Charles Schwab Large International Transfers Alternatives [2025]

Charles Schwab offers a great range of brokerage services for trading and investing, and related accounts to let you move your money to and from your investment vehicles. There are also some checking and savings account products, and options to take loans. However, at the time of research Charles Schwab no longer allows international wire transfers to and from its accounts. As Charles Schwab accounts are mainly intended for investors to receive and hold funds in between trades, they’re limited to USD functions.

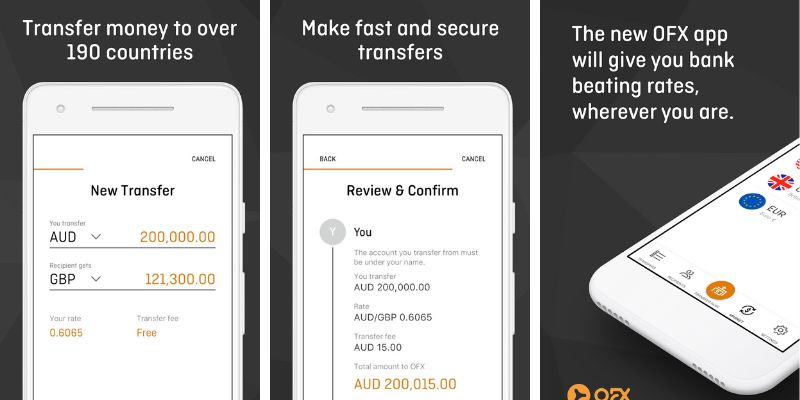

The chances are that if you have a Charles Schwab account and need to send money overseas, you’ll need an alternative option. Third party providers like Wise and OFX can be a smart way to move your money internationally with low fees and great exchange rates. This guide covers all you need to know.

Quick summary: Alternatives to Charles Schwab international large transfers

Before we start, let’s get a summary of the Charles Schwab alternatives we’ll feature in this guide.

| Provider | 💡 Great for |

|---|---|

| Wise | Mid market exchange rates, transparent fees and speedy transfers to 160+ countries |

| OFX | Payments with low fees and a personal service 24/7 over the phone |

| Xe Money Transfer | Sending money online to 130+ countries, with one of the largest money transfer services in the world |

| Currencies Direct | Payments to 120 countries, in 40+ currencies, supported by a personal broker |

| Currencyfair | Transfers to 150+ countries, with fair fees and great exchange rates |

Can you send high value international transfers with Charles Schwab?

Charles Schwab did have options to send and receive international wires.

However, at the time of research, international wire transfers with Charles Schwab are no longer available.

While you can still send and receive wire payments with Schwab, these must be USD denominated and are supported within the US only.

This guide covers some alternatives that allow you to send your money overseas with a third party.

Alternatives to Charles Schwab for large international transfers

If you use a Charles Schwab account and need to send money to someone abroad, you still have options. You can simply use a third party provider – a specialist in international money transfers – to manage your payment for you. All you’ll need to do is pick a provider, register an account, and start managing your international payments from your phone or laptop. You can fund your transfer from your bank or with your card, and the provider will deposit the agreed amount in the recipient’s bank account abroad. Easy.

Let’s look at a few international money transfer providers which may be able to help with your payment.

| Providers | International transfer limits | Large transfer fees & exchange rates | Payment methods |

|---|---|---|---|

| Wise | Up to 1 million USD per payment* | Mid market exchange rates, with low, transparent fees Discounted fees on transfers over about 25,000 USD/month | ACH, wire, debit or credit card, SWIFT, Wise account balance |

| OFX | Usually unlimited | No fees, exchange rates include a markup | ACH and wire – other methods may be available depending on your transfer requirements |

| Xe Money Transfer | 535,000 USD per payment | Variable fees, exchange rates include a markup | Bank transfer or card |

| Currencies Direct | Usually unlimited | Variable fees, exchange rates include a markup | Bank transfer – other methods may be available depending on your transfer requirements |

| Currencyfair | Check for details of your limits in the Currencyfair app | 3 EUR or equivalent fee, exchange rates include a markup | Bank transfer |

*Some other limits may apply depending on the details of the transfer. Details correct at time of research – 9th January 2025.

Wise

Wise is a specialist in international transfers and multi-currency accounts for personal and business customers. Wise offers low cost currency conversion and cross border payments in 40+ currencies.

Wise maximum limits are high – usually around 1 million USD – and there are fee discounts on high value payments over 25,000 USD or so.

- Send payments to 160+ countries, in 40+ currencies

- Currency conversion uses the mid-market exchange rate with low, transparent fees for payments

- Discounted fees on higher value transfers, or if you may multiple transfers in a month which aggregate over around 25,000 USD in value

| Wise international transfer pros | Wise international transfer cons |

|---|---|

| ✅ Low fees and the mid-market exchange rate ✅ Send to 160+ countries ✅ High transfer limits ✅ Discounted fees on higher value transfers | ❌ Fees vary based on destination country ❌ No cash services for pay in or pay out |

OFX

OFX is well known for great customer service, and offers a 24/7 phone service to customers around the world. OFX personal and business customers can make international transfers in 50+ currencies, and access currency risk management products too. Payments are usually unlimited, with no transfer fee – an exchange rate markup will apply.

