist provider for overseas payments – or even opening a multi currency account for business. This can be cost-effective, especially if you need to make international business payments regularly, or if you’re also looking for ways to receive and exchange currencies.

Different providers offer different business features, allowing you to compare options, and decide on the best provider for your specific needs. Here is a summary of providers we’ll cover in this guide:

| Provider | 💡 Great for |

|---|---|

| Wise Business | Low cost international transfers to 160+ countries, with Wise Business accounts which offer 40+ supported currencies, mid-market exchange rates and perks like batch payment solutions |

| Revolut Business | Choice of 4 different international business account tiers which all support 25+ currencies, and offer low or no fee international payments. Choose the Basic plan with no ongoing fees or upgrade to an account with monthly charges for more features |

| OFX | Send business payments globally with no transfer fee and the great OFX exchange rate – you can also open a Global Currency Account to hold and exchange 7 major currencies |

| Bank of America | Various different USD business accounts, which have ways to waive monthly fees by maintaining a minimum balance. No outgoing wire fee when sending online in a foreign currency – exchange rate markups apply |

| Wells Fargo | Choose from various account types for business, with options to send money online and in person easily. Flat fees apply for outgoing international payments – 25 USD when set up digitally |

*Information correct at time of research – 17th December 2024

Business to business international money transfer fees

When you’re making a business account money transfer there are a few fees to think about.

Firstly there are any costs involved in maintaining the underlying business account. These may be monthly fees or there may be a one time account opening fee. In some cases there are ways to waive ongoing fees by transacting regularly or holding a high enough balance. Providers like Wise, Revolut and OFX all offer accounts with no monthly fee to pay, making this a simple and flexible option.

Then, of course, there are any costs involved in the payment itself. International business money transfer fees do vary a lot, and can be either a percentage fee or a flat charge. Here’s a quick summary of some of the most important fees involved in sending a business payment abroad, with the providers and banks we’ve picked out in this guide.

| Provider | Account opening fee | Ongoing account fees | International transfer fee | Incoming transfer fee |

|---|---|---|---|---|

| Wise Business | 31 USD fee for full feature access | None | From 0.29% | Free to receive payments in select currencies 6.11 USD to receive USD SWIFT or wire 10 CAD to receive CAD SWIFT |

| Revolut Business | None | 0 USD – 119 USD/month | 5 USD – some account plans waive this fee on some transfers | Not specified |

| OFX | None | None | None – exchange rate markups apply | None |

| Bank of America | None | Various options including Fundamentals account – 16 USD/month | No fee to send in foreign currency 45 USD to send in USD | 15 USD |

| Wells Fargo | None | Various options including Navigate account – 25 USD/month | 20 USD online, 45 USD in branch

| 15 USD |

*Information correct at time of research – 17th December 2024

Cheapest ways to make international business payments

The cheapest way to send an international business payment might depend on the destination, value of your payment and how quickly you need the money to arrive. Sending money overseas can mean you pay one or more fees, which can include:

- Transfer fee payable to the provider

- Exchange rate markup – a percentage fee added to the rate used for conversion

- Third party fees to intermediary banks and the recipient’s bank

The total cost of your transfer can only be calculated by looking at all 3 of these potential fees.

It’s worth knowing that the exchange rate markup can often end up being the highest single charge you pay – particularly on higher value payments. As it’s a percentage, the absolute cost here can rise very quickly when you send a large amount.

If you’re sending a high value payment you may want to take a look at a provider like Wise which offers discounts on fees for higher value payments. Here are some of the important transfer costs to consider when sending a payment abroad with our selected banks and non-bank alternative providers.

| Provider | International transfer fee | Exchange rate |

|---|---|---|

| Wise Business | From 0.29% Discounts on higher value payments | Mid-market exchange rate |

| Revolut Business | 5 USD – some account plans waive this fee on some transfers | Weekday conversion uses the Revolut rate with no extra fee to plan limit 0.6% fee for additional conversion beyond plan limit 1% out of hours fee |

| OFX | None – exchange rate markups apply | Exchange rate includes a markup |

| Bank of America | No fee to send in foreign currency 45 USD to send in USD | Exchange rate includes a markup |

| Wells Fargo | 20 USD online, 45 USD in branch | Exchange rate includes a markup |

*Information correct at time of research – 17th December 2024

Business to business international money transfer exchange rates

As we’ve seen, the exchange rate you’re offered to send a payment overseas is extremely important in deciding your overall costs. Different services set their own rates, which can make this a bit tricky to navigate. Where a provider uses an exchange rate markup this is usually variable and can depend on the currency in question. To spot the markup you’ll need to get a quote from the provider and then compare the rate you’re offered against the mid-market exchange rate for your currency pair, which you can get from Google.

