How to open a bank account in New Zealand in 2025

Looking to open a bank account in New Zealand? Whether you’ve just landed in the country or you’re planning everything ahead of your arrival, opening a bank account in New Zealand can be a complex process. This article will help you understand how to open an account in both situations, the documents you need, and analyze the options available and compare them to less complicated solutions, such as Wise or Revolut. But more on that later, read on.

What documents do I need?

Different banks will have slightly different requirements. However, to open a bank account in New Zealand, you’ll generally need the following documents:

- A completed application form.

- Proof of ID, including a valid passport or national identity card. You can also provide a valid New Zealand driver’s license.

- Proof of address dated within the last 12 months.

- Some banks might also request your tax identification number from your home country.

Save the paperwork with alternative solutions like Wise or Revolut

If you’ve just landed on New Zealand’s shores, the likelihood of you having a valid proof of address is low. That’s where digital specialists like Wise or Revolut come in.

Many of the documents that most banks need to prove your address, like a council tax or utility bill, already require you to have a bank account in that country. Wise and Revolut, on the other hand, lets you open a multi-currency account using your documents in your home country. This includes your passport, national ID card, or driver’s license.

With specialist providers like Wise and Revolut, verification is also done online, right from your phone, and involves uploading an image of your ID documents and a selfie.

With a Wise account, you can easily hold and exchange NZD and get local bank account details, allowing you to send, receive, and manage your finances like a local. You can also top up your bank in USD and convert it to New Zealand dollars using the mid-market exchange rate alongside low, transparent fees from 0.43% and spend in New Zealand, the US and over 150 other countries with the linked Wise Multi-Currency Card.

How to open a New Zealand bank account as a foreigner

Opening a bank account in New Zealand is a fairly straightforward process. However, it often involves specific requirements and steps that differ from local residents, like holding a valid visa.

Depending on the bank of your choice, you can conveniently apply and open a bank in New Zealand from 90 to even up to 365 days before your arrival. Major New Zealand banks like ANZ, Westpac, Kiwibank, and ASB offer this option, allowing for a smoother transition when you move.

In general you’ll need the following information to open a bank account:

- Your online application: Apply online or in person at your chosen provider.

- Required documents: As a foreigner, you’ll generally need to provide more documentation than a local would, such as a valid work or student visa, certified copies of your passport, a certified copy of proof of your residential address in your home country and your passport.

Here’s how to open a New Zealand account as a foreigner:

- Choose your provider: Select from one of the many banks on offer and complete their migrant banking form online or in person.

- Submit required documents: Submit certified copies of your passport, proof of address and visa.

- Receive confirmation: Once you’ve submitted your application, the bank will usually respond within a few working days with either a request for additional information or to confirm that your application has been successful.

- Complete verification: Regardless of whether you’ve applied online or in-person, you will need to visit your local branch to verify your identity.

What do I need to know before opening a bank account in New Zealand?

It’s worth mentioning that before you can open a bank in New Zealand, certified documents must be stamped, signed and dated by a recognized authority, like a lawyer. Likewise, foreigners who open an account online prior to their arrival in New Zealand will only have limited access and will need to activate their bank account in person at a New Zealand branch to fully access and withdraw their funds.

Which account is best in New Zealand for foreigners?

| Service | Wise | Revolut | BNZ | Westpac |

|---|---|---|---|---|

| NZD and USD account options | 40+ currencies, including USD and NZD | 25 currencies | NZD | NZD |

| Open before you arrive in New Zealand | Yes | Yes | Yes, but with limited access | Yes, but with limited access |

| Open online | Yes | Yes | Yes, but activation has to be in person at a local branch | Yes, but activation has to be in person at a local branch |

| Opening fee | Fee-free | Fee-free | No fee | No fee |

| Fall below fee | No fee | No fee | No fee | No fee |

| Maintenance fee | No fee | Ranges from 0 – 16.99 USD per month depending on your chosen plan | Varies depending on your chosen account | Varies depending on your chosen account |

| International transfers | Low and transparent fees that vary upon currency | Fees vary depending on destination | No fee when paying in a foreign currency online | 5 NZD per transfer if sent via Westpac One or Business Online Banking 20 NZD per transfer if sent via any other online banking channel

|

| Close account fee | No fee | No fee | Varies depending on your chosen account | Varies depending on your chosen account |

There is a wide range of bank accounts in New Zealand to choose from, each with their own features and benefits. While you can get the process started and submit an online application for both BNZ and Westpac banks, you won’t receive full access to your funds or available services until you arrive in the country and can go to your local branch for an in person verification and to provide a local address. F

or those who don’t yet have a regional New Zealand address or who don’t plan on relocating but would benefit from a New Zealand bank account, digital providers like Wise and Revolut can be good alternatives.

