Remitly vs Wise [2025]: Fees, Exchange Rates & Speed

If you want to send or receive an international payment, or if you’re looking for easy ways to manage your money across currencies, and spend with a linked payment card, you might have heard of both Remitly and Wise.

Remitly and Wise are both safe and reliable options for international payments. But their services, exchange rates, features and fees do vary somewhat.

This guide will help you navigate whether Remitly or Wise might be the best option for you, looking at international transfers, accounts and card options.

Summary: Wise and Remitly have some overlapping services for international payments, but their focus and their product range vary significantly.

- Remitly payments can be made from around 30 developed countries, to 170+ countries globally, to allow people working abroad to send money home to loved ones.

- Wise offers business and personal payments from a broad range of countries, to 160+ destinations, and has multi-currency accounts and debit cards to hold 40+ currencies.

Compare Remitly and Wise side by side

| Feature | Remitly | Wise |

|---|---|---|

| Send payments to | 170+ countries | 160+ countries, 40+ currencies |

| Multi-currency accounts | No | Yes, available with 40+ currencies |

| Debit card available | No | Yes |

| Pay to bank accounts | Yes | Yes |

| Cash payout available | Yes | No |

| Pay to mobile money account | Yes | No |

| Fully licensed and regulated | Yes | Yes |

| Open a business account | No | Yes |

To summarize:

- Wise is available for sending payments in many countries globally, with Remitly you can send from around 30 major countries

- Wise offers multi-currency accounts and cards, which Remitly does not

- Remitly lets you send to 170+ countries in 100+ currencies, Wise supports payments to 160+ countries, in 40+ currencies

- Remitly supports payments to bank and mobile money accounts, and for cash collection – Wise payments are usually deposited in a bank account

- Wise uses the mid-market exchange rate, while Remitly adds a markup to the rates available

- Both services are fully licensed and regulated for the services they offer

- Wise offers business accounts, while Remitly is for personal use only

What is the difference between Wise and Remitly?

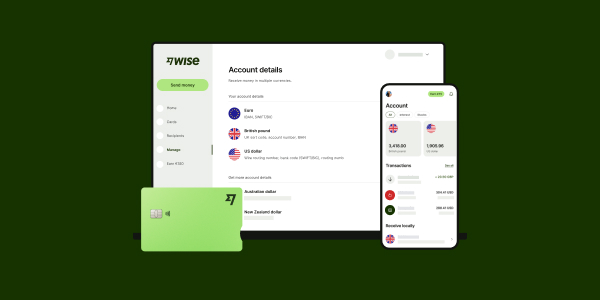

- Wise is a specialist in sending global payments to bank accounts directly. Wise also offers multi-currency accounts for personal and business customers, which allow you to hold and exchange money in 40+ currencies, send money internationally to 160+ countries, and spend with a linked debit card in 150+ countries.

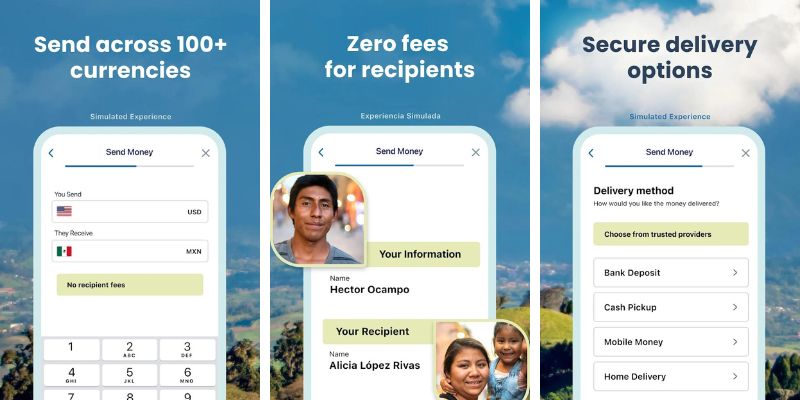

- Remitly on the other hand offers a range of payment types on common remittance routes, meaning with Remitly you may be able to send money for cash collection, home delivery or to a mobile money account for example. Remitly transfers are for personal use only.

