Best GBP accounts in US [2025]

If you send, receive, hold, or spend British pounds (GBP) frequently, you could save time and money with a GBP bank account. Sterling accounts can be useful for both individuals and businesses, to cut the costs of international transactions and currency conversion.

You may find it more difficult than you expect to open a pound sterling account with your bank in the US, although some global British banking brands do offer GBP accounts to US citizens and residents.

The downside here can be that GBP accounts from banks can be cumbersome, slow, and expensive. Specialist providers like Wise and Revolut can be good alternatives.

In this article, we’ll walk through everything you need to know about opening a pound sterling account, including the best GBP account US, the costs, and how to open one.

Quick summary: GBP currency account

| Provider | 💡 Great for |

|---|---|

| Wise | Personal and business accounts to receive, hold, send and spend GBP alongside many other currencies |

| Revolut | Choose from several different account plans which all offer GBP functions, and a linked debit card |

| HSBC | Add GBP features to your HSBC USD account by opening a Global Money account in the HSBC app |

| Natwest | International banking services in many currencies, for high wealth individuals |

| Airwallex | Business account with GBP details and ways to get paid by card, transfer and through PSPs and marketplaces |

| Barclays International | International banking services which may offer a relationship manager to high wealth individuals to manage their money effectively |

Here are some frequently asked questions, and their answers:

| Questions | Answers |

|---|---|

| Can I open a GBP account in the US? | Yes. Open a GBP account with a bank like HSBC or an online provider like Wise or Revolut. |

| How much does it cost to open a GBP account? | You may pay a one off or monthly fee to open a GBP account, or you may need to hold a minimum deposit in your account. Costs vary a lot, so shopping around is essential. |

| Which US banks offer GBP currency accounts? | Banks like HSBC, Everbank and East West could offer you a GBP account in the US, although features may be aimed at investors and savers rather than for day to day use. |

What is a GBP account?

A GBP account – which can be used to hold British pounds, often alongside other currencies – is a valuable tool for individuals and businesses alike. If you travel frequently or need to send or spend pounds, a GBP account could be particularly useful.

It’s also handy for anyone who shops with UK based e-commerce stores and pays in pounds. Finally, individuals with recurring payments to the UK, such as mortgage payments for a vacation home, can also take advantage of a GBP account to make payments easier, and often cheaper, too.

For businesses, freelancers and entrepreneurs, a GBP account is useful for receiving payments from UK based customers, and for paying contractors or suppliers in the UK. Plus, use your GBP account to collect payments from payment service providers like Stripe and marketplaces like Amazon. You can then either hold the balance in pounds until you need to make a payment to someone in the UK, or withdraw back to your local USD account if you’d prefer.

How does a GBP account work?

With a GBP account, you’ll be able to:

- Hold and exchange British pounds

- You may get local GBP account details to receive payments

- Send payments in GBP and other currencies to other bank accounts

- Spend GBP with a linked debit card

- Exchange currencies in your account, to withdraw a balance to USD for example

Can I open a GBP account in the US?

Few US based banks offer GBP accounts to retail customers. However, you do have a couple of options here. Many UK based banks allow non-residents – including US citizens – to open GBP accounts through their international banking divisions. Eligibility criteria and high minimum balances do often apply, though.

You might find you’re better off looking at specialist online services instead, which tend to be cheaper and have less restrictive eligibility criteria. Many online providers also offer accounts tailored to US businesses, freelancers and online sellers who need a GBP account to transact internationally.

A couple to look at in particular are Wise and Revolut. Both have services for personal and business customers, which let you hold dozens of currencies, including GBP and USD.

- You’ll be able to get a linked debit card,

- Convert between currencies with low or no fees, depending on the account type you pick.

- With Wise you can also get GBP account details, to get paid into your Wise account just like a UK local would.

This guide will walk through some smart options to help you find the best GBP account in the US for yourself or your business.

Best GBP accounts in the US

There are a few great providers both in the UK and internationally, which offer GBP accounts for US based individuals and businesses. Picking the best one for you will depend on your specific needs and the sort of transactions you’ll want to make. Here are a few options to consider:

| Provider | Availability | Fees | Debit card | Other features |

|---|---|---|---|---|

| Wise

| Personal and business customers |

| Yes |

|

| Revolut | Personal and business customers |

| Yes |

|

| HSBC | Personal customers in eligible states |

| No |

|

| Natwest | Personal and business customers |

| Yes |

|

| Airwallex | Business customers |

| Yes |

|

| Barclays International | High wealth individual |

| Yes |

|

Information correct at the time of writing – 16th of October, 2024.

