5 Alternative Online Money Transfer Companies to InstaReM

In this guide we list 5 of the best alternative money transfer companies similar to InstaReM and why we think they're better (or worse) in terms of value, speed and ease of use.

Whether you're an individual looking to transfer money abroad or a small business wanting to explore ways to pay staff in different currencies, you may have considered InstaReM as a way to complete your international money transfer.

While InstaReM is a great option, they might not be the money transfer company that will support your needs in the best way. Let's have a look at your other options in more detail.

Alternatives to InstaReM

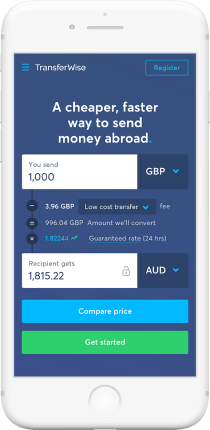

Wise (formerly known as TransferWise)

Wise (formerly known as TransferWise) is one of the biggest and most popular money transfer services in the world. Founded in 2011, they transfer over $5 billion USD every month for their customers and are one of the few companies that convert money at the real mid-market rate, with no mark-up added.

Wise offers ease and low fees due to their widely supported currencies list and percentage-fee transfer rates. Although these fees are transparent and low, it does make Wise a more expensive choice for larger international transfers.

InstaReM often match Wise in terms of cost and can even beat them for mid to large international money transfers due to the way they calculate their fees. InstaReM can also be faster for certain routes, allowing them to complete their transfer within 1-2 business days.

Pros

- Highly rated app - 4.8 out of 5 stars

- Easy-to-navigate website with simply, transparent information

- Converts money at the real mid-market rate - no mark-up or conversion fee applied

- Supports 50+ currencies for currency exchange

- Money delivered between 2-4 business days

Cons

- Not open to everyone worldwide yet

- Transfer fees can get costly when transferring larger amounts of money due to percentage-style calculation

- Does not yet support sending money to and from all currencies offered

| Wise | InstaReM | |

|---|---|---|

| Transfer fee | % amount check here | % amount |

| Exchange rate margin | 0-0.015% | 0.25-1% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 3.4 out of 5 stars |

| Speed | 2 working days | 1-2 working days |

Coverage | 50+ countries | 50+ currencies Click here for full list |

Wise is the more popular choice in the UK, US and European markets. Its app is its biggest strength, which offers customers an easy way to transfer money with low fees and to a range of supported currencies.

InstaReM is more established in the Asia market and continues to grow globally. Competitively matched against Wise, you’ll likely get similar or better rates and a potentially faster transfer to your bank account. What you’ll miss out on in ease of use will be rewarded in saving, particularly for larger transfers.

Value | Speed | Ease |

|---|---|---|

Both | InstaReM | Wise |

CurrencyFair

CurrencyFair was founded in Ireland in 2010. It’s a very popular option for many globally and has exchanged more than €10 billion to date.

We highly recommend CurrencyFair as an option to transfer. They are fairly priced compared to competitors and also have a unique option of choosing to exchange at a later date with another CurrencyFair customer.

Known as peer-to-peer exchanges, this can be a cost-effective way for both parties to exchange money, but only if you have the time to wait.

Pros

- Very highly rated app - 4.8 out of 5 stars

- Fixed flat fee applied to transfers, making it cost-effective for larger transfers

- CurrencyFair website is easy to navigate and offers clear and transparent information

- Payment options on how you wish to transfer your money

- Supports 21 currencies in over 150 countries

Cons

- Limited number of supported currencies compared to other providers

- Depending on your bank, the transfer can take longer than other providers

- The peer to peer service does not guarantee a lower exchange rate, so you may lose time and risk not getting the rate you requested

| CurrencyFair | InstaReM | |

|---|---|---|

| Transfer fee | % amount | % amount |

| Exchange rate margin | 0.25-0.3% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 3.4 out of 5 stars |

| Speed | 3-5 working days | 1-2 working days |

Coverage | 17 currencies | 50+ currencies Click here for full list |

CurrencyFair and InstaReM are well matched.

For value, CurrencyFair has a great peer-to-peer service: you request an exchange rate that you wish to transfer at and see if this is accepted by another user looking to transfer in the opposite direction. Although it's not guaranteed to be accepted, it is a great way to explore getting the best value if you are not pressed for time.

Value | Speed | Ease |

|---|---|---|

InstaReM | InstaReM | CurrencyFair |

OFX

OFX has been around for 20 years and has transferred an impressive £65 billion to date for customers around the globe.

Unlike other transfer services such as MoneyGram, OFX has worked hard to keep up with its digital competitors and has an easy-to-use, highly rated app and website to complete your international money transfer. They are also well-known for excellent customer service.

Pros

- Highly rated app - 4.8 out of 5 stars

- Easy-to-navigate website with simply, transparent information

- Converts money at the real mid-market rate - no mark-up or conversion fee applied

- Supports 50+ currencies for currency exchange

- Money delivered between 2-4 business days

Cons

- Not open to everyone worldwide yet

- Transfer fees can get costly when transferring larger amounts of money due to percentage-style calculation

- Does not yet support sending money to and from all currencies offered

| OFX | InstaReM | |

|---|---|---|

| Transfer fee | Fee-free above $10,000 | % amount |

| Exchange rate margin | 0.4% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 3.4 out of 5 stars |

| Speed | 2-4 working days | 1-2 working days |

Coverage | 55+ currencies | 50+ currencies Click here for full list |

OFX and InstaReM both offer over 50 currencies to exchange, although there are restrictions in the routes of your chosen exchange.

