Best CAD foreign currency accounts in US [2025]

If you send, receive, hold, or spend Canadian dollars (CAD) frequently, you might be considering getting a CAD account.

While it’s possible to open a Canadian dollar account from the US, you might find you can’t easily get an account with a traditional US or Canadian bank. Major US banks don’t typically offer CAD accounts, and while Canadian banks do offer accounts to non-residents, these are often meant for people planning to relocate north of the border permanently. Instead of relying on your normal bank, you might be better off with specialist providers like Wise and Revolut.

In this article, we’ll walk through everything you need to know about opening a Canadian dollar account, including the best CAD account US, the costs, and how to open one.

What is a CAD account?

A CAD account, used to hold Canadian dollars, can be a valuable resource if you travel frequently or need to send or spend Canadian dollars. It is also convenient for anyone who shops with Canadian ecommerce stores as you’ll be able to pay in Canadian dollars rather than using USD. That can mean you avoid foreign transaction fees.

If you’ve got recurring payments in Canada, such as mortgage payments for a vacation home, a CAD account can also make life easier – and maybe cheaper, too.

Businesses, freelancers, and entrepreneurs with customers, contractors or suppliers in Canada can use a CAD account to streamline the process of sending and receiving payments in CAD. If you work through payment service providers like Stripe and marketplaces like Amazon you can also use CAD bank details to get paid without needing to convert back to USD immediately. You then have the option to hold the CAD balance until you need to make a payment in Canada or withdraw it back to your regular USD account when the rates look good.

How does a CAD account work?

The primary function of a CAD account is to hold and exchange Canadian dollars. Some providers also offer local CAD account details that you can give to anyone looking to send you money in CAD.

CAD accounts may also offer a linked debit card for seamless online, in person and mobile transactions, and preferential exchange rates so you can do more with your money.

CAD account details

Not all CAD accounts offer CAD account details – but having them simplifies receiving payments from others, both for personal transfers and business purposes. The sender can simply set up a local transfer from their own CAD account, which is usually cheap or free for them – and it’s often free for you to receive the funds, too.

One provider that offers CAD details, which we will discuss in detail later, is Wise. To get Wise local account details for receiving CAD, first set up your Wise account online or through the Wise app. Once your account is up and running, just tap Open and then Balance and select CAD to retrieve local details for receiving Canadian dollars to your account. You’ll receive a CAD account number and transit number – plus, you can also get account details for other countries and currencies, such as IBAN and BIC for euros, if needed.

6 Best CAD accounts

Let’s run through some of the options for CAD accounts for US based individuals and businesses. We’ll look at a mix of online specialists, and some international banking options from traditional banks, for individuals, online sellers and businesses.

| Provider | Availability | Fees | Debit card | Other features |

|---|---|---|---|---|

| Wise | Personal and business customers | No opening or monthly fees for personal accounts One time 31 USD payment for business account | Available |

|

| Revolut | Personal and business customers | No-fee standard accounts available for personal and business customers Paid plans available for up to 16.99 USD/month for personal customers and 149.99 USD/month for business clients | Available |

|

| HSBC | Personal customers in eligible states | No account opening fees No transfer fees – exchange rate markups will apply | Not available |

|

| Natwest | Personal and business customers | Up to currency equivalent of 8 GBP/month | Available |

|

| OFX | Online sellers | No fee to open or operate account, but currency exchange rate markups will apply when converting currencies or sending international payments | Not available |

|

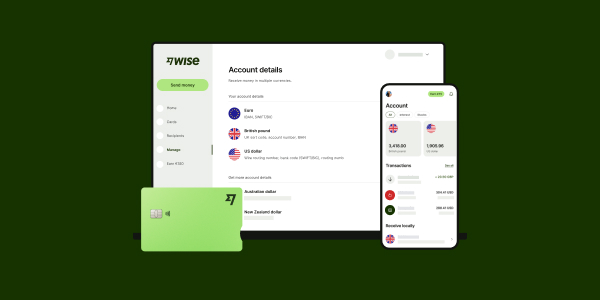

Wise

Wise accounts for personal customers can be opened free online with no minimum balance, and can hold CAD as well as 40+ other currencies. You can get your own bank account details for 10 different currencies including CAD to get paid from 30 countries just like a local. You’ll also be able to order a linked debit card for spending and withdrawals at home and abroad. All currency conversion uses the mid-market exchange rate with low, transparent fees.

Fees: No fee to open a personal account, 31 USD one-off fee to open a business account. No monthly fee for either personal or business accounts

Currencies covered: Hold and convert 40+ currencies, get local receiving accounts for 9 currencies

Wise currency conversion: Mid-market exchange rate

Other notable features: Receive payments like a local from 30 countries, send money to 70+ countries, spend with your linked debit card in 170+ countries

Revolut

Revolut offers both personal and business accounts which can hold 28+ different currencies including CAD. For both individuals and businesses, standard plans are no-fee and offer features such as 1,000 USD/month currency conversion with the mid-market exchange rate for personal customers. Paid plans offer higher no-fee limits, and perks like lounge access and insurance discounts.

