Wise vs OFX [2025]

If you’re looking for ways to send or spend foreign currencies for yourself or your business you may have heard of both Wise and OFX. Both are large, reputable and globally available specialists in currency conversion, international payments and more – but what exactly is the difference between Wise vs OFX?

This guide walks through how they both work and how they compare, on international transfers, multi-currency accounts, card services and business products.

Summary: Wise offers international transfers to 160+ countries, and multi-currency accounts for convenient card spending, currency exchange and ways to receive payments for yourself and your business. OFX offers international transfers to 170+ countries, and currency risk management products for business and personal customers, plus multi-currency accounts for businesses and online sellers.

Wise vs OFX: Side by side comparison

We’ll get right into the details of how Wise and OFX work in just a moment, but first let’s start with an overview of Wise vs OFX side by side, looking at available features.

| Feature | Wise | OFX |

|---|---|---|

| Service availability | Online and in the Wise app | Online, in the OFX app, by phone |

| Multi-currency account | Hold and convert more than 40 currencies – for personal and business customers | Available for business customers, to hold and exchange 7 currencies |

| Debit card | Yes | No |

| Spend with debit card | Free to spend in a currency you hold enough balance in, conversion fee from 0.33% for other currencies | N/A |

| Local account details for receiving payments | Yes – local account details and SWIFT details available in select currencies | Business customers only – available in 7 currencies |

| Send money to | More than 160 countries | More than 170 countries |

| Transfer fee | From 0.33% | No transfer fee |

| Transfer speed | 50% of payments are instant, 90% arrive in 24 hours | 1 – 2 days for most major currencies, 3 – 5 days for exotic currencies |

| Exchange rates | Mid-market rate | Exchange rates include a markup |

| Currency risk management products | No | Yes |

| Regulated in the US? | Yes | Yes |

| Open a business account | Yes | Yes |

So, to summarize:

- Wise is available in app and online, in most countries globally – OFX is offered in a fairly broad selection of countries including the US, with services online, in app and by phone

- OFX uses an exchange rate which includes a variable markup – Wise currency exchange uses the mid-market rate with fees from 0.33%

- OFX has currency risk management products for personal and business customers, Wise does not offer this service

- OFX does not charge for transfers although fees are included in the exchange rate used – Wise transfer fees start from 0.33%

- Wise offers international accounts for personal and business customers – OFX has international accounts for business customers only

- Wise has debit cards for personal and business customers – OFX does not

- Wise supports more currencies for holding and exchange

- Wise offers local and SWIFT account details for receiving a selection of currencies – OFX does not have this option for personal customers, although business customers can receive 7 currencies

- Both providers are fully regulated, and offer both personal and business services

The important bits

If you’re not sure which provider to pick for an international transfer, or to access other currency services, you’ll want to know more about the fees, safety and speed of the options available. Here’s a comparison of Wise vs OFX on the key features which may help you decide which is right for you:

| Wise | OFX | |

|---|---|---|

| Rates | Mid-market exchange rate | Exchange rates include a variable markup |

| Fees | Free to spend currencies you hold with your Wise Multi-Currency Card No monthly charges Transaction fees apply – from 0.33% for currency exchange and international transfers | No transfer fee No monthly charges for the OFX Global Currency Account for business customers |

| Speed | 50% instant, 90% same day | Can take 3 – 5 business days depending on destination |

| Service | Desktop browser and mobile app | Desktop browser, mobile app, and by phone |

| Safety | Fully regulated and licensed | Fully regulated and licensed |

| Reviews (TrustPilot) | 4.3, Excellent, 232,000+ reviews | 4.3, Excellent, 10,000+ reviews |

To summarize:

- Rates: Wise uses the mid-market rate, whereas OFX applies a variable markup to the rates used

- Fees: Wise accounts have no monthly fees, with currency exchange and transfer from 0.33%; OFX has flat transfer fees, while business account plans do not come with ongoing fees

- Speed: Wise transfers may arrive instantly, and 90% arrive in 24 hours, OFX transfers could take 3 – 5 days depending on the destination

- Service: Both providers have online and in-app service, OFX also offers a 24/7 phone options

