International Money Transfer Limits: Complete Guide 2025

Sending money overseas is something many of us need to do frequently. Whether it’s to pay a bill abroad, as a gift to an international friend, or as a remittance home, there are plenty of reasons you may find yourself making an overseas money transfer.

But is there a limit to how much you can send overseas? How does it work if you need to send a high value payment, or if you need to frequently make overseas transfers?

This guide shows you everything you need to know about the maximum amounts for international money transfer imposed by the most used banks in the US, how you can increase those limits, and some providers that offer more convenient and cheaper ways to send large amounts of money abroad, like Remitly and Wise.

Quick summary: International money transfer limits

- Transfer limits vary by provider: Different services have different limits – Wise allows up to $1.6 million via wire transfer, while Remitly has a limit of 30,000 USD for verified accounts, and OFX has no transfer limit at all.

- Bank vs. provider limits: Banks often have stricter limits on international transfers compared to specialized providers like Wise or OFX.

- Tax-free transfers: You can transfer up to $18,000 per person per year tax-free as a gift in the US

- Reporting requirements: Financial institutions are required to report wire transfers over $10,000.

- Best for high-amount transfers: OFX has no set maximum limit making it a good choice for large transfers as well as Wise which lets you transfer up to 6 million USD when you pay from your Wise account balance.

Here is most frequently asked questions about wire transfer limits:

| Questions | Answers |

|---|---|

| What is the maximum amount you can send internationally? | The maximum amount you can transfer will depend on your provider. For example, Wise has a $1.6 million limit for wire transfers, while OFX has no transfer limits at all. Remitly has a limit of $30,000. |

| Do I have to pay tax on money transferred from overseas to the US? | You generally don’t have to pay taxes on money received from abroad as a gift or personal transfer, but transactions over $10,000 will need to be reported to the IRS. |

| How much money can be transferred tax free? | The tax-free limit depends on the nature of the transfer. For example, in 2024, the annual gift tax exclusion is $18,000 per person per year. However, financial institutions are required to report wire transfers over $10,000. |

Which providers have the highest limits to transfer money abroad?

Let’s get right into the important stuff, with an overview of the international money transfer limits for some of the biggest US banks, and a few specialist providers. We’ll look at your options for sending high value payments overseas – including some smart ways to cut your costs and get a better exchange rate – in just a moment.

| Bank/provider | International money transfer limits |

|---|---|

| Bank of America |

|

| Chase |

|

| Wells Fargo |

|

| Remitly | Up to 30,000 USD. But to qualify for this limit, you’ll need to provide some information and documents for verification. Learn more from here: Remitly transfer limits |

| Wise |

Learn more from here: Wise transfer limits |

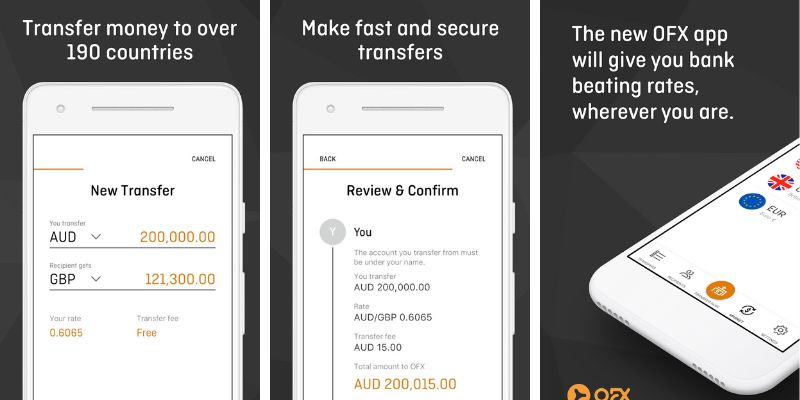

| OFX | No OFX maximum payment limits Some limits may apply based on the currency involved, to comply with legislation around the world |

As you can see, US banks may have fairly low limits on the amount of money you can send online or in the bank’s mobile app. For higher value transfers you may be asked to visit a branch. While that can give you peace of mind when sending a high value transfer, it also usually means far higher fees and a more complicated transfer process.

