How to Open a Canadian Bank Account From USA without Leaving Home

If you’re a US resident who wants to work and study north of the border, it’s worth knowing how to open a Canadian bank account before you relocate to Canada. You can get your finances in order, transfer money over and have everything ready to go when you want to make the move.

Although US and Canadian banks have close ties, most Canadian banks do require you to visit in person to open a full feature account. That’s not always the case though, you can explore online options like Wise and Revolut – so read on for all you need to know about how to open a Canadian bank account while you’re in the US.

Quick Summary: Canadian bank account for US Citizens

- Yes, it’s possible to open an account to hold, send, spend and receive CAD from the USA

- Banks usually require proof of address in Canada, but non-bank providers like Wise and Revolut allow you to open an account with a proof of address from the USA

- Some banks let you start the account opening process online before you move to Canada, but this service isn’t always available to US citizens

- For a flexible option you can open a Canadian dollar account with Wise online and get CAD account details

| Questions | Answers |

|---|---|

| Can a US citizen open a bank account in Canada? | Yes, you can open an account in Canada. Your options with banks might be complicated, however you can open a CAD account online with providers like Wise or Revolut. |

| What documents do you need to open a bank account in Canada? | The documents usually requested include some documents which US citizens might not have – like a Canadian passport or birth certificate. We’ll cover more on these later. |

| Can I open a Canadian dollar account online? | Yes, you might be able to open a CAD account with your bank, depending on foreign currency accounts they support. You can also check out online multi currency accounts such as Wise and Revolut. |

Can a US citizen open a bank account in Canada?

Americans can open a bank account in Canada, but if you don’t open an account in person at a Canadian bank branch, things do get more complicated. You have a few different options:

- Several US banks have Canadian branches or a partnership with banks in Canada. You can contact your US bank to ask them about the possibility of opening a Canadian bank account. In many cases, having an existing account with a US bank will be necessary before they will consider opening a Canadian bank account for you.

- If you’re going to be a Canadian resident, you can visit a Canadian bank when you’re there and provide documents proving your intent to immigrate, together with your identity and proof of address. There are several documents you will need to have before you’re allowed to open a Canadian bank account in person. Learn more about how to open an international bank account.

- Open an online multi-currency account with a specialist provider like Wise or Revolut, to access CAD bank account details and low cost currency exchange, before you move to Canada. We’ll cover this option in more detail later – and you can also get a full Wise CAD account review here.

What documents do you need to open a bank account in Canada?

The Financial Consumer Agency lists the documents that a bank will typically ask for. The documents usually requested include several options which US citizens are unlikely to have – like a Canadian passport or birth certificate.

Instead, to open a CAD bank account with a Canadian bank as a US citizen, you’ll probably need to provide a couple of pieces of ID taken from a list which includes:

- A current US passport

- An employee ID card with your picture on it

- A debit card, bank card or Canadian credit card

- Temporary Residence Permit

- Work or study permit

- Confirmation of Permanent Residence

In some cases, if you can’t provide the specific documents requested you may be able to have someone in good standing with the bank or in the local community confirm your identity.

If you’re opening an account that will earn interest and be liable to tax, you must also provide a Social Insurance Number (SIN). You can obtain an SIN from the Canadian government.

Identification and account opening requirements do vary from bank to bank, so it’s always worth contacting a bank where you want to open an account to see what their specific needs are.

Save the paperwork with alternative solutions like Wise or Revolut

Canadian banks usually require customers to provide a proof of residence document showing a local Canadian address. That can make it tricky if you’re not a resident yet – or even if you’ve just moved to the country and don’t yet have bills and household paperwork in your name.

Want an easier option? Specialist services like Wise or Revolut can help. These online alternatives have been built with international customers in mind, and can accept a proof of address from the US or a range of other countries. Verification is done by uploading images of your paperwork online or in the provider app. Just use your proof of address from your country of residence, to open a Wise or Revolut account online, and open up a CAD balance.

Once you’re all set up you can receive, hold, and spend CAD easily before you even arrive in Canada – a great solution for expats, non-residents and digital nomads who want to hit the ground running.