- Safetly: Both providers are fully regulated and licensed

- Reviews: Wise has an Excellent rating on Trustpilot from 232,000+ reviews, OFX has an Excellent rating on Trustpilot from 10,000+ reviews

Pros and cons

| Wise | OFX |

|---|---|

| ✅ Multi-currency accounts to hold 40+ currencies ✅ Payments to 160+ countries ✅ Local and SWIFT account details for receiving currencies ✅ Payment cards for use in 150+ countries ✅ Mid-market exchange rates | ✅ Send payments in 50 currencies to 170+ countries ✅ No fee for transfers |

| ❌ Some service fees apply ❌ No physical location for face to face services | ❌ Exchange rates include a markup ❌ Delivery can take several days |

The verdict: Which is better, Wise or OFX?

OFX and Wise both offer some great options for anyone looking to send or spend internationally – which will win for you might simply depend on the specific services you need.

- OFX is especially popular thanks to its 24/7 broker phone service, and currency risk management solutions like forward exchange contracts and target rate orders. You can send pretty much unlimited value payments to 170+ countries, but exchange rates include a markup. That means you’ll need to compare the OFX rate against the mid-market rate to check if it’s a good deal. OFX does not provide multi-currency accounts or cards for personal customers.

- Wise on the other hand has a multi-currency account with a linked international debit card, and offers fast and secure online and in-app transfers direct to bank accounts. Wise payments use the mid-market exchange rate with low, transparent fees which makes them easy to compare – just run an instant online comparison to see the Wise rates and fees, and compare against other available services including OFX.

Use this guide to compare both Wise vs OFX to see which is best for you.

About Wise and OFX

Wise review:  Wise was founded in the UK in 2011, and has expanded globally, offering low cost cross border transfers, multi-currency account services, debit cards and business products. Today, Wise has over 16 million customers globally. All Wise services are delivered online and in app, with transparent fees and low overall costs.

Wise was founded in the UK in 2011, and has expanded globally, offering low cost cross border transfers, multi-currency account services, debit cards and business products. Today, Wise has over 16 million customers globally. All Wise services are delivered online and in app, with transparent fees and low overall costs.

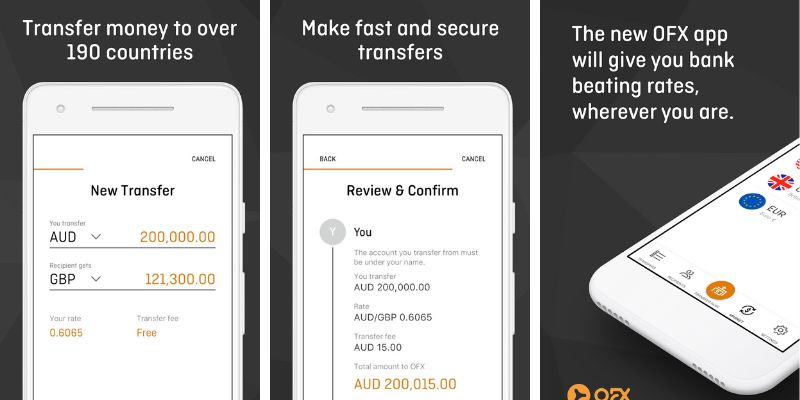

OFX review:  OFX was founded in 1998, and lets you send payments in 50 currencies to 170 countries. You can also access a personal broker service to set up forward exchange contracts and target rate orders. OFX business accounts are available to hold and manage 7 foreign currencies, and to make international business payments.

OFX was founded in 1998, and lets you send payments in 50 currencies to 170 countries. You can also access a personal broker service to set up forward exchange contracts and target rate orders. OFX business accounts are available to hold and manage 7 foreign currencies, and to make international business payments.