Let’s see how that compares with the specialist services we picked out:

- Remitly Review: Remitly has an upper limit of 30,000 USD for verified customers, with transfers to a good range of countries, with payout options including cash collection and home delivery

- Wise Review: Wise limits are set per transfer, and are generally at least 1 million USD per transaction. With Wise you’ll also get the mid-market exchange rate, and can even qualify for volume discounts on fees when you send a large payment, or send frequent transfers

- OFX Review: OFX does not apply its own limits to transfers around the world. However, it notes that there may be limits, particularly when the currencies involved are not freely traded, which are out of OFX control

How much money can you transfer internationally?

There isn’t a specific law that states how much money you can send or receive internationally. The amount you send will depend on your provider and the destination and financial institutions, and money transfer providers often impose their own daily transaction limits, which can vary significantly.

Some providers may have a limit of $3,000 per day, while others may have no set limit at all. Additionally, any international transfers that exceed $10,000 must be reported by the bank or financial provider to comply with regulatory requirements and prevent fraud and other illegal activities. The same rule applies for transfers coming into the US from abroad.

The different types of international transfers and sending limits

So what makes the difference to the amount of money you can send – either with your bank or a specialist provider? In some cases, the destination and the way you’re setting up your transfer matter. Other factors can include the type of account you hold – personal or business, standard or premier, for example. Finally, the type of payment you’re making can also mean differing limits. Here’s a look at some of the typical limits you’ll run into when making an international money transfer from the US.

International wire transfer (SWIFT) limits – online

When you send a high value payment overseas, the bank or provider which processes the transfer is obliged to check that the payment is legal and fulfills financial legislation requirements both in the US and in the destination country. That may mean checking the source of funds or getting more details about the reason for the transfer.

Banks may not be as well set up to handle high value transfers – with the added paperwork and process requirements – online. As such, the limits for sending an international wire online with a regular bank can seem pretty low. Instead, to send a high value transfer you may be asked to visit a branch – which is more hassle, and can come with higher fees.

Online specialist services tend to be better placed to verify payments and go through compliance checks digitally, allowing them to offer higher value transfers online. That can mean higher limits, and a more streamlined service when sending higher value transfers.

Here’s a rundown of the online limits from the banks and providers we looked at earlier:

- Bank of America wire transfer limits: 1,000 USD for personal customers

- Chase wire transfer limits: 25,000 USD for standard account holders

- Wells Fargo wire transfer limits: Set by account type

- Remitly transfer limits: 30,000 USD for fully verified accounts

- Wise transfer limits: 1.6 million USD if you pay by wire, 6 million USD if you pay from your Wise account balance.

- OFX transfer limits: No upper limit applies

In branch SWIFT transfer limits

If you’re sending your SWIFT or wire transfer in a branch you might find there’s a far higher limit compared to making your transfer online. The exact options open to you will depend on the specific bank and the account type you hold. However, one downside to this is that heading to a bank is more time consuming than setting up a payment online – and often can mean higher transfer fees, too. That’s simply because it takes more time for the in-branch service team to handle your request – which means more costs which they often pass on to the customer through higher fees.

Specialist services like Wise and OFX have no branches, but do offer high value – or even unlimited – payments online and in-app, with all legal processes and verification checks carried out digitally.

International ACH limits

When you’re sending a payment domestically in the US, you’ll probably turn to ACH payments as a convenient and low cost way to get your money moving. However, international ACH payments are seldom available from US banks. Instead, you’ll usually be directed to use a SWIFT or wire transfer, which can come with higher costs – particularly if you need to make an in-branch transfer.

The good news is that specialist providers may be able to help you use an ACH to transfer money abroad. Wise, for example, will allow you to use a USD ACH to fund an overseas payment to the value of 1 million USD. You’ll simply send your money to Wise in dollars, and Wise will convert your funds to the currency you need, to deposit directly to your recipient’s account for convenience. You may even get a discount on the Wise fee if you’re sending high value or frequent transfers. More on that in a moment.

