Bank of America Large Transfers [2025] Guide: How-to, Limits & Fees

If you’re looking to learn about the limits which apply on Bank of America transfers this guide is for you. We’ll explore the Bank of America bank transfer limit online and in app, and what to do if you need to send a large payment to someone at home or abroad.

Online, the Bank of America maximum transfer is set pretty low.

So, to help you find ways to send higher value payments without needing to head out to a bank branch, we’ll also look at a couple of alternatives for simple, secure digital payments – including

- Wise which has lower costs when sending over 25,000 USD in a month, and

- OFX which has no transfer fee and no maximum cap on the send amount.

Quick summary: Bank of America transfer limits

- For digital payments, the Bank of America bank transfer limit is set at 1,000 USD/day for personal customers

- You may find you can get a higher Bank of America bank transfer limit if you arrange your payment in a branch rather than online

- Bank of America does not have a transfer fee for overseas wires arranged in a foreign currency, incoming wires cost 15 USD

- Bank of America exchange rates will include a markup when you send money abroad

- You may find you can get a simple and cheap transaction experience if you choose an alternative provider like Wise or OFX instead of using your bank

| Summary of BofA transfer limits | |

|---|---|

| Bank of America daily transfer limit | Variable limits apply – you may be able to transfer more in a branch compared to online |

| Bank of America online transfer limit | 1,000 USD/day for consumers, 5,000 USD/day for small business customers |

| Bank of America receiving limit | Receive up to 999,999 USD/week from other Bank of America customers, with higher limits when sending money between accounts in your own name. No limit on incoming international transfers |

Can you send high value international transfers with Bank of America?

While you can send higher value payments with Bank of America, you may find you need to visit a branch or call the bank rather than sending your payment online or in the Bank of America app.

The Bank of America transfer limits for international digital payments are set quite low, at 1,000 USD per day for personal customers, and 5,000 USD for small business customers. If you need to send a higher amount with Bank of America you’re advised to talk to a member of bank staff to ask for the best route based on your specific account type.

| Bank of America large transfers pros | Bank of America large transfers cons |

|---|---|

| ✅ Service is safe and reliable ✅ High receiving limits ✅ No transfer fee to send a high value payment overseas ✅ Options to send domestic payments with Zelle | ❌ Low online limit at 1,000 USD/day ❌ Exchange rates include a markup which can add to the costs of high value transfers ❌ No discounts on high value transfers |

Using Bank of America for your high value payment is safe and reliable but for transfers of over 1,000 USD you’ll need to take time out of your day to visit a branch as digital transfers have a pretty low limit.

Services like Wise and OFX are not banks but do support high value payments to many countries and regions globally, with fair exchange rates and low overall costs. Wise also reduces the fee you pay, when you’re sending a higher value transfer. More on that later.

Bank of America high amount transfer fees

Bank of America does not charge a transfer fee for outgoing international payments sent in a foreign currency.

If you send a payment overseas in USD, the charge is 45 USD.

It’s worth noting that a couple of other costs may also apply, even when Bank of America waives the upfront transfer fee. Firstly, there’s likely to be a variable markup added to the exchange rate. This is a percentage fee which is added to the exchange rate used to convert your dollars to the currency you need for deposit in the recipient’s account.

On top of this, the Bank of America fee schedule also states that foreign transfers may be subject to other fees such as taxes in the recipient country, third party bank costs and a fee applied by the recipient’s bank.

Bank of America exchange rate for international transfers

As we’ve mentioned, Bank of America exchange rates are likely to be calculated by taking the mid-market exchange rate and adding a variable fee to set the consumer rate offered to customers sending payments abroad.

This is very common, but it can mean that you’re paying more than you expected when you send money overseas.

Bank exchange rate margins can be in the ballpark of 3%. This percentage charge quickly mounts up when higher value payments are involved. Here’s how the exchange rate markup builds up with a 3% margin used for different transfer values:

- Sending 1,000 USD – the exchange rate markup adds 30 USD to the total

- Sending 5,000 USD– the exchange rate markup adds 150 USD to the total

- Sending 50,000 USD – the exchange rate markup adds 1,500 USD to the total

As you can see, when sending a higher value payment, the exchange rate used matters more than ever. The good news is that not all providers use a markup on their exchange rate. We’ll look at one which doesn’t – Wise – a little later.

