TorFX Review [2025]: Fees, exchange rates & safety

UK based specialist currency broker TorFX has a range of services for individuals and businesses. You can send one off or recurring payments, arrange forward contracts, and set up market orders. These can help cut the costs of sending money overseas, and mitigate some of the risks of exchange rate fluctuations.

This TorFX review will cover everything you need – including the fee structure, whether it’s safe to use, how fast it is, how to get set up, and more.

TorFX: Key points

Key features:

- Send international transfers in 40 currencies – both one off and regular payments available

- Arrange forward contacts, target rate orders and stop loss orders to mitigate currency exchange risks

- Set up payments online, in the app and by phone

- Personal and business services are both available

Key stats:

- Established in 2004, TorFX now processes 10 billion GBP in transactions annually – that’s the equivalent of over 13 billion dollars!

- Over 425,000 customers, and 550 employees

- Voted International Money Transfer Provider of the Year by Moneyfacts 5 years running

- Send payments in over 40 global currencies

| TorFX pros | TorFX cons |

|---|---|

| ✅ Dedicated account manager service ✅ Competitive rates, especially when you’re transferring large sums of money ✅ They do not charge transfer fees, regardless of the amount. ✅ Excellent customer support available via phone and email | ❌ Exchange rates include a markup ❌ You need to sign up to get a quote ❌ You have to send funds to TorFX using SWIFT, which can be costly |

What is TorFX?

TorFX is a UK based, specialist currency exchange business that’s been operating for over 20 years. They offer money transfer services to both individuals and businesses.

They have offices in the US, Europe, the UK, Australia, and South Africa.

They’re frequently recognized as a top money transfer service in industry awards, taking prizes for customer service, forward contracts and overall excellence.

Is TorFX available in the US?

Yes. TorFX is a UK registered business which offers services in many regions and countries, including the US. The exact services available may vary by state, so do check the options by giving the TorFX team a call before you begin to transact.

Their services are available for both business and personal customers. Here’s what you can do with TorFX:

One off and recurring international transfers

TorFX international transfers can be made online on by phone. You’ll need to get a quote for the available TorFX exchange rate – online, in the app, or by phone – then fund the payment by sending your USD funds to TorFX using a SWIFT transfer.

Once your money arrives your payment will be processed immediately. There’s no upper limit to how much you can send with TorFX.

TorFX also has a recurring transfer service for payments which need to be made on a regular basis. This can be handy if you’re paying for an international mortgage for example.

Great for: people sending international transfers on a one-off or recurring basis

Forward contracts

You can book a forward contract with TorFX which locks in an exchange rate for future payments for up to 2 years. This can be useful for people who need certainty about the costs of international transfers over time. However, although you’ll be protected from negative changes in the exchange rate, you won’t be able to benefit from any positive shifts in your favor until the contract expires.

Great for: people who want to fix the exchange rate to mitigate the impact of changes in the market on future international payments.

Market orders

TorFX offers a couple of different types of market orders which can benefit customers who need to target specific exchange rates to convert currencies. You can do this in 2 different ways:

- Limit orders

- Stop loss orders

A limit order involves setting a desired exchange rate to buy currency. If the markets move and this rate is achieved, your exchange will then be processed automatically, to make sure you don’t miss out. Stop loss orders work in the other direction. You’ll set a worst case exchange rate which means that if the exchange rate of funds you hold triggers a stop loss, they’ll automatically be sold. This can protect you from sharp or sudden decreases in the value of your currency holdings.

Great for: people targeting specific exchange rates to buy or sell currency.

Business FX services

The full range of TorFX currency services set out above is available to business clients as well as personal customers. There’s also the option to get risk management guidance based on your specific circumstances.

A member of the TorFX team will check your international payment processes to spot opportunities to minimize currency exchange risks. You’ll then receive a bespoke plan to help cut costs and improve your profits.

Great for: businesses working internationally and looking to cut the costs and mitigate risks of currency exchange.