How to open a bank account in Canada as a non-resident

If you’re already in Canada, or you’re about to move there for the long term, you may decide to open a bank account with a bank there. Typically most Canadian banks will require you to either be a resident or have immigration papers that show you are going to be a resident before you open an account.

If you’ve chosen a bank which allows you to start the process of applying for an account online before you relocate, you’ll normally need proof of ID, and your Canadian Visa/Landing Document Number. You may then need to visit a branch to finalize your application and get full account features.

If you’re not intending to move to Canada, you may still find that some banks will let you open your non-resident account online – or at least get started on your application online – but it’s pretty common to need to visit a branch to show your paperwork and get your account up and running.

Can I open a bank account in Canada before arrival?

If you’re planning to move to Canada in the near future you can go some way towards setting up a local account with a global provider like HSBC. However what you’ll actually have to do is set up an international account which has limited functionality initially, and then convert it to the account package you prefer once you can attend a branch in person. That can be a hassle.

Alternatively, or if you’re not actually moving to Canada at the moment, you can choose a specialist service like Wise or Revolut instead.

How to open a bank account online in Canada

If you can’t open a Canadian bank account using the options above, you have another choice—an online account from a specialist. These are digital accounts that you can access from anywhere and that give you a bank account in a variety of countries.

Online specialist services offer the option to open a multi-currency account which can hold both USD and CAD, and may even provide local bank details so you can get paid in CAD as easily as you can in US dollars. The providers we’ve picked out below offer accounts with no ongoing fees, which can hold, send, spend and exchange multiple currencies – for more flexibility with transparent, low fees.

Wise multi-currency account: Hold and exchange 40+ currencies and get local bank details to be paid in USD, CAD and up to 8+ other major currencies. You can also get a linked debit card to spend in 150+ countries, and send low cost payments with the mid-market exchange rate to 160+ countries.

Revolut multi-currency account: Hold and exchange 25+ currencies, with a linked international debit card and some no-fee currency exchange which uses the mid-market exchange rate. You can choose a plan with no monthly fee – or upgrade to an account with monthly charges for full feature access.

Next, we’ll look at some of the best account options in general, then we’ll look at Wise and Revolut more in detail, so you can compare and see which approach might suit you.

Which account is best in Canada for foreigners?

To help decide which account might work for you, let’s look at 2 online providers – Wise and Revolut – alongside a couple of newcomer account packages from traditional Canadian banks.

| Service | Wise | Revolut | TD Bank (Unlimited Chequing) | Scotiabank (Preferred Package) |

|---|---|---|---|---|

| USD and CAD options | 40+ currencies including CAD, GBP, USD and AUD | 25+ Currencies, including CAD, and USD | CAD only | CAD only |

| Open before you arrive in Canada | Yes, you can open it online while you’re still in US | Yes – you’ll need to open your Revolut account before you move | Possible for residents of some countries to start the process before arriving – complete by visiting a branch | Possible for residents of some countries – you’ll need to convert your account to a checking account in a branch once you arrive |

| Open an account online | Yes | Yes | Newcomer account can not be opened fully online | Possible for residents of some countries |

| Account opening fee | $0 | $0 | $0 | $0 |

| Maintenance fee | $0 | Up to $16.99/month | 16.95 CAD | 16.95 CAD |

| Online international transfers | Low transparent fees, varies by currency | Fee varies by currency | Up to 25 CAD | Variable fees, confirmed at the time of arranging your transfer |

As you can see, if you’re opening an account before you move to Canada – or if you love to travel and need ways to hold CAD alongside USD or other currencies – online specialist accounts may offer a more flexible option compared to Canadian banks. Here’s the topline on the providers we picked and what’s great about them:

Wise – 40+ currencies, and ways to get paid conveniently in foreign currencies, including USD and CAD. All currency exchange uses the mid-market exchange rate

Revolut – 25+ currencies, including USD and CAD, with some no-fee currency exchange depending on the account plan you select

TD Bank – large, established bank in Canada, which offers some USD products alongside its standard CAD accounts. Good if you need a branch network for face to face service

Scotiabank – reliable and familiar banking services, where you can get all your financial needs met under one roof

We’ll take a look at Wise and Revolut in more detail, next – and there’s more on TD Bank Canada and Scotiabank a little later, too.

