Remitly vs Xe Money Transfer vs Wise Comparison: 2025

If you’re looking for a reliable and safe money transfer service from the US, you may be trying to choose between Remitly vs Xe Money Transfer vs Wise. All three offer great coverage from the US, with good rates and fees. However, the services aren’t quite the same – so this guide is here to walk you through how each provider works.

We’ll mainly look at international transfers in this Remitly vs Xe Money Transfer vs Wise comparison – but as Wise also offers additional services like multi-currency holding accounts and debit cards, we’ll also touch on these so you can decide which option works best for you.

Summary: Remitly has a focus on supporting people working abroad and sending money back home. You’ll find a wide reach, and a really good choice of payout options – but low maximum limits. Xe has payments for personal and business customers, to 130+ countries, while Wise offers transfers to 160+ countries as well as broad add-on services covering ways to receive, hold, exchange and spend currencies in a powerful international account.

Remitly Vs Xe Money Transfer VS Wise: side by side

Each of the services we’re looking at has its own fees and exchange rates, as well as some unique features and varying coverage.

To give a flavour, here’s an overview of Remitly vs Xe Money Transfer vs Wise side by side, looking at available features.

| Feature | Remitly | Xe Money Transfer | Wise |

|---|---|---|---|

| Eligibility | Personal customers in the US and many other countries | Personal and business customers in the US and many other countries | Personal and business customers in the US and many other countries |

| Account fees | No fee | No fee | No fee to open a personal account, 31 USD one time fee for business account features No ongoing fees |

| Multi-currency account features | Not available | Not available | Hold USD, and 40+ other currencies Local and SWIFT account details available to receive payments in 20+ currencies |

| Debit cards available | Not available | Not available | Yes – the Wise international debit card |

| Send payments to | 170+ countries, 100+ currencies | 130+ countries | 160+ countries, 40+ currencies |

| Payout options | Bank and mobile money account, cash collection | Bank and mobile money account, cash collection in a selection of countries | Bank and mobile money account |

| Fully licensed and regulated | Yes | Yes | Yes |

*Correct at time of writing – 20th January 2025

So, to summarize:

- Remitly is for personal customers only, Xe Money Transfer and Wise offer services to personal and business customers

- Remitly and Xe Money Transfer do not offer multi currency accounts or cards, Wise has a multi-currency account and cards to support 40+ currencies

- Remitly and Xe Money Transfer both support transfers to bank and mobile money accounts, and cash collection in a selection of countries – Wise payments are sent to bank and mobile money accounts only

- All 3 providers are fully regulated and safe to use

The important bits

Not sure which is best? Here’s a comparison of the providers on key features including fees, safety and speed, which may help you decide which is right for you:

| Feature | Customer reviews (Trustpilot) | Coverage | Fees | Exchange rates | Speed | Limits |

|---|---|---|---|---|---|---|

| Remitly | 4.6 stars, Excellent rating, from 70,000+ reviews | Send to 170+ countries, | Variable fees depending on destination | Exchange rate includes a markup | Variable based on destination and payment type | 25,000 USD |

| Xe Money Transfer | 4.3 stars, Excellent rating, from 75,000+ reviews | Send to 130+ countries | Variable fees depending on destination | Exchange rate includes a markup | Variable based on destination and payment type | 535,000 USD |

| Wise | 4.3 stars, Excellent rating, from 246,000+ reviews | Send to 160+ countries | Send from 0.57% | Mid-market exchange rate with no markup | More than 60% of payments are instant* | Usually up to 1 million USD |

*The speed of transaction claims depends on individual circumstances and may not be available for all transactions. Information correct at time of writing – 20th January 2025

**Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

To summarize:

Reviews: On Trustpilot, all providers get an Excellent rating – Wise has far more ratings registered than the other providers

Coverage: Remitly supports payments to the most countries – 170+. Send to 160+ countries with Wise, or 130+ with Xe

Fees: All providers have variable fees for international transfer which are based on the destination country and payment type

Rates: Wise uses the mid-market rate, Remitly and Xe add a markup to their exchange rates

Speed: Wise payments can be instant, with 90% arriving in 24 hours. Remitly and Xe don’t publish exact delivery times, as these vary based on destination

Limit: Send 25,000 USD with Remitly, 535,000 USD with Xe, or up to 1 million USD with Wise

Pros and cons

| Remitly | Xe Money Transfer | Wise |

|---|---|---|

| ✅ Send to 170+ countries ✅ Various different payout options including cash collection ✅ Easy to use service with a good app ✅ Many popular remittance routes supported ✅ Transfer online and in-app for convenience | ✅Send to 130+ countries ✅ Transfer online and in-app for convenience ✅ Various different payout options including cash collection ✅ Large and trusted provider ✅ Business services include currency risk management solutions | ✅Send to 160+ countries ✅ Multi-currency account with 40+ supported currencies ✅No ongoing fees or minimum balance requirements |

| ❌ Exchange rates include a markup ❌ Low payment limits | ❌ Exchange rates include a markup ❌ Variable transfer fees | ❌ Variable transfer fees ❌ No cash services available |

The verdict: Which is better: Remitly or Xe Money Transfer or Wise?