- Send to a huge range of countries, in 50+ currencies

- 24/7 personal phone service

- One off and recurring international transfers available

| OFX international transfer pros | OFX international transfer cons |

|---|---|

| ✅ Personal phone service if you need help and advice, plus no upfront transfer fee ✅ Send payments in 50+ currencies with no fee ✅ Business and personal services supported ✅ Access to more complex currency products like limit orders | ❌ Exchange rates include a markup ❌ Card payments not usually accepted |

Xe Money Transfer

Xe Money Transfer lets you send a payment online or in app to 130+ countries from the US, for personal or business use. Xe has a fixed limit of 535,000 USD or the currency equivalent per personal payment. This limit does not apply on business transfers.

- Send up to 535,000 USD in a single online payment

- Payments available to 130+ countries

- Pay by bank transfer or with a card

| Xe Money Transfer international transfer pros | Xe Money Transfer international transfer cons |

|---|---|

| ✅ Well known service which is part of the largest money transfer business in the world ✅ Low fees are often available – some payments have no fee at all ✅ Send to 130+ countries ✅ Get currency exchange rate data to view and check trends in the market | ❌ Variable fees and delivery times ❌ Exchange rates include a markup |

Currencies Direct

Currencies Direct has been established since 1996 and serves 500,000+ people globally, with payment services to 120+ countries and a dedicated personal account management service. You can send money online and in the app, and pay with bank transfer. Payments are usually unlimited.

- Send money to 120+ countries with just your phone

- No limits on the amount you can send

- Personal support and account management services

| Currencies Direct international transfer pros | Currencies Direct international transfer cons |

|---|---|

| ✅ Send to 120+ countries ✅ Get a personal broker or account manager to help you ✅ Send one off or recurring payments ✅ Award winning service offer | ❌ Transfers have a variable fee ❌ Exchange rates include a markup |

Currencyfair

Currencyfair supports payments in 20+ currencies to 150+ countries, with a flat fee no matter how large your payment is. Exchange rate markups apply, but Currecnyfair states that the markups are small and competitive against banks. Services are easy to use and all you’ll need is your phone once you’ve registered an account.

- Send to a very large range of countries – 150+ supported

- Flat 3 EUR or equivalent fee for all transfers

- Small exchange rate markups apply which are competitive against banks

| Currencyfair international transfer pros | Currencyfair international transfer cons |

|---|---|

| ✅ Flat fee of 3 EUR or the equivalent, even on large transfers ✅ Send to 150+ countries ✅ Set up rate alerts to keep an eye on market movements ✅ Large and trusted business | ❌ Variable payment limits – check your own limits in app ❌ Exchange rates include a markup |

Can you receive large transfers with Charles Schwab from overseas?

You can not receive payments from overseas to a Charles Schwab checking account. Only domestic wires are supported, and you can also use Zelle to send money to others in the US if you need to.

Alternatives to Charles Schwab for receiving large payments from overseas

You can not receive payments to your Charles Schwab account from overseas, but you can open an account with a non-bank alternative provider which offers multi-currency accounts, to receive payments from overseas conveniently. You can then hold the funds in your account, or convert to USD, to send to your Schwab account. This gives flexibility and because non-bank specialist providers offer great exchange rates you could save on fees, too.

Here are a couple of options to consider, depending on whether you want a personal account or an account for your business.

Wise Account: Receive money with local and SWIFT account information in 8+ currencies, with quick payment options and low or no fees. Hold, send, or spend your money as you choose, with mid-market exchange rates

OFX Account: Receive business payments in 7 major currencies to your OFX account, which you can use for future payments or withdraw to your US bank later. There’s no OFX fee to receive a payment in a foreign currency with your local account information.

Charles Schwab USD wire transfer fees

Charles Schwab does offer outgoing USD domestic wires, but there’s a fee to consider. Usually from a checking account you’ll pay 25 USD to send an outgoing wire.

If you’d like to consider other US banks to send an international large transfer, these guides might help:

- Wells Fargo large amount transfers

- Chase large amount transfers

- Bank of America large amount transfers

Conclusion: Does Charles Schwab support large international transfers?

No. Charles Schwab international wires are not supported from checking accounts.

You can send and receive USD payments only, using a domestic wire or an alternative like Zelle.

If you need to send a transfer overseas, you could still fund it from your Schwab account if you choose to use a non-bank specialist third party provider like Wise or OFX. Simply register an account with a provider of your choice, set up your international payment in their app, and then fund it with a bank transfer from your Charles Schwab account. This process is user friendly, and third party providers usually have low fees and great rates for international transfers, too. Use this guide to pick the Charles Schwab alternative which may work for your next international payment.