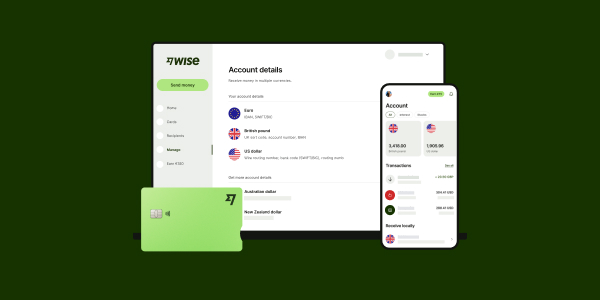

Wise account

Open a Wise Account online or in the Wise app for free, to hold and exchange 40+ currencies with the mid-market exchange rate and low fees from 0.43%.

You’ll be able to order your linked international debit card for a low one time fee, to spend in 150+ countries. Wise accounts can be topped up in around 20 currencies, and also come with local bank details for up to 9 currencies so you can get paid by others conveniently.

Key points about Wise account:

- The Wise Account is a multiple currency account that lets you hold money in more than 40 currencies, including US dollars and Canadian dollars.

- You can get local bank account details for 9+ currencies including USD, CAD, AUD and GBP.

- You can use your Wise account to send payments to 160+ countries, and exchange currencies using the mid-market exchange rate with low, transparent fees.

- You also get a linked Wise Multi-Currency Card, so you can spend money from the account. The debit card is free to use if you’re spending money in the local currency.

- Spend from your CAD balance using your Wise Multi-Currency Card – and if you don’t hold enough in CAD, the card will auto convert from another currency balance using the lowest available fee.

- There’s a Wise mobile app where you can easily check your spending, balances and limits.

- Wise is safe, fully licensed and regulated for all its activities in the US around the world.

Account types: Wise accounts can be opened by people resident in many countries around the world, including both the US and Canada. Open on arrival, or before you head out, to hold, exchange, send and spend in 40+ currencies

Eligibility: Use your home proof of address to get your account open and access a CAD balance. The exact account services available may vary based on location, so check the Wise website for more information.

Is it safe? Wise is registered and regulated in the US – and also covered by FINTRAC in Canada, and a range of other global bodies in the other countries it trades in.

If you want to learn more, check our detailed review: Wise account review

Wise CAD account details

Once you’ve opened your Wise account you can open a CAD currency balance and get local CAD account details so other people can pay you conveniently.

Just log into Wise on the app, and tap on the CAD currency balance to see your bank details, which you can then give to anyone needing to send you a payment in Canadian dollars.

Here’s what you’ll get:

Fees for the Wise account

There are no minimum account amounts, no monthly fees and no maintenance fees on the Wise account.

The key Wise fees you’ll pay are:

- Fees from 0.43% for switching between currencies and sending international payments

- 9 USD one off charge to get a Wise Multi-Currency Card

- First 2 withdrawals up to a combined total of $100/month for no fee. After that: $1.50 + 2% (ATM operators may charge their own fees)

- Receiving USD wire payments – 4.14 USD – getting paid by ACH is free

- Receiving CAD SWIFT payments – 10 CAD – no fee to get paid by local payment methods