Is Bank of America safe for large amount transfers?

Bank of America is one of the largest banks in the world, and is safe to use.

It’s licensed and regulated for the services it offers, and if you ever have any questions or concerns it’s easy to get help and advice in a branch or on the phone.

Bank of America transfer limits

Bank of America transfer limits depend on the type of payment. Here’s a quick summary of some key limits. Bear in mind that some of the limits which apply may vary a little depending on the specific account you have with Bank of America. You can see your own limits by logging into your online banking or by calling the bank directly.

| Transfer type | Bank of America transfer limit |

|---|---|

| Outgoing international payment | Online: 1,000 USD/day for personal customers, 5,000 USD/day for small business You may be able to send more by visiting a branch instead |

| Incoming international payment | No limit |

| Outgoing domestic payment | Next day ACH: 1,000 USD/day for personal customers, 5,000 USD/day for small business 3 day ACH: No limit for personal customers, 5,000 USD/day for small business |

| Incoming domestic payment | Next day ACH: No limits 3 day ACH: 1,000 USD/day for personal customers, No limit for small business |

*Correct at time of research – 2nd December 2024

There are also some limits on receiving payments from accounts in your own name, or from accounts in other people’s name, set by the incoming amount per week. Usually this means you can receive up to 999,999 USD a week from other people, and almost 10 million USD a week from accounts in your own name.

Alternatives to Bank of America with higher transfer limits

If you need to send a high value payment it’s worth comparing your options on convenience and cost. You might find that an alternative could offer you a better exchange rate, lower costs, or a quicker delivery time.

Here we’ve picked out OFX, Wise and Xe Money Transfer as some alternative services you might want to look at, which can support high value payments online and in app, with good exchange rates and low overall costs. Here’s how they measure up:

| Providers | International transfer limits | Transfer methods | Transfer fees & exchange rates |

|---|---|---|---|

| Bank of America | Online: 1,000 USD/day for personal customers You may be able to send more by visiting a branch instead | Transfer online, in app or in person | 0 USD – 45 USD transfer fee Exchange rate includes a markup |

| OFX | No limit | Transfer online, in app or by phone | No transfer fee Exchange rate includes a markup |

| Wise | 1 million USD per payment | Transfer online or in app | Fee from 0.33% |

| Xe Money Transfer | 535,000 USD per payment | Transfer online or in app | Often no transfer fee Exchange rate includes a markup |

*Other limits may apply, depending on the payment method and destination country

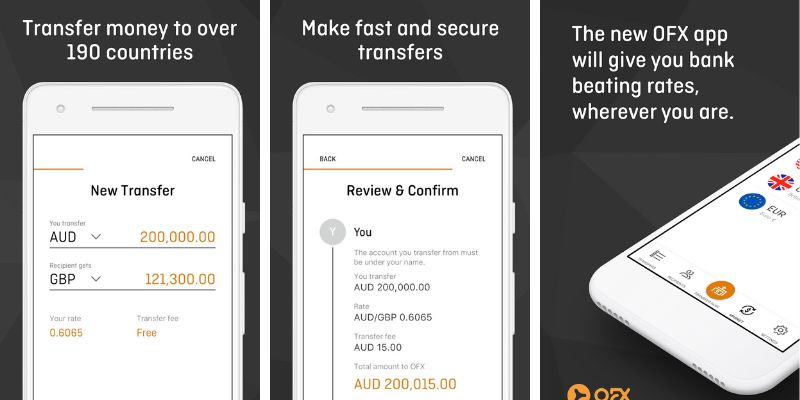

OFX

| OFX – best features for high value transfers |

|---|

|

OFX allows customers to send money in 50+ currencies, all over the world. OFX does not charge US customers any transfer fee, although there is a fee included in the exchange rate that’s used to process your payment.

There’s no upper limit on the amount of money you can send with OFX. If you’re sending a high value payment you may need to talk it through with OFX using their 24/7 call line, to make sure you have all the right information and documentation to support your transfer.