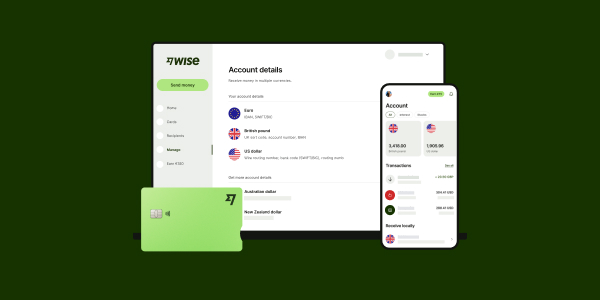

Wise GBP Account

| 💡 Great for: Managing GBP alongside 40+ other currencies with the mid-market exchange rate |

Wise accounts are designed for personal and business customers and can hold GBP as well as 40+ other currencies. When you open a Wise account for free online you can get your own account details for 8+ different currencies including GBP, as well as a linked debit card for spending and withdrawals at home and abroad.

Hold and convert currencies in your account, or send payments to 160+ countries – currency conversion uses the mid-market exchange rate with low, transparent fees.

| Wise GBP account pros | Wise GBP account cons |

|---|---|

| ✅ Receive GBP payments for free ✅ Hold and exchange with the mid-market rate ✅ GBP supported alongside USD and 40+ other currencies ✅ Send money from 0.33% | ❌ Variable fees apply on currency exchange ❌ No branch network |

Wise fees: No fee to open a personal account, 31 USD one-off fee to open a business account. No monthly fee for either personal or business accounts

Currencies covered: Hold and convert 40+ currencies, get local account details for 8+ currencies

Wise currency conversion: Mid-market exchange rate

Other notable features: Receive payments like a local from 30 countries, send money to 160+ countries, spend with your linked debit card in 150+ countries

GBP account details: Available – GBP account number and sort code supplied

Account limits: Some Wise US account holders have a holding limit, but in most cases there’s no limit to the amount you can have in your account (If the routing number starts with 026, there is a limit of $35m per year)

Interest rates: Variable rate up to 4.18% at time of writing

Learn more: Wise GBP Account Review

Revolut GBP Account

| 💡 Great for: Choosing between different account types to get the right match for your transaction needs |

Revolut accounts for both personal and business customers can hold 25+ different currencies including GBP. Standard plans have no monthly fee or you can choose to upgrade to a paid plan for more features and no-fee transactions. Even the no-fee Standard plans offer up to 1,000 USD/month currency conversion which uses the Revolut exchange rate with no additional fee, meaning you can top up your account in USD and switch to GBP when you need to. Plans with monthly charges offer higher no-fee limits.

| Revolut GBP account pros | Revolut GBP account cons |

|---|---|

| ✅ Choose from several account tiers ✅ Get local GBP account details to receive payments ✅ Some currency exchange with no additional fee monthly ✅ Accounts offer a debit card | ❌ Monthly fees for most feature packed accounts ❌ Fair usage and out of hours fees may apply on currency conversion |

Fees: Standard accounts are no-fee. Upgrade to a monthly fee paid personal account for up to 16.99 USD/month or a fee paid business account for up to 149.99 USD/month

Currencies covered: Hold and exchange 25+ currencies

Currency conversion: Revolut exchange rate with no additional fee to plan limits, out of hours and fair usage fees may apply

Other notable features: Broad range of account services including budgeting tools, savings and investments

GBP account details: Available – GBP account number and sort code supplied

Account limits: Transfer limits vary by country – domestic payments available up to 50,000 USD for wires, or 175,000 USD for ACH