Here’s a reminder of how the providers we’ve looked at in this guide treat exchange rates:

| Provider | Exchange rate |

|---|---|

| Wise Business | Mid-market exchange rate |

| Revolut Business | Weekday conversion uses the Revolut rate with no extra fee to plan limit 0.6% fee for additional conversion beyond plan limit 1% out of hours fee |

| OFX | Exchange rate includes a markup |

| Bank of America | Exchange rate includes a markup |

| Wells Fargo | Exchange rate includes a markup |

*Information correct at time of research – 17th December 2024

Bank exchange rate markups may be in the region of 3%. While that doesn’t sound like a huge amount, it adds up very quickly on high value payments. If you’re sending 10,000 USD to a supplier for example, a 3% markup means a fee of 300 USD in the exchange rate alone.

Business international money transfer limits

Different banks and providers can have extremely varied limits when it comes to international business payments. In some cases there’s a per transaction limit, or you might find a limit is applied per day for example.

Generally providers set the limits on business accounts pretty high to allow businesses to transact freely. If you run into a limit on a payment you’ll be notified in the provider or bank’s app and you can either restructure your transfer or look for an alternative way to get your money moving.

Here are the basic payment limits on the providers we’ve featured in this guide:

| Provider | International transfer limit |

|---|---|

| Wise Business | Limits vary by currency and payment method, usually set at around 1 million GBP or the equivalent |

| Revolut Business | Limits vary by currency – you can make multiple payments if you hit a limit for a specific transfer |

| OFX | No limits |

| Bank of America | International wires are limited at 5,000 USD |

| Wells Fargo | Not specified – contact the bank to ask about your specific account terms |

*Information correct at time of research – 17th December 2024

How to send money to a business account internationally

If you need to transfer money to a business account overseas you’ll normally be able to do so most conveniently using your bank or account provider’s digital payment services. In some cases, banks may ask you to call them or to visit a branch to process a high value payment.

You’ll need to contact your own bank or provider to check their processes for sending business payments. Digital first providers like Wise and Revolut will offer fully in-app or online payment processing while OFX has a 24/7 phone service as well. We’ll look at how to send a business transfer online in just a moment,

Requirements for business to business international money transfer

You will always need some basic personal and banking information for your recipient in order to safely process an international business transfer. In some cases you might also be asked to provide some extra paperwork too.

Generally you need the following information:

- The recipient business name, as shown on their account

- The recipient’s bank account number

- The recipient’s bank name and address

- The recipient’s bank SWIFT/BIC code

You may also be asked for some documents to show the source of funds, which are used to prevent illegal account use and money laundering. The paperwork you need will depend on where the money came from in the first place. For example:

| Reason for payment | Examples of documents needed |

|---|---|

| Sending money from business income | Last 3 months of bank statements Audited financial statements Other proof of funds based on your business type |

| Sending money from investments | Investment certificates, contract notes, or statements Confirmation from your investment company, bank, or dividend payer Bank statements showing you received the money |

| Sending money from a loan | Your loan agreement 3 months of loan statements Bank statements showing you received the money |

How to make a large business payment online internationally

If you’re able to send money online or in your account’s app, the basic steps you’ll need to take include:

- Log into your provider’s account, and navigate the the send money section

- Enter how much you want to transfer, or how much you need the recipient to get

- Confirm the account you want to pay from, and review the fees and exchange rates offered

- Enter the recipient’s personal and banking details – check them carefully

- Upload the required documents following on screen prompts

- Confirm and your payment will get started

Best business accounts for international payments

If you’re looking for a business account for international payments you might want to stick with your bank, or you could decide to go to a non-bank specialist service like Wise Business or Revolut Business instead.

Generally most US bank business accounts are designed to operate in USD only. While you can send payments overseas easily, you can’t hold or receive foreign currencies in your account. Providers like Wise and Revolut have stepped in to offer multi-currency accounts with international features and low fees. These can be a handy solution if you’re looking to cut the costs of transacting internationally.

Here’s a quick roundup of the best international business accounts for international payments we’ve covered in this guide:

| Provider | Supported currencies | Account fees | International transfer fee | Exchange rate |

|---|---|---|---|---|

| Wise Business | Holding and exchange: 40+ currencies including USD Transfer to 160+ countries | 31 USD fee for full feature access No ongoing fees | From 0.29% | Mid-market exchange rate |

| Revolut Business | Holding and exchange: 25+ currencies including USD Transfer to 150+ countries | 0 USD – 119 USD/month | 5 USD – some account plans waive this fee on some transfers | Weekday conversion uses the Revolut rate with no extra fee to plan limit 0.6% fee for additional conversion beyond plan limit 1% out of hours fee |

| OFX | Holding and exchange: 7 major currencies including USD Transfer to 150+ countries | None | None – exchange rate markups apply | Exchange rate includes a markup |

| Bank of America | USD for holding Transfer to more or less anywhere | Various options including Fundamentals account – 16 USD/month | No fee to send in foreign currency 45 USD to send in USD | Exchange rate includes a markup |

| Wells Fargo | USD for holding Transfer to more or less anywhere | Various options including Navigate account – 25 USD/month | 20 USD online, 45 USD in branch | Exchange rate includes a markup |

*Information correct at time of research – 17th December 2024

Wise Business Account

Hold and exchange 40+ currencies in the Wise Business account which has no ongoing fees and no minimum balance.