Who owns TorFX?

TorFX is a private limited company, registered in the UK.

How much can I save with TorFX?

Using a specialist provider like TorFX can be safe, convenient and cheap. You may find you can save money compared to using your bank – often thanks to a better exchange rate. Learn more: How to avoid international wire transfer fees

TorFX doesn’t have a transfer fee.

Instead, they add a small margin to the exchange rate used to convert your payment from USD to the currency needed for deposit. Compare both the rate and the fee your bank offers, against the quote you get for your transfer from TorFX, to see how much you can save.

TorFX alternatives

- TorFX vs Wise – send online and mobile payments which use the mid-market exchange rate and low transparent fees, or open an online international account to send and hold multiple currencies

- TorFX vs Remitly – domestic and international payment service with a network of agents as well as online and in-app services. Payouts available to bank accounts or for cash collection.

- TorFX vs PayPal or Xoom – send instant payments at home and abroad – convenient and quick, but not always the cheapest. With PayPal your recipient will also need to set up an account to get their money.

- TorFX vs Revolut – open an online international account to send and hold multiple currencies from the same account.

Learn more: Alternatives to TorFX

How does TorFX work?

TorFX offers services:

- Online

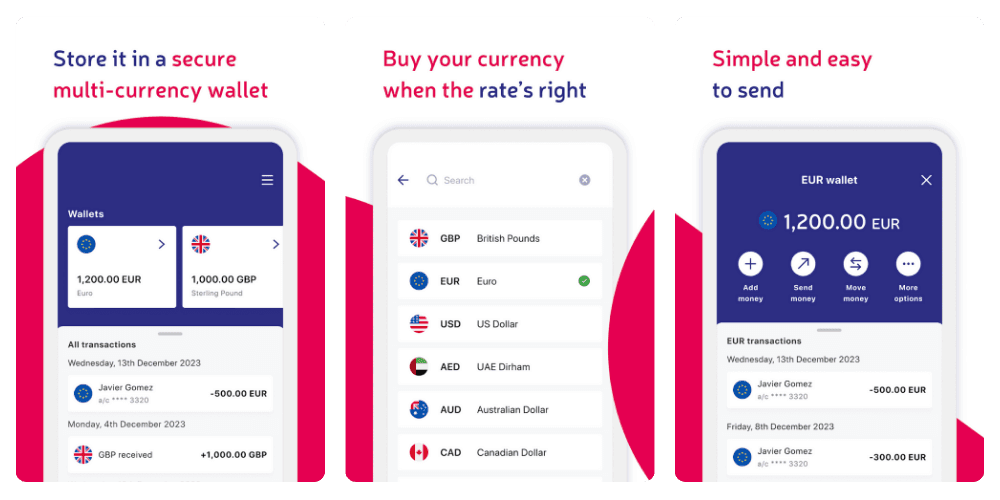

- In the TorFX app

- By phone

- By email

There’s no transfer fee for international payments, although there is a charge in the form of an exchange rate markup.

Not all payments can be arranged electronically – for high amount payments and currency solutions you’ll need to set up your transaction by phone. It’s actually possible to set up payments in person, too – but you’ll need to be in the UK to use this service.

Funds you transfer are deposited into the recipient’s bank account. The recipient does not need to register with TorFX to get paid.

Is TorFX safe to send money?

Yes.

TorFX is a UK headquartered business, and is fully regulated in the UK by the Financial Conduct Authority (FCA), meaning they have to stick to strict rules and regulations.

They also receive the highest credit rating (Level 1) by Dun and Bradstreet, a credit agency that rates businesses, so you know they are safe.

Learn more: Is TorFX safe?

TorFX pricing

TorFX does not charge a transfer fee for international payments. Instead, they make money by adding a small margin to the exchange rate used for payments. This is common practice – and by adding a smaller margin compared to banks, TorFX covers their costs and still provides a service which represents good customer value.