Interest rates: Variable rate to 4.25% at time of research

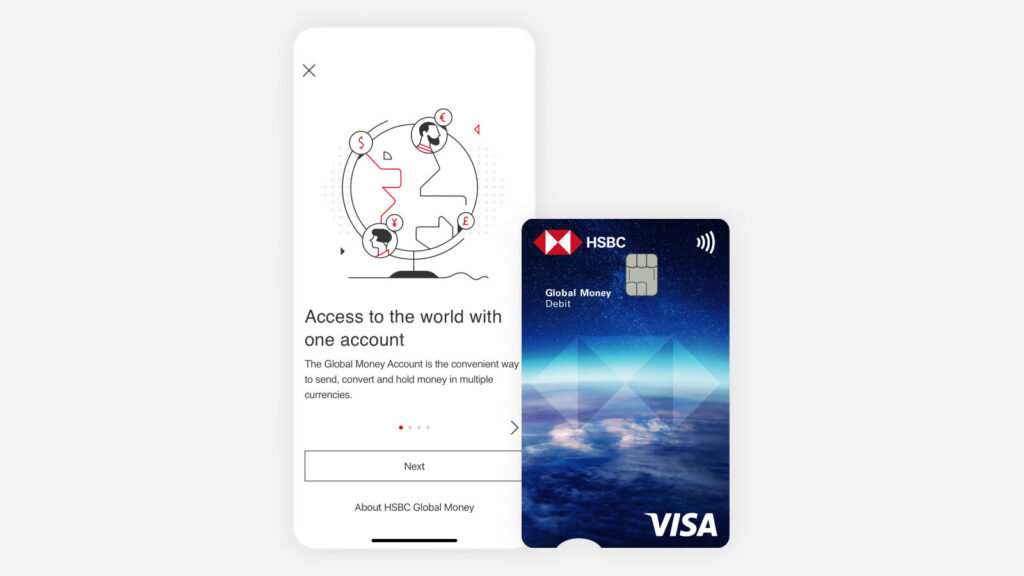

HSBC US

| 💡 Great for: Existing HSBC US customers looking to add GBP functions to their account, for sending payments abroad |

The HSBC US Global Money Account can be opened in 8 currencies including GBP. There are no fees to open the account, and you’ll be able to manage your money entirely from your mobile device. You’ll need an HSBC deposit account to link to your Global Money Account.

HSBC US recently announced it would stop serving some states – double check the details for your state before you begin the application process.

| HSBC GBP account pros | HSBC GBP account cons |

|---|---|

| ✅ 8 supported currencies including GBP and USD ✅ Transfer globally from the HSBC app ✅ Move your money between your HSBC accounts ✅ No ongoing fees | ❌ Not intended for sending to banks other than HSBC ❌ No card |

Fees: No fees to open account or send global transfers – an exchange rate margin will apply when you convert between currencies in the account, or send to a different currency

Currencies covered: USD + 7 foreign currencies offered for holding and exchange

Currency conversion: Exchange rates are likely to include a markup

Other notable features: Not available in all US states – check the details before you apply

GBP account details: Not specified – designed to move money from one HSBC account to another only

Account limits: Send up to 50,000 USD to a third party HSBC account, or 200,000 USD to an account in your own name

Interest rates: Add on a savings account product for interest

Natwest

| 💡 Great for: High wealth individuals who need to manage GBP alongside a broad range of other currencies |

Natwest’s International Select Account lets customers hold and manage 25 currencies including GBP. If you’re a US resident and can place a minimum opening deposit of 25,000 GBP to open your account, you may be eligible to get your International Select Account, which can also be paired with a Cash Management account for foreign currency savings.

Businesses can also open a Cash Management account to hold, grow and manage their foreign currency balance, including holding GBP.

| Natwest GBP account pros | Natwest GBP account cons |

|---|---|

| ✅ 25 supported currencies ✅ Savings account products available ✅ Debit card available ✅ Offshore banking service, run through Jersey | ❌ High minimum balance ❌ Monthly fees apply |

Fees: Currency equivalent of 8 GBP/month

Currencies covered: 25 major currencies covered

Currency conversion: Exchange rates have a markup which varies by currency

Other notable features: Minimum deposit of 25,000 GBP. Cash Management savings and fixed term deposit accounts also available in GBP

GBP account details: Not specified

Account limits: Hold any amount, transfer up to 100,000 GBP daily

Interest rates: Open a Cash Management account to earn interest – fixed term and instant access options available