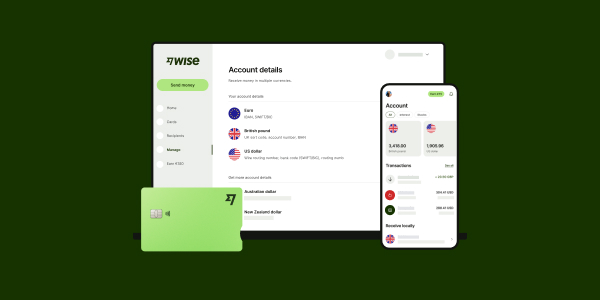

Wise account

Wise is a digital specialist that’s popular for its international money transfer services, foreign currency accounts and travel cards. Wise multi-currency accounts can be used to hold and exchange 40+ currencies, including NZD and USD.

You can open a Wise account, and open a New Zealand dollar balance to get ‘Account number’ in NZD. This will allow you to receive payments, spend and make transactions like a local. You’ll also receive a linked Wise Multi-Currency Card that you can use to spend internationally.

Account types: Wise offers both personal and business accounts with no monthly maintenance fees and currency conversion at the mid-market exchange rate with low and transparent fees.

How to open a foreign currency account with Wise

- Download the Wise app or go to the Wise desktop site

- Click ‘Sign up’ and create an account

- Follow the prompts and enter the requested information

- Upload a photo of your ID and proof of address

- Wait to be verified and start using your account!

To open your New Zealand dollar balance on Wise:

- After your account is verified, login to your account on your phone or desktop,

- Click on ‘Open’ and then click on ‘Balance’.

- From the currency list, choose ‘New Zealand dollar’, and your bank account in New Zealand will be opened instantly.

- From here, you can add money to your account, or get your Account Number for NZD to receive payments like a local from New Zealand

Revolut account

Revolut is another digital provider known for its multi-currency accounts that allow you to hold 25+ currencies and also comes with a linked card. Revolut offers three personal account plans to choose from and customers can send and exchange money internationally using the mid-market exchange rate.

All plans have some no-fee currency exchange but fees apply at weekends and on certain currencies. With Revolut account, you can hold and exchange your money in New Zealand dollars. They also support other major currencies such as USD, AUD, and CAD.

Account types: Choose from a range of three different plans: a standard plan at 0$/month, or upgrade to a Premium plan for 9.99$/month or the Metal plan for 16.99$/month to access more features like unlimited no fee currency exchange on the Metal plan and discounted international transfers.

How to open an account with Revolut

- Download the Revolut app from Google Play or the App Store.

- Enter your phone number, and set a 4-digit passcode.

- Revolut will send a PIN to your phone via text message. Enter this PIN into the app to verify your account.

- Enter your personal details and upload the requested documentation for verification.

- Once verified, select your preferred account plan, choose between a no-fee standart plan or premium account with a monthly fee that provides additional features.

BNZ account

If you want to get a head start and open a bank account before your big move to New Zealand, you can open an account with BNZ while you’re still at home in the US. Once you’ve submitted your application you’ll receive an account number within 15 days, allowing you to deposit funds into your account. However, you won’t have access to these funds until you arrive and can verify your identity in person at a local branch.

Choose from a range of accounts, including the YouMoney account for everyday spending and the Rapid Save account for saving and earning interest on your hard-earned dollars. As one of New Zealand’s big four banks, BNZ also provides a comprehensive range of services, including overdrafts, loans and mortgages.

How to open an account with BNZ

- Choose your preferred account and check if you’re eligible to apply

- Start your application online

- Upload the requested information and documents

- Visit your local branch in person once you arrive in New Zealand to verify your account

Westpac account

One of New Zealand’s major banks, Westpac, also allows foreigners to set up a bank account from overseas up to 180 days before you arrive. Simply email your application and requested documents, like a certified passport, proof of address and Visa to get your account set up and then activate it upon your arrival in New Zealand.

A good option that allows you to start building your credit history and savings from day one, Westpac provides a range of account options and services including credit cards, loans, mortgages and insurance.

How to open an account with Westpac

- Choose your preferred account and check if you’re eligible to apply

- Start your application online

- Upload and send the requested information and documents for Westpac to go through

- Visit your local branch in person once you arrive in New Zealand to verify your account

Can I open a bank account in New Zealand only with my passport?

Generally, non-residents will need a valid visa alongside a passport or other valid form of ID to open a bank account in New Zealand. This is standard practice for traditional banking institutions, ensuring compliance with local regulations.