There’s not a single winner when it comes to Remitly vs Xe Money Transfer vs Wise – it all depends on the services you need.

For overseas payments, Remitly and Xe use variable transfer fees and a marked up exchange rate – which means there’s a fee added to the currency conversion rate available. Wise uses the mid-market rate and splits out all the costs of sending a payment overseas – this can make it easier to spot exactly what you’re paying for currency conversion.

On coverage, Remitly serves slightly more countries – with payments to 170 countries compared to Xe at 130+, and Wise’s 160 countries.

On the other hand, Wise has the highest transfer limits – as well as a multi-currency account with a linked international debit card, and ways to get paid by others conveniently in a selection of currencies.

If you want an account for holding foreign currencies, check out Wise – and if you’re sending money abroad and all providers offer the type of transfer you need to make it’s worth comparing them carefully to see which is best for you.

About Remitly and Xe Money Transfer and Wise

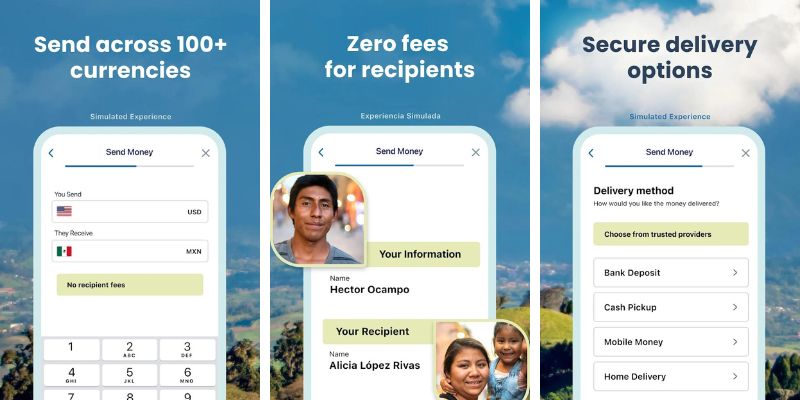

Remitly has been around since 2011 and lets customers send money to 170 countries for personal use. Remitly has an easy to use app, and allows you to send money for a selection of different payout methods, to many different destination countries.

Xe Money transfer was founded in 1993, and is now part of Euronet, one of the largest money transfer companies on the planet. You can send payments to 130+ countries with Xe. Xe business accounts offer some extra services as well as international transfers, including currency risk management solutions and mass payments.

Wise (formerly TransferWise) has been in business since 2011, and offers customers in the US and many other countries and regions personal and business accounts to hold and manage 40+ currencies, receive payments internationally and spend using a linked Wise debit card. You can also send money to 160+ countries with the mid-market exchange rate and low, transparent fees.

How do they work?

To use Remitly, Xe or Wise you’ll first need to create an account, and provide some ID for verification. This is an important security requirement to keep your account and money safe.

Once you have created an account and been verified, you can start to transact with just a phone app, or by logging into your account on a laptop. If you need to send money you can enter the value and currency to transfer, and follow the on screen prompts. All providers offer various ways to pay for your transfer, and you can select your pay out method based on the provider and destination you’ve selected.

It’s helpful to know that Remitly payments are intended for personal use only. You should only send to friends, family and people you trust – not to businesses. Both Wise and Xe support international business payments.

Remitly vs Xe Money Transfer vs Wise fees

Our 3 providers have different products – and therefore, different fee types. Here’s a rundown of the typical costs you’ll need to know about:

| Service | Remitly | Xe Money Transfer | Wise |

|---|---|---|---|

| Open an account | No fee | No fee | 31 USD (business customers only) |

| Order a card | Not applicable | Not applicable | One time fee applies |

| Spend with your card | Not applicable | Not applicable | No fee to spend currencies you hold Currency conversion from 0.57% when you don’t hold the right balance |

| ATM withdrawals* | Not applicable | Not applicable | First 2 withdrawals up to a combined total of $100/month for no fee. After that: $1.50 + 2% |

| Receive a payment | Not applicable | Not applicable | Free to receive payments in select currencies using local account details (except receiving USD wire payments). 6.11 USD fixed fee to receive a USD wire (ACH payments are free) 10 CAD fixed fee to receive payments via SWIFT in CAD |

| Send a payment | Variable fee based on payment details | Variable fee based on payment details | From 0.57% |

| Currency conversion | Exchange rate includes a markup | Exchange rate includes a markup | Mid-market exchange rate |

Correct at time of writing – 20th January 2025

*ATM operators may charge their own fees. Fee amount varies by ATM operator.