Best ways to transfer large sums of money abroad

If you’re sending a high value international transfer you may be wondering how to make sure your payment goes through smoothly. Here are a few things to do in advance to make sure your payment is hassle free:

- Check your own bank’s payment limits, which can vary depending on how you set up your transfer

- Ask your bank, or the provider you’re using, if any verification checks are required to process your payment – you may need proof of the source of funds, for example

- Make sure your provider account is fully verified, by providing all required ID documents before you start to make your transfer

- Double check you have all the details needed for your recipient, including their full name, bank account number, and any country specific information like a sort code for transfers to the US

Before you set up your international payment with your regular bank, have a look to see if a specialist service can help with an easier online experience and lower overall costs. Here are a few to check out:

- Remitly: Send up to 30,000 USD per day with a fully verified account – funds can be collected in cash or deposited to the recipient’s own bank

- Wise: High limits of up to 6 million USD, depending on how you want to pay, plus volume discounts on fees, for high value and frequent transfers. Learn more: How to send a large amount transfer with Wise.

- OFX: No OFX limits on transfers – you’ll also be able to talk through your payment on the phone with a broker 24/7

- Xe: Send up to 3,000 USD, 5 times in any 24 hours, for cash collection, or up to 535,000 USD for deposit to a bank account

- WorldRemit: Send up to 9,000 USD in any 24 hour period, and pay by card or Apple Pay from the US

How to increase the limit of your international transfers

Need to send a higher value transfer? Usually you’ll find you have a few options.

- Some banks allow you to increase your transfer limit for online payments by visiting a branch – Wells Fargo is one example

- You can often send more with a bank by arranging your transfer in a branch, although this may mean a higher fee compared to their online service

- If you have a specific need to make a high value payment – buying a house for example – your bank may be able to support you on a case by case basis – ask directly to see if they can help

- Some online providers like Wise or Revolut offer multi-currency accounts, which allow you to send international payments easily – and often with higher limits compared to other transfer types

Providers like Wise, Revolut or XE Money Transfer usually offer transparent pricing and rate conversion when sending money overseas. Also, in many cases, transfer limits are displayed more clearly than with many banks.

Maximum money transfer limits without taxes applied

When sending or receiving any money internationally, it’s important to understand the tax implications to avoid penalties and other significant consequences. The IRS doesn’t place limits on the amount of money you can send or receive internationally, but there are reporting requirements for transactions of $10,000 or more, including multiple payments that total over $10,000 within a short period.

You can also make tax-free gifts up to $18,000 per person, per year, such as cash or other assets like real estate without triggering gift tax. However, if you’re transferring capital gains from selling a foreign property, those gains will be taxed based on whether they are short-term or long-term while inheritances from abroad typically aren’t taxed federally, but reporting requirements apply if they exceed $100,000.

International wire transfer regulations

International wire transfer regulations are put in place to ensure that transactions are lawful, preventing fraud, money laundering, and the funding of illegal activities. To verify if a money transfer provider is regulated, look for authorization by the relevant country’s regulatory body, which you can usually find on their website.

Regulations may require documentation, such as proof of identity, the source of your funds, and the purpose of the transfer, and high-value transfers usually demand more rigorous checks. These rules vary by country but generally include verification of payment purpose, sender-receiver relationship, and the source of funds.

Regulations to send international transfers from the US

When you’re sending money out of the US, the bank or service which processes your transfer is legally obliged to collect information – and in some cases, carry out verification checks, on any payment worth 3,000 USD – 10,000 USD or more (depending on the payment type).

You might be asked for further documents to support your transfer, such as receipts or proof of the source of the funds, for example. Banks will also carry out checks on customers who may be trying to break down transfers into smaller payments to avoid detection. This is all to avoid fraud and to make sure that funds aren’t being transferred for illegal purposes.

Don’t forget, also, if you hold funds overseas – usually to the value of 10,000 USD or more over the course of a year – you may be required to file a Report of Foreign Bank and Financial Accounts (FBAR) with the IRS.