Some banks have a daily or per transfer limit on the amount you can send. If your bank imposes a limit, OFX can accept partial payments for a transfer – so you can make several bank transfers to pass OFX the full amount required for processing.

Wise

| Wise – best features for high value transfers |

|---|

|

Wise offers high value payments for individuals and businesses to 160+ countries, with the mid-market exchange rate and low fees from 0.33%.

Wise is a secure provider which also offers volume discounts on fees, so the costs could be reduced if you use the service regularly or if you’re sending a large amount.

If you send more than the currency equivalent of 20,000 GBP a month (around 25,000 USD) you could get an automatic discount of up to 0.17%. There’s no need to pre-arrange the fee.

Here’s how the Wise high value payment discounts break down:

| Payment volume (GBP) | Discount |

|---|---|

| Under 20,000/month | 0 |

| 20,000 – 300,000/month | 0.1% |

| 300,000 – 500,000/month | 0.15% |

| 500,000 – 1million/month | 0.16% |

| 1 million+/month | 0.17% |

The limits for Wise accounts held in licensed states, Guam and the Virgin Islands are as follows:

| Wise personal account transfer limit | Wise Business account transfer limit | |

|---|---|---|

| Per transfer | 1,000,000 USD | 1,000,000 USD |

| ACH | 50,000 USD per day 250,000 USD per 60 day period | 50,000 USD per day 400,000 USD per 60 day period |

| Debit or credit card | 2,000 USD per day 8,000 USD per week | 2,000 USD per day 8,000 USD per week |

If your account address is in Nevada, American Samoa, or Mariana Islands the limits are slightly different:

| Wise personal account transfer limit | |

|---|---|

| Per transfer | 50,000 USD |

| Per year | 250,000 USD |

| ACH limit | 10,000 USD per day 400,000 USD in a 60 day period |

Learn more: How to send large transfers with Wise

Xe Money Transfer

| Xe Money Transfer – best features for high value transfers |

|---|

|

With Xe Money Transfer you can send a payment online or in app to 130+ countries from the US, for personal or business use. Xe has a fixed limit of 535,000 USD or the currency equivalent per personal payment. This limit does not apply on business transfers.

Xe does not market volume discounts on fees or exchange rates, but if you’re using the service for a big transfer it may be worth calling them to check if there’s a good deal to be had.

How long do large transfers take with Bank of America?

When you send a payment with Bank of America your money is debited from your nominated account, then sent to the beneficiary’s bank. It will be received by the beneficiary bank in 1 – 2 days, and then the bank must deposit the money to your recipient’s specific account, which may take another day or two.

All in all, once your payment is initiated it is likely to take 1 – 4 business days to arrive, although there are some countries which Bank of America designates slow to pay countries, where transfers take longer.

To make sure your payment with Bank of America starts to be processed as soon as possible, arrange it before 5pm Eastern Time on a working day.

How to send a large amount transfer with Bank of America

You can send a payment with Bank of America online or in the mobile banking network if you’re sending under 1,000 USD over the course of a day. If you want to enroll in the secure transfer service you can do so with your debit card number, and a US mobile number or a USB security key.

Here’s how to arrange a Bank of America transfer online or in app:

- Log on to Bank of america online or in app

- Select Pay & Transfer

- Add your recipient, tap the funding account, and enter the payment amount

- Review and send your payment

If you’re sending more than 1,000 USD you will need to make an appointment in a Bank of America financial center to set up your transfer in person.

Information needed to send large amounts of money with Bank of America

You will need the following information to send a payment with Bank of America:

- Recipient’s name and address

- Recipient’s bank account number or IBAN

- Recipient’s bank SWIFT code

Some countries also require some extra information, such as Canada’s Transit Code or India’s IFSC code.

Is it possible to increase Bank of America transfer limits?

If you need to send an amount above the payment limit for digital transfers, you’ll need to visit a Bank of America branch or financial centre to arrange your transfer. In branch limits may depend on the account type you have.

How to increase Bank of America transfer limits

Make an appointment at your local Bank of America financial center to send a high value payment. You can find the list of locations on the Bank of America website or in their app, and arrange an appointment online to avoid waiting around for service.