TorFX exchange rate

We know you want to get the most from your money, so it’s important to know if TorFX provides competitive exchange rates. Unfortunately, they don’t make it easy to understand how much they charge, as you need to create an account with them before you can see online rates. You can also call them to get foreign exchange rates over the phone, or complete an inquiry form on their website and they’ll call you.

How long does a TorFX transfer take?

For many currencies, the money could be in the recipient’s bank account on the same day, although less commonly traded currencies can take a couple of business days after your funds have cleared. Like any other provider, the actual speed depends on where you’re sending money and how you pay.

For example, if you’re paying by bank transfer, that may take a couple of days to reach TorFX, and they won’t start the clock until they have your funds. Be sure to plan for those types of delays when you send money.

How to use TorFX

TorFX offers services through its app, online, or through your own personal broker. Exactly how you set up your payment or access services like forward contracts depends on a few factors. You can send many payments online or in the TorFX app, but higher value transfers and currency risk management solutions are only offered by phone.

How to send money with TorFX

TorFX has a sign-up process that makes it easy for you to create an account and transfer money. Here’s what you need to do.

You can apply for a TorFX account online through the website, or give them a call and they’ll talk you through the process.

- Once your account is registered, you’ll be assigned a specialist, dedicated account manager who will provide advice.

- When you want to send money, you can do that online, through the app, or by contacting your account manager.

- You’ll need to provide details of who you want to send the money to, including their name, address and international banking details.

The details you’ll need when you’re sending money

So, you’ve registered your account. Now, when you want to send money, you’ll also need to provide more details, including:

- The amount of money you’re sending

- The countries you’re sending money from and to

- The currencies that you’re sending money between

- The name and address of the person you are sending money

- Bank account details of the person you are sending money

The bank account details you’ll need vary between countries, but typically you’ll need to provide the sort code or routing number and the account number. In some cases, you’ll need to provide a SWIFT code or IBAN (International Bank Account Number.)

TorFX payment methods

TorFX only accept bank transfers via SWIFT for payment from the US.

Payout methods

TorFX transfers are delivered into your recipient’s bank account directly. Your recipient won’t need to set up a TorFX account to get their money.

How to track a TorFX transfer

You can log into your TorFX account online or in the app, or call the team 24/7 to get help with your payment.

How to create an account

Create an account online, in the TorFX app, or by calling the TorFX team. Here’s how to set up a TorFX account online:

- Open the TorFX desktop site or app

- Select Open an Account

- Confirm if you want a business or personal account

- Enter your email address and create a password for security

- Follow the onscreen prompts to enter your personal information including phone number

- You’ll receive a PIN by SMS, enter this to proceed

- Confirm your identity – a verification process may be required

- Review all the details and you’re done

What documents you’ll need

TorFX does need some details if you want to create an account and send money overseas:

- Your full name and contact details

- Government issued documents to prove your identity

- Whether your account is for personal or business use

They can not complete your transfer until your ID is verified.

If you are providing photo ID, it needs to include the following:

- Your photograph

- Your full name

- Your date of birth

If you are proving proof of address, it needs to include the following:

- Your full name

- Your full current residential address (within the past 3 months)

How long does TorFX verification take?

If your account needs to be verified the TorFX team will guide you through the process and inform you of the likely timeline.

Do I need a bank account for TorFX?

Yes. If you’re sending money with TorFX from the US you must pay with a SWIFT transfer which can usually only be arranged through your bank.

How to receive money from TorFX?

If you’re receiving money from TorFX, it will be deposited into your bank account. You simply need to give the person sending you money your personal, contact and bank information and wait for the payment to arrive.