In the end, the rules which apply can vary based on the specific payment type and value – check relevant authorities websites for the best up-to-date information.

Rules for receiving money from overseas

When receiving money from overseas, it’s important to be aware of certain rules and regulations. For transactions over $10,000, the transfer must be reported to the IRS to comply with U.S. financial regulations. You may also need to file forms such as the IRS Form 3520 if the money received is a gift or inheritance.

Additionally, you’ll want to make sure that your funds are transferred through regulated financial institutions to avoid any legal issues and keep your money safe. Proper documentation, including proof of the transfer’s purpose and source, may also be required.

Related: Best ways to receive money from overseas

How much can you wire transfer without reporting to the IRS?

When wiring money, the IRS doesn’t impose specific limits on the amounts you can transfer, but financial institutions must report any transactions over $10,000 in order to prevent fraud.

Additionally, while gifts under $18,000 per person per year don’t require reporting, exceeding this amount will require you to file a U.S. Gift Tax Return (Form 709) to avoid potential penalties.

What happens when you transfer over $10,000?

When you transfer more than $10,000 internationally, whether from the US to another country or vice versa, financial institutions are required to report the transaction to the IRS. This is in order to stay compliant with laws such as the Foreign Account Tax Compliance Act (FATCA).

The IRS uses this information to track foreign assets, and failing to report your foreign accounts can lead to penalties. Depending on your situation, you may also need to submit specific tax forms and it’s always advisable to consult a tax attorney who can guide you on the necessary compliance requirements to avoid complications and any unwanted situations.

You can learn more about them here: International wire transfer regulations and taxes.

What is Foreign Account Tax Compliance Act (FATCA)?

The Foreign Account Tax Compliance Act (FATCA) is a U.S. law aimed at preventing tax evasion by U.S. citizens and residents with financial assets held in foreign accounts.

FATCA requires foreign financial institutions to report information about accounts held by U.S. taxpayers to the IRS. Additionally, U.S. taxpayers with foreign financial assets exceeding certain thresholds must report them annually on the IRS Form 8938. Non-compliance with the FATCA can result in penalties, so it’s essential for individuals and institutions to follow these regulations.

Conclusion: Is there a limit on international money transfers?

There’s not a legal limit to the amount of money you can send internationally. However, banks and providers do set their own limits which vary based on where you’re sending money to and how you want to set up your international transfer.

Generally, online payment limits with banks can be on the low side – 1,000 USD per transfer for Bank of America, and 25,000 USD for Chase for example. However, you can usually send more by visiting a branch – and paying a higher fee.

Specialist online services can often offer higher value online transfers, which come with transparent fees and fairly low overall costs compared to banks. Wise, for example, has payment limits of 1 million USD when you’re using an ACH, or 1.6 million when you send with a wire. And OFX has no limits at all, aside from those which are imposed by law in the US or the destination country. Check out the options for a few specialist services before you make your international transfer, to see if you can get a lower fee and an easier end to end payment process.

International money transfer limits FAQs

Which bank has the highest limits to transfer money abroad?

Most banks have lower limits when sending payments online, but can offer higher value transfers in a branch. The downside is that this may mean higher fees. As an alternative check out Wise for payments up to 1.6 million USD when you pay by wire – or Remitly for transfers of up to 30,000 USD which can be collected in cash in the recipient’s location.

What is the limit for international wire transfers?

There’s no legal limit for international wire transfers, but banks and specialist services do impose their own limits – and some currencies also have legal limits set by local laws in the destination country. Check with your bank or preferred provider to see the limits applied to your specific transfer.

What is the maximum transfer limit per day?

Maximum transfer limits vary widely between banks and providers, and may include daily, monthly or 6 monthly limits. Check in your online banking service, or in the provider’s app, to see the limits which apply to your specific account.

How can I increase my bank transfer limit?

You’ll usually be able to view your bank transfer limit in your online banking service, and raise it by calling or visiting the bank in person.