However, if you decide to choose a digital-only provider like Wise or Revolut, you’ll be able to open an account without a New Zealand visa, using your local documents only. With

Wise, you can get your own account number in New Zealand, and receive payments in New Zealand conveniently like a local. Learn more here: How to use Wise account

What is a bank account in New Zealand needed for?

In New Zealand to work? Study? Or are you simply a frequent visitor? If so, then opening a New Zealand bank account will be essential. Opening a local account lets you easily hold and spend in NZD, allowing you to manage your finances in the country. If you live in New Zealand, it’s also convenient for paying your bills, receiving your salary and making everyday purchases.

Benefits of opening a bank account in New Zealand

Opening a bank account in New Zealand offers multiple benefits, especially for anyone studying, working or simply living in the country. A New Zealand bank account will help simplify your financial transactions and give you a safe place to hold and manage your hard-earned money. Some key benefits include:

- Convenience: Having a local bank account in New Zealand is convenient for making daily financial transactions, like paying your electricity bill or doing your weekly grocery shop.

- Savings: A local bank account will help you avoid fluctuating and often unfavorable currency exchange rates and foreign transaction fees when making transactions in New Zealand dollars.

- Security: A New Zealand bank account will provide you with a high level of security and peace of mind that your funds are safe.

- Access to financial services: Opening a bank account in New Zealand gives you access to a wide range of financial services like loans, overdrafts and other credit facilities, which can be a big help when making bigger purchases, like buying a home, or managing unexpected emergencies.

Can I open a bank account in New Zealand before arrival?

For those who want to get a head start before making their big move, the good news is that some New Zealand banks will let you open an account before you arrive. Well-known banks like BNZ, Westpac, ANZ, Kiwibank, and ASB let you start the process online well in advance of your move.

You can also choose alternative providers like Wise, who offer the convenience of opening a New Zealand Dollar account with local account details, and a debit card to spend in New Zealand. With Wise, you can hit the ground running and experience the flexibility of managing your finances online,

- send payments to over 160 countries,

- spend with the Wise Multi-Currency Card in over 150 countries and

- Hold and exchange money in over 40 different currencies with no hidden fees.

- Wise NZD balance also lets you bank as if you were a New Zealander alongside local account details in 9 other currencies.

Can I open a bank account online?

Depending on the type of visa you have, many banks in New Zealand will let you open a bank account online from 90 to 365 days before your arrival. However, you won’t have full access to the funds in your account until you complete an in person verification at a local branch in New Zealand when you arrive in the country.

If you need access to your money straight away, digital-only banking providers like Wise and Revolut could be a better alternative, letting you get fully set up online without needing a New Zealand address. These platforms allow you to set up an account online that’s ready to go with full access to your funds from the get go.

How long does it take to open a bank account in New Zealand?

The exact timeline for opening a bank account in New Zealand will vary from bank to bank and can vary from a couple of days to several weeks. For example, the Bank of New Zealand has a pretty speedy process with an account opening time of five business days. Online providers like Wise and Revolut speed up the process. You can register in minutes and verification usually takes no longer than 2 working days.

What are the types of bank accounts in New Zealand?

Like most countries, when it comes to banking in New Zealand, there are some common account types available to suit varying financial needs. Whether you need a New Zealand account for simple daily transactions, a savings account to safely store and grow your money or a business account for your new venture, you’re sure to find what you need.

Typical bank accounts in New Zealand include:

- Current account: Ideal for daily transactions, like making payments, using a linked debit card, receiving a salary and transferring funds. They usually come with an overdraft facility subject to approval.

- Student account: A specialized account for those in higher education, which typically comes with special offers and features like low or no fees and an interest-free overdraft.

- Savings account: Specially designed accounts for short and long-term savings, usually with no account-maintenance fees. These accounts tend to offer interest on deposits to maximize savings via flat or tiered rates where higher savings are rewarded with higher interest rates.

- Business account: Designed for freelancers and business owners, a business account helps entrepreneurs make business transactions, separate their personal and business finances, pay their employees, receive payments from customers and generally manage their business finances.

- Multi-currency account: Kiwibank, Westpac and ASB are just some of the banks in New Zealand offering multi-currency accounts that allow you to hold multiple currencies and save money when making international transactions. These accounts also protect against fluctuating exchange rates and are perfect for those who frequently travel or receive and spend money in various currencies.

How to choose a bank account in New Zealand

There are several important factors that you should look at before choosing your provider and bank account in New Zealand. Consider how easy the account is to open, especially if you’re a non-resident. Banks may have varying requirements for foreigners, and usually request proof of a local address, which you might not have immediately on your arrival. Some may also require more extensive paperwork, which could be a challenge if you’re just settling in.