Key differences between Remitly and Wise

| Wise | Remitly | |

|---|---|---|

| Personal or business customers | Supports personal and business customers | Supports only personal customers |

| Services | Offers multi-currency accounts, business accounts and debit cards alongside money transfers | Money transfer only |

| International transfers | Transfers sent to the recipient’s bank account directly. | Various payout types are supported. Based on location, you may be able to send money for cash collection, home delivery or to a mobile money account. |

| Exchange rates | Mid-market exchange rate | Exchange rates include a markup |

| Transfer limits | Bank transfer limits up to 1,000,000 USD | 25,000 USD (30,000 USD when sending to India). This can be increased to 30,000 USD, but requires additional documentation |

| Transfer speed | More than 50% of transfers can be instant (less than 20 seconds), 90% of transfers arrive in less than 24 hours. | Express payments can be instant, Economy payments can take several days |

| Payment methods | Wire transfers, ACH transfers, debit and credit card | Bank transfer, debit or credit card |

*Correct at time of research 22nd November 2024

To summarize:

- Rates: Remitly uses an exchange rate with a markup added, whereas Wise uses the mid-market rate

- Fees: Wise accounts are free for personal customers to open, and have no monthly fees. Wise money transfer costs start from 0.29%. Remitly doesn’t offer accounts, and has variable fees for international transfers, which can include different prices based on speed

- Speed: Remitly Express transfers can arrive instantly, while Economy transfers could take 3 – 5 days, while Wise transfers may arrive instantly, and 90% arrive in 24 hours

- Service: Both providers have online and in-app service

- Regulations: Both providers are fully regulated and licensed

- Reviews: Wise has an Excellent rating on Trustpilot from 240,000+ reviews, Remitly has an Excellent rating on Trustpilot from 65,000+ reviews

Pros and cons

| Remitly | Wise |

|---|---|

| ✅ Send payments to 170+ countries and territories ✅ Send for cash collection, to bank and mobile money accounts ✅ Pick Express or Economy payments depending on what’s important ✅ Set up payments online and pay with card or by bank transfer ✅ Available for sending from 30 countries | ✅ Payments to 160+ countries ✅ Multi-currency accounts to hold 40+ currencies ✅ Local account details for 8+ currencies ✅ Debit cards to use in 150+ countries ✅ Mid-market exchange rates |

| ❌ Exchange rates include a markup ❌ Limited selection of sending countries | ❌ Some service fees apply ❌ No physical location for face to face services |

The verdict: Which is better Remitly or Wise?

Remitly offers an important service to customers who want to send money home on popular remittance routes, especially if they’re looking for cash collection or mobile money pay-outs.

Wise on the other hand is a specialist in transfers direct to bank accounts, and offers the mid-market exchange rate with low, transparent fees. Wise also has a multi-currency account with a linked Wise Multi-Currency Card.

If Wise supports payments to the country you’re sending to, and you want your transfer to be delivered to a bank account, it’s worth checking out the fees for your specific payment from both providers. And for payments to be collected in cash, Remitly is worth considering thanks to its broad reach and extensive agent network.

About Remitly and Wise

Remitly launched in 2011 with a mission to make it easier and cheaper to send money home to loved ones. All Remitly payments are arranged online or in-app, and you can choose pay out options including cash collection and deposit to bank and mobile money accounts, depending on your specific needs.

You can send payments with Remitly from the US, to over 170 countries in 100+ currencies.

Wise has been around since 2011 and launched with a focus on cross border transfers. Over time, Wise services have grown to include multi-currency accounts, debit cards and business products. Today, Wise has over 16 million customers globally. All Wise services are delivered online and in app, with transparent fees and low overall costs.

You can send payments with Wise from the US, to over 160 countries in 40+ currencies.

