Remitly Limits [2025]: Full Guide

Remitly is an international money transfer service which lets individuals send money in 100+ currencies, to bank accounts, to mobile money accounts and for cash collection. The exact services available depend on the destination you’re sending money to – but all of Remitly’s services are considered to be safe and easy to use.

Remitly has some limits to the amount of money you can send. These limits are for customer safety and to comply with local and international law.

This guide covers all you need to know about Remitly’s limits for US senders, and some alternatives like Wise and OFX that you may want to consider for high value or business transfers.

Quick summary: Remitly transfer limits

- Remitly offers most customers in the US a maximum payment limit of 30,000 USD

- Remitly limits may also apply to the amount of money a customer can receive

- To qualify for the highest available limit you’ll need to be verified by Remitly, including giving some information about your account use, and uploading your ID

- Remitly is not intended for commercial or business payments, and does not offer accounts for holding a balance in foreign currencies

If you are looking for a money transfer app for your business, you can check out some of the Remitly alternatives we’ll here, such as Wise and OFX.

Does Remitly have limits?

Yes, Remitly has limits on the amount of money you can send and receive.

Previously, Remitly offered accounts in 3 different tiers, which all had their own limits for payments in a 24 hour, 30 day and 180 day period. At the time of research, Remitly is in the process of moving customers over to a new system which will give a higher, flat, limit per transaction, for verified accounts.

Aside from the Remitly sending limit, other limits may apply which can vary based on the destination you’re sending money to, as well as the pay out method you select. Remitly’s limits are in place to ensure customer accounts and payments are secure.

How much money can I send through Remitly?

At the time of research, Remitly is in the process of moving customers over to a new system which will give a higher 30,000 USD limit per transaction, for verified accounts in the US.

This is a significantly higher limit than was previously in place for customers, and is intended to allow customers to send money more flexibly. However, bear in mind that other factors may also influence the payment limit applied to your transaction – which may mean you can only send smaller amounts.

Alternatives to Remitly with higher transfer limits

Remitly does not support business transfers, and the 30,000 USD payment limit is relatively low compared to some other services. If you’re looking to send a business transfer, or if you need to make a higher value payment, you may need to pick a different provider.

Options like Wise, Xe Money Transfer and OFX may be able to help. Here’s a summary of these services – we’ll get into more detail about each in just a moment.

| Remitly | OFX | Wise | Xe Money Transfer | |

|---|---|---|---|---|

| Supported currencies for international transfers | 170+ countries, or in 100+ currencies | 170+ countries, or in 50+ currencies | 160+ countries, or in 50+ currencies | 200 countries, or in 100 currencies |

| Payment limits | 30,000 USD per transfer | Usually unlimited | Variable by currency, usually the equivalent of 1 million GBP (~1,328,500 USD) | 535,000 USD per transfer |

| Fees | Variable fees based on destination and payment method | No transfer fee on most payments | From 0.33% | Variable fees based on destination and payment method |

| Exchange rates | Exchange rates are likely to include a markup | Exchange rates are likely to include a markup | Mid-market exchange rate | Exchange rates are likely to include a markup |

*Some other limits may apply to all providers, based on factors including the payment destination, currency and the customer’s location. Information correct at the time of writing (9th of September 2024)

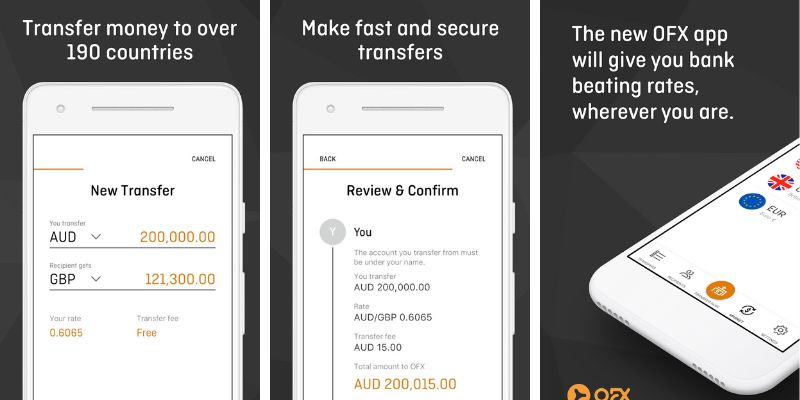

OFX money transfer

OFX supports payments for personal and business customers, in 50+ currencies. You can make your transfer online or in the OFX app, and there’s also a 24/7 phone service if you want to talk your options through with someone. This can be very reassuring when making a higher value transfer.

Generally, OFX does not have an upper limit on the value of payments you can send. Aside from transfers, OFX also offers currency risk management products and has a business account you can use to hold, send and receive foreign currency payments in 7 currencies.

Best features:

- Services for individuals and businesses

- Often no limit to the value of a payment you can send

- No transfer fee – although exchange rates include a markup

Learn more on OFX review. You can also compare OFX exchange rates here.

Wise money transfer

Send payments in 50+ currencies, to 160+ countries. Wise international transfers are available for individuals and business customers, and while there are some limits to the value of payments you can send, these limits are generally set very high to allow customers to transact freely.