Fees: Standard accounts are no-fee. Upgrade to a fee paid personal account for up to 16.99 USD/month or a fee paid business account for up to 149.99 USD/month

Currencies covered: Personal accounts can hold and exchange 25+ currencies, for business accounts, 28+ fiat currencies available

Currency conversion: Mid-market exchange rate to plan limits, out of hours and fair usage fees may apply

Other notable features: Broad range of account services including budgeting tools, savings and investments

HSBC US

HSBC US offers a Global Money Account in 8 currencies including CAD. It’s free to open the account, although you’ll need an HSBC deposit account to link to it. This account is operated entirely from your phone or mobile device, which will suit people who need to manage their money on the go.

HSBC US recently announced it would stop serving some states – double check the details for your state before you begin the application process.

Fees: No fees to open account or send global transfers – an exchange rate margin will apply when you convert between currencies in the account, or send to a different currency

Currencies covered: USD + 7 foreign currencies offered for holding and exchange

Currency conversion: Exchange rates are likely to include a markup

Other notable features: Not available in all US states – check the details before you apply

Natwest

Natwest offers foreign currency accounts through its international division, which are available for US residents. Natwest’s International Select Account lets customers hold and manage 25 major currencies including CAD. You’ll need a minimum opening deposit of the currency equivalent of 25,000 GBP to open your account, which can also be paired with a Cash Management account for foreign currency savings.

Businesses can also open a Cash Management account to hold, grow and manage their foreign currency balance, including holding CAD.

Fees: Currency equivalent of 8 GBP/month

Currencies covered: 25 major currencies covered

Currency conversion: Exchange rates have a markup which varies by currency

Other notable features: Minimum deposit of 25,000 GBP. Cash Management savings and fixed term deposit accounts also available in CAD

OFX

Currency specialist OFX has a Global Currency Account for online sellers which lets account holders accept payments in 7 different currencies including CAD. Get paid from marketplaces like Amazon, and use your local bank account details to get paid in a range of global currencies without fees. You can also access OFX’s currency risk management products like forward exchange contracts which can be used to lock in an exchange rate for a future payment.

Fees: No fees to open or operate account

Currencies covered: 7 currencies offered

OFX currency conversion: Exchange rates include a small markup

Other notable features: OFX transfers and currency conversion have no upfront fees but there will be a markup on the exchange rate used. Currency risk management products also available, with support of personal brokers

How to open a CAD account in the US

The easiest way to open a CAD account is likely to be with a specialist online service. If you intend to open an account with a physical bank in Canada you’ll usually need to visit a branch to present your verification documents and get started. In either case, the process is usually similar:

- Choose the best provider for your needs

- Register for your account online, through the provider app, or in a branch

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

When you open your account you’ll need to prove your ID and residential address. The exact documents you need will vary depending on the account type, but can include:

- Government issued photo ID

- Proof of address – a utility bill or bank statement in your name for example

- Business registration documents if you’re opening a business account

Can I open a CAD account in the US?

Few US based traditional banks offer CAD accounts to retail customers. That likely means you’ll need an alternative such as:

- A Canadian bank which offers non-resident accounts

- A global bank with an international banking division

- A specialist provider which offers flexible accounts in CAD

Many Canadian banks have newcomer programs which exist to help people moving to Canada full-time to get an account prior to moving. However, if you don’t intend to move to Canada, getting an account with a traditional Canadian bank may be trickier.

Global banks may allow US citizens to open CAD accounts through their international banking divisions, but eligibility criteria and high minimum balances do often apply.

For many people, the best option will be a specialist online service, which may be cheaper and more flexible. A couple worth checking out are Wise and Revolut. We’ll dive into these providers in more detail later, but they both offer the option to manage dozens of currencies on your phone or laptop, with linked cards for spending and withdrawals, and free or low cost currency conversion, depending on the account type you prefer.

With Wise you’ll also get local account details in 10 currencies, including Canadian Dollar, to get paid directly to your account from 30+ countries easily.

What are the advantages of a CAD account in the US?

If you transact regularly in Canadian dollars – either for yourself or your business – you may benefit from a CAD account.

A foreign currency account can cut the costs of international transactions, and also make it easier to manage fluctuations in currency exchange rates. Avoid losses by holding a CAD balance rather than selling when rates look poor. Or maximize gains by buying Canadian Dollar when the rates are good, and holding them until you need them

CAD accounts can also make it far easier – and cheaper – to get paid from Canada if you’re a business owner, freelancer or online seller. Get paid for free by local transfer from Canadian clients, or use your account to collect CAD payments from PSPs like Stripe and marketplaces like Amazon. Hold your balance as it is, or convert it back to USD at your convenience.

How to open a CAD account online

You can open a Canadian account from the US online with a provider like Wise or Revolut. Digital services like these have developed a fully online or in-app application, onboarding and verification process so you can get your account set up without leaving home.

