Is OFX safe? [2025]

OFX is a specialist broker service which arranges individual and business transfers, and also provides currency risk management solutions.

Using a specialist provider for international transactions can mean you get a better exchange rate and a lower fee compared to using your bank. But if you’re considering using OFX to send or convert your hard earned cash, you’re probably wondering: is OFX safe? This guide covers all you need to know.

Quick summary

- FinCEN registered in the US, with state licenses covering the services offered

- Overseen by 50 global bodies covering its international operations

- 24/7 phone contact if you have any queries

- Account verification and anti-fraud processes as standard

- Customer funds are safeguarded and kept separate from operating capital

| Advantages | Disadvantages |

|---|---|

|

|

Is OFX safe?

Before we get into the detail of how OFX keeps customers and their money safe, let’s get some key facts and figures about OFX:

Regulators: Overseen by 50 global regulators, registered as a money transmitter in the US at state and federal levels

Established in: 1998

Customer numbers: 1 million

Volume of transfers: 140 billion USD

Learn more: OFX Review

How is OFX regulated?

USForex Inc. , doing business as OFX in the US, is registered as a Money Service Business. You can check details of all relevant state licenses online. Additionally, companies like OFX need to be licensed and regulated according to local laws in any other country in which they operate – that means that OFX is overseen by a total of 50 different regulators.

Examples include the Financial Conduct Authority (FCA) in the UK, FINTRAC in Canada, or AUSTRAC in Australia.

Is OFX as safe as banks?

Sending a payment with OFX is safe. OFX isn’t a bank and so isn’t subject to exactly the same regulation – that’s because it offers different services to a bank. For the services it does offer, such as international payments and account services, it is as safe to use as a bank, and is subject to very similar rules. As a specialist broker, OFX can often also offer a broader range of services and a better exchange rate than a bank.

Services such as OFX which are registered as a Money Service Business are regulated by both state and Federal law, and must register with the Financial Crimes Enforcement Network (FinCEN) in the US. In practice, that means there’s little difference – when it comes to safety – between choosing your bank or choosing a specialist provider for your international payment.

It is worth mentioning up front that as well as international payments, OFX also offers currency risk management solutions for individuals and businesses. These include forward exchange contracts in which you’ll lock in an exchange rate for a future transfer, by paying a deposit and signing a legally binding contract.

These types of currency products are fairly complex, and while safe they do come with a risk you’ll miss out on benefits if the exchange rate changes in your favor during the lifetime of the contract. Make sure you understand any currency risk management products you’re considering before you sign up.

How does OFX keep your money safe?

Let’s look at how OFX keeps customer funds safe when transferring payments, or for customers who have a business account which lets you hold money in several currencies.

Is OFX safe to transfer money?

Yes, transfers are safe with OFX and as it is a licensed and registered money transmitter, you know your money is protected. You can transfer from a minimum of 1,000 USD with OFX.

As a registered Money Services Business, OFX has to stick to state and Federal laws about how to protect customer funds – these often mean providers are obliged to hold a minimum balance amount to avoid insolvency, offer a surety bond, and stick to legally mandated processes to arrange payments.

Is OFX safe to keep money with?

If you’re sending a payment with OFX, the chances are that they won’t hold your funds at all. Once your money arrives with OFX it will be passed on to the recipient instantly.

If there is ever a need to hold your funds, or if you have an OFX business account with a holding facility, OFX is subject to local and international regulations which dictate how your money is kept safe. Usually this will mean that any funds you hold with OFX are safeguarded – that is, they’re stored securely away from OFX’s own operating capital.

Is OFX safe for large amounts?

OFX does not have a maximum payment amount, which means you can send any sum you wish with no limits. Making a large payment with OFX is safe. You might have to complete extra verification or place your transfer order over the phone rather than online – but these are all steps taken to make sure payments are always secure.

OFX also has a service to allow customers to send partial payments when funding a transfer, if their own bank limits them from sending the whole amount in one transaction. You’ll need to talk to a broker to set this up, but it can be handy if you need to send a large amount but your bank has transaction caps in place.

As with any service, if you’re making a high value payment be sure to double check all the recipient details, and complete any verification steps you need to take promptly to make sure everything works smoothly.

Is the OFX business account safe?

OFX offers a range of services to businesses, including global currency accounts and currency risk management solutions. Sending a business payment, or opening a business account with OFX is safe. You may also find you get a more convenient way to manage multiple currencies compared to a bank, and can access more favorable exchange rates too.

Is OFX legit?

OFX is legit. OFX was set up in Australia in 1998 and has since grown to become a global business with offices around the world.

As a currency specialist, OFX has knowledgeable teams and provides a broad range of services. Having offices around the world also helps OFX to keep up with local changes in legislation and best practice to make sure everything continues to run smoothly. That makes the entire process for OFX customers sending payments, receiving funds, or managing money in a multi-currency business account, safer, smoother and more convenient.

Is OFX trustworthy?

Yes. OFX has 24/7 customer support and while simple transfers can usually be arranged online or in the app, higher value payments and currency risk arrangements must be set up on the phone with the support of an expert broker. This enhances customer security because the broker can talk through the required verification steps and ensure payments are set up properly with all the necessary details.

Is the OFX website safe?

Yes. OFX uses industry standard approaches to keep customer accounts and funds safe. These include technology and dedicated teams to spot and prevent fraud, a thorough verification process, encryption, and a requirement for accounts to be password protected.