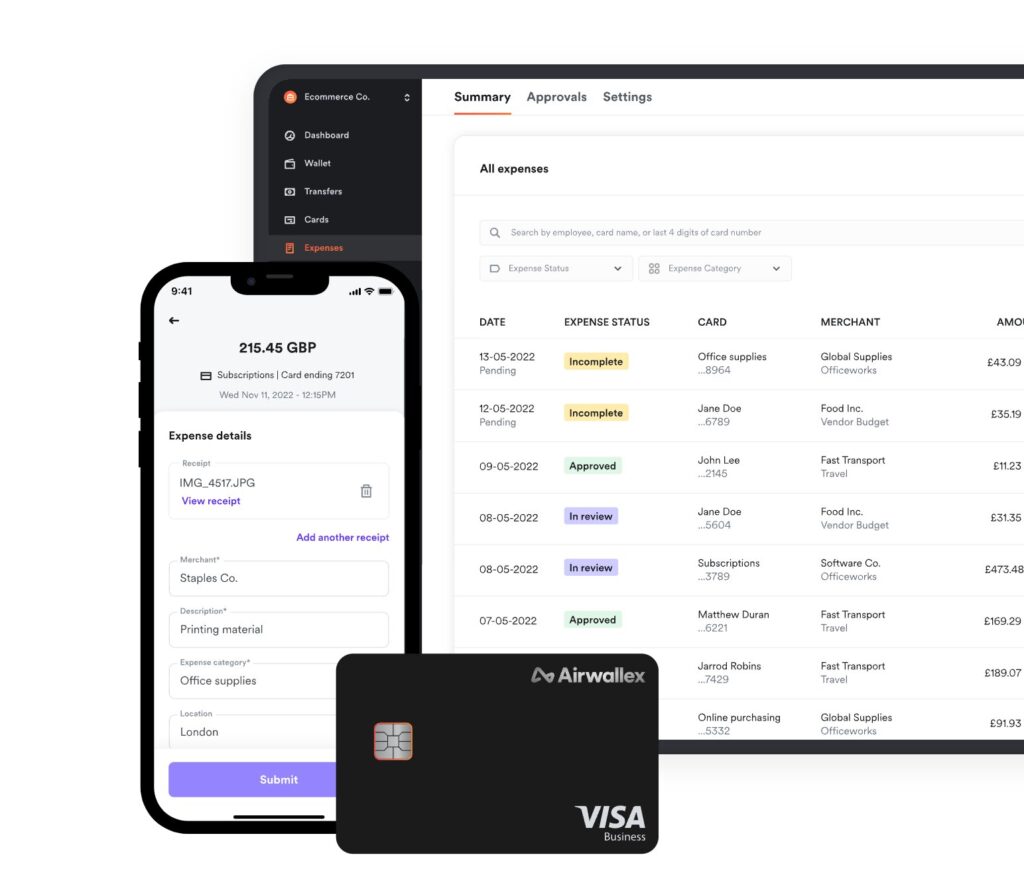

Airwallex

| 💡 Great for: Businesses and online sellers receiving payments from customers, PSPs and marketplaces in GBP |

Airwallex has business accounts which are designed to hold GBP, USD and a selection of other currencies. Integrate your account with online stores if you’re an ecommerce seller, or use your local account details to get paid in GBP from international clients. Currency conversion is available with a competitive exchange rate. Debit cards are available for account holders and their teams.

| Airwallex GBP account pros | Airwallex GBP account cons |

|---|---|

| ✅ Get local details for GBP and many other currencies ✅ Low currency conversion fee of 1% or less ✅ Order business debit card for GBP spending ✅ Take ecommerce store payments | ❌ No personal accounts ❌ Debit card can’t be used in an ATM |

Fees: No fees to open or operate account

Currencies covered: Local receiving accounts in many major global currencies, payout to 130 countries

Currency conversion: Exchange rates have a low markup from 0.5% – 1%

Other notable features: Business friendly features like bulk payments available

GBP account details: Available, alongside local details for 20+ other currencies

Account limits: Limits apply, which you can see by logging into your account

Interest rates: Not interest bearing

Barclays International

| 💡 Great for: High wealth individuals looking for bespoke currency solutions in GBP or other currencies |

Barclays International offers foreign currency accounts which are aimed at high wealth individuals who would like to open an account in GBP and access personal banking services. These accounts are held in the Isle of Man, and provided through Barclay’s specialist international banking division. As Barclays is a large global bank, you’ll also be able to access a range of other products like overdrafts, investments and advice about mortgage products which may be available to you.

| Barclays GBP account pros | Barclays GBP account cons |

|---|---|

| ✅ Get a full range of GBP support and services ✅ Relationship banking service available ✅ Savings account products offered for interest earning ✅No monthly fee if you hit minimum balance requirement | ❌ Very high minimum balance requirements ❌ 40 GBP/month fall below fee |

