International Wire Transfer Regulations Guide: Taxes, Limits & Requirements [2025]

Sending money overseas can be daunting – particularly if you’re sending a high value payment. You’ll need to make sure you pick a reputable provider and have all the information and documents needed to process the transfer securely, and you’ll also have to make sure you’re complying with any relevant legislation.

This guide walks through the basics of tax, limits and overseas payment rules for the US. Plus we’ll introduce some good ways to send your payment overseas safely, such as Wise and OFX.

Key points: International wire transfer regulations

- If you send payments valued at 10,000 USD or more, your bank or transfer provider will need to report these transfers to the Financial Crimes Enforcement Network (FinCEN)

- Taxes may apply when you send payments overseas – this depends on the value of the transfer, the source of the funds, and who you’re sending it to

- Consumer protection bodies like the CFPB support customers who have a complaint about an international transfer service

- If you have overseas assets, you’ll need to make sure you understand the FATCA and FBAR rules which may mean you need to report assets to the IRS or FinCEN

- Providers like Wise and OFX offer secure, simple ways to send payments abroad, with low fees and good exchange rates

| FAQs | Answer |

|---|---|

| How much money can you legally wire transfer internationally? | There’s not a legal limit on the amount of money you can wire abroad, but payments of over 10,000 USD are reported to FinCEN. Providers also have their own limits which can vary widely. |

| What is the maximum amount of money you can transfer internationally without taxes? | Whether or not you need to pay tax on an international transfer will depend on the source of the funds as well as the value and the person the payment is sent to. Get professional advice if you’re unsure. |

| Do banks have to report international wire transfers? | Banks must report wire transfers of over 10,000 USD, or daily transfers aggregating over 10,000 USD, to FinCEN, to prevent financial crime. |

What is the maximum amount of international wire transfer without taxes?

Whether or not you need to pay tax on an international transfer will depend on the source of the funds as well as the value and the person the payment is sent to. If a payment is salary, for example, it would be subject to income tax, while money sent to someone as a gift may be subject to Gift Tax.

If you’re a US citizen living abroad and earning money overseas, you’ll need to check the guidelines from the IRS regarding overseas income. Because worldwide income is considered taxable in the US, you may need to report, pay taxes, or claim an exception for payments received from abroad.

If the payment is a gift you’ll need to understand the gift tax rules.

The Gift Tax allowance for 2025 is set at 19,000 USD per recipient, but there are strict definitions of what constitutes a gift in this sense. If you’re at all unsure about whether or not an international transfer requires you to pay taxes, you’ll need to seek professional advice.

Generally, as with all things related to tax, getting the help of an accountant or other professional is a smart move if you’re unsure of the rules when you’re sending or receiving money internationally. Penalties apply if you make a mistake, including financial and legal consequences.

What happens if you wire transfer more than $10,000?

If you send a payment of over 10,000 USD, your bank or the payment provider you use must report this to FinCEN. This rule also applies if you make several related transfers over the course of a day, which cumulatively value 10,000 USD or more.

You won’t normally need to take any action here – your bank will report the payments for you.

To send a large payment internationally you’ll need to gather some information and documents, which you’ll pass over to your bank or payment provider, to allow the transfer to be processed.

This includes information about the recipient, and where the money came from. Usually you’ll be asked for:

|

What is the best way to send large amounts of money overseas?

There’s no single best way to send a payment overseas. As long as you’re using a licensed and regulated provider, your transfer should be processed safely – so the best option will normally simply come down to personal preference, and the fees and rates offered by different providers.