InstaReM charge a fee ranging anywhere between 0.25-1%, but charge zero mark-ups on the exchange rate. OFX do not charge a fee but instead add a percentage mark-up to the exchange rate, on average 0.4%, making OFX a slightly more expensive option depending on where you're sending money to.

Value | Speed | Ease |

|---|---|---|

InstaReM | InstaReM | OFX |

PayPal/Xoom

PayPal provides its millions of customers with an easy to use, secure international transfer service called Xoom. Xoom is open to anyone, not just PayPal account holders.

Although PayPal may not be the first company you think of for overseas money transfers, Xoom has raving reviews from customers and is now one of the leading transfer choices for the US, Canada and Europe.

But with all bigger brands, there is a price to pay for using them and sending money under the PayPal umbrella. Because of this, Xoom is more expensive than other money transfer options and the exchange rate mark up is often obscure and high.

Pros

- Highly rated and reviewed app: Xoom gets 4.7 out of 5 stars out of 37,000 reviews

- Send to 30 countries worldwide in US dollars or local currency. For the full list, click here.

- A number of payment options available for pay in and pay out: use your PayPal account, debit or credit card to transfer and your recipient can receive via a bank deposit, cash out or door delivery of funds. You can also pay bills directly to countries and different currencies.

- Secure and convenient

- Fast money transfer: money can be delivered in a number of hours in most occasions, or a few days depending on the details of your international money transfer.

Cons

- Adds a mark-up to the exchange rate that differs with each currency, amount and transfer method

- Fees are often unclear and close to the retail exchange rate, making it far more costly than other providers like InstaReM

- Expensive for international money transfers

| Xoom | InstaReM | |

|---|---|---|

| Transfer fee | 0.30 fixed fee | % amount |

| Exchange rate margin | 3.9-7.4% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 3.4 out of 5 stars |

| Speed | 2 hours | 1-2 working days |

Coverage | 24 currencies | 50+ currencies Click here for full list |

You may be drawn to Xoom/PayPal simply because you have used them previously for online transactions and you know they are secure and easy to use.

But despite PayPal being a well-known and trusted online transaction provider, they simply don’t offer value in international transfers even under their cheaper Xoom brand and you will lose a larger percentage of your money overall than other providers, including InstaReM.

Value | Speed | Ease |

|---|---|---|

InstaReM | Xoom | Xoom |

MoneyGram

MoneyGram is the second largest money transfer service in the world, after Western Union. Founded in 1940, you are likely to have seen their logo in one of your go-to stores such as 7/11, Walmart and the Post Office. With over 380,000 locations, MoneyGram is one of the few companies that offer in-person cash collection of money transfers.

But this convenience comes at a cost, and MoneyGram’s fees and exchange rates are a lot worse than other transfer services.

If you’re looking for an online digital transfer and are not restricted to collecting cash in-person, then we recommend InstaReM or other alternatives, instead of MoneyGram.

Pros

- Cash pick up points across the world, often in stores such as 7/11, Walmart and Post Offices

- Supports transfers to over 200 countries/territories

- Very fast transfer, can be from 10 minutes after the transfer that the cash can be available to pick up

Cons

- Much more expensive than another money transfer service

- MoneyGram adds a margin on the market rate plus a high fee, usually around 3% meaning you will be charged more for your transfer amount

- Cash pick-up is their default method and bank transfer is only available in selected countries

- Highly variable fees applied - this can be calculated by the currencies you’re converting, how much and the method of your transfer

| MoneyGram | InstaReM | |

|---|---|---|

| Transfer fee | % amount | % amount |

| Exchange rate margin | 3% | 0.25-0.3% |

| Mobile app | Yes 4.8 out of 5 stars | Yes 3.4 out of 5 stars |

| Speed | 10 minutes – 2 working days | 1-2 working days |

Coverage | 200 countries/territories | 50+ currencies Click here for full list |

MoneyGram is an expensive method to complete your international money transfer. With fees calculated by multiple factors such as location, amount, payment method and how the money is received, it’s not transparent or clear how much a customer will be charged.

For ease and value, we recommend InstaReM. Only use MoneyGram if you need someone to pick up cash, but be aware that you will lose a larger percentage of your money in the process.

Value | Speed | Ease |

|---|---|---|

InstaReM | MoneyGram (cash)InstaReM (transfers) | InstaReM |

Summary

Transferring money is simple and easy when transferring with the right provider. We hope the above five alternatives have helped you to choose the best one for you. For help getting the cheapest alternatives to InstaReM check out our international money transfer comparison table.

Here's the overall list of alternatives we recommend in order of preference:

- Wise is the best rated and our overall recommended service for foreign exchange. Easy to use through their app, they offer transparent information and security throughout.

- CurrencyFair is a great service and one of the main competitors to InstaReM. A new digital transfer provider, it offers everything from low rates to a slick app. If you’re not feeling InstaReM, definitely check CurrencyFair out!

- OFX has been around for 20 years and has evolved with technology and the needs of its customers. For that, they are rated highly by their users and would be a great alternative to InstaReM.

- PayPal's Xoom service is a highly rated option by thousands of customers globally. Although they cost you more than other transfer providers (hence why we've placed them fourth), they offer a lot of flexibility, security and range of services which are supported by Paypal.

- MoneyGram is only a good option if you need to prioritise convenience of cash over transferring into a bank account. With a huge network of agents, it’s pretty easy to get cash from a MoneyGram transfer but as the sender, expect to see a healthy chunk of your money go into MoneyGram’s pockets.

Compare money transfer companies like InstaReM