Fees: No monthly fee if you maintain a minimum balance of 100,000 GBP or currency equivalent – fall below fee may apply if you fail to maintain this balance

Currencies covered: Accounts available in EUR, USD and GBP; you can also trade in up to 60 different currencies

Currency conversion: Exchange rates have a markup which varies by currency

Other notable features: Minimum opening balance is 100,000 GBP in either this account or other eligible Barclays products

GBP account details: Not specified

Account limits: Limits apply on some savings accounts, but products are aimed at wealthy individuals, with high limits for convenience

Interest rates: Variable rates – International Reserve Account pays up to 3.05% at time of research

How to transfer money to your GBP account in the US

If you’re going to be using your GBP account for payments to the UK you’ll need to add some money to it. Some banks only allow you to add money from another account you hold with that institution, while others give you local GBP account details which you can use to send money to your account yourself, or to give to others who need to send you money.

Consider using a provider like Wise or Revolut if this is an important feature – both offer GBP and USD account information which you can use to receive convenient local payments in USD or GBP.

Once you have funds in your account you can send payments through the bank or provider you hold the account with, or through another third party service.

Let’s look at how to send money with Wise as an example. To send a transfer with Wise you’ll need to create an account, and depending on the type of payment you want to make you might need to provide some ID or your SSN for verification.

Once your account is up and running make payments online and in the Wise app:

- Log into your account

- Type in how much you want to transfer, or how much you need the recipient to get

- Enter the recipient’s details – bank account number or email

- Check over the details

- Fund your payment using a card or bank transfer

- Confirm and your money will be on the move

How to transfer large amounts from your GBP account

If you’re using your account for high value payments you’ll want to know about the limits which apply to it to ensure you can transact freely. In many cases, limits are variable depending on how you use your account and the type of transaction you’re trying to make. Here’s a quick summary of some of the limits on the accounts we’ve looked at in this guide:

| Provider | Large amount transfers |

|---|---|

| Wise limits | Payment limits vary by currency, usually around 1 million GBP or the equivalent |

| Revolut limits | Transfer limits vary by country – domestic payments available up to 50,000 USD for wires, or 175,000 USD for ACH |

| HSBC limits | Send up to 50,000 USD to a third party HSBC account, or 200,000 USD to an account in your own name |

| Natwest limits | Hold any amount, transfer up to 100,000 GBP daily |

| Airwallex limits | Limits apply, which you can see by logging into your account |

| Barclays International limits | Limits apply on some savings accounts, but products are aimed at wealthy individuals, with high limits for convenience |

How to open a GBP account in the US

Opening a GBP account with a specialist online service can usually be done easily online or on your mobile device. If you’d prefer to look for an account with a physical bank you may need to visit a branch to get started.

In either case, the process to open a GBP account in the US is usually similar:

- Choose the best provider for your needs

- Register for your account online, through the provider app, or in a branch

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

When you open your account you’ll need to prove your ID and residential address. The exact documents you need will vary depending on the account type, but can include:

- Government issued photo ID

- Proof of address – a utility bill or bank statement in your name for example

- Business registration documents if you’re opening a business account

How to open a GBP account online

You can open a UK account from the US, if you need to manage your money in pounds, but you’re not a UK resident just yet. The easiest option by far is to open a GBP account with a provider like Wise or Revolut, to get set up online or in an app, to hold and exchange GBP, USD and a selection of other major currencies.

Here’s how to open a GBP account with Wise as an easy example:

- Download the Wise app or open the Wise desktop site

- Register with your email, Facebook, Apple or Google ID

- Complete the verification step

- You’re ready to send or receive a transfer, order a card or add a balance

Getting verified with Wise is pretty easy, and can be done from your phone. It’s also an important step in keeping customers and their accounts safe. Here’s what you’ll need:

- Proof of ID – like your passport, driving license or ID card

- Proof of address – like a utility bill or government letter in your name

Business customers may need to add some additional documents and business information. But the good news is that the whole process can be managed online or in-app, without needing to leave home.