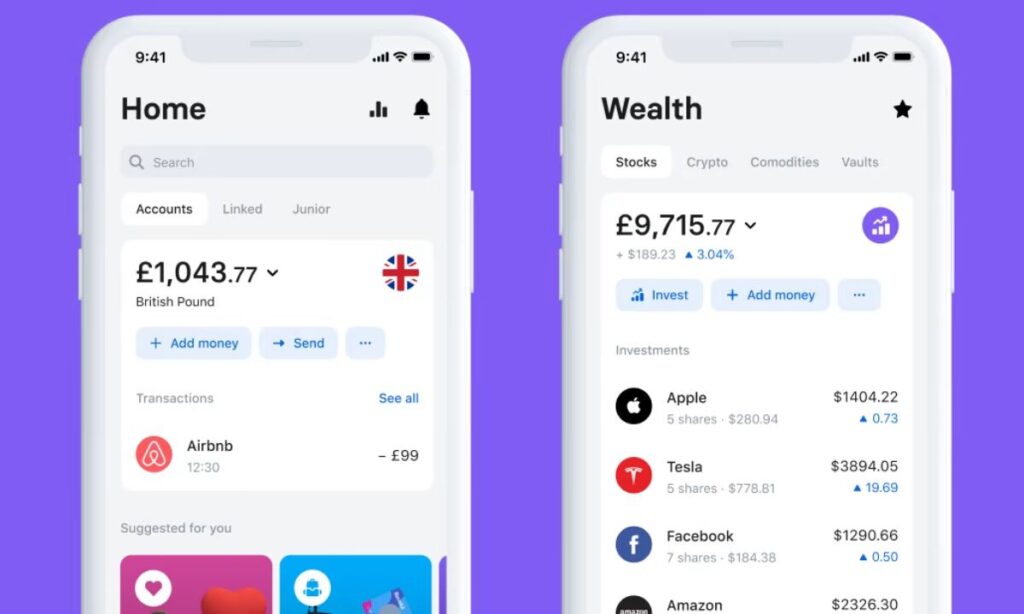

Revolut account

Revolut accounts have multi-currency functionality for 25+ fiat currencies including both USD and CAD, a linked debit card for spending and withdrawals, and extra perks like budgeting and saving tools. Revolut customers can provide a proof of address from the US or any of the other regions they operate in. It’s worth noting, though, that Revolut can’t be opened using a Canadian proof of address – so this is one to set up before you travel.

Standard Revolut plans come with no monthly fees and an array of features including some no-fee currency exchange. Or you can upgrade to a different account tier, where you’ll pay a monthly fee to get higher levels of no-fee transactions and extra benefits.

Account types: Personal and business accounts available. Standard plans don’t have monthly fees for both personal and business customers. Or you can upgrade to a paid plan for up to $16.99/month as a personal customer.

Eligibility: Available to customers with addresses in regions including the UK, EEA, Australia, Singapore, Switzerland, Japan, and the US.

Is it safe? Yes. Revolut is fully authorized and licensed for all the services it offers.

Fees for the Revolut Account

The fees you pay for a Revolut account will depend a lot on the account tier you pick. Here’s a rundown of some key costs:

- Monthly fee – no monthly fee for standard accounts; Premium account plans cost 9.99 USD/month and Metal account plans cost 16.99 USD/month

- 2% fee once you’ve exhausted your plan limit for no-fee ATM withdrawals

- 1% fee for currency exchange out of hours

- 0.5% fee when exchanging currency above your plan’s no-fee limit

More information: Best Canadian Dollar accounts in the US

Canadian Banks for US Citizens

Canadian banks in the USA

There are quite a few Canadian banks which have branches in the USA, or global banking brands which have branches in both Canada and the US. Here are a few you may consider:

- TD Bank

- CIBC

- Scotiabank

- HSBC

- BNP Paribas

If you already have a bank account with one of these banks, that may be a good starting point. However, these accounts may have high minimum one-off or ongoing deposit requirements and there can be significant ongoing fees for holding these accounts.

Visit a Canadian bank with the right documentation to open an account

The easiest way to open a Canadian bank account is to visit a Canadian bank. While you can’t do that from home or remotely, in some cases it may be your easiest option. Before you visit a Canadian branch, contact the bank and ask them about the account opening process as a US citizen. They will talk you through all of the rules, requirements and documentation you will need to open a bank account in Canada.

US banks with Canadian branches

Canada has US branch and office locations of several major US banks, some of which may be able to help you as an immigrant. Bear in mind though that some US banks only offer specific services in Canada, such as wealth management or business banking. You’ll need to shop around a bit to see whether any suit your specific needs. Here are a few to consider:

- Citibank

- Bank of America

- Chase

- Wells Fargo

Here’s a bit more detail about the 2 banks we picked out in the comparison table earlier – TD Bank and Scotiabank. We’ve also looked at another popular Canadian bank – RBC.