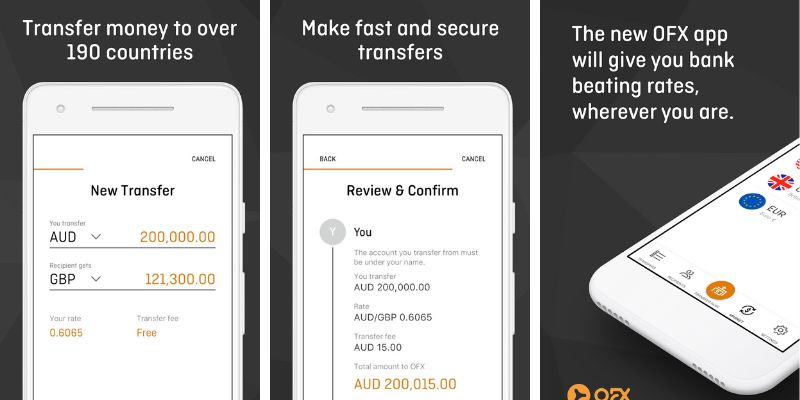

Is the OFX app safe?

The OFX app is safe to use, with regular updates to ensure any issues or problems are resolved as soon as possible.

OFX money transfer reviews on Trustpilot

Here’s a summary of what customers say about OFX on Trustpilot:

| Provider | Number of reviews | Score (out of 5) | Rating |

|---|---|---|---|

| OFX | 6,000+ | 4.3 | Excellent |

Most customers posting reviews on Trustpilot are very satisfied with the service they receive from OFX. There are only about 9% of reviews listed which give the worst available rating.

In the reviews with a poor rating, one theme is that customers have been asked to provide extra documents for verification to allow their payments to be processed. This is due to strict anti-money laundering and counter terrorism legislation around the world.

Verification could be requested at any time, because the required documents can vary by send amount and destination country. Unfortunately this does slow down the process of transferring money – but it also helps keep accounts and customers safe. Banks have the same level of checks in place, as they must adhere to the same global legislation.

Can you get scammed on OFX?

Although OFX takes steps to prevent fraud and keep customers safe, criminals are always looking for new ways to profit, and therefore it’s not impossible that you’ll get scammed on OFX. The exact same could happen with a bank or any other provider, unfortunately.

However, there are a few simple pointers to follow and red flags to look out for to make sure you don’t fall victim to a fraud. OFX suggests the following:

- Don’t send payments to people you don’t know or trust

- Stay away from anything that simply sounds too good to be true

- Watch out for phishing attacks asking you to share personal information or alter your bank account information

- Don’t send a wire transfer to repay someone who has sent you a check – the check may be a forgery

Can I avoid falling victim to fraud?

Take sensible steps to protect your OFX account and your personal information. Some of them can be:

- Use secure passwords

- Avoid public wifi when on sensitive sites

- Don’t share your financial details with anyone you don’t know

Because OFX has a 24/7 customer support service, you can always check if you’re unsure about the details of a payment, or if you’ve received a message you think may be a phishing attack.

Is your personal data safe on OFX?

OFX will collect customer data from anyone using their services – we’ll look at what that might include in a moment. Customer data is used for a variety of legal and practical reasons:

- To comply with legislation in the US and the destination countries

- To process transactions

- To monitor and improve services

- To communicate with and market to you

OFX keeps customer data safe, and complies with all relevant legislation about collecting and storing information. Your personal data may also be shared with certain third parties if you request services which require it, or if it’s legally necessary. Third parties include affiliates, government agencies and identity verification services for example.

What personal data does OFX collect?

The types of data OFX will collect can include:

- Identity information – your name. SSN, email and phone number

- Verification information – your government issued ID details

- Demographic information – your nationality and occupation

- Transaction information – payments you make, and your recipient’s details

- Financial information – your bank details and your credit record if required

- Service information – what type of transactions you make

- Technological information – your device and IP address

OFX keeps personal data for as long as is legally required, or practically necessary. In most cases this is for up to 7 years after you close your OFX account.

How to get started on OFX?

You can create your account online or by calling the OFX team. Here’s what you’ll need:

- Download the OFX app or head to the desktop site

- Register your account with your name, email, date of birth, address, occupation, contact number

- You’ll get a phone call from a member of the OFX team to talk through getting verified, and confirm your account is active

Once your account is up and running you can send payments online or by phone. Some high value transfers or complex currency products must always be arranged by phone for safety.

Conclusion: Is OFX money transfer safe?

OFX is a very popular service which offers international payments for personal and business customers, as well as multi-currency accounts for business customers. There are also currency risk management services available which makes it a flexible service for a range of customer needs.

It’s safe to use OFX as a personal or business customer. OFX has robust digital security measures in place, and also has a 24/7 phone line which can offer reassurance for customers who have questions. OFX is a licensed and regulated company which is overseen by 50+ global regulators, and FinCEN licensed in the US. It’s not a bank – but if you want low cost currency services, it’s a good bet – and you can be assured it’s as safe as a bank for the services it offers, too.

FAQs

Is OFX money transfer safe?

OFX is safe to use. In the US it’s registered with FinCEN, and holds state licenses – and it’s also overseen by 50 global regulators.

How is OFX regulated?

OFX is regulated globally. In the US that means it’s covered at State and Federal levels; and it’s also overseen by over 50 global bodies to cover its international services.

Is OFX good for bank transfers?

OFX offers global transfers which can be convenient and easy, with good exchange rates and fast delivery times. Compare the service available against the options your own bank can offer, to see which is best.

Is it safe to link a bank account to an OFX account?

If you need to link a bank account to OFX to process a payment you can rest assured your data and all important information is stored safely, and only for as long as necessary for OFX to fulfill the transaction and meet its legal obligations.

How good is the OFX service in the US?

OFX is a popular service in many countries, including the US. You can get the full range of OFX products and services in the US, including international payments and currency risk management solutions for individuals and businesses.