How to use GBP account

Let’s look at some of the most common ways to use a GBP account:

- Receive GBP payments: Get an account which has local UK details, including an account number and sort code, which you can use to receive payments in GBP from others. Or, as a business use your details to get payments from customers or through PSPs and marketplaces

- Send money internationally: Send personal or business transfers in GBP and other currencies, with low fees and a fast delivery time. Handy for making one off and recurring payments to anyone in the UK

- Hold GBP & USD in one place: Manage your money in different currencies side by side, to conveniently check transactions and spend in whichever country you choose

- Exchange between GBP & USD: Switch funds between dollars and pounds in your account. Look out for a good exchange rate and switch when you need to, before holding your balance in whichever currency you prefer

- Spend in the UK & the US: Get an account which offers a linked debit card to spend and withdraw when you travel. It’s usually free to spend a currency you hold in your account, so once you’ve got a GBP balance you can use your card in the UK with no foreign transaction fee

GBP account details

Getting local account details for GBP makes it far easier to get paid by others, either for personal transfers or for your business. Not all GBP accounts offer local account details, but one which does is Wise.

You’ll get a GBP account number, sort code and IBAN to receive payments from a bank in the UK. If you need account details for other countries and currencies – like your IBAN and BIC for euros – that’s also possible.

| GBP account details: |

|

To get Wise GBP local account details to receive payments in GBP:

- Set up your Wise account online or in the Wise app.

- Once your account is verified you can tap Open and Balance,

- and then select GBP to pull up local account details to receive pounds to your account

- You just need to give the sender your details to receive your GBP payment into your Wise account

Can a GBP account receive USD?

If someone sends you a payment in USD to your GBP account it will be converted to dollars, either by the senders bank, an intermediary, or your own bank. This can mean incurring a fee on the currency exchange, and some banks will also charge you for an incoming wire transfer.

You can avoid this issue by using an account which can hold multiple currencies. Options like Wise and Revolut give you local account details for USD as well as GBP. So if someone needs to send you dollars, just give them your account and routing number and the funds can be sent to your Wise or Revolut account without currency exchange. Hold your balance in USD or switch it to GBP or whichever other currency you need, conveniently.

GBP account with debit card

If you’re looking for an account to hold British pounds, with the bonus of a convenient way to spend your GBP balance, it may be worth exploring alternative options such as Wise or Revolut.

Open your account online or in app, and order a debit card to directly spend from your GBP balance. Simply add funds to your account in USD or your preferred currency and begin spending British pounds – often with low fees and a great exchange rate, too. Here are some of the best GBP currency cards:

- Wise account & card: Hold 40+ currencies including pounds, and spend any currency you hold for free with your linked Wise Multi-Currency Card. Switch USD to GBP before you spend – or let the card convert automatically with the mid-market rate and low fees from 0.33%

- Revolut account & card: Hold 25+ currencies, and use your linked payment card to spend globally. All currency exchange uses the Revolut rate with no additional fee until you hit your plan limit – after that a fair usage fee may apply for conversion. Out of hours fees may also be added for conversion and spending while currency markets are closed.

What are the advantages of opening a GBP bank account in the US?

- If you pay or get paid in British pounds regularly you may benefit from a GBP account.

- A foreign currency account can make it easier to ride out fluctuations in currency exchange rates. Hold your GBP balance if exchange rates deteriorate and convert it to USD only once the rates have improved. Or, look to capitalize on good exchange rates by buying pounds sterling for future use when the rates look good, and holding them in your GBP account until you need them.

- If you’re a business owner or work with international clients in the UK, a GBP account can make it far easier – and cheaper – to get paid. Just give your GBP account details to clients and have them pay you with a local transfer.

- It’s free for them, and fast for you. Or if you’re an online seller you can use your account to collect GBP payments from PSPs like Stripe and marketplaces like Amazon.

- Hold your balance as it is, or convert it back to USD using your preferred provider.

GBP business account in the US

The banks we have featured in this account offer foreign currency business services, but these may be aimed more at corporate clients looking for treasury management.

Smaller businesses may prefer to have a more flexible account for GBP which you could use in the following ways:

- Hold and exchange GBP and other foreign currencies

- Send low cost payments in GBP to contractors and suppliers

- Receive payments in GBP from customers

- Get a debit or expense card for team spending.