It’s worth shopping around for different payment providers, considering the fees, exchange rates, transfer limits, delivery speeds and other factors. You’ll find a range of providers offering different features and benefits, so you’ll have to weigh up which is the best choice for your specific payment. Here are a few providers you may want to consider.

| Provider | Fees | Exchange rates | Limits | Speed | Safety |

|---|---|---|---|---|---|

| Wise | From 0.29% | Mid-market rate | Variable – usually around 1 million GBP | 45% of payments are instant, 90% arrive in 24 hours* | 2 factor authentication, in-app tracking |

| OFX | No transfer fee | Exchange rate includes a markup | No limits | 1 – 2 days | Secure app, 24/7 phone support |

| XE | Variable fees based on payment details | Exchange rate includes a markup | 535,000 USD | Variable delivery times based on payment details | Industry level security from a huge global provider |

| Remitly | Variable fees based on payment details | Exchange rate includes a markup | 25,000 USD (30,000 USD to India) | Variable delivery times based on payment details | Secure app, anti fraud tools |

| Currencyfair | 3 EUR or equivalent | Exchange rate includes a markup | Not specified | Variable delivery times based on payment details | AWS hosted, thorough verification processes |

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions. Details correct at time of research – 18th December 2024

Wise

Wise offers payments to 160+ countries, which you can arrange online and in the Wise app. Transfers are processed quickly and securely, and you’ll be able to track your payment by logging into the Wise app.

Currency exchange uses the mid-market exchange rate with no fee added, and a small, transparent transfer fee which starts from 0.29%.

Wise offers high value payments, and has discounts on fees when you send 20,000 GBP or the equivalent in a single payment, or as a cumulative amount over the course of a month.

| Wise international transfers: | |

|---|---|

| Transfer fees | From 0.29% |

| Exchange rates | Mid-market exchange rate |

| Wise transfer limits | From USD: In US licensed states, Guam and the Virgin Islands, send up to 1 million USD per transfer |

| Does Wise report to the IRS? | Yes, full compliance with all IRS reporting requirements |

| Is Wise regulated in the US? | Yes. Wise is licensed as a money transmitter in many states, and in other locations works with partner financial institution Community Federal Savings Bank, which is supervised by the Office of the Comptroller of Currency |

| Is Wise safe to send money? | Yes. Wise uses industry level security as standard, and offers live tracking of all payments in the app |

*Details correct at time of research – 18th December 2024

Learn more on Wise money transfer review.

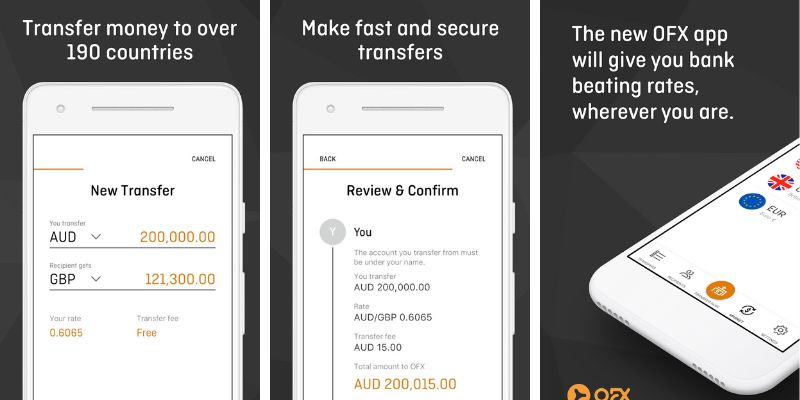

OFX

OFX is a specialist in international payments and currency conversion, which offers international transfers with no upfront transfer fee.

You can arrange your payment online or in the OFX app, but the service the brand is best known for is offered by OFX brokers, who you can talk to on the phone 24/7.

There’s also no limit to the amount you can send with OFX – if your bank has a limit you can send in partial payments to fund your transfer in stages. OFX exchange rates include a small fee.

| OFX international transfers: | |

|---|---|

| Transfer fees | No transfer fee from the US |

| Exchange rates | Exchange rate includes a markup |

| OFX transfer limits | No OFX limits apply |

| Does OFX report to the IRS? | Yes, full compliance with all IRS reporting requirements |

| Is OFX regulated in the US? | Yes. IFX is licensed as a money transmitter by every state regulatory agency that requires a license |

| Is OFX safe to send money? | Yes. OFX uses secure processes, and also has a 24/7 phone service if you need to track a payment |

*Details correct at time of research – 18th December 2024

Learn more on OFX Review.

XE

XE Money Transfer supports payments from the US to 130+ countries, with variable fees and exchange rates depending on where you’re sending to.

You can arrange your payments online or in the XE app, for deposit to bank accounts globally.

