Bank of America international wire transfer: Fee, rates and speed [2025]

Planning to transfer money abroad with Bank of America? This guide covers all you need to know including the fees for a Bank of America international wire transfer, how long it takes, and how to get started.

Despite serving some 66 million customers across the US, Bank of America might not be your best choice when it comes to sending an international wire transfer. Specialist services like Wise and OFX are convenient to use and could help you make your transfer cheaper and faster.

Quick summary: Bank of America wire transfer

| Questions | Answers |

|---|---|

| Does the Bank of America allow international wire transfers? | Yes, BofA supports international money transfers. |

| How much is Bank of America’s incoming international wire transfer fee? | Fees vary by account, they are usually around $15 per transaction. |

| How long does international wire transfer take with Bank of America? | When you start the transfer, the money will be deducted from your account immediately and generally arrive in your recipient’s account in 1 or 2 business days. The exact delivery time depends on the destination country and the receiving bank’s own processes. |

Pros and cons of transferring money abroad with Bank of America

| BofA wire transfer pros | BofA wire transfer cons |

|---|---|

| ✅ Secure and familiar service ✅ Set up payments conveniently online ✅ Broad range of countries and currencies covered ✅ Many accounts allow international wires with no transfer fee ✅ Trusted global bank that’s one of the big 4 banks in the US | ❌ Exchange rate markups push up the total overall costs ❌ Most payments are limited to 1,000 USD per transfer ❌ Some account types have transfer fees for all international wires ❌ Delivery times aren’t market beating ❌ Third party costs also apply |

Although Bank of America international wire transfers are familiar and safe, they may not necessarily be the cheapest or fastest option out there. Specialist providers have their own payment networks which can cut down both costs and delivery times, allowing customers to arrange international transfers for less. In this guide we’ll cover alternatives like Wise and OFX that might offer better exchange rates, lower fees and higher transfer limits.

Bank of America international money transfer comparison

For most Bank of America account holders, there’s no upfront transfer fee for international payments sent in a foreign currency. However, before you start setting up your Bank of America international wire, you’ll need to double check your account terms and conditions, as some account types do come with an international wire transfer fee.

Even if your account allows for cross-border payments with no transfer fee, other charges will apply:

- Exchange rate markup or margin

- Third party fees paid to correspondent banks

We’ll look at these costs one by one in a moment.

Let’s start with a comparison of the costs and delivery times involved when sending an international transfer with Bank of America compared to some specialist providers.

Here we’ll use the fees that would apply for a payment to a friend in Canada, assuming we want the end amount received to be 1,000 CAD:

| Provider | Total cost | Transfer time |

|---|---|---|

| Bank of America | $0 (for most accounts) + intermediary fees + exchange rate margin | 1 -2 working days |

| Wise | 9.46 USD | 50% of transfers arrive instantly + the vast majority of payments arriving within 24 hours* |

| Western Union | $0 + exchange rate margin | 0 – 5 business days |

| OFX | $0 + exchange rate margin applies | 1 – 2 business days |

* Information correct as of 29 August 2024. **The speed of transaction claims depends on individual circumstances and may not be available for all transactions.

When you arrange your transfer, you’ll get a price quote which includes the Bank of America international transfer exchange rate and also specifies any third party fees which will apply.

Bank of America international wire transfer exchange rates include a markup or margin added to the exchange rate. This is a percentage fee added to the rate you’d find on Google or in a calculator tool. Although Bank of America doesn’t publish the margins it uses, bank exchange rate markups are commonly around 3%, which pushes up the total costs of your payment.

Intermediary or recipient bank fees may also apply, which aren’t paid to Bank of America but which will be deducted from your payment as it’s being processed. You’ll be made aware of these costs before you arrange your transfer.

Depending on the payment, you might be able to get a lower overall fee and a faster delivery with a specialist. International money transfer services are secure and simple to use, and you can usually transact 24/7 online and through mobile apps.

Bank of America international transfer fees

Here are the fees for sending and receiving international wire transfers with Bank of America:

| International transfer type | Bank of America international transfer fee |

|---|---|

| International wire, sent in foreign currency | Usually no transfer fee |

| International wire sent in USD | 45 USD |

| Receive an international wire | Varies by account – fees are commonly around 15 USD |

Bank of America exchange rate

Like most banks, Bank of America makes a profit from currency exchange when customers send international wires. Here’s how this is explained in the Bank of America terms and conditions:

“The exchange rate you are offered may be different from, and likely inferior to, the rate paid by us to acquire the underlying currency.”

Bank of America buys currency on global markets using the mid-market exchange rate. However, this rate isn’t available for customers directly. Instead, a margin or markup is added to the rate used for customer transactions. This is usually an extra percentage fee, covering the Bank of America’s costs and profit margin:

“The price provided may include profit as determined by us in our sole discretion. The level of the fee or markup may differ for each customer and may differ for the same customer depending on the method or venue used for transaction execution.”