Alternative providers can often offer a comprehensive GBP currency account for business which has lots of great perks for businesses – you might consider these specialist services:

Wise business account review: There’s a one time fee to open an account, and no ongoing charges. Hold 40+ currencies, exchange with the mid-market rate, and get cloud accounting integrations and batch payments

Revolut business account review: Accounts may have monthly fees, and different plans offer their own levels of no fee or discounted transactions monthly. Hold and exchange 25+ currencies

Airwallex business account review: Hold and exchange 20+ currencies, send payments, and get physical and virtual cards for spending. No monthly fee to pay

GBP foreign currency bank accounts in the US

While a few major banks in the US do provide foreign currency accounts, they typically target high-net-worth individuals, business owners, and corporate clients. Here are a couple of options you might want to consider if you want an account based in the US:

East West Bank – GBP accounts are available for savings and investment, including foreign currency demand accounts and certificates of deposit

HSBC US: Open a Global Money account as an add-on to your HSBC USD account, which lets you move money between your HSBC accounts in 8 currencies

Everbank: 25 currencies available for savings and investment – minimum deposits of 2,500 USD to 20,000 USD depending on the account you pick

As an alternative option you might consider opening an account with a digital provider such as Wise or Revolut. These digital platforms offer accessible solutions for individuals looking for flexible foreign currency accounts, with a convenient and user-friendly banking experience.

Here’s our full guide to some of the best foreign currency accounts in the US.

Conclusion: What is the best British pound bank account in the US?

A GBP account can make life easier if you need to hold, send, receive or spend British pounds. You’ll cut international payment costs and can manage fluctuations in the exchange rate more easily. However, the main US banks don’t have a great range of pound sterling accounts on offer, and the accounts available from UK based providers often have restrictive eligibility requirements.

You may be better off choosing an online provider which can offer a more flexible account with lower fees and no minimum balance requirement. Check out Wise and Revolut to see if either of these leading providers might suit your needs.

With Wise you can open a personal account for free, to hold 50+ currencies and exchange between them with the mid-market rate and low fees from 0.33%. Revolut has a selection of account options, including standard plans which have no ongoing charges, and accounts with a monthly fee which have more features and fee free transactions.

Use this guide to kickstart your research and find your perfect GBP account match, whether you’re a personal or business customer, freelancer or online seller.

A quick summary of the providers we covered in this guide, as a reminder:

- Wise account: Open an account online or in-app, to hold 40+ currencies including GBP, and get a linked card to spend in 150+ countries. Whenever you switch currencies to send or spend, you get the mid-market rate and low fees from 0.33%

- Revolut account: Choose from a range of account plans, depending on the features you need from your account. Exchange currency with the Revolut rate to plan limits, for sending payments or spending with your linked card – subject to fair usage and out of hours fees

- HSBC Global Money Account: Hold 8 currencies, no fee to open an account. Manage your money through a mobile app – there’s no debit card, but you can send global transfers easily in a selection of currencies

- Natwest: Open accounts to hold and manage any of 25 currencies, with fees from the equivalent of 8 GBP/month. Account options include saving products as well as holding accounts, with a minimum balance from the equivalent of 25,000 GBP

- Airwallex: Business customers can open accounts in 20+ currencies, to get paid by customers and via platforms, and to send payments around the world in a good selection of currencies

- Barclays international: Accounts designed for high net worth individuals looking to deposit 100,000 GBP or more, with a range of personal services to help you manage and grow your money

British pounds bank account FAQs

Can I open a pound sterling bank account in the US?

You can open a pound sterling account in the US – often the easiest way is using a specialist online service or a UK based global banking brand. Use this guide to start your research to find the perfect GBP account for your needs.

How much does it cost to open a pound sterling account?

Many GBP accounts are free to open with low, or no ongoing fees. However, the GBP accounts offered through global banks’ international divisions may have high minimum balance requirements to avoid a fall below fee.

Which US banks offer GBP currency accounts?

There aren’t many GBP accounts on the market from US banks, although some international banking brands might be able to help. One to check out is HSBC with a mobile account to hold and exchange pounds alongside a small selection of other currencies. Or, have a look at an alternative like Wise and Revolut, for a flexible low cost account you can do more with.

Can a foreigner open a GBP account in the US?

There’s no legal reason why a foreigner can’t open a GBP account from the US, but as banks set their own policies, and don’t tend to offer a broad range of GBP products, you may find it tricky to find one that suits your needs. If you’d rather have a simple online experience, you can use your US proof of ID and address to open a GBP account with a digital service like Wise or Revolut.

Can a US citizen have a GBP bank account?

Yes. A US citizen can open a GBP bank account with a major bank or a specialist provider. There aren’t many GBP bank accounts on offer from US banks, so if you’re still US based and looking for a way to manage your money in pounds, a specialist service like Wise or Revolut may suit your needs better.