The XE transfer limit from the US is set at 535,000 USD, with different limits if you use the service from another country.

| XE international transfers: | |

|---|---|

| Transfer fees | Variable fees depending on payment details |

| Exchange rates | Exchange rate includes a markup |

| XE transfer limits | 535,000 USD |

| Does XE report to the IRS? | Yes, full compliance with all IRS reporting requirements |

| Is XE regulated in the US? | Yes. XE Money Transfer is licensed by the New York State Department of Financial Services, the Georgia Department of Banking and Finance, and the Massachusetts Division of Banks, and authorized to operate as a money transmitter in all United States’ jurisdictions where it conducts business |

| Is XE safe to send money? | Yes. XE is part of a huge organization which uses industry standard protocols to protect customer money, data and accounts. |

*Details correct at time of research – 18th December 2024

Learn more on Xe money transfer review.

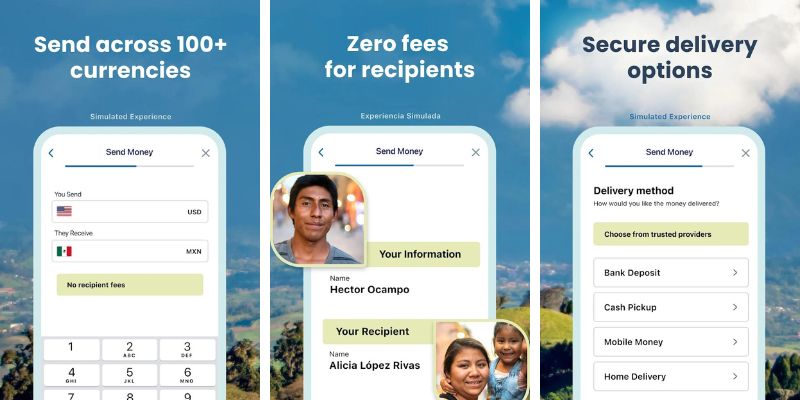

Remitly

Remitly offers international payments with a variety of payout methods, on popular remittance routes.

You can have money sent to a bank account, mobile wallet, or for cash pickup, depending on your recipient’s location.

Remitly has fairly low limits for payments from the US, to protect customers and ensure account security.

| Remitly international transfers: | |

|---|---|

| Transfer fees | Variable fees based on payment details |

| Exchange rates | Exchange rate includes a markup |

| Remitly transfer limits | 25,000 USD (30,000 USD to India) |

| Does Remitly report to the IRS? | Yes, full compliance with all IRS reporting requirements |

| Is Remitly regulated in the US? | Yes. Remitly is registered as a Money Services Business, licensed in several US states as a money transmitter, and authorized to transmit money in all U.S. states and Washington, D.C |

| Is Remitly safe to send money? | Yes. Remitly uses secure registration processes and has an extensive anti-fraud education centre |

*Details correct at time of research – 18th December 2024

Learn more on Remitly Review

Currencyfair

Currencyfair uses a flat rate for transfers, which is set at the equivalent of 3 euros.

There’s also a small fee added to the exchange rate used to convert your dollars to the currency needed for deposit.

You can create your payment online or in the Currencyfair app, to be securely deposited to your recipient’s bank account.

| Currencyfair international transfers: | |

|---|---|

| Transfer fees | 3 EUR or the currency equivalent |

| Exchange rates | Exchange rate includes a markup |

| Currencyfair transfer limits | Not specified |

| Does Currencyfair report to the IRS? | Yes, full compliance with all IRS reporting requirements |

| Is Currencyfair regulated in the US? | Currencyfair does not list any US body where it describes its regulators. However, it is regulated in other countries including the UK and Ireland. |

| Is Currencyfair safe to send money? | Yes. Currencyfair uses secure log in processes and verification, and is safe to use. |

*Details correct at time of research – 18th December 2024

Is there a limit on international wire transfers?

While there’s no legal limit on the amount you can send overseas, providers do usually impose their own limits to help keep accounts secure. In some cases you may be able to increase your basic limit if you provide additional documents to support the payment, and to show the source of the funds.