Wise vs OFX fees

Wise and OFX have slightly different product ranges, and a varying approach on fees. OFX has a fixed fee for international transfers which is waived for higher value payments. Currency risk management products also attract varying fees which you’ll need to discuss with a broker. Wise has transparent fees for international payments and card services – here’s a rundown:

| Service | Wise fee | OFX fee |

|---|---|---|

| Ongoing fees | No fee to open a Wise personal account, no ongoing fees | No fee to register or to open a Global Currency Account as a business customer, no ongoing fees |

| Card fee | One time order fee, no ongoing charges | Not applicable |

| Spend currencies you hold | No fee | Not applicable |

| Spend currencies you don’t hold | From 0.33% | Not applicable |

| ATM fee | Low cost withdrawal fees, after no-fee limits are withdrawn in a month | Not applicable |

| Overseas transfers | From 0.33% | No transfer fee |

| Currency risk management services | Not applicable | Varying – discuss your specific needs with a broker by phone, 24/7 |

Fees correct at time of writing – 9th September 2024

Wise vs OFX: Which is cheaper?

Looking to send an international payment? Using a specialist service like Wise or OFX is often cheaper than using a bank. Specialist international money transfer providers have invested in new ways to process global transfers – and don’t have the overheads a bank does. This lets them drive down costs. However, as each money transfer service has its own fees, it’s still well worth shopping around before you pick one.

Here’s a head to head between OFX and Wise on costs for a couple of different value payments, to give a flavor.

| Amount & Currency | Recipient gets with Wise | Recipient gets with OFX | Which is cheaper? |

|---|---|---|---|

| Sending 1,000 USD to GBP | 757.99 GBP | 753.80 GBP | Wise |

| Sending 5,000 USD to GBP | 3,792.46 GBP | 3,768.71 GBP | Wise |

| Sending 1,000 USD to EUR | 898.34 EUR | 891.60 EUR | Wise |

| Sending 5,000 USD to EUR | 4,494.89 EUR | 4,457.99 EUR | Wise |

Fees correct at time of writing – 9th September 2024

You can also check the costs and exchange against other providers, on this page here.

Wise vs OFX exchange rates

Wise exchange rate: Wise uses the mid-market rate for currency exchange – the same one you’ll find on Google or using a currency conversion tool. All the costs you need to pay are shown separately so you can easily compare and check the total amount.

OFX exchange rate: OFX may add a small markup on the exchange rate offered for currency conversion. This is included in the rate you’re shown – to spot it you’ll need to compare the OFX rate against the mid-market rate you can find on Google.

Wise vs OFX: Which is faster?

50% of Wise payments are instant, 90% arrive on the same day – although the exact delivery time can depend on factors including the destination country, and the recipient’s bank processing times.

OFX offers same day payments on some currency routes, with most major currencies arriving in 1 – 2 days. Payments to more unusual currencies can take 3 – 5 business days depending on destination.

How do they work?

How does Wise work?: To use Wise to send a payment – or to set up a multi-currency holding account – you’ll need to register and get verified by uploading a photo of some ID documents. Once you’re set up, whenever you need to make a payment you just send the money in USD to Wise’s local US account, and Wise will dispatch the transfer through its global network of local bank accounts. This process works differently to a bank wire, which means your money could arrive faster and won’t incur intermediary fees.

How does OFX work?: Before you can use OFX you’ll also need to set up an account online or by calling the OFX team. Your first international payment must be made on the phone through a specialist broker, and after that you can send money online or in the OFX app. As well as international transfers, OFX also offers more complex currency risk management products which you can arrange by calling a broker on the OFX 24/7 phone line.

Wise vs OFX: Payment methods

If you’re sending a Wise transfer you can pay by:

- bank debit (ACH)

- wire transfer

- debit/credit card

- Swift

- Wise Account balance

OFX has varied transfer options which you’ll be able to talk through with a broker. Common choices for payments originating in the US include:

- direct debit

- bank debit (ACH)

- wire transfer

Ease of use: Which is easier to use?

- Creating an account: Create your account online or in-app with both OFX and Wise; OFX also allows customers to register by phone, 24/7

- Making a transfer: Wise and OFX both let you pay for a transfer by ACH or wire transfer, Wise also allows customers to pay with a card or wallet such as Apple Pay

- Ways to send money: Send payments to your recipient’s bank account directly with both OFX and Wise; Wise also supports payments to some mobile money wallets depending on destination country

- Languages: Wise offers 15 languages, plus multi-lingual support services, OFX offers services primarily in English

- Minimum & maximum amounts: Wise sending limits can vary by destination country, and based on your account type. OFX usually has no maximum payment limit

Wise vs OFX international transfer limits

Both Wise and OFX offer high value international transfers for personal and business customers.