TD Bank

TD Bank is one of the largest banks in Canada, and a familiar name to many US citizens, too. There’s a specific newcomers service which allows residents from certain countries to start account opening before traveling, and complete on arrival. If you’re coming from certain regions you can also call on free local numbers to get advice and support in arranging your account. At the time of writing this service is not promoted to US residents looking for a standard account, so you’ll need to call the bank to check if it’s on offer at the time you want to apply.

TD Bank has a wide range of account products, but suggests the Unlimited Chequing account as a good option for new arrivals. In this account you’ll pay a 16.95 CAD monthly fee, which can be waived if you meet a minimum balance requirement, for unlimited free transactions and TD Bank ATM withdrawals. Fees apply to send and receive international payments.

Account types: There are a few different accounts on offer to newcomers – you’ll be able to pick from checking and saving accounts, as well as student accounts aimed at international students.

Eligibility: You’ll need to provide ID including your passport and proof of legal residence in Canada

Is it safe? Yes. TD Bank is one of the largest banks in Canada, with a significant presence internationally, too. It’s a fully regulated provider, trusted by millions.

Scotiabank

Scotiabank lets customers from selected countries open international accounts online. At the time of writing this is not available to US residents, so you may need to wait until you arrive to get your account arranged. Scotiabank offers a range of account options, with the most popular – the Preferred account – being eligible for the newcomer international application process.

The Preferred Package costs 16.95 CAD a month but comes with unlimited free transactions, interest on your balance, and overdraft protection. If you hold a 4,000 CAD or more minimum balance for the month your monthly fee may be waived.

Account types: Scotiabank has a good range of chequing and savings accounts, including a couple which can be opened online in advance or arrival by people from selected countries

Eligibility: You’ll need to provide ID including your passport and proof of legal residence in Canada

Is it safe? Yes. Scotiabank is FINTRAC registered and fully licensed to trade in Canada

Royal Bank of Canada

Royal Bank of Canada – often shortened to just RBC – has a newcomer package which is aimed at new residents and international students. You can get some fees waived when you first arrive, and there are also easier ways to get a credit card which don’t rely entirely on having a local credit history. Once your fee free period is over you’ll pay 11.95 CAD a month for a standard package, or more if you have the VIP service.

Account types: RBC is a large bank with a full suite of checking and savings accounts, credit cards, loans and more

Eligibility: You’ll need to provide ID including your passport and proof of legal residence in Canada

Is it safe? Yes. RBC is large, trusted and fully licensed to trade in Canada

Cross-border account opening between the US and Canada

Several US banks have Canadian branches or close partnerships with Canadian banks. In these cases, you may be able to open a Canadian bank account without leaving the US. You should contact your US bank and ask them about the possibility of opening an account in Canada.

Many of these banks will have a cross-border account opening process. Find the contact details for your bank, get in touch and ask them if they have provisions for opening an account in Canada from the US. In every case, you’ll need your immigration details as you can’t open an account without them.

What do I need to know before opening a bank account in Canada?

As a foreigner in Canada you’ll usually need to provide a suite of documents to support your application if you want to open an account with a bank. Generally, full service accounts are only available to full Canadian residents, so if you’re not living in Canada yet you’ll probably only be able to access a more limited account type with banks.

Can I open a bank account in Canada with only my passport?

You can not usually open a bank account in Canada with only a passport. You’ll normally need 2 pieces of ID which confirm your name and address. In some cases you may be able to present only one piece of ID, but this is usually only an option if you can also have someone locally – who is in good standing in the community, or holds an account with your preferred bank already – visit the bank with you to vouch for you.

What is a bank account in Canada needed for?

If you’re moving to Canada you’ll need a CAD account to pay for rent, utilities, everyday essentials and services, as well as to allow others to pay you. If you’re not a resident all year round you may still like a CAD account if you spend time in Canada often or if you’re a frequent visitor there.

Benefits of opening a bank account in Canada

Opening a CAD account can bring a few benefits if you need to transact in CAD often:

- Make payments in Canadian dollars without incurring currency exchange costs

- Hold a balance in CAD, and access preferential exchange rates

- Get paid a salary, benefits or other payments in CAD without needing to convert back to USD

- Get a Canadian credit card and build your credit history

How much does it cost to open a bank account in Canada?