Different providers can have very different payment limits – here’s a summary of the services we’ve looked at in this guide:

| Providers | International wire transfer limits |

|---|---|

| Wise | Variable – usually around 1 million GBP (or equivalent) |

| OFX | No limits |

| XE | 535,000 USD |

| Remitly | 25,000 USD (30,000 USD to India) |

| Currencyfair | Not specified |

*Details correct at time of research – 18th December 2024

Do banks have to report international wire transfers?

Under the Bank Secrecy Act, US banks and financial institutions have to report wire transfers of 10,000 USD to FinCEN, the Financial Crimes Enforcement Network. This applies to any type of cash transfer, and is also required if the daily aggregate of payments by any individual exceeds 10,000 USD.

This reporting requirement is designed to prevent money laundering or other financial crimes such as tax evasion.

Do I need to notify my bank of a large wire transfer?

The most convenient way to send a large wire transfer is online or in your mobile banking service. However, if your transfer is over the bank’s specific electronic transfer limit for your account, you may need to visit a branch instead. This can cost more.

Bank’s don’t necessarily have a blanket limit on the amount you can send electronically – instead this may vary based on your account type. Chase and Wells Fargo both have variable limits you can see in your online banking service, for example. Bank of America has a 1,000 USD standard limit for consumer electronic wires. However, you’ll usually find you can have these limits increased if you arrange your payment in a branch.

If you don’t have the time to visit your bank’s branch to set up your payment, using a digital specialist provider with high transfer limits, like Wise or OFX might be more convenient. As digital first services, providers like these will allow you to submit any required paperwork electronically rather than needing you to go to an office in person.

How are international wire transfers regulated in the US?

There are several different official bodies which set and enforce rules related to wire transfers in the US. The CFPB oversees payments from a consumer protection standpoint, for example, while FinCEN takes action to detect and prevent financial crime, money laundering and other issues. There are various different pieces of legislation which cover different aspects of international wire transfers in the US – and other countries may also have laws of regulations which impact your payment.

Do you have to pay taxes on international wire transfers?

If you’re unsure about whether or not you need to report an international payment, or whether or not you need to pay tax on it, it’s important to take professional advice.

Different types of tax may apply, depending on the nature of the payment, where the funds originated and the value. For example, if you’re sending a payment to someone as a gift, you need to check on whether Gift Tax is required. In this case, the tax is usually paid by the person giving the gift. Special arrangements can be made if you’d prefer the recipient to pay this tax instead. There’s an annual exclusion for gift tax, which in 2025 allows you to give up to 19,000 USD to any single recipient. This tax is reviewed annually, and applies to the cumulative value of gifts given to any one individual.

If you’re receiving a gift of money from a foreign person, you may need to report this to the IRS depending on the value of the gift. Usually you need to report payments if related amounts aggregate to 100,000 USD over the course of a tax year. You won’t necessarily have to pay tax on amounts paid from overseas – this depends on the reason for the payment – but penalties do apply if you fail to correctly report such payments to the IRS.

Aside from Federal taxes and reporting rules, bear in mind that additional requirements may exist at a state level, depending on where you live. Get professional advice to avoid any issues and to stay on the right side of the law.

International wire transfer reporting requirements

If you’re sending a payment overseas which is worth 10,000 USD or more, a report will be made to FinCEN, who can notify the IRS if there appears to be any issue with tax compliance. This is done by the bank or provider you send the money with.

However, you may still need to report payments yourself to the IRS, as we’ve discovered. You might have to report if you receive a gift of money from abroad, using Form 3520. Or you might need to file Form 709 if you need to pay Gift Tax.

If you hold overseas assets it’s also worth looking up the FATCA and FBAR rules to check if any reporting is required here when sending and receiving international payments.

Keeping on top of your taxes is essential, and it’s not always straightforward. We’ve not set out all the rules regarding tax on international payments here – so you’ll still want to seek professional support if you’re at all unsure.

Information need to make a wire transfer overseas

When you send money overseas to be deposited in a bank account you’ll need to have all the information needed to process the payment safely, which will usually include:

- The recipient’s name, as shown on their account

- The recipient’s bank account number

- The recipient’s bank name and address

- The recipient’s bank SWIFT/BIC code

Some countries also need some additional information, such as a sort code for payments to the UK. Your recipient will be able to tell you if there’s more detail needed for the transfer.