Limits vary by currency, and are generally set at around 1 million GBP equivalent (around 1,328,500 USD). Wise transfers cost from 0.33%, with no markup added to the exchange rate used for currency conversion.

Aside from international transfers, Wise also offers multi-currency accounts which can be used to receive foreign currency payments, and which offer a linked international debit card for spending and withdrawals around the world.

Best features:

- Mid-market exchange rates and low, transparent fees

- High transfer limits, usually around 1 million GBP in value

- Account and card services also available for personal and business customers

Learn more about Wise Business Account. You can also compare Wise exchange rates here.

Xe Money Transfer

Xe Money Transfer has a per transaction limit of 535,000 USD for customers in the US. You can send payments to more or less any country in the world, in 139 currencies.

Transfers have variable fees and the exchange rate used to convert your dollars to the currency needed for deposit may include a markup.

You can arrange your Xe transfer online or in the Xe app.

Best features:

- Send money more or less anywhere in the world

- Single transaction limits are 535,000 USD

- Popular and safe provider

Learn more: Xe money transfer review. You can also compare Xe exchange rates here.

Is it possible to increase Remitly transfer limits?

To qualify for the Remitly transfer limit of 30,000 USD you’ll need to provide some information and documents for verification.

It’s possible that you’ll be asked for details about a payment you’re making, such as your reasons for sending, source of income, and your current occupation. This process is part of the Remitly verification and required to keep accounts and customers safe.

How to increase Remitly transfer limits

You’ll be prompted online or in the Remitly app, if you need to complete verification to raise your sending limits or to process a specific payment.

You may be asked:

- To confirm your name, date of birth, and address

- To upload an image of your passport, or other government-issued ID

- To enter your Social Security Number (SSN) or ITIN number

- To provide bank statements or pay stubs to show the source of the payment you’re sending

Remitly transfer limits

The exact limit which applies to your Remitly account will depend on a number of factors, including whether or not you’ve completed the Remitly verification process. As we’ve mentioned, previously Remitly money transfer limits were set on 3 different tiers. To qualify for a higher tier account – which also has higher limits – you’d need to provide some additional information and documents to Remitly for verification.

Remitly customers in the US who already had a tier 2 or tier 3 account are being moved automatically to new Remitly limits which are set by the sending country.

In the US this means you can send up to 30,000 USD per payment, although other limits may also apply on specific payments.

If you had a tier 1 Remitly account you’re likely to need to provide some extra paperwork and information to get this new, higher limit. We’ll look at how you can increase your Remitly limit in a little while.

How much money can I send through Remitly to Mexico?

Remitly transfer limits may vary based on which documents you’ve provided for verification purposes.

At the time of research (September 2024), Remitly is in the process of migrating customers from their previous tier based limit system, to a new flat limit of 30,000 USD per transfer.

How much money can I send through Remitly to India?

Remitly has variable transfer limits, which may change based on your account’s verification and the pay out method you pick.

Verified customers can send up to 30,000 USD in most cases, but you’ll be told of any limits which apply to your particular transaction when you start to set it up.

How much money can I transfer from Mexico to the USA?

Remitly doesn’t offer services to customers based in Mexico. However, you may be able to find an alternative provider which can help, such as Paysend.

Different providers do set their own transfer limits, though – so shopping around will be the best way to find one which suits your specific needs.

Remitly business payments limits

Remitly doesn’t allow business or commercial payments.

The service is intended for sending money to people you know and trust only, such as remitting money home to a loved one.

If you are looking for an international money transfer app for business payments, you can check out some of the Remitly alternatives we’ve explored here, such as Wise and OFX.

High amount transfers with Remitly

If you’re sending a higher value payment with Remitly you’ll be able to arrange everything online or in the Remitly app.

To make sure your payment can be processed you’ll need to complete the verification steps including uploading your ID and entering your SSN or ITIN.

Remitly offers some promotional exchange rate offers for new customers, although these might only apply to smaller amount payments.

Learn more about Remitly safety and the features in place to protect customer payments here.

We also have safety guides on other providers we mentioned in this article:

Conclusion: Does Remitly have transfer limits?

Remitly has transfer limits which may vary based on the country or currency you’re sending to, as well as which documents you’ve provided for verification purposes.

At the time of research, Remitly is in the process of migrating customers from their previous tier based limit system, to a new flat limit of 30,000 USD per transfer. While this is a higher limit than previously offered, it’s still lower than many other providers, because Remitly is intended for payments to friends, family and loved ones rather than for business or commercial purposes.

If you need to send a high value payment – or if you’re transacting for your business – you may need to choose a Remitly alternative, such as XE Money Transfer, OFX or Wise.

Looking for more? Get our full Remitly review here.

Remitly international transfer limits FAQs

Does Remitly work in the USA?

Yes. US customers can use Remitly to send money to bank and mobile money accounts and for cash collection through agents.

What is the maximum limit for Remitly?

Remitly US limits can be as high as 30,000 USD per transfer.

However, limits do depend on where you’re sending money to and whether or not you have a fully verified Remitly account. If you run into a limit on your payment you’ll be notified by Remitly directly.