Remitly vs Wise fees

Here’s a summary:

| Fee type | Remitly fee | Wise fee |

|---|---|---|

| Open account | No fee | No fee for personal customers; 31 USD one time charge for business customers |

| Monthly fees | No fee | No fee |

| Debit card fee | Not available | One time order fee for delivery, with no monthly or annual fees. |

| Send international payment | Variable fees based on destination and payment type You can often choose either a cheaper Economy payment – which will take a few days to arrive – or a faster Express payment. Express transfers could be available in minutes – but may come with higher fees | Variable fees from 0.29% based on destination and payment type |

| Currency conversion | Markup applies to the exchange rate used | Mid-market exchange rate |

*Correct at time of research 22nd November 2024

Remitly pricing

Remitly transfer fees might include: Transfer fee + Exchange rate markup + Third party fees. Remitly’s exchange rates and fees depend on where you’re sending money to, the specific service you require, and how you’ll pay.

Often you can choose from 2 different payment types – Express and Economy.

- Express payments are funded by debit or credit card, and can arrive quickly.

- Economy payments are funded with a bank transfer but can take several days to arrive.

- If you use a credit card to pay for your Remitly transfer you may also pay a cash advance fee to the card issuer.

Wise pricing

Wise doesn’t charge an exchange rate markup, and offers the mid-market exchange rate which is the rate you might often see on Google.

Instead there’s a transparent fee which will depend on the value of your payment and the way you pay for it. All costs are clearly shown when you calculate your payment.

You can also open a Wise account to hold and exchange 40+ currencies. Personal accounts are free to open, and there’s a 31 USD one off charge for a full business account. Linked debit cards are available for personal account holders, with a one time delivery fee and no monthly fees.

Learn all about Wise fees here.

Remitly vs Wise: Which is cheaper?

Choosing an international payment specialist can be cheap and convenient. However, as fees and rates do vary, it still pays to compare a few providers before you pick.

Let’s look at how a couple of different payments from Remitly and Wise work out. This table looks at how much will be received if you send a payment to a friend in EUR. Payments are funded by bank transfer and delivered to the recipient’s bank account:

| Amount & Currency | With Wise recipient gets: | With Remitly recipient gets: | Which is cheaper? |

|---|---|---|---|

| 1000 USD > EUR | 953.15 EUR | 957.30 EUR | Remitly |

| 5000 USD > EUR | 4,775.19 EUR | 4,734.35 EUR | Wise |

*Fees and exchange rates correct at time of research – 22nd November 2024

As you can see, in our comparison both providers offered quite similar overall value, with Remitly is a few Euros cheaper on the smaller transfer, and Wise nearly 40 euros cheaper on the higher value payment. As the fees and rates vary according to the currency route, it’s well worth comparing both before you choose the right one for your payment.

Remitly vs Wise exchange rates

We mentioned earlier that one of the fees you’ll pay with Remitly is an exchange rate markup – that’s a charge added to the rate used for currency exchange. Remitly often offers a promotional rate for new customers, which can be better than the exchange rate offered to people who’ve sent money with them before.

Remitly exchange rates

While Remitly uses a fairly low markup, it’s useful to know that with some providers, the highest of all of the fees you pay for an international transfer is in the exchange rate markup. And as markups are applied as a percentage of the transfer value, they quickly mount up if you’re sending a large amount. Find and compare live Remitly exchane rate today here.

You can find some popular currency pairs here:

How to find Remitly exchange rate

- Visit the Remitly website or open the Remitly app.

- Select the sending country and the receiving country.

- Enter the amount you want to send, and Remitly will display the exchange rate for your chosen currency pair.

Wise exchange rates

Wise uses the mid-market exchange rate with no hidden costs. That means you’ll get the rate you see for your currency pair on Google, and the fee you pay is split out to make it easy to check and compare. Find and compare live Wise exchange rate today here.

You can find some popular currency pairs here:

How to find Wise exchange rate

- Visit the Wise website or open the Wise app.