Aside from this, you may be required to prove the source of the funds, particularly if you’re sending a very large payment abroad. In this case you’ll be asked to provide some extra documents to the bank or payment provider which is processing your transfer, to demonstrate that the funds have been legally obtained. The paperwork you need can vary a lot depending on where the money came from, but may include the following:

| Source of funds | Examples of documents needed |

|---|---|

| A property sale | Final sales contract signed by both parties Letter from a solicitor, auditor or regulated accountant Bank statements showing you received the money Extracts from the property register |

| An inheritance | Signed copy of the will Grant of probate or court document Letter from a solicitor Bank statements showing you received the money |

| Your salary | Recent payslips Salary section of your contract A letter from your employer saying how much you earn Last 3 months of bank statements |

| Investments | Investment certificates, contract notes, or statements Confirmation from your investment company, bank, or dividend payer Bank statements showing you received the money |

| A loan | Your loan agreement 3 months of loan statements Bank statements showing you received the money |

What are penalties for not following the rules?

There are many different types of IRS penalties if you fail to file or pay your taxes on time and in full.

Penalties tend to be financial, and can be linked to the issue in hand. For example, if you fail to report a gift from a foreign individual without good reason, you may need to pay a penalty of up to 5% of the value of the gift for every month that you’re late in filing the report. Interest is also due on any penalty you need to pay.

Conclusion

You can send money overseas easily enough these days, but it’s important to be aware of the rules and regulations which apply both in the US and in the destination country. Generally there’s not a limit to how much you can send, but individual banks and providers will usually impose limits on payments for security. You’ll also often need to provide extra paperwork with high value international payments, to prove the source of the funds and to comply with law.

This guide covers some of the basics related to sending international payments – but it is still very important to get individual professional advice if you’re not sure whether you need to report a payment, or pay taxes.

- Send money overseas with a bank or a regulated provider like Wise or OFX – fees and exchange rates vary so shopping around is important

- There’s not a legal limit to the amount you can send overseas, but payments over 10,000 USD are reported to the IRS, and tax may apply depending on the type of payment

- When you send a high value payment you’ll often need to provide some additional documents to support your transfer, proving the money has come from legal sources

- Your bank might ask you to visit a branch to make a high value international payment while digital first providers like Wise and XE can help you complete the necessary verification steps with your phone or laptop

International money transfer regulations in the US FAQs

Does the IRS monitor international wire transfers?

International payments over 10,000 USD are reported to FinCEN by the bank or provider which processes the transfer. FinCEN is notified in order to prevent financial crime, and can notify the IRS of your payment if required. This also applies if you send several related payments which aggregate to 10,000 USD or more.

What law governs international wire transfers?

There are many different US laws on sending money abroad covering different aspects of compliance, tax and legalities. One important law is the Bank Secrecy Act which requires all payments of 10,000 USD or more to be reported to FinCEN. For US citizens abroad, or with international assets and income, FATCA is also important, requiring you to report international assets to the IRS.

What is Foreign Account Tax Compliance Act (FATCA)?

FATCA – Foreign Account Tax Compliance – requires foreign financial institutions, and in some cases, individual US taxpayers, to report overseas assets held by US persons to the IRS. As an individual you’ll usually need to complete a FATCA report to the IRS if your overseas assets exceed 50,000 USD in value. This legislation aims to stop tax avoidance by US taxpayers.

Do wire transfers over $10,000 get reported to the IRS?

Yes. Your bank or payment provider will report payments valued at over 10,000 USD to FinCEN which can in turn notify the IRS. Your bank will also report if you make several smaller related payments which in total accrue to over 10,000 USD. These rules help FinCEN and the IRS detect and prevent financial crime.

What is the Consumer Financial Protection Bureau (CFPB)?

The CFPB is a US government agency which works to ensure that consumers are fairly treated by financial institutions like banks. Its role includes consumer education, managing complaints when financial institutions have treated customers unfairly and working to reduce unnecessary issues for customers engaging with financial institutions, such as junk fees.