- Wise has limits which can vary based on destination country – usually around 1 million GBP or the equivalent. Learn more: Wise limits

- OFX often has no upper limit to the amount you can send, although you’ll usually need to talk to a broker to make a very high value payment.

Supported currencies

OFX supports 50+ currencies on major payment routes.

Wise supports 40+ currencies, and lets you send payments to over 160 countries.

Are they regulated in the US?

Both providers are regulated for the services they offer in the US.

- Wise is registered with the Financial Crimes Enforcement Network (FinCEN) and licensed as a money transmitter in many US states. In other US states and/or territories, services are offered in partnership with Community Federal Savings Bank, which is supervised by the Office of the Comptroller of Currency.

- OFX is registered as a Money Service Business at the federal level with FinCEN in the US. OFX is also licensed as a money transmitter by every state regulatory agency that requires a license.

Are they safe to use?

Both OFX and Wise are safe to use with various security measures in place.

You can find more about them in these guides: If OFX safe? and Is Wise safe?

As global businesses, they’re both overseen by a selection of international bodies, including ASIC and AUSTRAC in Australia, and other bodies such as the FCA in the UK.

Wise vs OFX for business payments

As we’ve seen, both Wise and OFX have business services – but the options do vary a little. Here’s a comparison to help you decide if either might suit your business needs:

| Wise Business | OFX Business |

|---|---|

|

|

Wise vs OFX customer service

Wise customer service is primarily delivered through in-app chat, which is available in a selection of languages, 24/7. You can also email the team if you’d prefer – log into your Wise account to check which is the best way to connect with customer services based on your specific issue.

OFX has an in app customer service option – but also has a 24/7 phone line which can be useful if you’re arranging a high value payment or if you need help with complex currency risk management products.

Conclusion: Comparing Wise and OFX

OFX and Wise are two of the best international money transfer apps in the US.

- Both OFX and Wise are safe, popular and properly regulated, with interesting features and products which will suit different customer needs.

- You can make online and in-app international payments direct to bank accounts with both OFX and Wise.

- In our price comparison, Wise was cheaper – but you’ll need to compare the costs and speed for your specific transfer before you decide which to use.

- Where OFX stands out is in its 24/7 personal broker service which you can use to set up transfers and currency management solutions. This option is not available through Wise – so if you prefer to talk through your options before you make a payment, you may want to check out OFX.

- On the other hand, Wise also has an international account which you can use to hold 40+ currencies, spend internationally in 150+ countries, make ATM withdrawals and avoid foreign transaction fees when you shop online with international retailers.

- OFX has a global currency account for businesses which can be used to hold and exchange 7 currencies, but this service isn’t available for personal customers. If your priority is to have a flexible multi-currency account and card, Wise may be the right pick for you.

OFX vs Wise FAQs

What is the difference between Wise and OFX?

Wise and OFX are global currency specialists offering international transfers and multi-currency accounts. Their services overlap, but are somewhat different in scope. Wise accounts can hold 40+ currencies and use the mid-market rate for currency conversion when sending payments, while OFX has no fee for payments but uses an exchange rate markup instead. Compare both to see which suits your specific needs.

Which is better: Wise or OFX?

Both OFX and Wise are great options, so which is better will depend on your specific transaction. Wise has more flexible account services including a card, while OFX has a 24/7 broker option and currency risk management solutions. Compare both using this guide to see which is best for you.

Is Wise or OFX cheaper?

We compared Wise vs OFX on a couple of different payment routes – and Wise came out cheaper in our comparison. However, as fees and rates do vary, it’s important to shop around before you confirm your transaction to make sure you get the best deal.

Is Wise or OFX faster?

50% of Wise payments are instant, 90% arrive on the same day. OFX offers payments arriving in 1 – 2 days for major currency routes, or 3 – 5 business days for more exotic currencies depending on destination.

How many currencies do Wise and OFX support?

OFX supports 50+ currencies on major payment routes. Wise supports 40+ currencies, and lets you send payments to over 160 countries.