TorFX limits

If you want to transfer a lot of money TorFX could help. They state that they don’t have a maximum international money transfer limit – there are some limitations for security though:

- They have a “Regular Overseas Payment” service that’s only meant for transfers between £500 and £10,000 ($660 – $1,320)

- You can send between £100 ($130) and £25,000 (or $33,000) online

- For individuals amounts over £25,000 (or $33,000), you’ll need to call TorFX and speak to your account manager

- For businesses, amounts over £100,000 (or $132,000), you’ll need to call TorFX and speak to your account manager

Supported currencies

TorFX supports 40+ different currencies and lets you send to a broad selection of currencies globally.

TorFX reviews

TorFX scores a pretty amazing average of 4.9 out of 5 stars on Trustpilot, from a total of nearly 7,800 listed reviews at the time of writing. That’s a comfortable Excellent score.

Customers highlight the service available from TorFX, and particularly the fact you can talk to someone when you need to, as positives. Here are some live reviews from the site:

“My experiences with this company have all been positive. When a problem arises it is easy to talk to a person who can solve it. Easy to do online as well.”

“I’ve used Torfx several times in recent months. I have found them to be reliable and quick to act on my requests. Very friendly in a professional manner. Very happy with the service provided.”

About 2% of reviews on Trustpilot give the lowest available Bad score, which tended to involve challenges with the verification process or specific payment delays.

TorFX customer service

- 365 days a year

- Phone: UK 0800 612 9625

- Phone: Rest of World – +44 (0) 1736 335250

- Email: Available online

Business services offered by TorFX

TorFX provides services to businesses including regular overseas payments and payroll processing for employees in other countries. They also provide market insights, so you can sign up for the latest news and they’ll keep you updated so you can time your transfers.

TorFX also provides several different business transfer options:

- Spot contracts for sending money now

- Forward contracts for future payments

- Limit orders for targeting a specific exchange rate

- Stop-loss orders for protection against falling exchange rates

Using these contracts and market orders can require some additional knowledge of how currency markets work, so speak to your TorFX personal account manager for more information. It’s also important to note that TorFX may require a deposit or there may be other fees for these types of orders.

TorFX accessibility

TorFX allows customers to set up many transactions online and in the app – which is available on both Apple and Android phones. However, if you’d rather, you can also call the TorFX team, or email your account manager.

For some high value or complex currency transactions you may need to talk to a team member directly rather than making arrangements electronically.

Is the TorFX app easy to use?

The TorFX mobile app lets you access many of their services through your smartphone. You can make currency transfers, check foreign exchange rates, buy currency in advance, set rate alerts, add new recipients, and update your account information.

When it comes to simplicity, we took a look at reviews on both the Apple App Store and Google Play.

The TorFX app scored reasonably well, getting 4.5 out of 5 on the App Store and 4.3 out of 5 on Google Play.

Conclusion: Is TorFX good to transfer money internationally?

TorFX has a few differentiators which make it stand out as an international money transfer service. As well as offering international payments, you can access products to mitigate the risks of currency exchange – like forward exchange contracts and market orders. And there’s no transfer fee if you’re sending payments abroad.

TorFX works on lower margins than many banks, which means one off and recurring transfers may work out better value than relying on your usual provider. However, the exchange rate markups used aren’t publicly available, so to work out if TorFX is right for you, you’ll need to register, get a quote, and then compare it to the options available elsewhere on the market.

TorFX money transfer review FAQs

Is TorFX legitimate?

Yes. TorFX has been in business for over 20 years, and helps individual and business customers to move billions of dollars in payments annually.

How does TorFX apply exchange rates?

There’s no transfer fee when you send money with TorFX, but there will be a small fee included in the costs of currency exchange. Get a quote for your transfer to find out more.

How long does TorFX take to transfer funds?

TorFX payments can arrive on the same day on popular currency routes, or within a couple of days for exotic currencies.

Is it safe to transfer money with TorFX?

TorFX is FCA regulated in the UK, making it a safe provider to choose.

Does TorFX have a mobile app?

Yes. Get the TorFX mobile app on Apple and Android phones.

How many currencies does TorFX support?

TorFX supports 40 major currencies.