Remitly vs Xe Money Transfer vs Wise: Which is cheaper for international payments?

Using an international payment specialist can be among the cheapest available options for sending money overseas. However, as fees and rates do vary, it still pays to compare a few providers before you pick.

Remitly and Xe Money Transfer both offer variable fees which can depend on the pay out method among other factors. You can view the exact costs of your payment once you have registered an account. Some fees and rates are not available until you’ve set up your account and been verified.

Wise allows customers to check the fees and rates without needing to create an account or log in. Just open the Wise website or app. Wise transfer fees can be as low as 0.57% for overseas transfers, and currency exchange uses the mid-market exchange rate.

Remitly Vs Xe Money Transfer Vs Wise exchange rates

Remitly and Xe Money transfer both use a variable exchange rate markup when arranging international transfers.

This markup is a fee, which varies depending on the currency, and the value of the transfer you’re sending. You’ll be able to check and confirm the exchange rates available for your currency once you’ve created an account. Compare it to the mid-market rate to see the markup that’s been used for your specific currency pairing.

Wise uses the mid-market rate for currency exchange – the same one you might find on Google or using a currency conversion tool. All the costs you need to pay are shown separately so you can easily compare and check the total amount.

Remitly Vs Xe Money Transfer Vs Wise: Which is faster?

If you’re sending a payment and need it to be with the recipient in a hurry, you’ll need to look at some different providers to get the one with the quickest delivery for your specific currency route.

| Providers | Transfer speed |

|---|---|

| Remitly transfer speed | Variable based on destination and payment type |

| Xe Money Transfer speed | Variable based on destination and payment type |

| Wise transfer speed | More than 60% of payments are instant*, vast majority delivered in a day. |

All providers will offer a delivery estimate before you set up your transfer. However, the exact delivery time can depend on factors including the destination country, and the recipient’s bank processing times.

Remitly vs Xe Money Transfer vs Wise international transfer limits

In general, providers will have payment limits for both personal and business customers which can vary based on destination country.

Remitly has pretty low limits as its main focus is on people sending money to loved ones at home. Xe has a higher per transfer limits, while with Wise, most US customers can send up to 1 million USD per transfer, depending on how they want to pay.

| International transfer limits | |

|---|---|

| Remitly limits | 25,000 USD |

| Xe Money Transfer limits | 535,000 USD |

| Wise limits | Up to 1 million USD |

Sending large amount transfers

Finding a provider with dedicated services for large value payments can be useful for business payments or if you need to send a large personal payment – to buy a house or cover overseas education costs for example. Here’s how each of the providers we’re looking at works:

Remitly high amount transfers

Remitly does not focus on high value payments. The service is mainly intended for people who work abroad and want to send money home to loved ones. From the US you can send up to 25,000 USD per transfer with Remitly.

Xe Money Transfer high amount transfers

Xe has an upper payment limit of 535,000 USD for each transfer. Xe does not advertise better exchange rates or lower fees for high value payments, but you may want to give them a call if you’re sending money frequently or in high amounts to see if there’s a better deal to be had.

Wise high amount transfers

From your bank you can usually send up to 1 million USD per transfer – lower limits apply to some other payment methods.

Wise also offers volume discounts on fees. If you send more than the currency equivalent of 20,000 GBP (about 24,000 USD at the time of writing) a month you could get an automatic discount of up to 0.17%. There’s no need to pre-arrange the fee.

Here’s how the Wise high value payment discounts break down:

| Payment volume (GBP) | Discount |

|---|---|

| Under 20,000/month | 0 |

| 20,000 – 300,000/month | 0.1% |

| 300,000 – 500,000/month | 0.15% |

| 500,000 – 1million/month | 0.16% |

| 1 million+/month | 0.17% |

Learn more on Wise international high amount transfers.