Let’s walk through the steps to open a CAD account with Wise to show how it’s done:

- Download the Wise app or open the Wise desktop site

- Register with your email, Facebook, Apple or Google ID

- Complete the verification step

- You’re ready to send or receive a transfer, order a card or add a balance

As with all financial service providers, Wise requires customers to provide some paperwork for verification before accounts can be used for transactions. This is to keep accounts safe and comply with legal requirements. To set up your Wise personal account you’ll need to upload images of:

- Proof of ID – like your passport, driving license or ID card

- Proof of address – like a utility bill or government letter in your name

Business customers may need to add some additional documents and business information. But the good news is that the whole process can be managed online or in-app, without needing to leave home.

CAD account with debit card

If you want a CAD account for day to day use you probably also want a debit card to make it easy to spend and withdraw in CAD. Here, specialist services like Wise and Revolut can help, with physical and virtual cards you can use online, in person and with mobile apps and wallets. Open your account online or in app, add funds in USD or your preferred currency and begin spending CAD easily.

- Wise account & card: Hold Canadian Dollars and an extra 40+ currencies, with no fee to spend any currency you hold with your linked Wise Multi-Currency Card. If you don’t have the balance you need, the Wise Multi-Currency Card can convert automatically for you, with the mid-market rate and low fees from 0.41%

- Revolut account & card: Hold 25+ currencies, and spend globally with your linked payment card. Currency exchange uses the mid-market rate to your plan limit – after that a fair usage fee of 0.5% may apply for conversion. Out of hours fees may also be added for conversion and spending while currency markets are closed.

Foreign currency bank accounts in the US for GBP

Foreign currency accounts are pretty hard to come by if you’re sticking with major banks. The foreign currency accounts on the market typically target high-net-worth individuals looking to invest, business owners making overseas payments, and corporate clients with international treasury needs. However, digital providers such as Wise or Revolut can be a good alternative, with accessible solutions for individuals looking for flexible foreign currency accounts.

Here’s our review and comparison of some of the best foreign currency accounts in the US. Plus, a quick summary of the providers we covered earlier, as a reminder:

- Wise account: Manage your money across 40+ currencies including CAD online or in-app, and get a linked card to spend in 170+ countries. Currency conversion uses the mid-market rate and low fees from 0.41%

- Revolut account: Pick the account plan to suit your specific needs, with currency exchange that uses the mid-market rate to plan limits, for sending payments or spending with your linked card – subject to fair usage and out of hours fees

- HSBC Global Money Account: Hold 8 currencies, no fee to open an account. Manage your money through a mobile app – there’s no debit card, but you can send global transfers easily in a selection of currencies

- Natwest: Open accounts to hold and manage any of 25 currencies, with fees from the equivalent of 8 GBP/month. Account options include saving products as well as holding accounts, with a minimum balance from the equivalent of 25,000 GBP

- OFX Global Currency Account: Business owners and freelancers can hold and exchange 7 currencies, and receive payments from customers and platforms easily. Currency exchange uses a small markup on the mid-market rate

Conclusion: What is the best Canadian dollar account in the US?

Despite being close neighbors it can be harder than you expect to open a CAD account with a traditional bank – either in the US or over the border. However, there are ways to get a CAD account as a US citizen or resident – and it’s well worth checking out the options to help you cut international payment costs and manage fluctuations in the exchange rate more easily.

For many customers looking for a CAD account from the US, an online provider may be the smart alternative to a bank. You’ll often find you can get a flexible account with low fees and no minimum balance requirement, which you can open from home on your smartphone. Providers like Wise and Revolut let you hold dozens of currencies, spend on a linked payment card, and convert between currencies in just a few taps whenever you need to.

Use this guide to kickstart your research and find the best CAD account for you, whether you’re a personal or business customer, freelancer or online seller.

Canadian dollar bank account FAQs

Can I open a CAD account in the US?

You can open a Canadian dollar account in the US, but your normal bank might not be able to help you – often the easiest way is using a specialist online service. Use this guide to start your research to find the perfect CAD account for your needs.

How much does it cost to open a CAD account?

Many CAD accounts from online specialist services are free to open with low, or no ongoing fees.

Which US banks offer CAD currency accounts?

There’s not a huge choice of CAD accounts for US residents from major banks. Check out HSBC which has a mobile account to hold and exchange Canadian dollars alongside a few other currencies. Or, have a look at an alternative like Wise and Revolut, for a flexible low cost account you can do more with.

Can a foreigner open a CAD account in the US?

Your nationality isn’t usually a barrier to opening a bank account – but you’ll need to find an account that suits your needs, which can be a challenge if you’re in the US looking for a CAD account with a major bank. As a smart alternative, why not use your US proof of ID and address to open a CAD account with a digital service like Wise or Revolut.

Can a US citizen have a CAD bank account?

Yes. Open a CAD account with a major bank or a non-bank specialist provider. Which suits you best depends on your preferences and needs. Large banks have CAD account options which often focus on investors – while specialists like Wise or Revolut have day to day accounts you can manage from your phone.