It’s usually free to open a bank account in Canada. However accounts from traditional banks will often have monthly fees, which can only be waived if you maintain a set minimum balance all month. There are also transaction costs to consider, which can quickly mount up.

Is it possible to open a fee free account in Canada?

It’s not usually possible to get a completely fee free account in Canada. However, many banks offer accounts which waive certain costs if you hold a high enough balance or if you’re a new customer. It’s worth comparing a few options to see which may suit your needs. Don’t forget to also look at non-bank alternatives like Wise and Revolut which have low cost accounts which are flexible and easy to open.

What are the additional costs?

Transaction costs are the most common extra fees you’ll pay. Some banking packages come with a fixed number of free transactions a month, some have unlimited transactions for free, and some come with charges for every transaction you make within your account – make sure you read all the details carefully before you sign up.

Here’s what to look out for:

- Account maintenance costs

- ATM withdrawal fees

- Overdraft or credit card interest charges

- Inactivity or closing fee

- International transfer fees

- Foreign transaction fees

Tips for transferring money

One of the most common transactions you’ll need to make as an expat is probably moving money across currencies with international transfers – this can also be a costly thing with traditional banks. Here are a few things to watch out for:

- Check the exchange rate you’re offered against the rate you find on Google to see if a markup – and extra fee – has been applied

- International transfer fees may vary depending on the value of the payment, and whether you arrange it online or in a branch

- Third party fees may be deducted as the payment is processed, and can mean your recipient gets less than you expect

Using a specialist service like Wise to send your international payments can mean you get less complicated fees – with no hidden costs added to the exchange rate.

Related: Best travel cards for Canada

How to open a business account in Canada?

If you’re interested in opening a business bank account in Canada you may need to follow a slightly different process. While some banks offer online opening options for personal accounts, it’s far more common to open a business account in person by visiting a branch. That means it’s trickier to open a business bank account with a traditional Canadian bank as a non-resident. If you’re not planning on moving to Canada you might find that choosing a multi-currency account with a specialist online provider is a simpler option.

No matter how you decide to set up your Canadian business bank account you’ll need to provide your personal ID documents plus a suite of business documentation, based on entity type – business licenses, registration numbers, partnership agreements or articles of incorporation for example.

To learn more, check our detailed guide on How to Open a Business Bank Account in Canada.

Conclusion: Can you open a bank account in Canada from the US?

Yes. You can open a bank account in Canada as a US citizen. However exactly how you get started will depend on whether you’re planning to move to Canada or need an account as a non-resident.

Usually it’s far easier to open a bank account with a traditional Canadian bank if you’re a resident there. If you’re not planning on making the move to Canada, you can still get a CAD account with Canadian banking details from a specialist provider like Wise or Revolut. Wise offers both personal and business account options for US citizens, with CAD bank details, a linked debit card and no ongoing charges. Revolut accounts can be opened from the US, to hold and exchange CAD and USD, and access some no-fee currency exchange, depending on the account type you pick.

FAQs on opening a Canadian bank account as a US citizen

Can I open a bank account online in Canada from the USA?

Some Canadian banks do offer online account opening services, but it’s pretty common to need to visit a branch in person to get your account fully up and running. If opening your account online is essential you might be better off choosing a specialist provider like Wise, which offers a fully digital account opening service.

Can a foreigner open a bank account in Canada online?

Some Canadian banks do offer online account opening, but you may find it tricky to provide the required identification and residence documents. As a US citizen the easiest way to open your Canadian account is probably to choose a specialist online account provider which can accept your US identification documents.

Which US banks have branches in Canada?

Key options for banks which have branches in both the US and Canada include:

- BNP Paribas

- Citibank

- HSBC

- TD

Can I open a Canadian Bank Account from the US?

You’ll be able to open a Canadian bank account from the US with a specialist provider, or in some cases, with a traditional bank in Canada. Use this guide as a starting point to research which banks and account providers might suit you.

Can you open a bank account in Canada as a non-resident?

As a Canadian non-resident you might be able to open an account with a traditional bank, but many regular accounts aren’t available to non-resident customers. Learn more about how to open a Canadian bank account as a non-resident – or take a look at specialist international account providers which tend to be more flexible with non-resident customers.