The margin used by Bank of America isn’t publicly available but banks commonly use a markup of around 3%. That may not sound like much but can quickly become the biggest of all the fees you’ll pay when sending an international transfer. Here’s how a 3% markup would add up for a few different transfer values:

- Sending 1,000 USD – the exchange rate markup adds 30 USD to the total

- Sending 5,000 USD – the exchange rate markup adds 150 USD to the total

- Sending 50,000 USD – the exchange rate markup adds 1,500 USD to the total

Here’s a reminder of the total costs – including exchange rate markups – from the providers we looked at earlier. This is what you’ll pay with each if you set up your payment online and want your recipient to end up with 1,000 CAD in their account in the end:

- Bank of America: No transfer fee – Exchange rate margin + relevant intermediary bank fees apply

- Wise: 9.46 USD transfer fee

- Western Union: No transfer fee, exchange rate margin applies

- OFX: No transfer fee, exchange rate margin applies

Bank of America additional fees

When you send an international remittance with Bank of America, you may also need to pay fees to other banks involved in processing the payment. These fees tend to arise whenever banks process wire transfers through the SWIFT network.

SWIFT payments involve several partner banks moving money between themselves until it arrives at the right recipient’s account. Each bank involved can levy a fee for their service which is deducted as the transfer passes through the system.

You’re not out of luck through – here are some smart ways to cut or avoid international wire fees:

- Use a multi-currency account, from a specialist provider such as Wise or Revolut

- Choose a specialist international transfer service like Wise or OFX

- Compare your options with our comparison engine to see a range of providers, including their fees, rates and delivery times

Alternatives to Bank of America international wire transfer

Modern online alternative providers like Wise and OFX could provide better exchange rates and lower fees when you’re sending a payment overseas. You’ll also often find higher transfer limits compared to Bank of America. Here are a few to consider:

| Provider/feature | Wise | OFX | Western Union |

|---|---|---|---|

| Currencies/countries supported | To 160+ countries, or in 50+ currencies, | 170+ countries, or in 50+ currencies | Payments globally in a broad range of currencies |

| Transfer fees | Low fees which vary by destination | Often no transfer fee applied | Transfer fee applied depends on payment type |

| Exchange rate | Mid-market exchange rate | Exchange rate includes a markup | Exchange rate includes a markup |

| Pay out options | Direct to bank accounts | Direct to bank accounts | Direct to bank accounts, for cash collection and to mobile money accounts |

| Multi-currency account options | For business and personal customers | For business customers only | Not available |

| Delivery times | 50%+ of payments are instant, 90%+ arrive in 24 hours | Usually 1 – 2 business days | 0 – 5 days |

* Information correct as of 29 August 2024

Wise: Low cost international transfers which use the mid market rate, to 160+ countries. Over 50% of payments arrive instantly, and you can set up an account online or in the Wise app easily without leaving home.

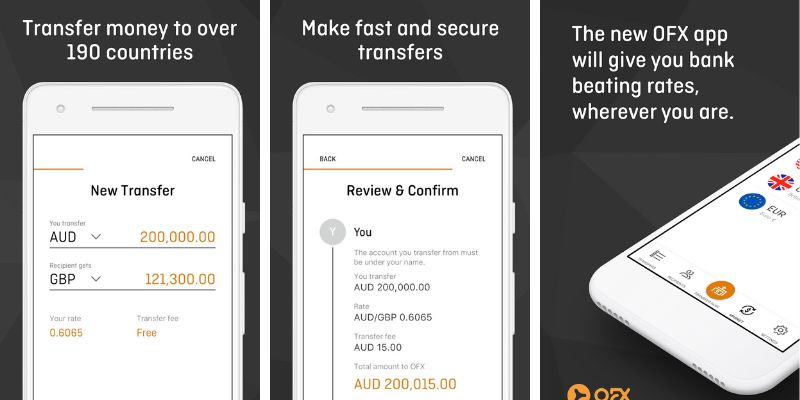

OFX: Currency specialist offering personal and business payments to 170+ countries, plus currency risk management services, and a 24/7 phone support team to answer your questions.

Western Union: One of the world’s largest payment providers, you can send payments with Western Union for delivery to bank accounts, as well as for cash collection, to mobile wallets and more.

How long does a Bank of America international money transfer take?

When you send a Bank of America international money transfer, the funds will be deducted from your account immediately and generally arrive in your recipient’s account in 1 or 2 business days. If you’re arranging a payment after the Bank of America cut off time, on a holiday or weekend it will start to be processed on the next working day. The cut off time for international wires is 5pm ET.

The exact delivery time depends on the destination country and the receiving bank’s own processes. There are a handful of destinations Bank of America deems slow to process countries, where payment is likely to be longer – you can access this list on the Bank of America website.