It’s also crucial to do your research and compare fee structures of different banks, as this can significantly impact your finances in the long-run.

For those seeking a more convenient and streamline process, Wise and Revolut offers a practical alternative. Catering to global customers, it’s easy to register and set up an account without the need for extensive documentation or proof of New Zealand residency, making it an appealing choice for expatriates, students and international travelers alike.

How much does it cost to open a bank account in New Zealand?

Opening an everyday personal bank account in New Zealand is usually free of charge, making it accessible for both residents and non-residents. However, some monthly or annual maintenance fees may apply depending on the account and we would always recommend checking the fee structure for any potential hidden charges.

Alternative providers like Wise and Revolut offer accounts without any account opening or maintenance fees, with low and transparent transaction fees.

In some cases, you might need to pay a minimum deposit to open your New Zealand bank account and more premium personal and business accounts that offer extra features like overdraft facilities, credit cards or interest might come with associated costs.

Is it possible to open a fee-free account in New Zealand?

Luckily, New Zealand offers a wide range of accounts to choose from, including some with no monthly or yearly maintenance fees. However, it’s worth remembering that there’s no such thing as a completely free bank account and there are likely to be certain fees associated with different services and activities, like overdrafts, transactions and card or ATM fees.

What are the additional costs?

Aside from the typical monthly fees that you might expect to pay, there are often several other additional costs that you might run into. While these will vary and are very much dependant on the provider and account, additional costs to look out for include:

- Withdrawal fees: Includes both local and international ATM charges

- Interest or overdraft fees: If your account has an overdraft facility that you’re using, you might incur interest charges if you overdraw your account.

- Card fees – Costs based on your selected card and transactions

- International transfer fees: Charges incurred when sending or receiving money from overseas.

- Foreign transaction fees: Fees applied when you spend in a foreign currency abroad or at home.

- Closing fee: Charged if you decide to close your account.

Tips for sending money between the US and New Zealand

Sending money between the US and New Zealand doesn’t have to be as complicated or expensive as it may seem. All you have to do is follow a few practical tips.

- Use specialist providers like Wise and Revolut for affordable and quick international transfers, often with better rates and lower and transparent fees.

- Compare the exchange rate that you’re offered by various providers against the mid-market exchange rate to ensure that you’re getting the best deal for your money.

- Stay alert and always be on the lookout for potential scams and only use trusted services.

- Review the terms and conditions of your chosen account to identify fees and charges.

- Check transaction times if you need a quick transfer. Most bank services take around 3-5 business days and charge an extra fee for faster delivery times compared to online specialists, which usually offer instant or next day delivery services.

Conclusion

If you’re moving or traveling to New Zealand and need to open a bank account, the good news is that there are options available. Banks in New Zealand allow foreigners to open a bank account as long as they hold a valid visa or proof of local residency. Some banks will even let you open an account and pay in funds from the comfort of your home in the US, although you won’t be able to access your money until you’ve activated your account by verifying your identity in person at a local branch when you arrive.

If you don’t have a valid visa or a local New Zealand address, don’t worry – alternative providers like Wise and Revolut can help. These digital specialists let you fully open an account online or in-app and hold NZD alongside USD and other major currencies for convenience. If you open an account with Wise, you’ll even receive New Zealand account details, allowing you to spend, receive and get paid in NZD like a local.

FAQs

Can a foreigner non-resident open an account in New Zealand?

Both foreigners and non-residents can open an account in New Zealand either online or in person as long as they hold a valid visa.

How much do I need to open a bank account in New Zealand?

There are many fee-free bank accounts in New Zealand with no monthly or annual maintenance fees, making them free to open. However, some premium or business accounts may have a minimum opening deposit.

Can I open a New Zealand bank account online?

Depending on your visa, some New Zealand banks will let you open a bank account online 90 to 365 days in advance of your arrival. However, you won’t have full access to your account until you arrive in the country and verify your identity in person at a local branch. If you need instant access to your money, looking at online specialists like Wise and Revolut, may be a better alternative thanks to their fully digital onboarding and verification processes.

How to apply for a bank account online in New Zealand?

If you’re planning on relocating to New Zealand, you can start your application for a local bank account online or in-person as long as you have a valid visa. If you apply online, you can complete the application process once you land in the country by verifying your ID in person at your local branch. Alternatively, you can check out digital providers like Wise and Revolut who will get your account opened and set up entirely remotely.

Can I open a bank account in New Zealand before landing?

You generally can’t open a New Zealand bank account with full access to funds and features without proof of a local address. Online specialists like Wise and Revolut tend to be more flexible, allowing customers to open accounts with proof of address from the US instead.