How to receive large transfers with Bank of America

There’s not usually any Bank of America limit for receiving international wire transfers. Bank of America has a 15 USD fee for incoming payments from the US and overseas.

To receive a payment, you’ll need to give the sender your Bank of America account number and wire routing number.

You must also give them the correct SWIFT and address information:

Wires sent in U.S. dollars or unknown currency:

Swift Code: BOFAUS3N

Address: Bank of America, N.A., 222 Broadway, New York, NY 10038

Wires sent in Foreign currency:

SWIFT Code: BOFAUS6S

Address: Bank of America, N.A., 555 California St. San Francisco, CA 94104

Learn more: Bank of America address for wire transfers

Alternatives to Bank of America for receiving large payments

Receiving a large value payment to your Bank of America account is hassle free but can mean paying an incoming wire fee. Transfers to your bank are also not always the fastest or cheapest option.

If your sender is overseas, for example, you may find you get less than you expect because of third party charges involved in sending the payment via SWIFT.

You may avoid some of these costs if you choose to receive your payment to a specialist multi currency account which lets you receive payments in a foreign currency instead:

Wise Account: Receive money with local and SWIFT account information in 8+ currencies, with quick payment options and low or no fees. Hold, send, or spend your money as you choose, with mid-market exchange rates

OFX Business Account: Receive business payments in 7 major currencies to your OFX account, which you can use for future payments or withdraw to your US bank later. There’s no OFX fee to receive a payment in a foreign currency with your local account information

Bank of America business payments limits

Bank of America publishes its limits for small business customers. Larger organisations which use the bank’s corporate banking services are likely to have higher limits which can be negotiated according to customer needs.

Here’s a reminder of the small business limits for Bank of America:

| Transfer type | Bank of America business transfer limit |

|---|---|

| Outgoing international payment | Online: 5,000 USD/day for small business You may be able to send more by visiting a branch instead |

| Incoming international payment | No limit |

| Outgoing domestic payment | Next day ACH: 5,000 USD/day for small business 3 day ACH: 5,000 USD/day for small business |

| Incoming domestic payment | Next day ACH: No limits 3 day ACH: No limit for small business |

*Correct at time of research – 2nd December 2024

Bank of America customer support for high amount transfers

Bank of America has customer support through its branch and financial centre network and also by phone. To call the bank you’ll need to dial 844 375 7028, and you can also schedule advance appointments to attend a branch through the app.

If you are a Bank of America customer, our guides might help you with your international banking:

- Bank of America non resident bank account

- Bank of America currency exchange

- Bank of America foreign transaction fees

- Bank of America foreign currency account alternatives

Conclusion: Does Bank of America have transfer limits?

Bank of America has fairly low online payment limits, set at 1,000 USD/day for consumers, 5,000 USD/day for small business customers. If you want to send more than this you’ll need to schedule an appointment in a branch location. This shouldn’t cost you more, but it’s not the most convenient option either.

If you want to send a higher value payment online or using an app, you may want to consider alternative services like Wise and OFX which both offer high value payments which can be arranged securely without even needing to leave home.

BofA transfer limits FAQs

How much can I transfer with BofA internationally online?

Bank of America online transfer limits are 1,000 USD/day for consumers, 5,000 USD/day for small business customers. Alternatives include Wise which has lower costs when sending over about 25,000 USD in a month, and OFX which has no transfer fee and no maximum cap on the send amount.

Learn more: Bank of America Business Account

What is the maximum amount you can transfer abroad with Bank of America?

Bank of America does not publish the sending limit for in branch payments. This may vary depending on your account type, where you’re sending money to and the reasons for the transfer for example. You’ll need to schedule an appointment to visit a branch and discuss your needs with a member of the team.

How can I increase the Bank of America maximum transfer limit?

You’ll usually have to make an appointment at your local Bank of America financial center to send a high value payment. You can find the list of locations on the Bank of America website or in their app, and arrange an appointment online.

Learn more on BofA transfer fees, exchange rates and limits on our guide: BofA international wire transfers