- Go to the currency conversion calculator on the homepage.

- Select your sending currency and receiving currency.

- Enter the amount you want to convert, and Wise will display the mid-market exchange rate with no markups.

Remitly vs Wise: Which is faster?

Remitly Express payments may be processed in minutes. Economy transfers can take 3 – 5 business days to arrive.

Wise payments can arrive in seconds on some currency routes, and most transfers arrive within a day. You’ll see the estimated delivery time when you set up your transfer, and can always track it online or in the Wise app.

Remitly vs Wise international transfer limits

Remitly customers sending from the US have a 25,000 USD limit (30,000 USD when sending to India). This can be increased to 30,000 USD, but requires additional documentation for identity verification. Learn more here: Remitly transfer limits

Wise has limits on some currencies, but they’re usually set very high – at around the equivalent of 1 million GBP – so people can transact freely. Learn more here: Wise transfer limits

Here’s what you need to know:

| Remitly limits | Wise limits |

|---|---|

| The amount you can send per transfer depends on where you’re sending from, and if your identity has been verified. Customers sending from the US have a 25,000 USD limit (30,000 USD when sending to India). This can be increased to 30,000 USD, but requires additional documentation for identity verification purposes. | If you’re sending in USD and your address is in a Wise licensed state, the following limits apply: Personal Account

Business Account

|

*Correct at time of research 22nd November 2024

Remitly vs Wise: Payment methods

With Remitly you can pay for a transfer by bank transfer, credit or debit card.

When sending money with Wise, you have several payment options, including:

- ACH transfer: This method is typically the most cost-effective, though it may take longer to process.

- Wire transfer: Faster than ACH and still relatively low-cost, suitable for larger amounts.

- Debit card: Offers a balance between speed and cost, funds are usually available quickly, with moderate fees.

- Credit card: Provides the fastest transfer times but comes with higher fees due to processing costs.

How do they work?

Send money with Remitly

Before you can make a Remitly payment, you’ll need to create an account online or in the app. This is straightforward to do by following the on-screen prompts. However, to keep your money safe and comply with US law you may also need to provide documents for verification. When your account is set up you can make transfers in just a few steps:

- Sign in on the webpage or open the Remitly app

- Select Get started or Send money

- Enter the amount you want to send and the delivery method

- Add recipient information – bank account details for a bank transfer, or name and personal details for cash pickup

- Complete your profile, adding your name and personal details

- Connect your preferred payment method – bank account or card

- Review, and when you’re ready, hit Send money

- You’ll see a confirmation screen once the payment is finalized

Send money with Wise

Wise also requires customers to open a Wise account online. You might need to provide some ID for verification, depending on the transfer type you’re making.

Once your account up all up and running you can make payments easily online and in the Wise app:

- Log into your account

- Type in how much you want to transfer, or how much you need the recipient to get

- Enter the recipient’s details – bank account number or email

- Check over the details

- Fund your payment using a card or bank transfer

- Confirm and your money will be on the move

Find out more about how Wise works in this full guide.

Remitly vs Wise business

Remitly is for personal use only – you cannot make business payments or set up an account in your business name.

Wise offers business payments and accounts. Here are some key features of Wise Business accounts and payments.

| Wise Business |

|---|

|

Learn more on How to open a Wise Business Account

Ease of use

| Remitly | Wise | |

|---|---|---|

| Create an account | Online or via the app | Online or via the app |

| Making transfers | Online or via the app | Online or via the app |

| Ways to send money | Bank transfer, credit card, or debit card | Bank transfer, credit card, debit card, ACH, or wire |

| Supported languages | Global support in multiple languages via app, online, and phone | Global support in 14 languages via app, online, and phone |

| Minimum transfer amount | Varies by destination and transfer type | No minimum transfer limits |

| Maximum transfer amount | Customers sending from the US have a 25,000 USD limit (30,000 USD when sending to India). This can be increased to 30,000 USD, but requires additional documentation for identity verification purposes. | Bank transfer limits up to 1,000,000 USD |

| ATM withdrawals | Not available | Linked debit card available for global ATM withdrawals |

| Receiving money | Bank accounts, cash pickup, mobile money, or delivery (depending on the destination country) | Delivered directly into the recipient’s bank account |

Supported currencies

From the US you can send money to over 170 countries in 100 currencies with Remitly.