Remitly vs Xe Money Transfer vs Wise: Payment methods

Here’s a summary of the different payment methods each provider can offer for sending a transfer overseas (or adding money to your account, for Wise).

| Providers | Payment methods |

|---|---|

| Remitly |

|

| Xe Money Transfer |

|

| Wise |

|

Ease of use

| Remitly | Xe Money Transfer | Wise | |

|---|---|---|---|

| Creating an account | Online or using the provider’s app | Online or using the provider’s app | Online or using the provider’s app |

| Making a transfer | Online or using the provider’s app | Online or using the provider’s app | Online or using the provider’s app |

| Ways to send money | bank transfer

debit/credit card | bank or wire transfer (over 3,000 USD)

debit/credit card | ACH wire transfer debit/credit card SWIFT Wise Account balance |

| Languages | Multi-lingual services in app and by phone | English only phone service | Multi-lingual services in app and by phone |

| Maximum amounts | 25,000 USD | 535,000 USD | 1 million USD |

Supported currencies

- Remitly supports a broad selection of currencies for payments to 170 countries and territories globally.

- Xe Money Transfer supports payments to 130+ countries.

- Wise supports 40+ currencies for hold and exchange, and lets you send payments to over 160 countries.

Are they safe to send money with?

Yes. All of the providers we have featured have industry level security features built into the app, including manual and automatic anti-fraud tools.

Learn more about their safety features on these guides: Xe safety, Remitly safety and Wise safety.

Are they regulated in the US?

All of the providers are regulated for the services they offer, in the US and beyond, and required follow international wire transfer regulations in countries they operate in.

Remitly: Remitly is authorized to transmit money in all US states and Washington, D.C. Remitly has licenses in all states where this is required.

Xe Money Transfer: Xe Money Transfer is licensed as a Money Transmitter by the New York State Department of Financial Services and the Georgia Department of Banking and Finance, and also licensed as a Foreign Transmittal Agency by the Massachusetts Division of Banks. Xe is authorized to operate as a money transmitter everywhere it conducts business.

Wise: Wise is registered with the Financial Crimes Enforcement Network (FinCEN) and licensed as a money transmitter in a number of US states. In other US states and territories, Wise delivery services in partnership with Community Federal Savings Bank, which is supervised by the Office of the Comptroller of Currency.

Remitly vs Xe Money Transfer vs Wise customer service

You can get in touch with all the providers through an in app chat, and you also have the following phone options:

Remitly phone support: +1 844-604-0924

Xe phone support: +1 877-932-6640

Wise customer support: Wise offers phone support 24/7 in English. The quickest option may be to open an in app chat – if you need to speak to a specific team due to the type of question you have, you’ll be connected or passed the details for contacting the best person to support you.

Conclusion: Comparing Remitly and Xe Money Transfer and Wise

Remitly and Xe Money Transfer and Wise are all excellent apps to send money internationally money transfer apps operating in the US and many other countries. The right one for you depends on what you need.

- If you want to send a smaller payment to someone for cash collection, Remitly may be a good choice, with low maximum limits but great coverage of 170+ countries, and options for cash collection transfers.

- Xe may suit for payments up to 535,000 USD, including business services. Transfers have variable fees and delivery times.

- Or look at Wise for fast payments to 160 + countries, with the mid-market rate and low fees. You can also open a Wise account for personal or business use, which offers a linked debit card and plenty of great perks, with no ongoing fees.

FAQs

What is the difference between Remitly and Xe Money Transfer and Wise?

Remitly and Xe Money Transfer and Wise are all different companies, with a different focus.

Remitly supports payments to 170+ countries, including cash options, while Xe covers 130+ countries from the US.

Wise has low cost payments to 160+ countries, with multi-currency accounts and cards available for personal and business customers. Learn more about it on Wise Account Review.

Compare them all to see which works best for you.

Is Wise better than Remitly?

Neither Wise or Remitly is better – they’re both different. Wise has higher payment limits but deposits payments to bank accounts mainly. Remitly has lower transfer limits but lets you send for cash collection. Which works for you depends on the transfer you want to make.

Is Remitly better or Wise?

Remitly is a better pick if you want to send a payment for cash collection – but if you are sending to a bank account you should compare both on fees and exchange rates. If you want a multi-currency account or card, or business services, Wise is your best option.

Is Wise better or Xe?

Wise offers different services compared to Xe, including multi-currency accounts for personal and business customers. Xe has business services, which are a bit different to Wise, as well as personal payments to 130+ countries. Compare them both based on your own specific needs.

Is Xe better than Remitly?

Neither provider is better every time, so you’ll need to look at your specific transfer to get an idea of which works best. To see quotes for fees and exchange rates, sign up for Xe and Remitly accounts online or in their apps – or take a look at Wise which allows you to get a quote before you sign up.

Is Remitly or Xe Money Transfer or Wise faster for international payments?

All providers have variable delivery times depending on the specific payment in question. You’ll see a quote for the expected delivery time when you set up your payment so you can compare your options.

What are the disadvantages of Remitly?

Remitly has pretty low limits and variable fees which can mean it’s not always the cheapest option out there. Compare a few providers to see which works best for your next transfer.