You can send business payments to 160+ countries with fees from 0.29% and the mid-market exchange rate.

Accounts also come with local and SWIFT details to be paid in foreign currencies conveniently, and you can order debit and expense cards for spending and withdrawals.

Best features:

- Broad range of 40+ currencies supported, with payments to 160+ countries

- Mid-market exchange rates

- Fast delivery times and low, transparent fees

Learn more on Wise Business Account requirements

Revolut Business Account

Revolut in the US has several different account tiers for business customers, including the Basic plan which has no ongoing fees, and other options which come with monthly charges and extra features and no-fee transaction allowances.

All accounts support 25+ currencies for holding and exchange, with ways to send payments to 150+ countries. You may find you get some no fee international transfers as part of your monthly account fee – and Revolut business payments then cost 5 USD after this allowance is exhausted.

Best features:

- Several different account tiers to allow you to pick thee one which matches your business needs

- 25+ currencies supported, transfer to 150+ destinations in the app

- Some accounts offer no-fee international transfers as part of the package

Related article: Wise Business vs Revolut Business

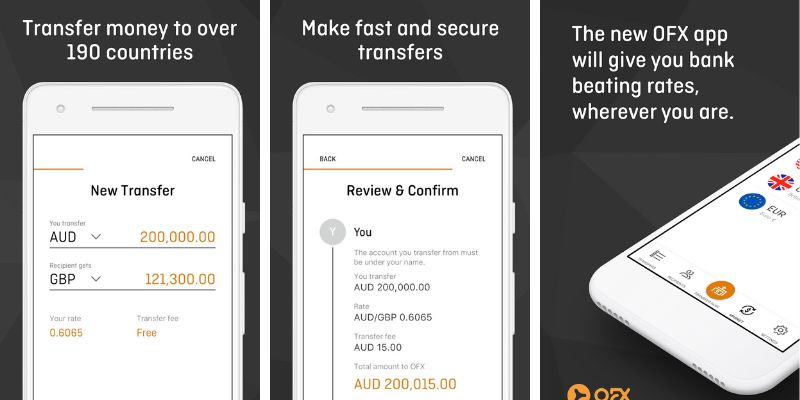

OFX Business Account

OFX is a specialist in currency conversion and payments, and offers the Global Currency Account which is aimed at ecommerce businesses and online sellers.

You can hold and receive 7 major currencies, with no OFX fee for sending international business payments online, in app or by phone. Instead a small exchange rate markup applies.

Best features:

- Receive and hold 7 currencies, send in 50+ currencies

- No transfer fee – just a small exchange rate markup

- Well known for offering excellent service including 24/7 phone coverage

Bank of America Business Account

Bank of America offers services for business of all sizes, including the popular Fundamentals account and the Business Advantage Relationship Banking service. Both have ongoing fees, but you can have the monthly charges waived if you transact regularly or hold a high enough balance.

Bank of America international transfers have no outgoing fee if you arrange them in a foreign currency, although an exchange rate markup will apply.

Best features:

- Full range of business banking services including branch service if you need it

- No transfer fee for outgoing payments – exchange fees apply

- Several different account options including ways to have the monthly fees waived if you need them

Learn more on Bank of America Business Account.

Wells Fargo Business Account

Another popular option for bank business account services, Wells Fargo offers a broad range of business accounts with easy ways to send money abroad. You’ll pay a fee for sending Wells Fargo international payments, with fixed charges of 25 USD for digital transfers and 40 USD when sending in a branch. Wells Fargo can also offer other business banking tools like credit and loans so you can get all the financial services you need from one place if you choose to.

Best features:

- Flat fee for business transfers

- Send more or less anywhere in the world

- Branch and phone services available if you need them

If you are interested in opening a multi currency business account, these guides might help:

- Best Euro business accounts

- Best Canadian dollar business accounts

- Best British pounds business accounts

Conclusion: Best ways to make an international business payment

You can send an international business payment using a bank or a specialist non-bank alternative provider. Banks like Wells Fargo and Bank of America allow you to send money globally but may charge various fees, including an exchange rate markup. As an alternative you may want to look at non-bank providers like Wise, Revolut and OFX, which have built their own payment networks to process fast, low cost international transfers to 150+ countries.

- International business transfer fees can vary and may include a fixed fee or a percentage charge

- Exchange rates may include a markup – using a provider like Wise which offers the mid-market rate with separate fees can help keep down the costs

- Making a higher value international business transfer may mean providing extra documents or visiting a bank branch

- Transfer limits can vary a lot – some accounts have fairly low limits which others like Wise and OFX are optimized for high value business payments