With Wise you can send money to 160+ countries in 40+ currencies, and hold and convert 40+ currencies in your Wise account.

Sending large amount transfers

Wise offers competitive exchange rates and even discounts of up to 0.17% for high-value transfers over 1 million GBP (or currency equivalent). In contrast, Remitly offers a fixed limit of 25,000 USD with possibility to increase to 30,000 USD with additional documentations.

Remitly high amount transfers

Remitly used to offer accounts in 3 different tiers, which all had their own limits for payments in a 24 hour, 30 day and 180 day period. However, Remitly is now in the process of moving customers over to a new system which gives a higher, flat, limit per transaction, for verified accounts, and customers who were previously Tier 2 or 3 are automatically being moved to the new flat limit.

The amount you can send per transfer depends on where you’re sending from and if your identity has been verified. Customers sending transfers from the US have a 25,000 USD limit (30,000 when sending to India). This can be increased to 30,000 USD, but requires additional documentation for verification purposes.

Fees depend on the transfer type—Express transfers are quicker but cost more, while Economy transfers are slower but cheaper.

Remitly also applies a markup to its exchange rates, which can affect the final amount the recipient receives. Additional sending limits may also apply depending on your choice of payout partner or receiving location.

Remitly limits for high-value transfers:

| Country | Limit per transfer |

|---|---|

| United States | 25,000 USD (30,000 USD when sending to India) |

Remitly doesn’t offer specific discounts for high-value transfers, but customers that need to send amounts exceeding the 25,000 USD limit can contact customer support to increase it to 30,000 USD and explore more options.

Wise high amount transfers

Wise supports high transfer limits, but how much you can send will depend on the currency and your chosen payment method. For sending USD, the following limits apply:

- Local transfers funded by ACH: 1 million USD

- Local wire transfers when paying from your USD balance: 6 million USD

- International transfers via SWIFT: Up to 1.6 million USD

Wise rewards customers who send large amounts by offering fee discounts of up to 0.17%. Once your total transfers exceed 20,000 GBP (or the equivalent in your currency) within a calendar month, you’ll automatically benefit from a lower fee on the amount above this threshold. This applies whether you’re making a single large transfer or multiple smaller ones that add up to the limit.

Here’s a breakdown of how the discount works:

| Monthly Volume (GBP) | Discount (%) |

|---|---|

| 0–20k GBP | 0 |

| 20k–300k GBP | 0.1 |

| 300k–500k GBP | 0.15 |

| 500k–1m GBP | 0.16 |

| 1m+ GBP | 0.17 |

Are they regulated in the US?

Remitly is licensed to transmit money in all US states and Washington, D.C.

Wise is registered with FinCEN and licensed as a money transmitter in most US states. In some states Wise operates as a service provider to Community Federal Savings Bank.

Is Remitly and Wise safe to send money with?

Both Remitly and Wise are safe to send money with. Get more information on Remitly safety here – and read our guide to Wise safety here. Here is a quick overview:

Is Wise safe?

Wise uses safeguarding practices, meaning that customer funds are held separately from the company’s own accounts to make sure funds are kept safe. In addition, all transactions are protected with two-factor authentication and Wise uses anti-fraud measures and account verification to keep customers’ money safe.

Is Remitly safe?

Remitly is a reliable and secure money transfer service. Regulated by financial authorities across multiple countries, including the U.S. Department of the Treasury, Remitly has several layers of security to keep your transfers safe. All Remitly accounts are subject to verification procedures that allow them to identify suspicious account activity alongside secure server connections and password security encryption.