Here’s a recap of the delivery times you may expect from the providers we profiled earlier:

- Bank of America: 1 – 2 business days

- Wise: 90% of payments arrive in 24 hours

- Western Union: 0 – 5 days

- OFX: 1 – 2 business days

Bank of America wire transfer limits

International wire transfer limits may apply which can vary based on your account type and the type of transfer you want to make. In some cases you may need to complete additional security steps to process your transfer.

The standard consumer limit for Bank of America wires is 1,000 USD per transaction. If you have a Bank of America business account you may be able to send 5,000 USD per transfer.

Large transfers with Bank of America

If you need to send a large amount of money overseas with Bank of America you’ll need to check within your online banking, or call into a branch to check your options, which may vary based on your account type. Most consumer accounts only allow payments up to 1,000 USD which can be a problem if you need to make a large transfer.

If Bank of America can’t help – or if you simply want to compare a few alternatives to see which works best for your needs – check out specialist providers like Wise and OFX which may be able to support higher value domestic and international transfers. In many cases, specialist providers don’t apply an upper limit to payments at all, making this a convenient way to cut costs as well as moving money where you need it to be quicker than a bank will.

Available countries

You can send payments in 140+ currencies, to over 200 countries through Bank of America.

Receiving money from abroad with Bank of America

If you need to receive an international payment into your Bank of America account you’ll have to give the sender a few key details. These usually include:

- Your full name as shown on your account

- Your bank account number

- Your wire transfer routing number

- The correct Bank of America SWIFT/BIC CODE

There may be a fee to receive a Bank of America international transfer, and third party fees may be deducted by correspondent banks as it is processed.

Bank of America SWIFT code

To receive an international wire transfer to your Bank of America account you’ll need to give the sender your account information as set out above, as well as the SWIFT code for your transaction type.

- For incoming wires in USD, use SWIFT code BOFAUS3N

- For incoming wires in all other currencies, use SWIFT code BOFAUS6S

You may also need to give Bank of America’s address. For USD payments the address to use is:

- Bank of America, NA, 222 Broadway, New York, New York 10038

And for incoming payments in foreign currency you’ll need to use this address:

- Bank of America, NA, 555 California St, San Francisco, CA 94104

Related: Bank of America foreign transaction fees

How to make an international transfer with Bank of America

You can usually send international wire payments through your bank in person – but using the online banking service is the most convenient choice for most customers. Here’s how to send a Bank of America international wire online:

- Log into online or mobile banking and select the Transfer option

Log into your Bank of America account in your preferred way. Tap or hover over the Transfer/Zelle menu, and then select Transfer and To/from other banks (includes wires).

- Add the recipient

If this is the first time you have sent a payment to this recipient you’ll need to add them to your account. The option to do this is available on screen, simply tap and follow the prompts to add the recipient’s personal and banking information, including the details set out above. You’ll be asked to complete a verification step at this stage for security reasons.

- Confirm the payment details

Now you can make your transfer. Select the Make transfer tab, and enter the amount, currency, recipient and date of the payment. You may need to complete an additional verification step at this stage. You’ll be prompted to check everything over and confirm the transfer – and your money will be on its way.

Learn more: How to make an international wire transfer with Bank of America

What information do you need to make an international transfer with Bank of America?

When you arrange your payment with Bank of America, you’ll need to provide the following information:

| Information needed | Details |

|---|---|

| Recipient bank details | Bank name Bank address Country |

| Recipient account information | Routing code Account number |

| Transfer identifiers | SWIFT code National ID or IBAN number of the bank where the receiving account is located |

| Purpose for transfer | Reason for payment |

Conclusion

Sending an international wire with your regular bank may seem like the obvious choice but it’s often not the cheapest or fastest way to get your money where you need it to be.

As an alternative if you’re sending money overseas, take a look at specialists like OFX and Wise, to see if they can help you move your money faster and for a lower fee. You may also find there are other handy services, like the multi-currency Wise Account which allows you to receive incoming payments from 30+ countries with no fee.

Bank of America international bank transfer FAQs

What is the Bank of America address for international wire transfers?

For USD payments the address to use is:

- Bank of America, NA, 222 Broadway, New York, New York 10038

And for incoming payments in foreign currency you’ll need to use this address:

- Bank of America, NA, 555 California St, San Francisco, CA 94104

Does Bank of America allow international wire transfers?

Yes. Make Bank of America international wire transfers online or by visiting a local branch.

How long does an international wire transfer take with Bank of America?

When you send a Bank of America international bank transfer, usually your payment will arrive in your recipient’s account in 1 or 2 business days.

Is the Bank of America SWIFT code the same for all branches?

The Bank of America SWIFT code you need will depend on the type of payment you’re receiving:

- For incoming wires in USD, use SWIFT code BOFAUS3N

- For incoming wires in all other currencies, use SWIFT code BOFAUS6S

Does Bank of America charge for incoming international wire transfers?

There are incoming wire payments for some account types – however, whether or not you need to pay a fee will depend on the specific Bank of America account you hold.