Remitly vs Wise customer service

Remitly customer service is offered by phone and through an in-app and online chat. If you want to call, you can get the right number over on the Remitly website, based on the issue and the language you want help in – English and Spanish support is available 24/7. You can also open an in-app chat any time of day, and get help in English, Spanish or French.

Wise customer support offers multiple channels, including in-app chat, making it easy to get help when you need it. You can find the answers to most of your questions via the Wise help center. For those who prefer to speak directly, phone support is available 24/7 in English and Wise has dedicated support in 14 languages.

If you’ve reported an issue, Wise may contact you via email, providing options to resolve the problem, so don’t forget to check your inbox for updates.

Remitly customer reviews

Remitly has a 4.6 Excellent rating on Trustpilot, based on over 65,000 reviews. Many customers appreciate the platform’s ease of use and straightforward transfer process.

“I highly recommend Remitly to anyone looking for a fast, reliable, and trustworthy money transfer service. They’ve earned my trust, and I’ll continue to use them for all my future transfers.”

Others have noted how convenient the service is for instant transfers without extra charges:

“The fact that the money transfer was instant and the process was so easy, no need for coaching. I recommend this to everyone. Plus, there is no fee charged to the sender.”

However, some negative feedback mentions delays in the transfer process.

“While the rate given was good, it took more than 5 days, whereas others are sending money immediately or overnight.”

Wise customer reviews

Wise has a 4.3 Excellent rating on Trustpilot, with over 240,000 reviews. Customers frequently praise the platform’s competitive exchange rates, transparency, and versatility for multi-currency transactions.

“Wise is my go-to for all money transfers. Fast, impeccable service, great rates, and you know exactly what the current exchange rates are (theirs is the best) and when your money arrives. I use their debit card when traveling because I preload it and never expose my money, accounts, or credit card to fraud. Great service!”

Another user reflected on their positive experience during an international trip:

“First time I had used Wise exclusively. No glitches at all at any level. Am now transferring money across borders and currencies to family and between my own single-currency accounts.”

However, negative feedback often highlights challenges with customer service and technical issues.

“I have been using Wise to transfer money to my family back home for 5 years now. Always the same method, from the same account to the same account. Today I was informed by their app that I must transfer directly from my local bank account instead of paying it over to a Wise account as usual. My bank doesn’t recognize the account. Since Wise’s customer service is minimal, I can’t get help. Now I must find another transfer service to support my family.”

Conclusion: Comparing Remitly and Wise

If you need to send a payment for cash collection you’ll want to pick Remitly. However, Remitly’s service does have limitations, and the rates and fees may not be the very best out there.

For low cost international payments to a bank account it’s worth comparing the fees and delivery times for both providers, as they’re relatively evenly matched on cost. Finally, if what you need is a multi-currency account or a card to spend with when you’re abroad or shopping online with international retailers, Wise could be a fit.

Wise vs Remitly FAQs

Which is better – Remitly or Wise?

Remitly and Wise have similar services when it comes to overseas payments, but there are some important differences too. Which is best for you depends on the service you need.

- While Remitly has a great range of payout methods, to suit people working overseas sending payments to loved ones.

- Wise has a broader product range, including personal and business transfers, and digital accounts you can use to hold and exchange 40+ countries and spend with a linked debit card.

Is Wise or Remitly cheaper?

In our comparison, the overall costs for Wise and Remitly were quite similar, making it worth getting quotes from each provider before you choose the right one for you.

Is Wise or Remitly faster?

Wise payments can arrive instantly, with most being delivered within 24 hours. Remitly Express payments may be processed in minutes. Economy transfers can take 3 – 5 business days to arrive.

How many currencies do Wise and Remitly support?

From the US you can send money to over 170 countries with Remitly.

Wise customers can send payments to 160+ countries, and hold and manage 40+ in their Wise accounts.

Can I open a business account with Wise or Remitly?

Wise business accounts are available to US residents, and can hold and exchange 50+ currencies.

Remitly payments and accounts are intended for personal use only.